tl;dr

FAR owns a single asset, an earn out of up to US$55m from Woodside which is in the money. This is ~AU$82.5m and compares with FAR’s market cap of AU$35m. FAR holds some cash and is burning est. US$500k/quarter.

The earn out is being marketed for sale right now. The present value of the earn-out (assuming some cost for hedging oil price risk) less another six months of cash burn is worth about 85% more than the current market price. Once sold, the company has no reason to exist and this is a clear catalyst to realise the value in the company. Woodside is the obvious purchaser.

My base case is a ~45% return in about six months (buying at 34c).

Downside is limited because the company could retain its earn-out and probably get full value for it. The major risks are that the oil price takes a big dive (would need to go down 12% to affect the earn out).

The upside could be increased further if there is further depreciation of the AUD (FAR reports in and holds USD).

Background

FAR has an interesting background (AKA a complete tale of woe and mismanagement) which I won’t go into here at length. The key points are that it owned a 13.7% interest in the Sangomar oil field in Senegal and ended up a distressed seller to Woodside (major owner/operator) for cash (now spent/distributed) and an earn out capped at US$55m.

By early 2022, it had lots of cash on the balance sheet, the earn out and some other mining interests that weren’t meaningful (and are now gone). At this point, it was trading at about 40c and Samuel Terry Asset Management lobbed a bid at about 45c which was rejected, Jeremy Raper began an advocacy campaign (which is how I first came upon it) which ultimately resulted in a board overhaul and made this all a bit more interesting.

Vestigial assets in Gambia have been abandoned. A big whack of capital was returned in August 2023 (40c/share). 6.5% of the company has been bought back at prices equivalent to 30c/share today. Head office costs have been cut to the quick; there is currently no CEO. A corporate advisory firm has been appointed to sell the earn-out. This company is in wind-down.

Earn out

Woodside’s project is 94% complete as at 31 December 2024 and first oil is estimated for mid-2024. The earn out is paid in arrears after the calendar year for oil production until the earlier of (a) 3 years after first oil or (b) 31 December 2027.

Woodside has little incentive here to ‘go slow’ on the project; it takes the lion’s share of profits and the oil field is large.

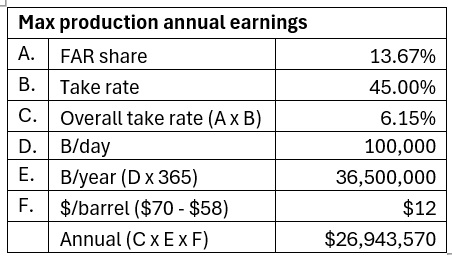

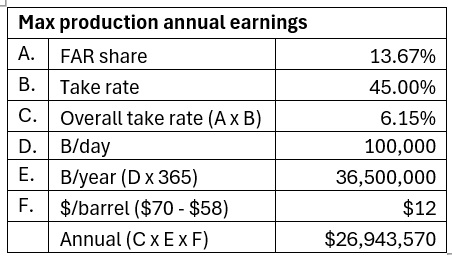

FAR gets 45% of its former entitlement of 13.67% (that is, 6.15%) multiplied by barrels produced multiplied by the excess of the Brent price above US$58, capped at US$70 (currently US$80), or:

6.15% x B x ($0 to $12)

Maximum production (ie. 100k barrels per day) at US$70 per barrel would see FAR being paid $27m p.a., so would clearly hit the US$55m cap. Futures say the price will not go below US70 before 2028. A purchaser could hedge out the price risk and get net US$8-10/barrel (I’m adopting Raper’s estimate here).

The Senegalese government has claimed a US$4 million capital gains tax payment from Woodside in respect of the sale of FAR’s interest to Woodside. FAR thinks it would have to indemnify Woodside and has objected to it (and there seems to be a view in some parts this could be challenged), but I have assumed it will all be payable.

So what is it worth?

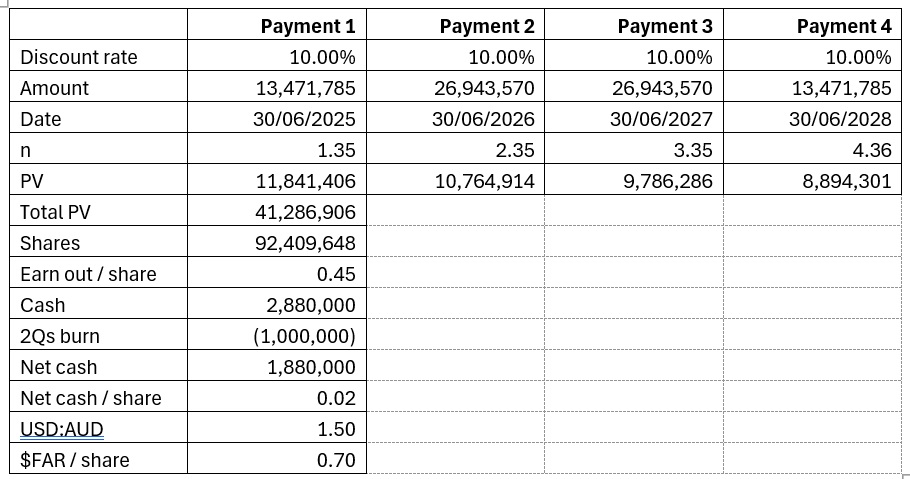

My assumptions are as follows:

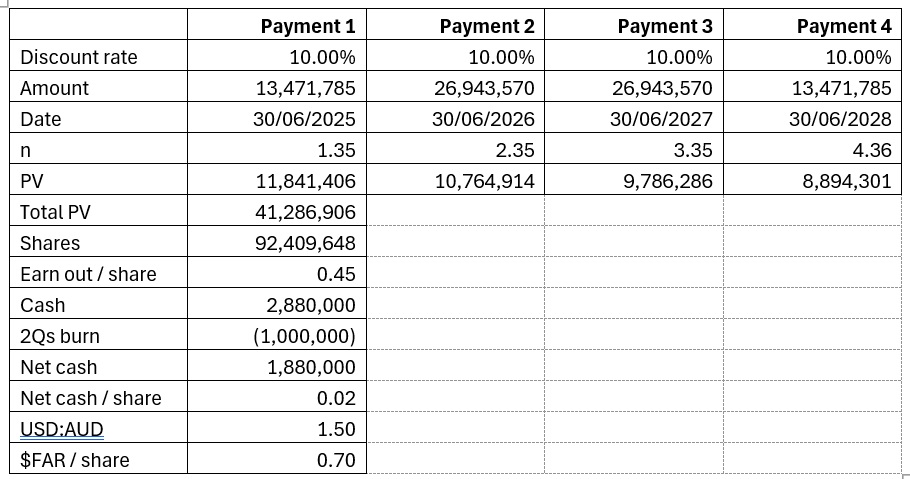

1. First production commences mid-2024 (Woodside’s estimate).

2. Production continues uninterrupted thereafter at roughly 100k bpd.

3. The Brent crude price is >=US$70.

4. The USD:AUD remains >=1.5x.

5. Discount rate of 10%.

6. Payments are made by Woodside in March following the previous calendar year of production.

On this basis, I work out FAR’s earnings at maximum production as being about $27m p.a.:

I think any purchaser is going to hedge forward prices (or take a discount having regard to that risk if Woodside), so taking Raper’s hedged net US$8-10 I have used a US$9 figure for ‘F’ in the table above. That gets us to earnings of about $20m. That would require payments going through part-way into a fourth year.

Discounting those earnings at 10% (keeping in mind the first year will be six months at best), deducting CGT and adding back cash less six months of burn, the company could be worth 69c/share:

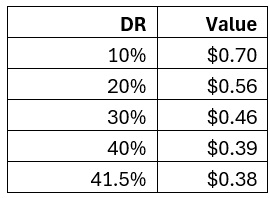

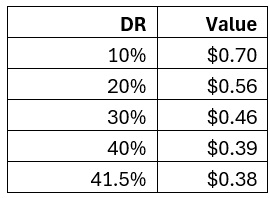

Of course, production might be lower or later than my assumptions. That doesn’t seem hugely likely to me (remember, the rig is 94% complete and it seems unlikely that Woodside would be building a rig with massive over-capacity). But what do I know? Rather than trying to get too scientific with these assumptions I think the better approach is to apply a higher discount rate to the goldilocks scenario.

The result at different rates are below – you will see that the you have to get to a about a 40% DR before you get to the current market price of ~38c:

I think this is a short-term play with very limited downside and pretty serious upside with a clear catalyst for realisation. I’ve assumed a 20% DR to get to my base case of 56c within six months.

Disc: held IRL and on SM.