Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

13-July-2020: OPERATIONS AND CORPORATE UPDATE

I don't hold DCN shares. I used to, but I learned my lesson. Here they go again, with another update full of positive spin and plenty of bad news. And once again their share price is plumbing new depths, down -17% so far today (at 11:50am Eastern).

Once again, they've downgraded production guidance while increasing costs guidance: Production for FY2021 is now guided to be between 110,000-120,000oz at an AISC of between $1,400-$1,550/oz (previously 120,000-130,000oz at an AISC of between $1,250-$1,350/oz).

This has become a very nasty habit of Dacian's - to overpromise, then downgrade, often multiple times, then probably underdeliver on their reduced guidance anyway. What you want is the opposite - where companies provide conservative guidance, then upgrade it as the year progresses. The best ones then often overdeliver on that upgraded guidance. Dacian can serve as a masterclass in how NOT to run a gold producer. Unless you trade this one, and have exquisite timing, you will have lost money in Dacian. Most people have. Except for their board and management. They've lost money on their shares, but they've made plenty out of salaries and early bonuses.

Dacian will always have a story. The best is ALWAYS just around the corner. However as someone who places a great deal of emphasis on being able to trust a company's management to deliver on their promises, and to make promises that they can keep in the first place, i.e. I want company management teams with great track records who consistently produce above-average shareholder returns - I would STEER WELL CLEAR of Dacian Gold.

Also, I note that they've also said, "Refinancing of the project loan facility is advancing towards a 1HFY2021 targeted completion, with further repayments of $25 million expected during the September quarter, after which total debt will be $39.1 million".

So their current debt is around $64m, and their market cap (at 32 cps) is only $180m, and they are still chasing a refinancing deal. They were only recently recapitalised after a long trading suspension, and they need to refinance again already. This is not a good place to be. And if you are an investor, there are not many reasons to be there. And most of those reasons are fraught with risk. Danger, Will Robinson, Danger!!

30-Apr-2020: Quarterly Activities and Cashflow Report

This is a company I used to own shares in, but sold out in May last year, at $1.00/share, for a considerable loss, for reasons I explained at the time. They are now trading at under 40 cents per share and have a LOT more shares on issue now than they did then, so each share is worth considerably less (as a proportion of the entire company) than it was last May. They also have high costs - on track for June quarter production of between 33,000-36,000 ounces at MMGO (their Mt Morgans Gold Operation) at an AISC (all-in sustaining cost) of between $1,400-$1,500/oz - and hedging in place that limits the upside from the current high A$ gold price. The A$ gold price today is around $2,600/ounce, and Dacian had a total forward hedge position as at 31 March 2020 of 115,455 ounces at an average price of A$1,978/oz, some 24% lower than the current spot gold price, which, in my opinion, is only going higher.

They recapitalised the company in April at 30 cps after being suspended from trading for the whole of February and March. They closed on 31-Jan-20 at $1.40 and opened up on 14-Apr-20 at 45 cents (-68% lower). The capital raising/entitlement offer was priced at -78.6% below their last traded price (of $1.40). What a ride for DCN shareholders!

Post receipt of recapitalisation proceeds and initial debt repayment, Dacian pro-forma balance sheet at 31 March 2020 consists of $87.4 million in cash (before costs) with total debt of $70 million. Not a big buffer there, so plenty more can go wrong from here. High cost gold miner with limited upside from a rising gold price. And they've still got substantial debt. Their market capitalisation is now under $200m, even with all of the extra shares they've just issued, and they have debt of $70m AFTER planned repayments using the proceeds from the raisings. Their retail entitlement offer closes tomorrow. Luckily it's fully underwritten, so they will raise the planned money, but to secure that underwriting, they had to do it all at 30c, almost 80% below their last traded price.

It's a terrible outcome for their retail shareholders.

A rescue-raising, the second one in 12 months no less, and they've come out of it still looking quite sub-par when compared to their peers.

They've got higher costs, poor hedging, and their ore is low-to-medium grade as well, with an average feed grade of 1.5 grams of gold per tonne of ore, and with a plant recovery of 92.8%, that means they are producing around 1.4 grams of gold for every tonne of ore they process. Hence their higher costs. Their 2nd half FY2020 AISC guidance is between $1,550-$1,650/oz, which takes into account higher costs in the March quarter and projected lower costs in the current June quarter. They say, "The Company’s three year outlook over the period FY2021 – FY2023 delivers average annual production of 110,000 ounces at an AISC of $1,350/oz."

I am particularly wary of their forward guidance, as their history is of overpromising and underdelivering.

They're still trying to put a positive spin on everything. They have always tried to do that. However, when you step back and look at Dacian as an investment, it has been a terrible one for the vast majority of their investors. And there are clearly better gold producers you can invest in - who have better fundamentals as well as much better track records, so there's just no need to be invested in Dacian Gold. Not much to like really.

[Disclosure - NOT a DCN shareholder.]

08-Apr-20. I sold out of Dacian when this downgrade cycle of theirs commenced in June last year. When they emerged from that first trading halt, after their first guidance and production downgrade (which was massive), I sold out into the opening auction and got $1/share. They closed that day at 51.5 cps - which was what I got for my virtual shares in Strawman.com (which I removed from my scorecard that day - i.e. "sold"). I said at the time that I'd lost faith in the competence and credibility of Dacian's management and I wasn't interested in owning shares in a company when I no longer trusted their management. They subsequently found more gold and rallied back up to as high as $1.73 (in January 2020) and then entered a trading halt (at $1.40) on January 31st, which turned into a trading suspension, and they've been suspended ever since.

Today (Wednesday 8th April 2020), they've announced all of this:

Equity Capital Raising to Recapitalise Dacian

Prospectus - Non Renounceable Entitlement Offer

They are conducting an institutional share placement and a 1:1 (1 for 1) accelerated pro rata non-renounceable entitlement offer (ANREO) to raise up to approximately A$98 million, with all the new shares to be priced at 30 cents each.

Dacian’s Managing Director, Leigh Junk, commented: “Today’s equity raising recapitalises Dacian’s balance sheet and transitions the Company into a derisked, sustainable and high margin gold producer. Together with the appointment of a new leadership team, an updated and independently verified Mineral Resource and Ore Reserve, and a three-year outlook that focuses on proven open-pit operations, this equity raising will effect a recapitalisation that will position Dacian to unlock the full potential of its asset base.

Our substantial Mineral Resource, advanced near-mine exploration targets and historical stockpiles present several opportunities to extend Mt Morgans beyond the three year outlook, while the optionality that Westralia presents for the Company under a re-optimised operating model provides currently dormant upside potential.

The proceeds from the Offer will enable the Company to deleverage the balance sheet and execute on its operating plan to generate sustained positive cash flow, while also providing the ability to invest in the future growth strategy for Dacian and Mt Morgans.”

--- click on links above for more detail ---

Plenty of positive spin, but a fairly disastrous outcome for existing shareholders. I'm not one of those. It goes to show, as I've said before, that owning a gold mine doesn't mean you're necessarily going to make a lot of money. The management of Dacian would certainly have made plenty, but ordinary shareholders who've "kept the faith" have not been rewarded for their loyalty - they've just been massively dilluted and seen severe value destruction. It has proven to be a LOT safer and more profitable to stick with the bigger and better gold miners like NST, EVN, SAR and SBM. Those 4 gold producers are all core holdings in my super fund and they're also in my other portfolios to various degrees. This is a very good time to be holding quality gold miners with capable and trustworthy management. Unfortunately, Dacian Gold (DCN) is not one of those.

22-Sep-18: This is just an update regarding the gold producers list I wrote about in another "Company Presentations" straw here.

Tribune (TBR) and Rand (RND) have announced during the past week that they have sold a large portion of the gold bullion that they had stored at The Perth Mint, and are returning that money to shareholders via massive fully franked special dividends. This has resulted in the share price of TBR rising 50% on Thursday and holding those gains on Friday, and RND rising almost 60% on Thursday and another 6% on Friday. I have full details of those dividends and the implications of them (and the risk that they may not proceed) in 3 "ASX Announcement" straws under Tribune Resources.

While our top 10 ASX-listed pure-play gold producers list hasn't changed, it has now grown to 11 (all with market values, a.k.a. market capitalisations, or market caps, or m/caps, of over $500 million), and the order of the next 7 (#12 to #18, all with m/caps between $200m & $500m) has certainly changed.

The main movers have been TBR (up 2 spots from #13 to #11) and RND (up from #22 to now be at #16). The list as of Friday's close, in market cap order, from biggest to smallest, of our seven $200m to $500m market cap gold gold producers is: WGX ($439m), PRU ($373m), SLR ($290m), RMS ($264m), RND ($242m), AGG ($231m), and AQG ($225m).

TBR has left those 7 behind for now - they should come back to the fold shortly as their proposed huge $3.50/share special dividend goes ex-div on Tuesday (25-Sep-18) which will undoubtedly result in a substantial share price fall - and the div might also be blocked or postponed by the Takeovers Panel; TBR have moved up into the $500m+ group for now, which was 10 companies but is now 11.

TBR is now #11 with a m/cap of $525m, nipping at the heels of DCN (Dacian Gold) which closed yesterday with a m/cap of $526m. Aurelia (AMI) has powered further ahead of DCN now and has a market value of $662m.

Those top 11 (all with m/caps of over $500m) are NCM, NST, EVN, OGC, RRL, SBM, SAR, RSG, AMI, DCN & TBR. The only change is the addition of TBR.

As I said, I would expect TBR to be back in the sub-$500m club soon enough, most likely Tuesday (25-Sep-18) when they are due to go ex-div for that $3.50 special dividend.

Back to DCN: To keep up to date with Dacian's latest presentations, you can check their website: http://www.daciangold.com.au/site/content/

Scroll down for their latest news and presentations.

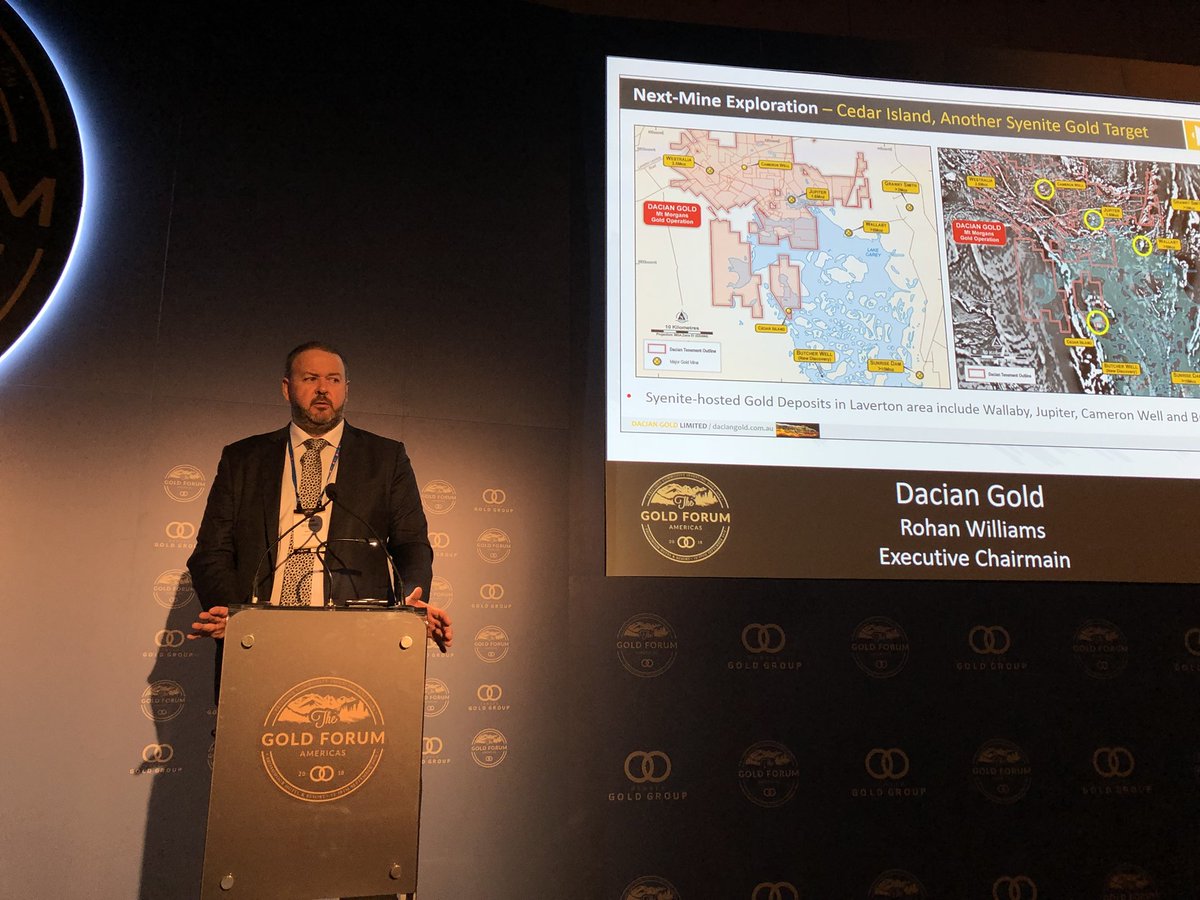

20-Sep-18: Dacian Gold Company Presentation - Denver Gold Forum - see here.

Dacian (DCN) is a top 10 gold producer in terms of market cap, yet they only started producing gold in the past 6 months. The other emerging gold producer in our top 10 is Aurelia Metals (AMI). I am excluding the larger miners who produce gold as a byproduct (BHP, OZL, SFR) or IGO who have a 30% interest in the Tropicana gold mine but whose main focus is on nickel and copper.

20-Sep-18: Of our top 10 listed pure-play gold producers (gold is the main commodity that they produce), we have three at the top, all with market caps of over $4 billion, being NCM, NST and EVN [21-Sep-19: One year later their market caps range from $7 to $26.7 billion].

We then have another 4 who all have market capitalisations of between $1 and $3 billion, and they are OGC ($2.5b), RRL ($2b), SBM ($1.9b) and SAR ($1.5b) (Sep 2019).

After those 7, there is RSG at $795 million, AMI at $580m and DCN at $504m.

Below those top 10, we have 7 smaller gold miners with m/caps of between $200m & $450m, being WGX, PRU, TBR, SLR, RMS, AQG & AGG.

Below those 17, there are 5 with m/caps of between $100m and $200m: PNR, MOY, DRM, GCY & RND.

Below those twenty two $100m+ m/cap gold producers, I am aware of another 7 listed companies here in Australia that produced and/or sold gold in the June 2018 quarter; those 7 (again, listed from biggest m/cap to smallest) are EGS, BDR, MML, BLK, TRY, MAT & DRA (worth a tiny $13m).

[September 2019: Much has changed in 12 months - DCN & AMI are well below the top 10 now for a start]

I am also aware of at least another 50 ASX-listed companies who own gold in the ground - or are actively exploring for gold, but did not produce or sell any gold in the quarter ending June 30, 2018. That list has GOR at the top (worth $544m) and GOR will be producing in 2019. Other larger explorers and developers include KDR, PAN, AUZ, ARV, CYL, LEG, OKU, RED and PEX. Not all of these have gold as their main focus (unlike my producers list). Exploration companies can shift focus quickly depending on commodity prices and what their drilling uncovers.

Explorers are very risky. Investing in those who are not yet producers is not really investing so much as gambling, but I do like to roll the dice with a small portion of my portfolio. You can narrow your odds of success by studying the form of their management and what they've achieved previously.

Disclosure: Of those mentioned here, I hold NST, EVN, RRL, SBM, DCN, AMI, IGO & SFR, who are all producers.

21-Sep-2019: One year on... I still hold NST, EVN, SBM & SFR, but I've sold out of RRL, AMI & IGO - all with good profits, and sold all my DCN at a loss. Dacian had a shock (major) production downgrade - which included much higher projected future costs - which is the subject of another straw. I lost faith in Dacian's management, so I sold all of my Dacian shares immediately.

That was in the first week of June this year (three and a half months ago) and they went from $1.585 to 51.5 cents in one trading session, losing two thirds of their market value. I sold into the opening auction when they resumed trading (from their trading halt/suspension pending that announcement) - so I got $1.00/share for my entire holding (the opening price on the day), but they show as 51.5c here on my Strawman.com scorecard - because that's the price they closed at on the day (being the day that I sold out in real life and also the day I closed the position on my scorecard here). They began to recover in August, and continued climbing back up in September (so far), closing yesterday (Friday 20th September 2019) at $1.46, being the highest price they've been since May. I'm still happy to be out - no faith in management means no shares in my portfolio - and I'm happy to forego possible gains on companies where I have serious concerns about their management's credibility, trustworthyness, and/or competency.

In the vast majority of cases where I made exceptions (in prior years) to my own rules and held such companies based on hope, sometimes waiting for a higher exit point, or (worst of all) trying to get back to "breakeven" - the stupidest reason of all - and the one that's lost me more money than any other excuse - I've either lost a lot more money than I would have if I'd done the right thing and cut my losses when the serious doubts first surfaced, or else I've lost 100% - because they went into voluntary administration and shareholders ended up with nothing. I've learnt the hard way that something is always better than nothing and it's always best to NOT anchor on purchase price.

It's always a case of: If I didn't already own them, would I buy them today at this price, knowing what I know now? If not, it's almost always best to sell out - to cut your losses before they get worse. In my experience.

Continued in a 2nd Straw...

Straw #2 of 2:

Being wrong - or making mistakes - is part of the game. You don't even have to be right more often than you're wrong. Geoff Wilson, a very succesful fund manager, disclosed a few years ago that his team at WAM Funds had analysed their win/loss ratio and found that they had lost money on around 60% of their trades and made money on around 40%, over the prior 12 months. However they had still outperformed the market and their own benchmark index, because they tended to quit losing positions quickly as soon as they realised they'd got it wrong, and lose not very much, and when they were right, they let their winners run and made plenty.

It's not so much how right you are and how often, but more about what you do about it when you realise you've made a mistake. The biggest losses tend to come from holding bad companies for too long. Selling winners too early is also another common mistake that Wilson and his team tend to avoid, for the most part.

So - is Dacian one of those "bad" companies I refer to? Time will tell. For now I think there are better gold producers out there, and certainly other ASX-listed gold producers that I would prefer to be invested in, and I am.

But where do Dacian fit in?

In August-September last year they were the ASX's 9th largest listed gold producing company (of the pure-play gold producers - as I explained in the previous straw, so does not include BHP, OZL, SFR, IGO, etc who produce gold mainly as a byproduct of other production).

Twelve months on, they have dropped 9 positions to #18, with their market cap falling from around $520 million to $315 million now - according to the ASX website.

AMI (Aurelia Metals) have also lost their market darling status, dropping from #10 to #17 and losing over 20% of their own market cap.

Of the 29 gold producers I mentioned in Straw #1, 25 are still trading on the ASX. Of the other 4, one (GCY) is in voluntary administration (and is suspended from trading), one (DRA) has chosen to de-list here and instead list on the HKEx (in Hong Kong), and two have been taken over - being Doray Minerals (DRM) who were aquired by Silver Lake Resources (SLR) and Beadell Resources (BDR) who were bought out by Great Panther Mining (who are listed in the USA and Canada - NYSE:GPL / TSX:GPR).

The 25 that are still mining and producing gold (as their main focus and activity) and are still ASX-listed - and trading - are below, in order of market capitalisation (from biggest to smallest). I have added GOR (Gold Road Resources) as well, as they have just transitioned from project developers to gold producers in the past 4 months, so that makes 26.

- NCM, Newcrest Mining

- EVN, Evolution Mining

- NST, Northern Star Resources

- AGG, AngloGold Ashanti

- SAR, Saracen Mineral Holdings

- RRL, Regis Resources

- OGC, OceanaGold Corporation

- AQG, Alacer Gold Corporation

- SBM, St Barbara

- RSG, Resolute Mining

- GOR, Gold Road Resources

- WGX, WestGold Resources

- PRU, Perseus Mining

- SLR, Silver Lake Resources

- RMS, Ramelius Resources

- TBR, Tribune Resources

- AMI, Aurelia Metals

- DCN, Dacian Gold

- PNR, Pantoro

- RND, Rand Mining

- MML, Medusa Mining

- MOY, Millenium Minerals

- OBM, Ora Banda Mining (formerly Eastern Goldfields, EGS)

- TRY, Troy Resources

- BLK, Blackham Resources

- MAT, Matsa Resources

I guess where Dacian fits in now - is in the bottom half, with higher costs, a lower market capitalisation, and a few questions over management credibility.

15-Oct-2018: Quarterly Activity (September Qtr) and Cashflow Report - see here

Dacian released this today (6th July 2018) and rose 6.9%:

http://www.daciangold.com.au/site/PDF/1570_0/OperationalUpdate

Their most recent investor presentation was:

http://www.daciangold.com.au/site/PDF/1545_0/InvestorPresentationJune2018

Their homepage:

http://www.daciangold.com.au/site/content/

Their gold plant at Mt Morgans is operating as expected, and they're on track to declare commercial production next quarter (in the December 2018 quarter).

They are also busy looking for more gold.

6th January 2018: Additional: DCN spent 2018 mostly falling - from over $3 (in March/April) to under $2 in December. They are on the rise again now, already back to $2.72 and the NE trajectory looks very good. They kept saying that they would achieve MMGO (Mt Morgans Gold Operation) Commercial Production in December, but they haven't declared it yet - that announcement is due any day now. However, there has been plenty of good news, including the following as disclosed on December 18th:

MT MORGANS ORE RESERVE INCREASES 16% TO 1.4MOZ - see here

Extends Westralia Ore Reserve life to FY2025 and includes maiden 45koz Ore Reserve for Cameron Well as 3.5Moz Mt Morgans Project remains on track to establish 10-year life at +200,000oz pa

Key Highlights

- Total Ore Reserve for the Mt Morgans Gold Operation (MMGO) increases by 16% to 1.39Moz (net of mining depletion), increasing current production visibility to at least FY2025

- Westralia Ore Reserve increased by 17% to 575,000 ounces (net of 28,000 ounces mining depletion), extending Westralia’s current Ore Reserve life to 7 years (FY2025)

- Jupiter Ore Reserve of 611,000 ounces, maintaining Jupiter’s current Ore Reserve life to FY2025

- Maiden oxide Ore Reserve for Cameron Well of 45,000 ounces forms the basis for mine planning activities – paving the way for further expansion and production growth from Dacian Gold’s third production centre

- Numerous initiatives underway to continue growing Ore Reserves and Mineral Resources at Westralia including... see announcement for details (link above or click here)

Also, it is worth noting that MAH (Macmahon) have the mining contract for Dacian at Mt Morgans - see here and here. MAH are very experienced at gold mining. They do the mining at Telfer for NCM and at Tropicana for AGG & IGO.

Disclosure: I hold DCN and MAH shares.

16-Oct-2018: Dacian Gold (DCN) Company Presentation - October 2018 - see here

23-Oct-2018: Dacian Gold 2018 Annual Report - see here

09-Jan-2019:

EXCELLENT DECEMBER QUARTER SEES DACIAN DECLARE COMMERCIAL PRODUCTION AT MT MORGANS

See here.

- Dacian meets its target of achieving Commercial Production in December at the Mt Morgans Gold Operation (MMGO) in WA

- Outstanding December quarter performance, with gold production at 37,930oz, up 30% from the September quarter

- Progressively increasing production levels expected through remainder of FY19

- Cash and gold-on-hand increased to A$85.6 million at December 31, 2018

10-July-2019: FY 2020 Guidance & Updated 8 Year Life of Mine Plan

The market liked it. DCN is up around 24% today on the back of that announcement. However, to keep that in context, they've risen from 52.5c to 65c, and they were trading at over $1.50 in May, over $2 in April, and over $2.50 in March, so even with a 20%+ rise today, they're still trading at around 80% less than they were 4 months ago.

I don't hold any DCN now. I sold all of mine on the day of the massive guidance downgrade (see straw titled "Massive Downgrade") at $1.00 each. They closed that day at 51.5 cents, almost half the price I sold at on the same day. I also removed DCN from my Strawman.com scorecard on the same day. Guess which price was recorded as my exit price. Yep, 51.5c, the closing price on the day, which is almost half of the price I sold the stock at in real life on the very same day. One of the biggest drawbacks of this site really - not being able to nominate limit orders for buys and sells - or to buy and sell at live prices. Maybe one day...

05-June-2019: Mt Morgans Operation & Corporate Update

Dacian Gold (DCN) came out of their trading halt this morning with a massive downgrade - Production guidance for the June quarter has now been revised down to 36,000-38,000oz at an MMGO (Mt Morgans Gold Operation) All-in Sustaining Cost (AISC) of A$1,500-$1,600/oz (previous guidance was 50,000-55,000oz at MMGO AISC of A$1,050-$1,150/oz). Their gold production for the first three days of June was zilch (nil, nada, bugger all) after a ball mill motor failed and shut down their entire operation for three days. They've also reported that underground contractor performance issues have resurfaced, which have resulted in lower productivity than previously anticipated.

DCN’s preliminary FY20 production and cost guidance now anticipates production will be in the range of 150,000-170,000oz at an MMGO AISC of A$1,350-$1,450/oz. A year ago, they had an aspirational target AISC of A$1,000/oz. They're now saying costs are 50% to 60% higher (currently), and will still be 35% to 45% higher in FY20.

A$1,400/oz (the mid-point of their latest FY20 AISC guidance) is NOT a low AISC and puts them in the least profitable 25% of our top 10 gold miners here in Australia. I immediately sold all 5,000 of my DCN shares, at $1 (the price they resumed trading at this morning). They're now down 56% to 70c.

An updated 5-year Mine Plan is set to be released by the end of June. The Company’s preliminary review anticipates an annual average production level over the 5 years in the range of 160,000-180,000oz. Several additional production sources that could increase this range are also being considered including from the Cameron Well, Morgans North and Mt Marven deposits. The Company is confident ongoing exploration success will continue the indicative production levels of the 5-Year Mine Plan well beyond 5 years.

While they have given indicative FY20 guidance this morning (which I have commented on above), they have said that final FY20 guidance will be released by the end of June following completion of further optimisation analysis.

Also, following several recent unsolicited enquiries from corporate entities, the Company has commenced a strategic review process to consider potential corporate and funding initiatives which may culminate in a change of control transaction.

Dacian's "Mt Morgans" gold project and Gascoyne's "Dalgaranga" gold project were the two large EPC contracts that gave GR Engineering Services (ASX:GNG) such a successful FY18 (and why FY19 is going to be quieter due to the absence of large contracts of a similar size). DCN & GNG also share a director, Barry Patterson, who has a decent personal shareholding in both companies (7.5m GNG shares and almost 7m DCN shares). GNG also did the feasibility studies for Dacian prior to being awarded the EPC contract for the construction of Mt Morgans (MMGO). GNG were NOT involved in the FS's (either the PFS or the BFS) for GCY (Gascoyne Resources), and Gascoyne's problems are now so bad they called in the administrators on Monday, which has had a knock on effect on NRW Holdings (NWH) yesterday (the mining contractors at GCY's "Dalgaranga" Gold Project) and Zenith Energy (ZEN) today (the electricity generation service providers at Dalgaranga).

Both NWH and ZEN have released announcements over the past 2 days outlining their take on how the various possible outcomes at GCY could affect them. The answer in both cases is "not too much" (my interpretation) although there is likely to be a decent provision in NWH's FY19 accounts for GCY when they report in August. While NWH have said that they estimate their total financial exposure to GCY to be around $35m, most of that was expensed in the first half and the resulting likely cash movement in the current half is only around $8m. To put that into some perspective, even with zero work at GCY's Dalgaranga, NRW Holdings (NWH) are guiding for FY20 revenue of around $1.5 billion, of which they have already secured $1.3 billion.

Disclosure: I no longer hold any DCN shares, and I didn't own any GCY shares. I do hold GNG & NWH, and a little ZEN as well.

08-Jul-2019: More bad news to come? DCN are in another trading halt pending the release of another announcement to the ASX regarding FY2020 guidance and an updated 8 year life of mine plan for their Mt Morgans Gold Operation (MMGO). Voluntary Administration time yet? Of course, with a A$ gold price that recently went over $2,000/ounce for the first time ever and a new high grade deposit found north of their existing operations since their last dowgrade, it could always be positive news... ...But probably not...

Post a valuation or endorse another member's valuation.