History ASX: DCC – DigitalX

Founded in 2014, DigitalX was the world’s first publicly listed blockchain technology company. As a bitcoin mining operation, they controlled over 2% of the network hashing power at their peak. They expanded to providing liquidity for exchanges as well as the development of other blockchain technology such as Airpocket, a mobile app for foreign currency transactions.

In 2017, DigitalX pivoted heavily into advisory and initial coin offerings (ICOs) then into security token offerings (STOs). If you’re wondering what ICOs and STOs are, think IPOs for digital currencies. Today, the company is involved with digital asset funds management and the development of blockchain enabled products for financial markets.

If only DCCs history were this boring…

“Truth is stranger than fiction, but it is because Fiction is obliged to stick to possibilities; Truth isn’t.”

~Mark Twain

2016 – Wire Fraud & Money Laundering

July 2016 saw the resignation of Director and DigitalX co-founder Mr Zhenya Tsvetnenko; a theme that would repeat itself for DigitalX.

In the late 2000’s, Mr Tsvetnenko was a university dropout with $200 to his name. Within a decade Mr Tsvetnenko used that $200 to become a BRW Young Rich lister, Ernst and Young Entrepreneur of the Year Award winner and won the Business News “40 Under 40” award. This rags to riches story is exactly the type of founder investors want running their company. He was now worth $100 million and with the money came an extravagant party boy lifestyle. He spent $1 million on his wedding, flew his wife out to LA to party with Snoop Dogg and had ice sculptures made of his Lamborghini and Ferrari for his 30th birthday.

But Mr Tsvetnenko’s story was too good to be true. His riches were built on a lucrative auto-subscription text messaging scam. Charged in 2016 with wire fraud, conspiracy to commit wire fraud and money laundering, he would later be arrested in 2018 and after 3 years in a Perth jail, finally extradited to the US. Each charge carries a maximum 20 year prison sentence. He’s alleged to have charged American mobile phone customers $10/month for recurring text messages about trivia and horoscopes they never signed up for.

DigitalX would enter into an agreement whereby all of Mr Tsvetnenko’s interest in the company would be terminated. DCC bought back and cancelled 17.6M shares at $0.03 per share (a significant discount) with Mr Tsvetnenko disposing of the remainder of his 25M shares.

2017 – Dilution, Compliance & Another Poisonous Director

With CEO Leigh Travers leading the company, DCC was focused on “blockchain-based software solutions” and providing “digital currency liquidity” as a market maker on approved cryptocurrency exchanges. The company held cash and digital assets worth $20.7M, including 490 Bitcoin and 460 Ethereum.

They transitioned into corporate advisory for initial coin offerings. DigitalXs advisory services for initial coin offerings (ICOs) was essentially what investment banks are to IPOs. They would help these coins list and receive remuneration in the form of cash or tokens. Some of these such as POWR tokens would 20X in short periods of time, with most fairing poorly over the long-run. Regardless, just as investment banks tend to fair well off IPOs, so too would DCC off ICOs.

2017 saw the appointment of Non-Executive Chairman Peter Rubinstein and Non-Executive Director Samuel Lee. We'll have to wait 2 years to see Mr Lee's story play out.

With revenue of only $47,133, a loss of $3.9 million, a $2.2 million operating cash outflow, negative net assets and negative shareholder equity, shares on issue would grow from 212M to 401M between June and September with a further 76M options.

With the company claiming to possess the highest quality technical talent, industry experience and a “robust focus on compliance” they would finish 2017 as the world’s leading publicly listed ICO advisor. It’s this “robust focus on compliance”, or lack thereof, that would see the company in hot water on more than one occasion in the future. But for now the company was well positioned to ride the ICO euphoria of 2018.

2018 – ICOs, Turnaround & a Lawsuit

According to icodata.io, the number of coin offerings rose from 252 the previous year to 1602 in 2018. A coin offering (ICO) is essentially an IPO but for digital currencies. Riding these tailwinds, DigitalX was starting to gain momentum and along with a strong brand, were able to win some of the highest quality ICOs. In FY2018 they recorded $8.2 million in revenue, a $2.4 million profit, positive free cash flow and $1.7M in appreciation of their digital assets; compared to a $3.6M loss the previous year. Revenue was entirely from ICO consulting concealing an underperforming Blockchain development segment. While investment banks need to generate interest in a company listing publicly, so to would DigitalX for an initial coin offering. As a result, management was very promotional during this period pumping out announcement after announcement. Was the over promotion justified? I’ll leave that to you to decide.

2018 saw DCC open a cryptocurrency funds under management division and a joint venture to launch a crypto business news website and education platform. At this stage the company was focused on 4 key areas:

1 ICO management & corporate advisory

2 Blockchain investor education & crypto news services

3 Blockchain Consulting & Development

4 Crypto-asset fund management

The second no longer exists and the fate of their ICO services would unfold in 2019. In late 2018 the company was being sued by a group in relation to an investment made in an initial coin offering to which the company was an advisor. Their “robust focus on compliance” was about to be put to the test.

2019 – A Lawsuit, Compliance Issues, Resignations & Director Buying?!

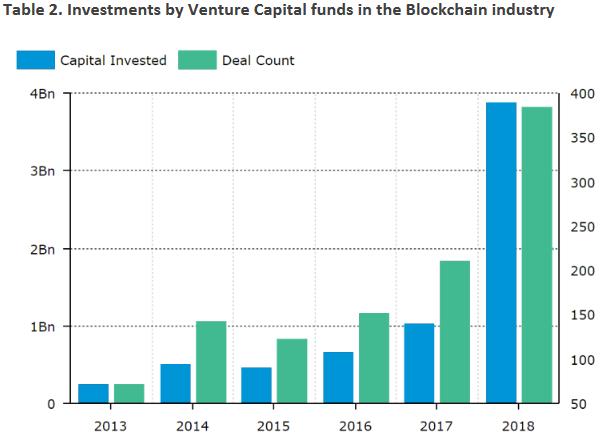

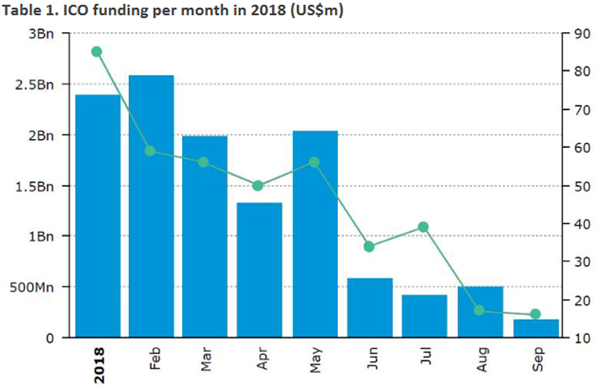

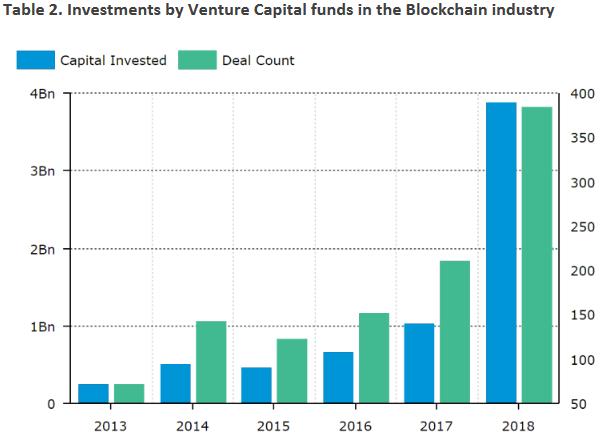

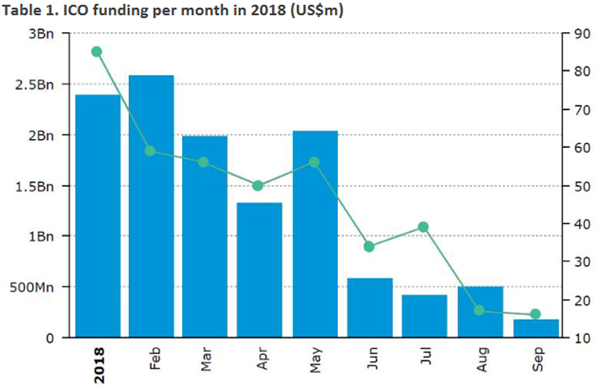

2019 was a busy year for DigitalX; unfortunately for all the wrong reasons. While VC funding in the Blockchain industry grew exponentially during 2018 (Table 2), ICO funding was all but drying up (Table 1). In response, the company attempted a pivot from ICOs to security token offerings (STOs).

From a $2.4M profit and positive free cash flow of $600,000 the previous year, DigitalX took a dive. Revenue from operations was $0.927M and free cash flow was negative $3.6 million. DigitalX’s history provides a valuable lesson to investors. Because revenue was entirely derived from ICOs and STOs, the savvy investor tracking ICO trends (a leading indicator) could have foreseen this well in advance and gotten out early.

DigitalX swung big during the ICO euphoria of 2018, taking gambles on some highly speculative offerings. Just as investment banks tend to do well off IPOs so too did DCC with ICOs. They received favourable equity terms in these ventures and tended to sell out some or all of their holdings early enough to make off with considerable gains. As a company betting everything on ICOs and STOs, their lack of revenue diversification and a highly speculative and unregulated new market would be their eventual downfall. As the ICO market dried up, so did DigitalX.

The number of ICOs by year according to icodata.io:

2017 = 252

2018 = 1602

2019 = 474

2020 = 121

2021 = 136

In April the company announced a capital raise to facilitate an investment into Bullion Asset Management (BAM) to develop a stablecoin (XGold) - a cryptocurrency backed by physical gold, allowing investors to purchase, transfer and store digital gold. With DCCs help, BAM’s goal was to provide a lower cost and more secure model of gold ownership compared to traditional methods. The investment would see DCC spend $450,000 in cash and $800,000 in DCC shares for a 17.5% interest in BAM.

The lawsuit brought on DigitalX would finalise in May. Despite denying any wrongdoing the Company paid out $350,000 in cash and $350,000 in shares, less than half of what was being sought by the plaintiffs. The legal status of an ICO depends on how it is structured and operated and the rights attached to the token. It’s hard to know exactly what went wrong but consider the following quote from John Price:

“Regardless of the structure, however, there is one law that will always apply – you can’t make misleading or deceptive statements about the product.”

In 2019 the company would face queries from the ASX regarding disclosure obligations involving directors Lee and Rubinstein. Today, DigitalX has a digital compliance app to help with continuous disclosure obligations; the irony isn’t lost.

Things only got worse for the company with the resignation of Non-Executive Director Stephen Roberts after only a few short months on the DigitalX board. Why would a director with long tenures at previous roles leave so quickly?

Perhaps he wasn’t impressed with a fellow Director?

Shortly after Mr Roberts resignation Mr Sam Lee, CEO and Founder of Blockchain Global Ltd, resigned as Director of DigitalX. That makes 2 resignations shortly after the company’s legal settlement and ASX query letter. Oddly enough, it’s unlikely they were related.

To understand Xue Samuel Lee or “Sam Lee” we’ll go back a few years to around the same time DigitalX co-founder Mr Zhenya Tsvetnenko ran into trouble. Sam Lee co-founded Bitcoin Group in 2014 along with Allan Guo and Ryan Xu which would later be rebranded to Blockchain Global. Blockchain Global would go on to develop the blockchain exchange platform ACX.io. In 2017 the company signed an agreement with DigitalX to onboard all customers from their liquidity desk, Digital X Direct with DigitalX receiving 50% of revenue over a 5 year term. Handing their liquidity desk duties over to Blockchain Global would allow DigitalX to focus on their software projects. According to Blockchain Global CEO Sam Lee, ACX.io was Australia’s largest Bitcoin exchange accounting for 60% of Australia’s Bitcoin market at the time.

Blockchain Global and ACX.io would eventually fail and in 2020 enter voluntary administration owing creditors $49 million and investors $10 million. Their assets included millions in Bitcoin and Ethereum; however, co-founder Allan Guo claims the credentials required to access it were on a laptop that had been stolen while in China. You can’t make this stuff up.

Around this time DCCs Sam Lee and Ryan Xu had created Hyperfund, a DeFi (Decentralised Finance) ecosystem for digital currency users. Membership cost 300 – 1,000 dollars with referral fees paid for members recruiting new users. If you’re thinking this sounds a lot like a Ponzi scheme, you would be correct. With revenue from Blockchain Global no longer being fed into Hyperfund, the scheme had no money and collapsed.

In response to both Director resignations and compliance issues DigitalX appointed a board member with a strong background in corporate governance practices - Mr Toby Hicks.

DigitalX would grow its digital assets by 58% to $7.1M during the financial year but underperform its benchmark as a result of an underweighting to Bitcoin. They would also launch their second asset management product – the DigitalX Bitcoin Fund with the company seeding it 215 Bitcoin in the hopes of growing the fund and benefiting from additional fees.

Believe it or not, CEO Leigh Travers and Non-Executive Director Peter Rubinstein would close out the year by buying $14,550 and $59,400 worth of DCC shares respectively; a surprising trend we’d see continue.

Of all the coin and token offerings DigitalX advised on, HMT (Human Protocol Foundation) appeared to be an afterthought. However, two years later it would “earn” them millions in revenue.

2020 - DCC2.0?

2020 was unlike any other year for DigitalX… uneventful and non-promotional.

Revenue fell 70% to $290,424, cash halved, net assets dropped 30% and there was an operational cash outflow of $2.1 million for the year. It was ugly. Fortunately they had no debt and would cut expenses by 42%.

DigitalX’s latest strategy would see them focused on Blockchain Consulting and Development and Funds Management. They now had the DigitalX Bitcoin Fund to complement their Digital Asset Fund. Since inception, both had returned 58% and 60% respectively.

xBullion was built and launched in 2020 as part of their partnership with BAM from the previous year. While isthiscoinascam.com gives the speculative nano cap a weak rating, DigitalX records its investment in Bullion Asset Management at almost double today.

The company launched its first RegTech product – Drawbridge, a digital compliance tool for publicly listed companies. Four ASX listed companies over 6 weeks would trial run the offering.

Continuing the theme from 2019, insiders remained confident in the company. Directors Hicks, Travers and Rubinstein would agree to take shares in lieu of cash salary; $33k, $31k and $33k respectively.

As part of their advisory services to the Human Protocol Foundation (HMT), DigitalX were entitled to 1.25% of the total 1 billion tokens that would be publicly offered in June 2021. Following its listing on FTX and Coinlist, the company would see their 12.5 million HMT tokens rise from $8.3 million in June to $18.8 million just a few months later. As of June 2022 they’re worth $4.7 million. The Human Protocol Foundation is the owner of the digital product hCaptcha, used to protect websites from bots and provide data labelling services to machine learning companies. DigitalX’s 12.5M HMT tokens are escrowed until June 2022, then released linearly in equal amounts over an additional 12 months.

In 2021 we would find out how would DigitalX’s financials would account for their new HMT tokens.

2021 – Phase 1: Collect HMT, Phase 2: ____, Phase 3: “Profit!”

Financial Year 2021 saw revenue of $9.7M, a profit of $6.8M and a fair value increase in digital assets of $14.9M… reminding us of the importance of the cash flow statement. Cash flows from operating activities was NEGATIVE $1.8M. Working with their auditor, the company felt the receipt of their HMT tokens complies with AASB 15 (Revenue from Contracts with Customers) and as such recognised it as $8.33M in revenue as part of advisory services performed in FY2019. With tokens escrowed for another year plus, that “revenue” and their $6.8M “profit” could end up being vastly different.

The company would raise $8.8M from new US institutional investors to fund growth of both their FUM division and rollout of their regtech product – Drawbridge. While only a 2% discount to the 5day VWAP, a further ~98M shares and nearly 56M in warrants (153.8M total) were issued. With a Form 603 filed, it’s safe to assume Armistice Capital (ACL) was one of the investors. Within 3 days ACL would sell ~9M shares of their initial 51.9M and a further 5.4M by the end of the month. Today they hold just 8.4M shares. Clearly they don’t have the same faith in DigitalX as management do.

DigitalX “achievements” earned ~20M in performance rights to Directors Hicks, Travers and Rubinstein. On a positive note, Travers and Rubinstein continued to buy on market - $21k and $191k respectively and to take shares in lieu of cash salary; albeit only $24k collectively this time around.

The company would invest a further $750,000 in its Digital Asset Fund in response to a downturn in the digital asset market.

July saw the resignation of CEO Leigh Travers who would move on to head Binance Australia while August would see the appointment of Greg Dooley. Mr Dooley was the Managing Director of Computershare Investor Services and their Fund Services Division. With consideration to the company’s past, Chairman Toby Hicks points out “Greg has already shown himself to be a person of high character…” (emphasis added).

A lone bright spot to close the financial year would see DCC achieve a cash flow positive 4th quarter from the funds management division. Excluding their $8.3M HMT “revenue”, their revenue for the financial year consisted of $862k from asset management fees, $269k from consulting, $191k from licensing and $2k from product revenue (their Regtech product Drawbridge). Both of the companies funds, the DigitalX Bitcoin Fund and DigitalX Fund, would return 254% and 387% respectively for the year.

September would see DigitalX acquire profitable trade execution business Sell My Shares for $1.64M with a further $250,000 subject to performance milestones being met. The integration of it’s trade execution system into the Drawbridge app enables compliant execution of internal trades for listed company customers and the ability to grow Drawbridge revenues through a brokerage-based business model.

Lisa Wade would take over the vacant CEO position. Ms Wade brings a strong background in blockchain project development and funds management.

Shares on issue have grown from 199 million to 745 million and DigitalX’s regtech software product (Drawbridge) continues to show a measly 100+ downloads in the Google Play store.

The Chairman’s address to the 2020 AGM is still relevant:

“Many are still trying to find their relevance and it isn’t unreasonable to say that for all the hype around blockchain as a technology, there has been a relatively small number of commercial success stories to date.”

Time will tell if new CEO Lisa Wade can bring DCC commercial success.

References:

https://finance.nine.com.au/business-news/millionaire-facing-jail-over-fraud-was-close-to-broke-years-ago/34dd440e-5c66-48cb-ae70-16e495bf4f18

https://www.afr.com/politics/perth-richlister-zhenya-tsvetnenko-cant-shake-the-partyboy-look-20160728-gqg4ar

https://www.news.com.au/finance/business/technology/russianborn-tycoon-eugeni-zhenya-tsvetnenko-surrenders-to-us-after-fighting-extradition-from-behind-bars-for-years/news-story/63e19053827bcc95d2fb9a427b3d30df

https://financefeeds.com/digitalx-faces-legal-claims-ico-advisor/

https://www.zdnet.com/article/blockchain-global-scoops-up-digital-xs-bitcoin-liquidity-desk/

https://en.wikipedia.org/wiki/Blockchain_Global

https://rorysinghreviews.com/hyperfund-blockchain-global-collapses/

https://hub.easycrypto.com/hyperfund-review

https://www.afr.com/companies/financial-services/collapse-of-crypto-platform-a-cautionary-tale-20210228-p576hn

https://behindmlm.com/companies/hyperfund/blockchain-global-fallout-confirms-hyperverse-execs-in-hiding/

https://isthiscoinascam.com/check/xbullion