After watching an episode of "Somebody Feed Phil" on Netflix (Just about my favourite show on Netflix... I 'highly recommend... basically he travels around the world and eats food, what's not to like...the host is the creator of "Everybody Loves Raymond", he's hilarious and it's a great show)

Anyway, he went to Mumbai, India - and it looked amazing. A few mates of mine have gone there, and they've always raved about it... I'll go one day.

As of late I've been having a look offshore. I like keeping my money in Australian companies, but this time I wanted to look at a company that has its teeth into a country / region that I don't have any exposure to yet.

So naturally, I started to dig into all things India... from the economics, the population growth, imports and exports and tried to find out what makes India tick. After doing that, I started having a look on the ASX to uncover some companies that are looking to take advantage of this hugely populous country.

Findi Limited

Subsidiary, Transaction Solutions International (India) Private Limited (TSI)

What they do:

A technology company that provides a range of solutions for payments, electronic surveillance and managed services in India. They do this through five (5) main ways.

- ATM machines - They deploy and manage ATM networks for the big banks in India, such as Central Bank of India (CBI) and the State Bank of India (SBI). They provide the supply, installation, commissions, along with on-going maintenance and support.

- Electronic Surveillance - Including monitoring, analytics and reporting services.

- FindiPay - A merchant- assisted payment marketplace which facilitates digital payment transactions between merchants and consumers.

- Loyalty and Rewards - Similar to what we know in Australia.

- Managed Services - Relating to payment infrastructure and technology. Services such as software development, system integration and customer support.

Currently, Findi has a network spanning across thirty (30) states and union territories. They process transactions worth around 1.5 trillion INR (roughly 27 billion AUD) across all of their product lines.

Findi's mission is to, "Empower individuals, businesses, and communities with convenient and accessible financial services. Findi aims to achieve this by expanding it's ATM network, growing it's digital payment offerings, and investing in innovative technologies and strategic partnerships".

In the most recent annual report (FY2023 - released 30 June 2023), Findi touched on a few key points relating to India's current use of cash, and transition to a digital payment system.

- "India is witnessing a harmonious blend as ATMs embrace the digital realm, fusing convenience & connectivity. The convergence of ATMs and digital payments symbolizes a transformative era, empowering individuals with seamless financial access.”

- The company has expanded its ATM network by deploying over 2000 ATMs and onboarding more than 1500 FindiPay merchants. "This is in line with our endeavour to increase our offline and online footprint to enhance our penetration in the underserved areas", "While ATMs continue to play a crucial role in financial inclusion, the company recognizes the importance of expanding its digital payment offerings, particularly in underserved regions"

- "Continue to invest & grow both organically and inorganically in this space towards our aspiration to create a full stack digital payments entity."

According to a report by the RBI in 2021, cash remains the preferred mode of payment for a majority of the population, particularly in rural areas and among lower-income groups. The report found that cash accounted for 89% of all consumer transactions by volume and 68% by value.

They outline a few factors which contribute to the use of cash, over digital currency.

- Large unbanked population: Despite efforts to increase financial inclusion, a significant number of Indians still lack access to formal banking services.

- Limited digital infrastructure: In some rural and remote areas, internet connectivity and access to digital payment platforms remain limited.

- Cultural preferences: Some people prefer cash due to its tangibility and the sense of control it provides.

- Informal economy: Many small businesses and individuals in the informal sector rely on cash transactions to avoid taxes and maintain flexibility.

The RBI report also noted that digital payments have been increasing at a CAGR of around 50% over the last five (5) years.

Annual Report 2023

The Outlook:

They've outlined five (5) key points moving forward

- ATM deployments: Deployed over 2000 ATMs under its contract with CBI and has the potential to secure an additional 625 ATM licenses from CBI over the next 12 months. The company also renewed its contract with SBI for 3912 ATMs until the end of 2024.

- White Label ATM license: Findi has applied for a White Label ATM license, which could provide strategic benefits, support the integration of its ATM and digital payments business, and assist with potential acquisitions.

- Organic growth initiatives: The company plans to focus on organic growth initiatives in FY2024 to generate further value under the CBI contract, such as introducing debit cards, increasing activation ratios, and improving acquiring vs. issuing transaction ratios.

- Strategic acquisitions: Findi remains alert to strategic acquisition opportunities that can enhance its market position and create value for shareholders.

- Digital payments: The company aims to expand its offline and online footprint in the digital payments space, particularly in underserved areas, to create a full-stack digital payments entity.

The Financials (snapshot):

- Revenue growth up 1000% ($4.7 million in FY22 to $54.5 million in FY23) - this is hugely inflated due to the consolidation of TSI's results following the acquisition in February 2022.

- Profitability - The company turned a profit for the first time... NPAT of $2.4 million compared to a loss of $1.5 million in FY22. EBITDA up to $16.8 million from $2.7 million (again, largely due to the TSI acquisition)

- Cash flow from operating activities - an inflow of $4.6 million. However, a negative FCF of $27.5 million in FY23 due to significant capital expenditure (deployment of ATM's, renewal of SBI contract, technology upgrades & white licence application)

- Cash & Cash Equivalents - $18 million.

- Debt - Increased to $63 million in FY23. Mostly due to investments in ATM deployments and the acquisition of TSI. (total net debt sits around $37 million).

Half Year Report to September 2023

Outlook Update:

I'll summarise a few of their key updates for the half:

- Secured a 10-year contract with State Bank of India (SBI) that will generate revenue of up to $620 million. Under the contract, Findi will provide 4,219 ATMs in India, with an initial 3,375 ATMs and a further 844 ATMs within 12 months of the contract start date in early 2025.

- The SBI contract is expected to deliver between $550-620 million in revenue and $250-280 million in EBITDA over the 10-year period, with an expected Internal Rate of Return (IRR) of over 35%. The contract will be 100% funded from Findi's free cash flow and new bank facilities.

- Redeploy all existing SBI ATMs as Findi branded ATMs, adding over 3,000 ATMs to their network. The white label license will provide strategic advantages such as supporting the integration of Findi's ATM and digital payments business and potential acquisitions.

- During the half year, TSI management received additional shares in the Indian subsidiary, increasing their shareholding and the minority outside interest in TSI from 10% to 19.4%, with no further shares available under the original sale agreement.

- Post period end, Findi's Indian subsidiary TSI India raised $37.6 million via the placement of Compulsory Convertible Debentures to Piramal Alternatives. The debentures reflect a fully diluted equity interest of approximately 16.7% of TSI India once converted at IPO.

Financial Update (snapshot):

- Revenue growth from ordinary activities - up 28% (from $23.7 million to $30.3 million)

- NPAT - up 352% YoY (from $171,000 to $773,000)

- Cash flow from operating activities - Significant increase from the previous half of -$1,024 million to $19.4 million. Largely due to receipts from customers increasing from $20 million to $31 million whilst payments reduced from $21 million to $12 million. (few other factors including timing of receipts from customers took its effect I believe)

- Cash & Cash Equivalents - down to $2.8 million. (note - total cash, cash equivalents and term deposits is $32.8 million as of the half year report compared to $25.8 million at last report)

- Debt - Up $5.2 million to a total of $68 million.

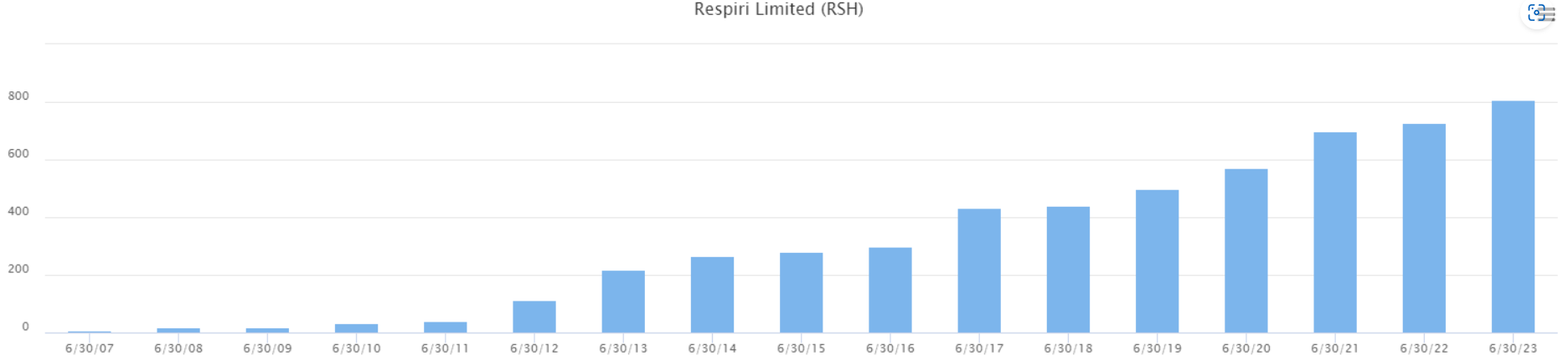

Announcement - 6th of December 2023

Announcement - 11th of March 2024

My Concerns:

- A pretty obvious one, the debt levels - As they burn through cash, they eventually run out of it. They either borrow money or issue more shares. Not a bad thing to raise money, however they need to get a decent return on the cash..

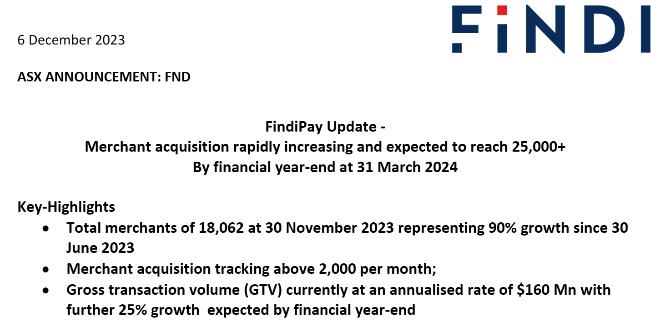

@Noddy74 brought something slightly concerning to my attention a while back on this one, and I'll copy his picture here.. (I hope you don't mind)

This is a chart from Respiri Limited (ASX:RSH) - unfortunately, this is the share count... as @Noddy74 outlined, Nicholas Smedley (CEO of RSH) is also the Chairman of Findi.

I'm slightly concerned that Findi's share count might end up looking similar.

- Market and Economic Risks - The Findi business model is pretty closely tied to the Indian economy and consumer spending patterns.

- Competition and Pricing Pressures - This is a very competitive market with other ATM operators, fintech companies and digital payment providers.

- Dependence on Key Partnerships - Heavy reliance with CBI and SBI for ATM deployments.

My Outlook:

I'll start off by saying, I think there is a lot to like about the company and how they've gone about business - albeit, considering the concerns I have as I have outlined above.

- They've reached profitability and I'll be looking to see this grow at a decent rate YoY.

- YoY cashflow growth.

- Reduction in debt.

- Even if they don't increase their profits, I want to see them spending their money through smart investments back into the company.

- Hitting the target of 25,000+ merchant acquisitions by the end of March 31st 2024.

- The white label licence being unconditionally approved.

- Market disruption - I want to see Findi begin to really take over the market share.

Valuation:

I'll be updating my valuation within the valuation section over the coming days... I'm still having a play around with a few valuation methods.

Disc: I hold both in RL and in SM.