https://hotcopper.com.au/documentembed?id=uOMxKKzFkiWRTLKhOROKAxjvSTYM4Qq9wBWZpP1uke92GA%3D%3D

Maybe we can adopt these strategies

Assessment of value: capture the opportunity a business has to prosper and thrive in the medium to long term.

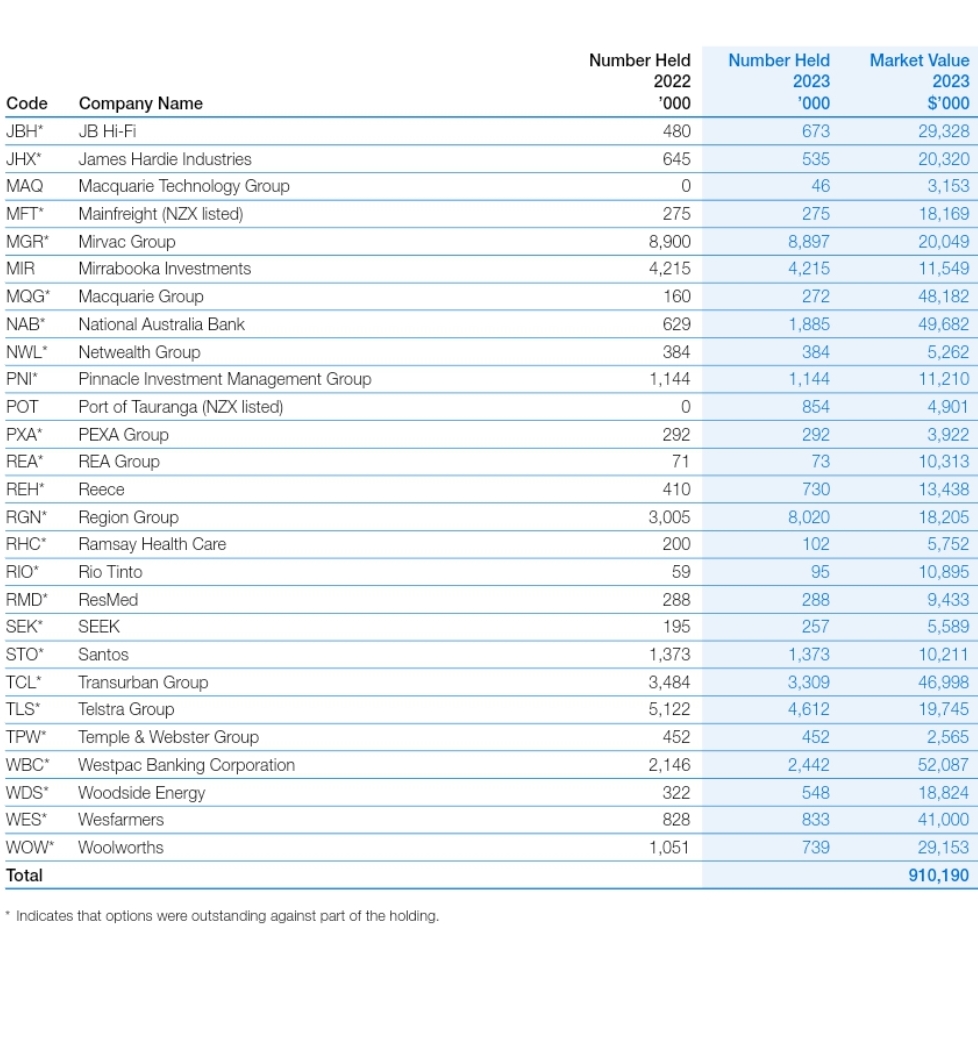

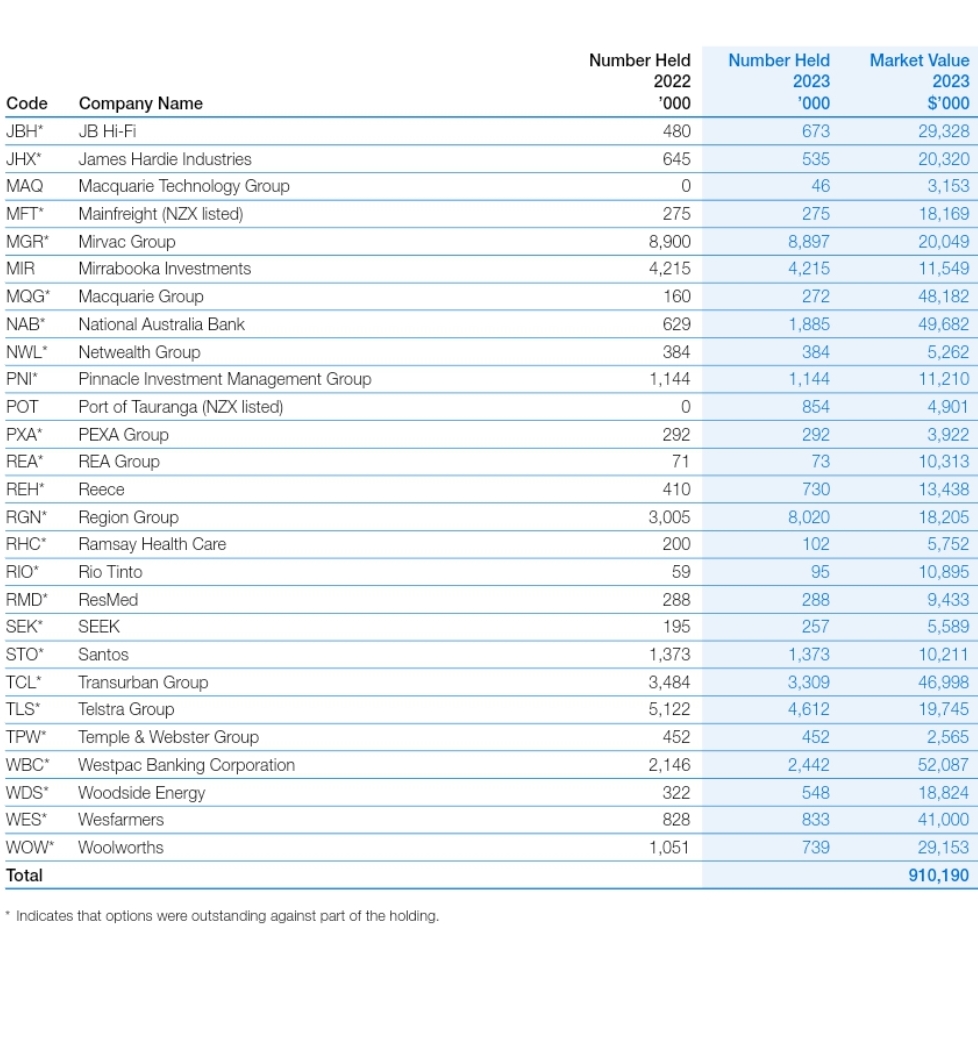

Mentions: CBA, WBC, Macquarie Group, Region Group, CPU, Port Tauranga

Exited positions: IRESS, Atlas Arteria, Accor, Invocare, Brambles, Sonic Healthcare, IAG

Holdings in 48 companies.

Noted: Some option exposure.

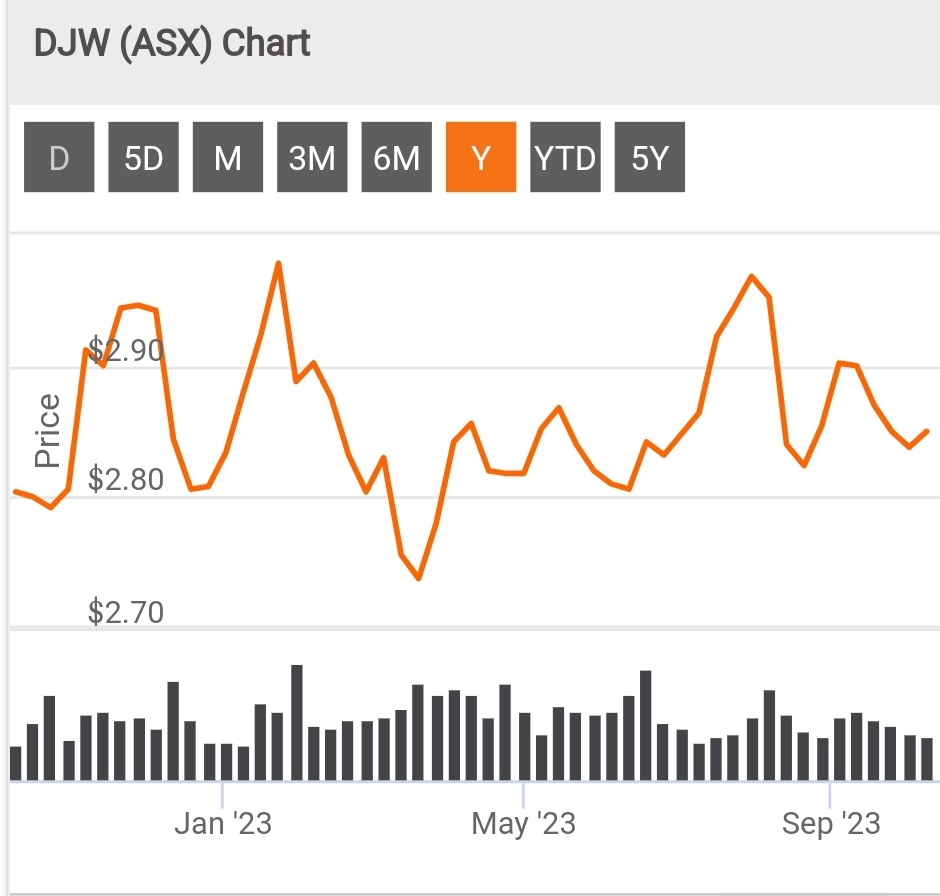

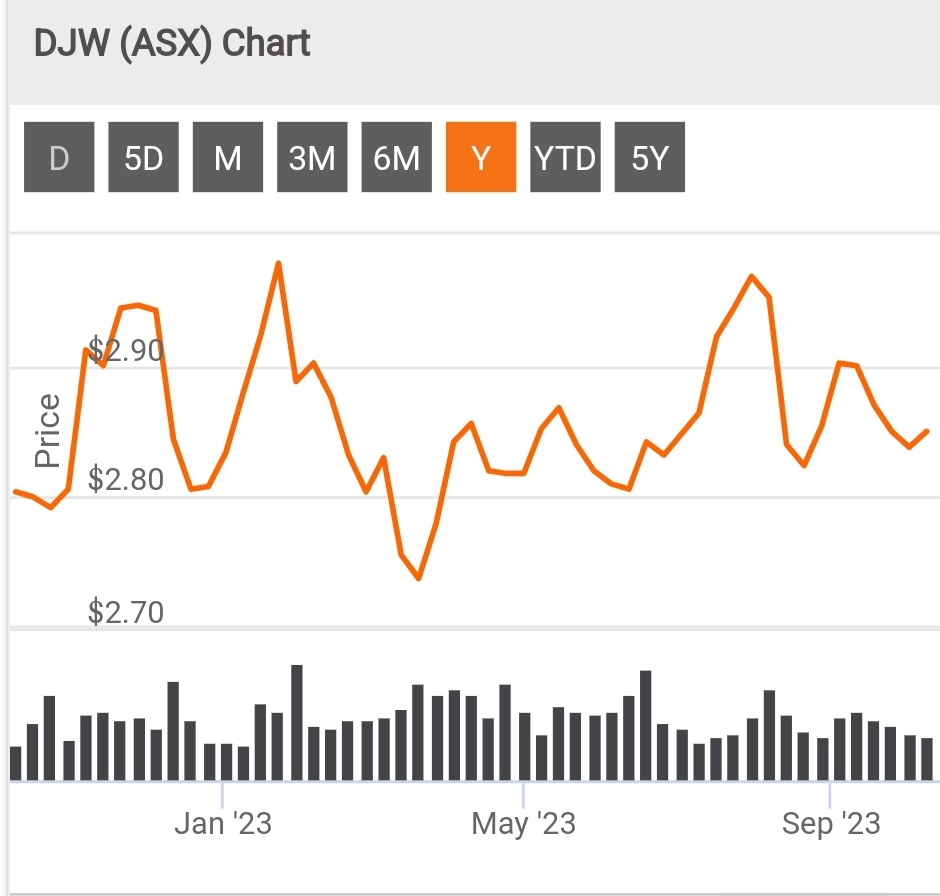

Return (inc div) 1yr: 6.02% 3yr: 8.03% pa 5yr: 1.72% pa

Listed Investment, A passive approach to investing. So a return of 6%, 8%pa after managers fees (MER)

Compound: Rule 72. (12=72/6) 12yrs to double the asset..could be ok.

NTA: i need to check.