Curious to know what Claude got for selling A Rich Life? It's on the public record if you follow the recent listing of Equity Story Group. Suffice to say if you're spruiking for a charitable cause you'd do worse than hitting up Claude on or around 1 July over the next couple of years.

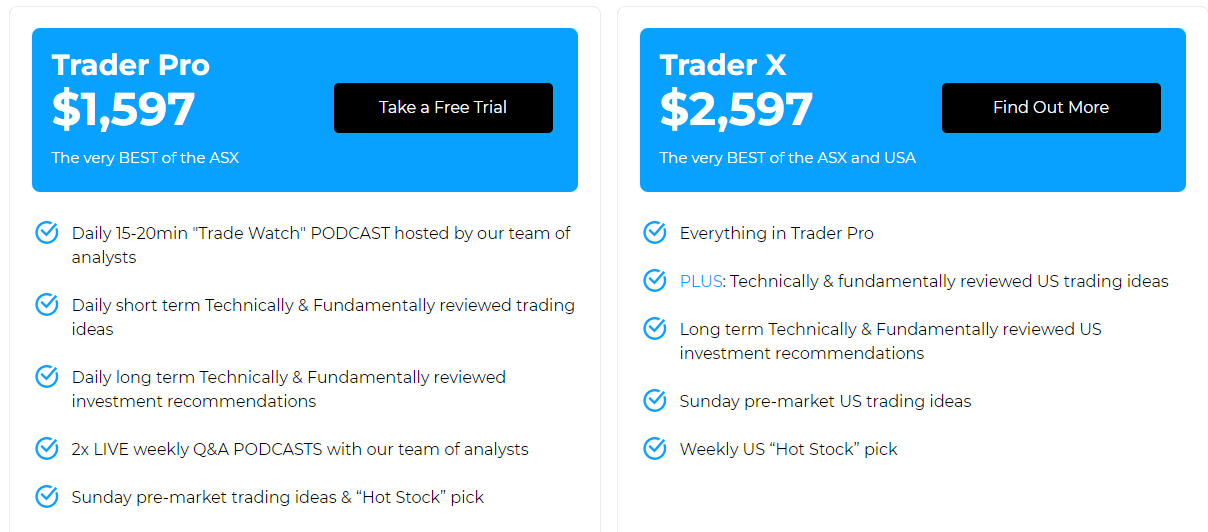

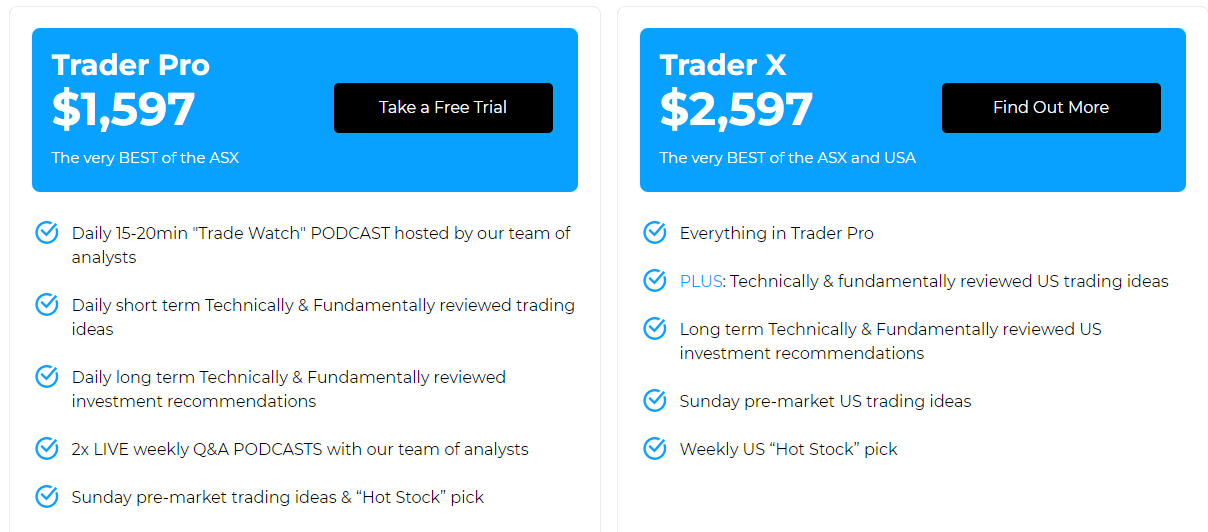

Equity Story Group is one of the very few 'successful' non-exploration IPOs to get away in 2022. I proviso 'successful' heavily given it hit the bourse on 3 May at 20 cents and closed on Friday under 8 cents. Still - actually listing in this market is an achievement in itself, especially when your primary business is providing share market investment advice. Essentially it's basically like Motley Fool or Intelligent Investor but much smaller. Annual subscriptions are between $1,597 and $2,597, depending on whether you want U.S coverage or not.

Other sources of revenue include:

- a training course for $1,997 in The Cincinnati Trading Method

- a boutique wholesale fund with around $5m FUM, under a 1.75/17.5 management/performance fee model

- a JV with a mob who will offer EQS members who qualify the ability to access company IPOs that may not have a retail offer

I had a look at a couple of their podcasts and although they use both Technical and Fundamental analysis, the balance was too much towards the Technical for my liking. Each to their own though.

To date their biggest move to date has been the acquisition of A Rich Life, which does make some strategic sense given their stated goal is to appeal to a younger demographic than may be being serviced by existing providers. Further acquisitions are expected to follow. I can't help but wonder whether the Strawman platform could be of interest to them??

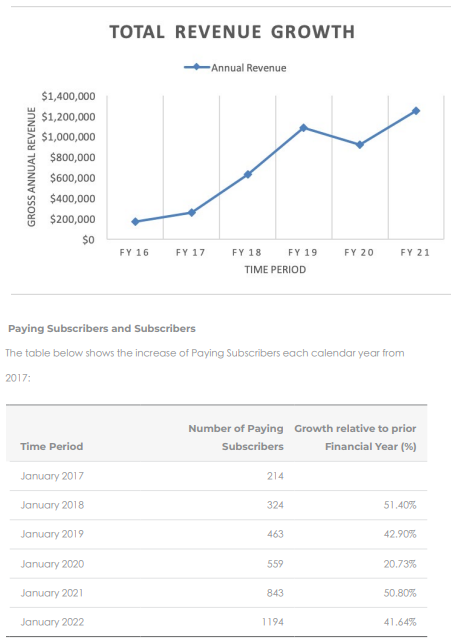

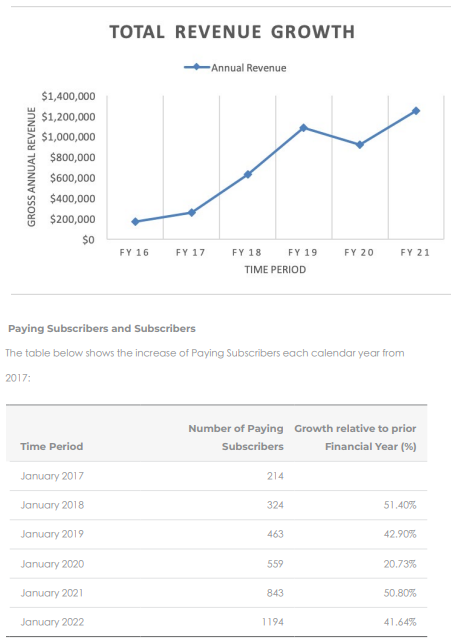

They've signed up ooh ahh Glenn McGrath as a brand ambassador and in return 1% of all revenue will go to the McGrath Foundation. Unfortunately that's not exactly making a mint for them right now given their very early stage of development. With the share price decline their market cap is just $2.3m (Spectur is a relative behemoth), which sounds cheap when you consider they have $3.6m cash (pre-A Rich Life) and no debt. The problem is they are burning cash at a fair clip and will need to remediate that fairly quickly to avoid coming back to the market for a top-up. Paid subscribers grew at a CAGR over 40% between Jan 2017 and Jan 2022 but given the last 12 months of cash receipts that may have reversed in 2022. It will be interesting what they report as paid subscribers and rev/sub in upcoming reports.

Overall far too early for me but I'll put it on the watchlist and see what they do. It has around 50% insider ownership so management are well incentivised to make it work.