Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

I’m hoping DDH1’s WHS standards are better than this drillers operation!

I had great expectations for DDH1 drilling, and once again I find we are tied up in a takeover deal that undervalues the business. Similar to Best & Less, a venture capitalist (majority holder Oaktree in this case) wanted out and Parenti (PRN) has taken the opportunity to swallow up DDH1 in a heavy script take over deal. The Board agreed to the deal most likely with a forced hand following a soggy start to drilling this year (extreme wet weather).

The ‘standard’ offer to DDH1 shareholders is 0.6924 Parent shares for each DDH share held plus 12.38 cps in cash following the 1.96cps fully franked dividend paid yesterday. There were other options with either more script or more cash. I reluctantly settled for the standard option. Selling DDH sub 90 cps was not a good option IMO.

Working on the PRN current share price of $1.08, DDH shareholders will receive close to 90cps including the fully franked dividend (which is deducted from the take over price). That’s OK and it’s about 6% above my cost price. We have also enjoyed dividends of over 6% fully franked since owning the business. So, overall it’s better than the average return on the ASX 300, but it would have been easier to own ASX:VAS.

I was hoping for a better outcome given my previous valuations were all above $1 per share and at times the share price came close to this. I still think the business was worth 20% more than the takeover price, but that’s history now!

Moving forward

So moving on, DDH1 has stopped trading and if you hold DDH shares today you will receive the offer you elected as part of the scheme.

- shareholders who elected to receive the Standard Consideration will receive approximately 0.6924 Perenti shares plus A$0.1238 cash, for every DDH1 share held at the Record Date; or

- shareholders who elected to receive the Maximum Cash Consideration will receive approximately 0.5263 Perenti shares plus approximately A$0.2978 cash, for every DDH1 share held at the Record Date; or

- shareholders who elected to receive the Maximum Scrip Consideration will receive approximately 0.8105 Perenti shares for every DDH1 share held at the Record Date.

Perenti

From the 9th October current DDH shareholders will hold PRN shares instead. At first I was not impressed with becoming a Petenti shareholder because of the following reasons:

- Founder ownership now highly diluted

- Perenti has poorer capital management

- Perenti hasn’t paid dividends and they should be

- Perenti’s ROE is poor, 7% compared to DDH’s 12.5%.

- Perenti has a higher debt to equity, 53% compared to 9% for DDH.

However, on the bright side DDH will make PRN a better business. It will lower debt on equity, improve ROE and increase the value of the business, despite the PRN share price losing value ever since the scheme of arrangement was announced.

Analyst expect PRN earnings to grow at 20% from here, let’s assume double digit growth. Forward ROE is expected to be double digit (11%) and the combined book value should be c $1.80 per combined PRN share. The PRN board has indicated that dividends will return in the future but this might have just been an enticer to tempt DDH shareholders voting on the scheme.

Valuation - Perenti post merger

So from 9th October DDH shareholders say goodbye to DDH and hello to Perenti. We get to walk away with c. 15.2 cps in cash and fully franked dividends and 0.6924 shares in PRN. It’s probably not a business I would buy with new money because it doesn’t pass my minimum ROE entry filter (15%), and I like to see the ROE on an upward trend. So unless ROE continues to improve from here I will be looking for an opportunity to exit.

However, the combined PRN seems to be well undervalued at $1.08 per share. Assuming ROE at 11%, book value of $1.80, 50% of earnings reinvested, and a required investment return of 15%, I get a valuation of $1.30, representing a possible 20% upside to the current share price.

I am worried though about Perenti’s capital management from here. When ROE is low double digit, the best use for earnings is to pay down the debt and return the rest to shareholders as dividends. However, I must credit the current Perenti board for acquiring a business which is a far better performer than the parent company at an undervalued price tag! Got to give credit where credit is due! :)

So, here’s my last post from DDH as another one bites the dust!

Disc: Held IRL 6.2%, SM 5.1%

Within minites of the DDH1 board announcing the Perenti acquisition agreement (26 June) the DDH1 share price reached a high of 92 cps before beginning to plummet. Four days later (30th June) the share price closed at 82.5 cps, which was even lower than the share price the day before the acquisition announcement.

The share price seemed to defy the views of both the DDH1 and Petenti Boards who suggested the combined business would create value for both DDH and PRN shareholders. DDH1 shares were said to have an implied value of $1.01 (a premium of 17.4%) based on the 5-day VWAP. The valuation was based on a cash payment of 12.38 cps plus 0.7111 shares in PRN for each DDH share held. So the DDH share price is now closely linked to the PRN share price due to the script heavy acquisition.

I did not expect the share price of both businesses to plummet and I have been trying to work out why. I think the reason for the sell down could be due to private equity firm Oaktree selling down borrowed shares in Perenti. While I’m not certain of this, it does look very suspicious. I guess the reason will become apparent.

I’ve learnt an important lesson this year. Be wary of businesses that have been floated by private equity and where they continue to retain a large stake in the business after listing. Private equity is there for a good time, not a long time! They are always waiting for an opportunity to exit and maximise their profits. Once they have made their money they are ready to move on to their next plaything, even though the business might be well undervalued. They have the capacity to create share price momentum in the wrong direction because they are not buyers, they are sellers! Something I have experience with both Best & Less and DDH1 this year.

Oaktree have been chomping at the bit to exit DDH1 since it listed (see AFR article below). I suspect Oaktree have been very supportive of the deal with Perenti as they see it as an opportunity to exit DDH1 and maximise profits in a year when earnings for DDH1 have been impacted by the wet weather and a slow start to 2H FY2023.

Their are a few things that point to Oaktree’s early exit on the DDH1 acquisition agreement:

- Perenti’s call option for 80,178,575 shares in DDH1 currently owned by Oaktree

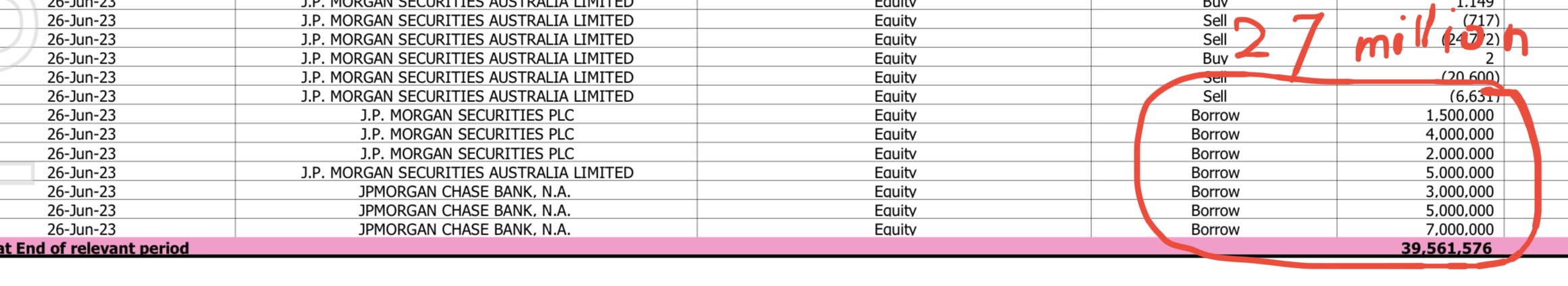

- JPMorgan Chase borrowed 27.5 million shares in PRN on 26 June.

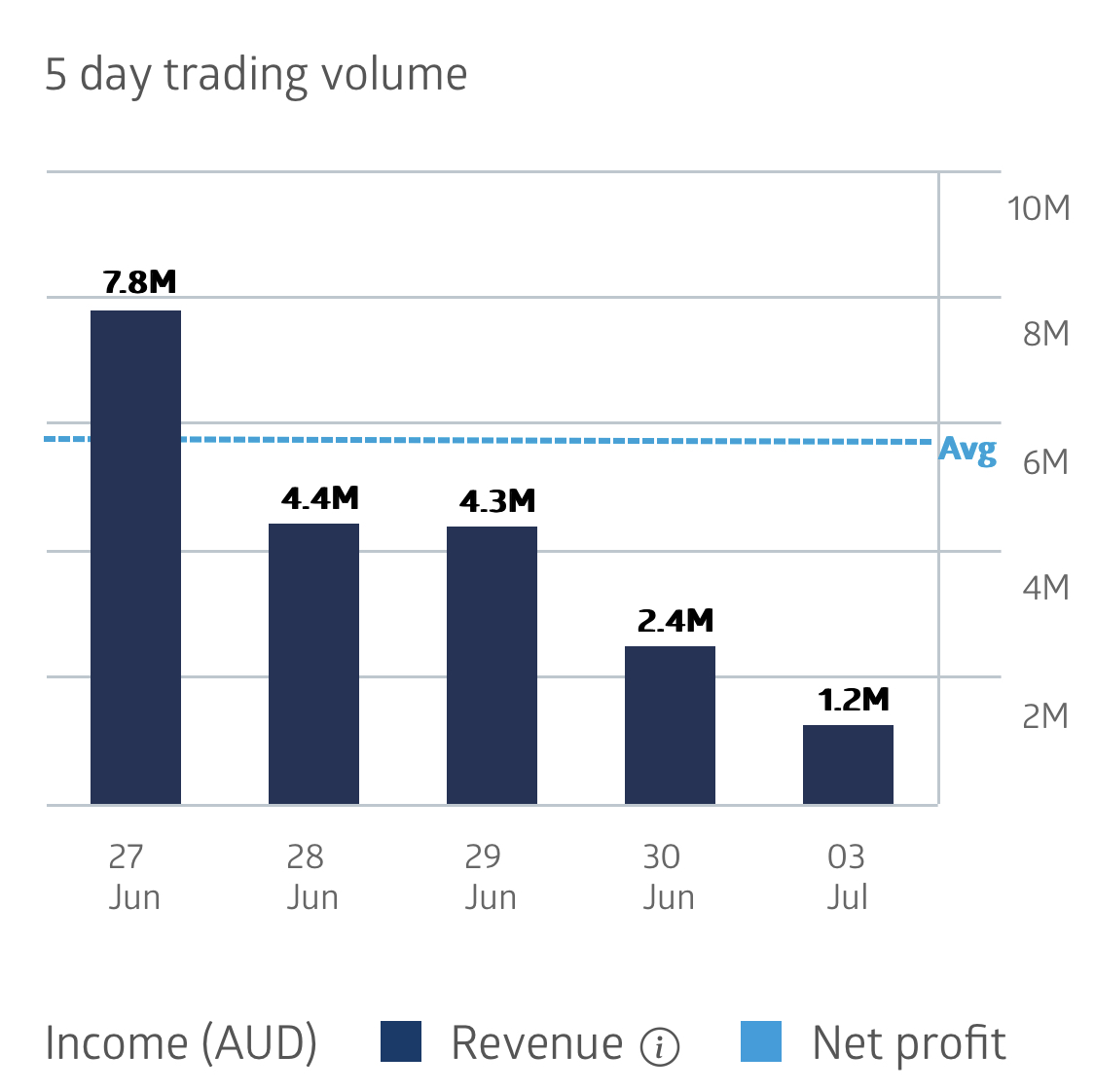

I suspect the 27.5 million PRN shares were borrowed to sell when the PRN share was close to a 12 month high of $1.29 per share. I don’t know if these shares were borrowed for Oaktree, but it looks suspicious given the heavy sell down (19 million) of shares over the four days following the announcement (ASX 5 day trading volume chart below).

The big sell down is also at odds with recent director buying (Timothy Longstaff bought 43,500 shares on-market for $50, 014).

Thankfully the selling has tapered off today and the PRN share price is up 6% at time of writing.

Disc: Held IRL and SM.

Oaktree’s white flag indicative of a life on the ASX

(AFR, 26 June 2023)

Oaktree Capital’s DDH1 joins the growing list of PE playthings to be snapped off the ASX. It shows the bourse is often just a temporary home.

It’s one thing putting a private equity investment together, it’s another finding an exit. And it’s the latter that’s the harder part, particularly with IPO markets either closed or suspicious of new listings.

Oaktree Capital did well investing in West Australian driller DDH1, taking a 50 per cent stake in June 2017 soon after the American firm formally set up in Australia by opening an office in Sydney.

The exit’s been a longer journey but can be consigned to Australian deals history as part IPO/part buyout, an increasingly common exit route for private equity sellers. The ASX boards are often just a temporary home for private equity-backed businesses such as DDH1.

Oaktree’s involvement in DDH1 stretches back six years. DDH1 was the leading provider of directional diamond core drilling services – used to extract core rock samples in gold and base metals – and went looking for a deep-pocketed backer to help it expand into other drilling disciplines.

Oaktree took the bait and invested for a half share in June 2017. It backed the “platform” strategy and DDH1 added Strike Drilling in June 2018 and Ranger Drilling in April 2019. Strike was an air core and reverse circulation driller used by exploration companies mostly in WA, while Ranger was a reverse circulation driller serving the Pilbara iron ore industry. With more rigs and more customers, the combined group was bigger and potentially more valuable than the three businesses operating alone.

By December 2020, DDH1 had 96 drill rigs and made most of its money drilling at producing mines or helping with brownfield expansion in WA. Servicing the gold sector accounted for half of its revenue in 2020.

The exit was planned at about the same time, when DDH1 set course for an IPO. It met with fund managers and eventually raised $150 million to list with a $367.5 million enterprise value in March 2021. The deal didn’t fly out the door, but had a big cast of stockbrokers to drum up buyers.

The IPO was a partial exit for Oaktree. The pre-float investors, which included Oaktree, took a combined $109 million off the table and retained a combined 60 per cent stake. About one-third of that (22 per cent of the company) was in Oaktree’s hands, locked up under voluntary escrow.

But listed life proved to be a bit of a slog. DDH1’s revenue and earnings grew strongly, but its share price did not. The stock listed at $1.10 a share, traded down straight away and has spent most of its time below the $1.10 mark in the two years and three months since.

DDH1 was either too small and too illiquid for fund managers (it is not in the S&P/ASX 300), left behind by the market’s flight to bigger and more liquid stocks, or not diverse enough in its revenue base, depending on who you ask. Investors did not reward it for beating its prospectus forecasts, or its acquisition of Swick Mining Services in early 2022.

DDH1 could also not escape the fact that drilling is a bit of a punt for Australian small-cap fund managers, with fundies trading in and out of the likes of Ausdrill (now Perenti) and Boart Longyear for years as a means to play the mining cycle. They see them as boom and bust stocks that you want to own in the boom times.

The other problem was Oaktree’s retained stake, with institutions a bit put off by the potential for a chunky selldown. That’s life on the ASX boards. Oaktree tried to address those concerns last year, while sell-side analysts continually pointed to DDH1’s big discount to its closest listed peer, Canada’s Major Drilling Group.

While the discount is still big – Major Drilling last traded at 5.2 times forecast EBITDA and 12.4 times earnings per share versus DDH1 at 2.7 times EBITDA and 6.3 times earnings per share – Oaktree and DDH1’s board and founder shareholders have called time on life as a separately listed company. It was the best of a bunch of potential deals studied, DDH1 chief executive Sy van Dyk said on Monday, and a way to fix the aforementioned problems.

Oaktree offered options over its 19.99 per cent stake to Perenti as a form of deal protection, proving it’s keen to see the transaction take place.

The scrip-heavy deal valued MA Moelis-advised DDH1 at a 17.4 per cent premium to the five-day volume weighted average price. Oaktree is expected to own 5.7 per cent of the combined group, while the wider DDH1 shareholder base will own 29 per cent stake of Perenti.

UBS-advised Perenti and DDH1 fronted shareholders and analysts on a call on Monday morning. Their pitch was about synergies and creating the biggest ASX-listed mining services play by market capitalisation and a company that could potentially be included in the all-important S&P/ASX 200. Both companies’ CEOs said the early reaction was positive.

The combined market capitalisation is $1.3 billion, which is astonishingly small for the title of Australia’s biggest listed mining services play, given the size of the mining sector and the miners’ appetite for drillers, mining contractors and the like. NRW Holdings is the No. 1 listed mining services group today with a $1.1 billion market capitalisation.

As for Oaktree, it will no longer have a seat on the mining services group’s board. It is not technically gone, but is clearly on the outer. That Oaktree overhang will become Perenti’s problem.

The situation is just another in a growing list of former PE-backed IPOs sold to a trade or financial buyer within only a few years of listing. Others include Healthscope, Spotless Group, MYOB, Asaleo Care, Cover-More, Pepper, Veda, Virtus Health, Scottish Pacific, APN Outdoor and Vitaco. Others in the pipeline include Silk Laser Clinics and Estia Health, both under offer from potential acquirers.

Each has their own reasons, but at the end of the day it’s all about value.

That list says IPOs may help create exits or partial exits for private equity owners, but the floats themselves do not always set the company up for its long-term future. Often the ASX boards are just a temporary home until stars align for a strategic buyer or a new cashed-up private equity player to try to make its own pot of money.

ENDS.

This morning DDH1 drilling announced that they have entered into a binding Scheme Implementation Agreement (SIA) under which DDH1 will combine with Perenti to create the ASX’s leading contract mining services group (Proposed Transaction).

Under the terms of the Proposed Transaction, DDH1 shareholders will receive for each DDH1 share held $0.1238 cash plus 0.7111 Perenti shares (Standard Consideration). DDH1 shareholders will also be offered an ability to elect maximum scrip or maximum cash consideration alternatives (subject to scale back arrangements based on a total available cash pool of $50 million). In other words, shareholders have the ability to elect for either more cash or more scrip consideration and the respective demand is matched to the extent possible, with parties scaled back to the extent of any mismatch. The consideration is subject to adjustment for any DDH1 or Perenti final FY23 declared dividend.

Key Points

• Transaction to occur by way of Scheme of Arrangement, with Perenti to acquire 100% of shares in DDH1

• DDH1 shareholders to receive $0.1238 cash plus 0.7111 Perenti shares for each DDH1 share held, with ability to elect maximum scrip or maximum cash alternatives (subject to scale back based on a total cash pool of $50 million)

• Implies a value of $1.01 per DDH1 share and a premium of 17.4% based on 5-day VWAPs to 23 June 2023

• Perenti shareholders to hold 71% and DDH1 shareholders to hold 29% of the combined entity, enabling

both sets of shareholders to participate in significant additional value creation upside

• DDH1 to be combined with Perenti’s existing Ausdrill business as part of a newly created Drilling Services Division, to be led by Sy Van Dyk (current DDH1 Managing Director & CEO)

• Expanded board of eight members, comprised of six existing Perenti directors, with Diane Smith-Gander AO (current DDH1 Chair) and Andrea Sutton (current DDH1 NED) to join from DDH1

• Unanimously recommended by the DDH1 Board, subject to no superior proposal emerging and an independent expert concluding the scheme is in the best interests of DDH1 shareholders

• Shareholders and Directors representing a combined 38% of DDH1 shares on issue have indicated an intention to vote in favour of the Transaction (subject to no superior proposal emerging and an independent expert concluding the scheme is in the best interests of shareholders)

Strategic Rationale

• Highly synergistic and accretive: $22m post-tax synergies (FY24 at full run rate), driving double digit EPS accretion

• Enhances scale: creates the ASX’s leading diversified contract mining services company, with pro forma market capitalisation of ~$1.3 billion (pre-synergies and potential re-rate), positioning Perenti for potential ASX200 inclusion

• Globally competitive service offering to customers: provides ability to offer a complete range of specialised surface and underground drilling services – highly complementary to Perenti’s client base

• Improves Australian earnings and free cash flow: increases proportion of Australian earnings and accelerates utilisation of existing tax losses

• Delivers on Perenti’s FY25 financial targets: improves margins, significantly improves free cash flow generation, increases return on equity and strengthens balance sheet.

My Initial Thoughts

My initial thoughts are that Parenti shareholders are not the losers in this transaction, even though you might think so by the share price movements today. Parenti’s share price was down over 10% and DDH up over 7% at at time of writing. Why do I think Parenti is getting the best outcome in this deal?

Over the past 5 years Parenti has never achieved a ROE higher than 9% on $2.00 in shareholder equity. Going forward over the next 3 years, (without the inclusion of DDH1), the forecasts for ROE were 9% based on analysts forecasts.

On the other hand DDH1 has achieved over 25% and 11% over the last 2 years and ROE is expected to be 15.5% on 87cps in shareholder equity over the next 3 years based on analyst forecasts.

In addition Parenti has net debt to equity of 38.3% while DDH1 has net debt to equity of 2.5%.

So by amalgamating the two companies Parenti becomes a better business, ROE up to 11% and debt to equity is reduced. Not to mention DDH1’s strong free cash flows will be offsetting Parenti’s expected negative free cash flows. In addition, Parenti’s share price is closer to valuation than is DDH1, however I think both businesses are undervalued.

The deal will help to realise a share price closer to DDH1’s valuation and I am happy about that! It’s early stages, and I still have more work to do in digesting what this means to DDH1 shareholders, and I am yet to value the combined business, but in these early stages I am tempted to start taking some profits on DDH1 over 95cps.

Disc: held IRL (7%), SM (3.3%).

There is nothing like a bit of confirmation bias to make you feel better about one of your larger holdings after a bad day on the market! :)

For the ‘Stock of the Day’ on The Call today (20 March 2023), Nadine Blayney asked the guests to name a stock of their choice to buy if we saw a more significant pull back in the markets. David Navock from Wealthwise Education chose DDH1 Drilling saying it was a STANDOUT BUY. I’ve summarise David’s comments below:

- It’s a drilling company with state of the art equipment it provides to the gold sector

- It took over Swick Drilling recently, one of the biggest underground drilling companies

- It has a 7.2% fully franked dividend yield which is 10.3% grossed up, and this is likely to go up

- It’s on a 6x earnings multiple

- It's instituting a share buy back

- It’s incredibly great value down here and has an 18% return on equity

- The demand for their drilling equipment is just going up, especially with the gold price and where it’s heading. Right now there is a huge demand for their equipment

- to me it’s a Standout Buy, regardless of what happens because it’s not just gold. They are also providing services to other commodities

- Of course it’s all based on the commodity cycle, but it’s a Strong Buy in my view.

I might be slightly biased, but I would have to agree! :)

Disc: Held IRL (7.7%)

DDH1 drilling is one of my largest holdings IRL (7.7%). The share price is down about 17% since the 1H23 results announcement. I think this is due to a number of reasons;

- The overall market has lost its momentum

- Mining stocks are losing favour

- DDH1 management flagged a slow start to revenue this calendar year due to contract delays and the wet conditions in mining areas, particularly Queensland

The weather conditions have not improved in Australian mining areas since the results announcement, as you would have heard on the news. The BOM 3 month rainfall map below shows the extent of heavy rainfall so far this year. This won’t be good for QLD miners either. I expect this will further delay the ramp up for DDH1’s drilling programs. Generally DDH1 hits its straps in March which I don’t think will be happening this year.

With the DDH share price back in the bargain bin, and today being the last trading day before DDH goes ex-dividend (20/03/23) I’ve been topping up. Unusual wet weather is not a structural problem for DDH1 and this will just push out drilling programs. On the bright side, climatologists are forecasting an end to 3 years of the La Niña conditions and a return to the drier El Niño influence (caution to holders of Agricultural stocks).

The current dividend yield for DDH1 is 7.7% fully franked (ie. 11% grossed up with franking credits). On top of this DDH1 are half way through a on-market buy back program. There is no point chasing dividends just for the sake of it, however I believe DDH1 is a well managed business that has plenty of potential upside to the share price. At the current price (86 cps) I think DDH1 can return 18% total return per year if your take a medium term view (1 to 2 years).

Given this year seems to be a year of dividend chasing, then dumping, I expect the price to fall by at least the dividend amount (3.3 cps) when it goes ex on Monday, and it could continue to fall. However, for patient investors with a view to hold for at least 12 months, the risk reward for DDH looks sound.

Disc: Held IRL (7.7%)

Today DDH1 released its 1H23 results. A decent result, with no change from the unaudited version released on 6 February.

A 3.33 cps fully franked dividend was declared (7% yield on current price), the on-market buy back is half way there, and the business is generating heaps of cash. All the metrics are up and in line with expectations, ROIC was 26.5%. Sounds pretty good right?

A 3.33 cps fully franked dividend was declared (7% yield on current price), the on-market buy back is half way there, and the business is generating heaps of cash. All the metrics are up and in line with expectations, ROIC was 26.5%. Sounds pretty good right?

There was nothing not to like until you get to one sentence in the outlook section. I went on the call this morning. When it got to question time most of the questions from analysts burrowed down into this one point. Admittedly it’s a big point!

I bet CEO, Sy Van Dyk, wished he’d never mentioned it! Sy tried to play it down a little saying that January is historically always a slower month, but it was worsened by wet weather, particularly in Queensland. He went on to say that February usually starts to ramp up, but this was behind expectations due to approval delays. You could sense a bit of nervousness in his voice which didn’t help to allay any analyst fears!

There is a lot riding on March as Sy said ‘this is when DDH usually hits the straps’.

The weak start seemed to be all the analysts wanted to focus on, the same question was put several different ways with the aim to squeeze out a bit more colour out of it. Sy couldn’t answer the question about the relative revenue from January and February, which didn’t help.

Anyway, the market reacted harshly by sending the share price down over 10%.

I guess the big question on everyone’s lips now, “Is this the start of the end of mining boom investment, or is it just a little hiccup on the back of the slower festive season?

Disc: Held IRL and SM (ouch!)

FNArena's All-Year Round Australian Corporate Results Monitor - Macquarie Price target increased to $1.15

Disc: Held IRL (7%), SM (3.5%)

Yesterday DDH1 announced its preliminary 1H23 results. Growth across all metrics was in line with my expectations. It’s pleasing to see 5yr earnings CAGR of 12.8%, with 1H23 EBITA up 18.4% on PCP. I also like to see the continued strong return on invested capital (ROIC) of 26.5%. The share price is up 59% from its low in June 2022 (an absolute bargin at 63cps) and it is still only trading on 7x analyst forecast earnings for FY23 of 14.4 cps (S&P Global data on Simply Wall Street). The business is focused mainly on production drilling and it is increasing its revenues from the forward facing battery metals industries. Seems like a safe bet for the next few years, and it pays c. 5% fully franked dividend. I’m happy to hold up DDH1 up to c. $1.50 (my previous valuation).

Held: IRL 6%, SM 3.2%

PRELIMINARY 1H23 UNAUDITED RESULTS DEMONSTRATE STRENGTH OF DDH1 BUSINESS AND STRONG TREND OF GROWTH

Leading global specialist drilling company, DDH1 Limited (ASX: DDH1) (“DDH1” or “the Company”) is pleased to release its preliminary half year unaudited results (“1H23”) for the six months ending 31 December 20221. DDH1 is continuing to perform strongly and is well positioned to leverage long-term industry growth drivers.

1H23 Operational Highlights (percentages compared to 1H22 unless indicated otherwise)

• Strong safety performance with TRIFR2 improving 8.9% to 9.88 (1H22: 10.85)

• Investing in automation technologies to enhance safety and drilling productivity for clients

• Increased rig fleet by 14 quality rigs compared to 31 December 2021

• Shifts increased 8.1% to 48,445

• Maintained strong rig utilisation of 77.1%

Preliminary Unaudited 1H23 Financial Highlights (percentages compared to 1H22 unless indicated otherwise)

• Revenue of $286.0M, up 15.7% (1H22: $247.1M)

• Revenue per rig of $1.53M, up 6.3% (1H22: $1.44M)

• Revenue per shift of $5,910, up 7.1%

• Operating EBITDA of $65.6M, up 15.9% (1H22: $56.6M)

• Statutory EBITA of $43.8M, up $6.8M (1H22: $37.0M)

• Strong cash generation of $62.2M at 31 December 2022 ($40.2M at 31 December 2021)

• Net debt of $11.6M at 31 December 2022 ($16.6M at 30 June 2022)

• Above average industry Return on Invested Capital of 26.5% at 31 December 2022

• Strong return of cash to shareholders of $26.7M (dividends paid $10.9M and the share buy-back

program at 31 December 2022 $15.8M)

DDH1 is now almost half way through its 8% on-market buy back. DDH1 have been particularly active buying back shares in November and December paying up to 93.5 cps, the highest share price in 6 months. The DDH chart looks good.

Is the on-market buy back still good for shareholders at over 90 cps? I believe so. Valuing the business requiring a minimum 12% return I get a valuation of $1.50 per share. I am very happy for management to continue buying back shares at current values. I don’t think drilling is under threat with lots of cashed up miners out there, and most of DDH1s revenues coming from productive mines.

Disc: Held IRL (6%) and SM

DDH1 reported a strong 1Q23 at the AGM in Perth late Friday afternoon with revenue up 16.7% pcp to $148.9million, and EBITDA up 9.5% pcp to $34.7 million for the quarter. Now that’s the type of ‘Boring’ I like! (excuse the pun).

If DDH1 continues with ‘the same old drill’ (sorry, I can’t help myself :D) for the rest of the year that puts FY23 revenue at c. $590 million compared to FY22 Proforma revenue of $507 million. Analysts are forecasting c. $570 million in revenue and c. $57 million in earnings for FY23.

To date DDH1 has also bought back 13.8 million shares on-market at a total cost of $11.5 million. DDH1 announced an on-market buy-back of up to 34.3 million shares valued at approximately $28 million in July 2022. That’s about 8% of the 415 million shares on record at 30 June 2022.

Assuming the buyback is completed and there are 381 million shares on record at the end of FY23, that puts earnings at about 15 cps slightly ahead of the analyst’s current forecasts of 14.7 cps.

There is still a lot of earth beneath the drill stem this year, but if DDH1 continues to punch through at the current rate that puts the business on a multiple of 5.5 times FY23 earnings. Looks cheap!

The forward dividend yield should be about 7% fully franked on a 40% pay out ratio (that’s mid DDH1’s current 30% - 50% dividend payout policy). Below are some highlights:

DDH1 2022 AGM and 1Q23 trading update

1Q23 Performance Highlights:

- Activity in all regions remained strong.

- During 1Q23 we generated unaudited revenue of $148.9 million, which is up 16.7% on the prior year

- average revenue per rig was up 4.3%.

- unaudited EBITDA result of $34.7 million was up 9.5% on 1Q22.

Operations:

1. Pleasingly, our recruitment drive has been successful building a quality team.

2. Rig utilisation remained very strong at 80.9% and our average number of shifts increased.

3. COVID related disruptions are significantly less and supply chain pressures, particularly freight times, are continuing to ease.

4. The integration of Swick is on track and we are now realising some of the cost efficiencies; and finally

5. Our EBITDA levels remain solid, despite the inflationary environment. As reported with our full year results, we are working hard to manage costs.

Outlook:

Despite the macroeconomic concerns that are currently impacting market sentiments, the fundamentals driving demand for DDH1’s services remain compelling. Key long-term growth drivers include:

• The majority of DDH1 revenue is derived from production and resource definition drilling programs. In FY22 87% of revenue was generated from this segment;

• Exploration and resource companies remain well funded and have strong balance sheets to undertake drilling programs;

• There is a strong need for exploration to maintain diminishing mining reserves;

• There is increasing demand for battery metals, which require commodities that DDH1 drills for and are found in abundance in Australia; and

• The need for deeper drilling is resulting in larger drilling programs and an increasing demand for specialist drilling.

Furthermore, we expect to increase our fleet size by 11 rigs during FY23.

Exploration budgets remain strong, and our customers are reporting ongoing or increased drilling programs.

In summary, we are positive regarding the outlook for FY23 and drivers for the longer-term are compelling.

Well Positioned to Deliver Sustainable Results

• We have a strong core business with a consistent track record of leading service delivery.

• Our workforce is one of the best in the industry and we have an increasing modern fleet.

• We have quality recurring revenue with 87% from the production or resource definition drilling phase.

• Our cash generation is strong.

• We have a healthy balance sheet with the ability to pursue disciplined organic and acquisitive growth.

• We maintain a dividend policy of 30% –50% of operating NPATA.

Last years performance:

Hi @Chagsy thanks for your query copied below:

“I was initially concerned by the huge reduction in NPAT, but that appears to be a tax timing issue - please correct me if I am wrong.”

Statutory NPAT fell from $57.2 million (FY21, 18cps) to $35.9 million (FY22, 11cps). DDH said “FY21 Statutory NPAT was positively impacted by a one-off income tax benefit of $30.2M as a result of the resetting of the tax bases of the Company’s assets upon IPO.” (Appendix 4E)

I don’t know how well this was explained to the market after the FY21 results, and it may have led to some investors paying too much for DDH shares based on a statutory PE multiple bases. The share price reached $1.28 in September last year.

Moving forward, analysts are forecasting FY23 NPAT of $57 million. However, outstanding shares have increased from 330 million to 415 million over FY22 as a result of the share based Swick acquisition, so FY23 EPS should be c.14cps.

Analysts are expecting DDH revenue to grow by 8% per year, and earnings to grow by nearly 20% per year over the next 3 years to c.18cps in FY25 (Simply Wall Street data).

At the current share price of 84cps, DDH is trading on a forward PE of 6 (forecast FY23 earnings). This sounds pretty cheap given the momentum in revenue, earnings growth and free cash flow (Analysts expect FY23 FCF of $48 million). Forward ROE is expected to be 17% over the next 3 years.

The DDH final dividend is 2.7cps and shares trade ex dividend next Thursday, 15 September.

Cheers

Rick

Disc: Held IRL (6%) and SM (3%)

Despite the COVID challenges, DDH1 preliminary unaudited results are better than I expected with all key metrics heading in the right direction. The only exception being Proforma underlying EBITDA margins impacted in the short-term by COVID-19 border closures and employee absenteeism, as well as cost inflation particularly in wages. Proforma EBITDA margins are still a respectable 22%, down from 23.2% last year.

Hopefully the market will also be pleasantly surprised.

Disc: held IRL and SM

DDH1 DELIVERS RECORD FY22 PERFORMANCE

Leading global specialist drilling company, DDH1 Limited (ASX: DDH1) (“DDH1” or “the Company”) is pleased to release its preliminary full year unaudited results for the 2022 financial year (FY22) ended 30 June 2022. The unaudited pro-forma results released, include Swick Mining Services’ Drilling Division (“Swick”) for all current and comparative reporting periods. Unaudited statutory results include Swick from 1 February 2022. DDH1 is continuing to perform strongly and is delivering on its organic and inorganic growth strategy.

FY22 Pro-Forma Operational Highlights (percentages compared to FY21 unless indicated otherwise)

• Strong safety performance with TRIFR1 decreasing 21.4% to 8.65 (FY21 - 11.01)

• Added 15 quality rigs to end the year with 183 rigs, a further 11 are on order or under build

• 87% of revenue generated from production and resource definition projects

• Shifts increased 10.2% to 91,228

• Rig utilisation of 77.4%, up 2.4 percentage points

• Annualised revenue per rig of $2.9m, up 6.9%

• Annual revenue per shift of $5,556, up 3.4%

• Above average industry Return on Invested Capital of 27%

• Post year end, announced share buy-back program of up to 34,280,468 shares, which will commence after this results release

• Completed transformative Swick Mining Services transaction, creating a global scale mineral drilling company and an international platform for expansion

It’s not a popular business on Strawman, or on the market for that matter. However, it’s currently trading at a very steep discount and it’s one of my top picks for 2022. I’m hoping for a good preliminary result tomorrow, but ongoing COVID and interruptions to the workforce could have an impact on the number of drilling shifts. Fingers crossed!

DDH1 FY22 Preliminary Unaudited Results Conference Call

Specialist Australian drilling services company DDH1 Limited (ASX: DDH) (DDH1) advises that it intends to announce its preliminary unaudited results for the year to 30 June 2022 (FY22) on Tuesday, 26 July 2022.

DDH1 will be holding an investor and analyst conference call to discuss the FY22 preliminary unaudited results. The call will be hosted by Managing Director & CEO, Sy Van Dyk and Chief Financial Officer, Ben MacKinnon.

Detail of the briefing are as follows: Date:

Start Time: 9:30am AWST / 11.30 AEST, Tuesday, 26 July 2022

Pre-Registration Link: https://s1.c-conf.com/diamondpass/10024033-pdslfsh772.html

Following registration, participants will receive a calendar invite and conference call participation code.

Prior to the commencement of the call, we recommend that participants download a copy of DDH1’s FY22 Preliminary Unaudited Results announcement from the ASX or DDH1’s website: www.ddh1.com.au This ASX announcement has been authorised by Sy Van Dyk, Managing Director

Today (01/07/22) on ‘the Call’ Adam Dawes from Shaw and Partners and Jun Bei Liu from Tribeca discussed DDH1. Adam talked about rig utilisation and pointed out that current rig utilisation was only 73%. This had me concerned. Not knowing how this compared to historical performance, I dug a little deeper.

In the DDH1 IPO Prospectus (08/03/21) I found a 10 year chart showing group historical rig utilisation from from 2011 to 2020 (below).

While utilisation was higher in 2011 and 2012 (89% and 87%), since then rig utilisation has ranged from 40% to 75%.

Then I compared recent rig utilisation rates with Return on Invested Capital (ROIC) for the group (below):

Year Utilisation ROIC

2018 75% 27%

2019 75% 30%

2020 73% 31%

As you can see rig utilisation of 73% to 75% can still deliver a very respectable ROIC of circa 30%.

I checked the latest reported rig utilisation rates in the Macquarie Presentation (03/05/2022). Q3 rig utilisation was 74% and YTD utilisation is 76%, so slightly better than Adam’s figures (see below). YTD Operating EBITDA % is 22%.

To sum up, I am not concerned by rig utilisation of circa 75%. This level of utilisation seems to be average performance for DDH1 over the last 4 years during which time ROIC has been circa 30%.

Improving Rig utilisation is also a key focus for the group going forward:

Disc: Held IRL and SM

DDH1 has just announced it will buy back on market up to 10% of the issued capital over the next 12 months. I think this is another example of savvy management by the Board. I have been accumulating DDH1 because I think it is a quality business going totally under the radar of the market. This is a business you could buy outright (if the board approved…and it wouldn’t!) for less than the shareholder equity value (70cps, currently trading at 62cps). Then you own a business with a net profit margin of 20%, projected earnings growth of 18%, ROCE of 22%, zero debt and cash on hand, all for a PE of 4.

I think it’s another bargain in the plain sight, and the management know it!

Disc: held IRL and SM

DDH1 INITIATES ON-MARKET BUY-BACK PROGRAM

The Board of DDH1 Limited (ASX code: DDH) is pleased to announce an on-market share buy-back program of up to 10% of the issued capital to be executed over the next 12 months (“Buy-Back”).

The Buy-Back will be made under ASX Listing Rules and section 257B(4) of the Corporations Act Cth 2001 and may run for up to 12 months from commencement.

In accordance with the ASX Listing Rules, the prices paid for shares purchased under the Buy-Back will be no more than 5% above the volume-weighted average price of DDH1 shares over the five trading days prior to purchase. The total number of shares to be purchased by the Company under the Buy-Back will depend on market conditions. The Buy-Back may be open for 12 months from 18 July 2022.

The proposed number of shares to be acquired pursuant to this Buy-Back program taken over the next 12 months is up to 34,280,468 shares. This number of shares represents approximately 10% of DDH1’s shares capital.

DDH1’s Chairperson, Ms Diane Smith-Gander (AO), said that in making this decision, the Board has looked at prevailing prices for DDH1 shares alongside DDH1’s strategy and overall business performance. The business has performed well, and we expect to deliver unaudited FY22 results in late July to the market. We enter FY23 with renewed optimism, given our expanded rig fleet and improving productivity, as COVID restrictions ease.

“The Board considers the prevailing price for DDH1 shares, particularly since early June, has significantly undervalued DDH1, which is a key reason for announcing this Buy-Back”.

“The announced share Buy-Back should not impact DDH1’s stated dividend policy of paying dividends, between the range of 30% to 50% of Net Profit After Tax due to the robust operating cash flows of the business.”

The number of shares purchased under the Buy-Back from time to time, and the average price, will be notified to the ASX on the business day following the date on which those shares are bought back. Shares bought back will be cancelled upon acquisition, so the number of shares on issue will reduce accordingly.

DDH1 will continue to assess market conditions, its prevailing share price, available investment opportunities, and all other relevant considerations throughout the Buy-Back period. DDH1 reserves the right to suspend without notice or terminate the Buy-Back program at any time.

Canaccord Genuity (Australia) Limited is acting as financial advisor to DDH1 in relation to the market Buy-Back and as the transaction broker.

Today (1/06/22) on ‘the Call’ Henry Jennings from Marcus Today and Andrew Wielandt from DP Wealth Advisory talked about DDH1. The request came from Reece who thought DDH1 had good fundamentals and was very undervalued. DDH1 was founded in 2006, and it listed on the ASX a year ago. Here is what they had to say:

Andrew Wielandt

Looking at the chart it looks like the market thinks it’s overvalued. It’s looking a bit sad!

Source: Commsec 1/6/22

It’s a $330 million business and it has good turnover. With around $600,000 per day traded, it has reasonable liquidity.

involved in mining services - drilling, they have a young fleet, 179 rigs, it’s certainly ticking all the boxes…and it’s involved in the area of production rather than exploration. Exploration can be quite lumpy whereas production is a far more predictable type of business.

They are exposed to commodities that are in play at the moment like gold and iron ore. But coming back to the share price and chart, the market is not having a bar of it!

I couldn’t find any broker research that was telling us what the foibles were…but the market is trying to tell us something…so at this stage I think it’s a HOLD.

Henry Jennings

I quite like this one! Macquarie has a price target of $1.50.

One of the problems the company has had…apart from COVID, apart from the border closures, apart from getting staff on site…is they have had some margin issues on old fixed contracts. They are feeling some pressure having to pay staff now on old contracts. As those contracts roll off that should help with the margins.

Bear in mind, we are in the middle of a mining boom…these guys do it very well, they have a strong balance sheet with not much debt, and there’s plenty of work out there for them!

I don’t mind it. It’s been whacked… I think because of the margin pressures, COVID, staffing issues, getting people to the right place at the right time, and international borders etc.

At these prices, around 80 cents, it looks attractive, especially if you are looking for exposure to the mining sector. For me it’s a BUY!

Disc: Held IRL and SM.

The DDH share price has taken a 20% hit since mid-April, down to 84c last week (20/05/22). I can’t see any reason for the recent sell off, particularly after the update at the end of March - Macquarie Conference Update.

Reported Revenue to the end of March 22 has DDH tracking toward a FY22 revenue 8% higher than management had forecast for the combined business back in October 2021.

The DDH share sell-off has me baffled. It seems to follow the finalisation of the Swick acquisition on 26 February. So, I’ve reworked the impacts of the Swick acquisition below, just in case I’ve missed something.

The following slides are from the DDH Swick Acquisition Proposal:

Strategic Rationale

- Future dividend expected to be 30% to 50% of NPATA excluding extraordinary items.

- Earnings post Swick acquisition are forecast by management to be 10-15% acretitive.

- Previous 330 million shares (77%)

- Additional 100 million shares (23%)

Combined DDH - SWICK Business FY22

430 million shares (post Swick acquisition).

Reported Revenue for 2022 up to the end of March (Q3) was $364. Q3 revenue was $117 ASX Report, 3/5/22

Given revenue for Q3 was $117 million we could reasonably expect Q4 revenue to be similar, and if this is the case we could expect FY22 revenue to be circa $481million. This is 8% higher than the $445 million forecast by management in the merger proposal back in October 2021.

EBITDA was forecast by management to be $104 million pre synergies ($109 post synergies) and an EBITDA margin of 23%.

Following the acquisition management said DDH would be debt free (ie. DDH cash will wipe Swick’s existing debt) which means interest costs should be nil.

NPAT should be circa $70 - $77 million, say $72 million (a Net Profit Margin of 15%). Last year (FY21) DDHs Net Profit Margin was 19.7%.

FY22 EPS estimate, 72/430 = 17cps

Valuation

If FY22 EPS is 17cps, the current PE is 5.

Sounds cheap for a debt free well-managed business with growing earnings, a 15% - 20% profit margin, 28% - 30% ROIC, and a fully franked 5.6% dividend.

Using the McNivan StockVal formula:

V = (APC/RR x RI + D)/RR x E

APC = 20 (this a conservative ROE based on historical and forecast ROIC)

RR = 10% (required return as an investor)

RI = 50% (Percentage of earnings reinvested)

D = 50% (Percentage of earnings paid as dividend)

E = 70cps (Shareholder equity per share)

V = (20/10 x .5 x 20 + .5 x 20)/10 x 0.70

= $1.40

I’m still baffled by the sell off and I have been topping up IRL. Am I missing something (acquisition costs perhaps??) in my assumptions?

Disc: Held IRL and SM

On the 10th May Independent Non-Executive Chairperson, Diane Smith-Gander, bought $54,000 worth of DDH shares for 87c per share.

A week earlier, on the 4th May, Independent Non-Executive Director, Andrea Sutton, bought $49,750 worth of DDH shares for 99.5c per share.

DDH1 Drilling Management have plenty of skin in the game. Combined, the Chairman, the Directors, the Founders and the CEO own over 20% of the business. There have been no shares sold by management in the past 12 months.

DDH1 Drilling Founders (2006), Murray Pollock and Matt Thurston hold 14.3% and 7.4% of the business.

Founders Murray Pollock and Matt Thurston https://ddh1drilling.com.au/about-us/

DDH1 CEO, Subrandt Van Dyke, owns 1.5% of the business.

https://www.businessnews.com.au/Person/Sybrandt-Van-Dyk

Disc: Accumulating

DDH1 Limited (ASX: DDH) is Australia’s largest mineral drilling contractor providing high quality surface and underground drilling services to a diverse group of exploration and mining houses across a balanced spread of mineral commodities. Established in 2006, DDH1 is an industry leader in enabling its clients to secure quality mineral samples with exceptional spatial accuracy.

On the 25th February DDH1 Limited released its 1H FY22 results announcement. DDH1 delivered a record 1H FY22 result.

Financial Highlights (percentages compared to 1H FY21):

• Revenue of $168.7m, up 19.2%

• Operating EBITDA of $42.8m, up 27.6% and operating EBITA of $31.1m, up 34.6%

• Operating EBITDA margin up 1.7% to 25.4% from 23.7%

• Statutory NPAT of $19.7m, up 47.0%

• Strong balance sheet with a net cash position of $6.5m

• 12-month rolling ROIC of 35%

• Declared a fully franked interim dividend of 2.51 cps. This represents a 40% payout ratio of the underlying NPATA for both DDH1 and the drilling business of the recently acquired Swick Mining Services Limited (Swick), for the six months ended 31 December 2021.

1H FY22 Operational Highlights (percentages compared to 1H FY21 unless indicated)

• Improved safety performance – TRIFR1 improved by 11%, compared to 30 June 2021

• Added six quality rigs to the fleet

• Rig utilisation of 79.3%, up 5.4%

• Drilled a record 1.17 million metres, up 6.9%

• Annualised revenue per rig of $3.3m, up 10.5%

• Shifts increased 17.1% to 25,384

• 81% of revenue derived from long-term production/resource definition projects

Swick Transaction

As announced on 12 October 2021, DDH1 entered into an agreement to acquire 100% of Swick shares via a Scheme of Arrangement (Scheme).

The Scheme became effective at 5pm (AWST) on 7 February 2022, with the allotment of the completion consideration taking place on the 16 February 2022.

The combination of DDH1 and Swick creates a global scale mineral drilling company with a balance of surface (~60%) and underground (~40%) drilling from a combined fleet of 176 rigs, with operations in Australia, North America and Western Europe.

Strong Revenue and Earnings Growth

Over 3 years DDH has increased revenues by 130%, and net profit by over 400% (41% CAGR).

1H revenue growth 19% CAGR

Good Margins

Good Margins

For 1H 2022 the gross margin was 43% and net profit margin was 19.7%.

Cashflow from operations before interest and tax of $37.6M, a conversion rate of 88% of operating EBITDA.

Debt free

DDH is debt free with $10 million cash and investments

Strategy for Further Growth

DDH1 is a well-established and strong business with diversified and recurring revenue across specialised brands. The Company has a modern drill fleet and the largest within Australia, extensive industry experience, long-term production / resource definition contracts, a robust balance sheet and a cohesive leadership team with a proven track record.

Key drivers of its multi-faceted growth strategy include:

• Expanding its full-service offering with existing clients;

• Increasing its fleet size;

• Driving higher rig utilisation and rate increases;

• Leveraging Swick’s international presence for market expansion; and

• Acquiring high quality and complementary drilling businesses that deliver a strategic advantage and enhanced value for shareholders.

Following the acquisition of Swick, DDH1 is in a stronger position to leverage each of these drivers and deliver sustainable returns for shareholders.

Positive Outlook

DDH1 had a strong first half of FY22 and successfully navigated the risks, and the subsequent industry constraints, associated with COVID-19. The fundamentals driving demand for DDH1’s services remain compelling:

• Commodity prices are strong, particularly gold, iron ore, copper, nickel and lithium;

• The move towards renewable energy transition is increasing demand for battery metals and is expected to

sustain growth in exploration and production;

• Strong capital market support has continued into CY22, particularly for gold, DDH1’s biggest commodity

exposure. As a result, clients are well-funded and are increasing drilling budgets;

• Further investment in exploration is needed to sustain current and forecast production levels; and

• There is increasing demand for specialised drilling techniques as discoveries and mines are getting deeper.

Forecast Revenue, profit and cash flow growth

An average of 4 Analyst Estimates (S&P Global) are forecasting for FY 2024 (Simply Wall Street data):

- Revenue increasing from $322 million to $571 million (up 78%)

- Earnings increasing from $63.5 million to $70.7 million (up 11%)

- Cash flow increasing from $53.2 million to $70.7 million (up 33%)

Valuation (17/03/22).

A average estimate of earnings by 4 analysts for 2024 is 17c per share. Using a PE ratio* of 10 and discounting at 10%, the valuation for DDH is 10 x 17c x 0.75 = $1.25.

*DDH is trading on a 12 month trailing PE of 5.4. Given earnings growth is expected to be at least double digit, 12-month rolling ROIC of 35%, and forecast ROE over the next 3 years of 17.5%, I think we will see the PE for DDH increase from 7.5 (CommSec historical PE) to 10. The industry average is 11 (Simply Wall Street) and DDH appears to be a better than average industry business

DDH closed today, ex dividend, at $1.035.

The PEG ratio is 0.3 (PEG of 1 or less represent great value).

Disc: Held IRL (took a nibble yesterday)

Post a valuation or endorse another member's valuation.