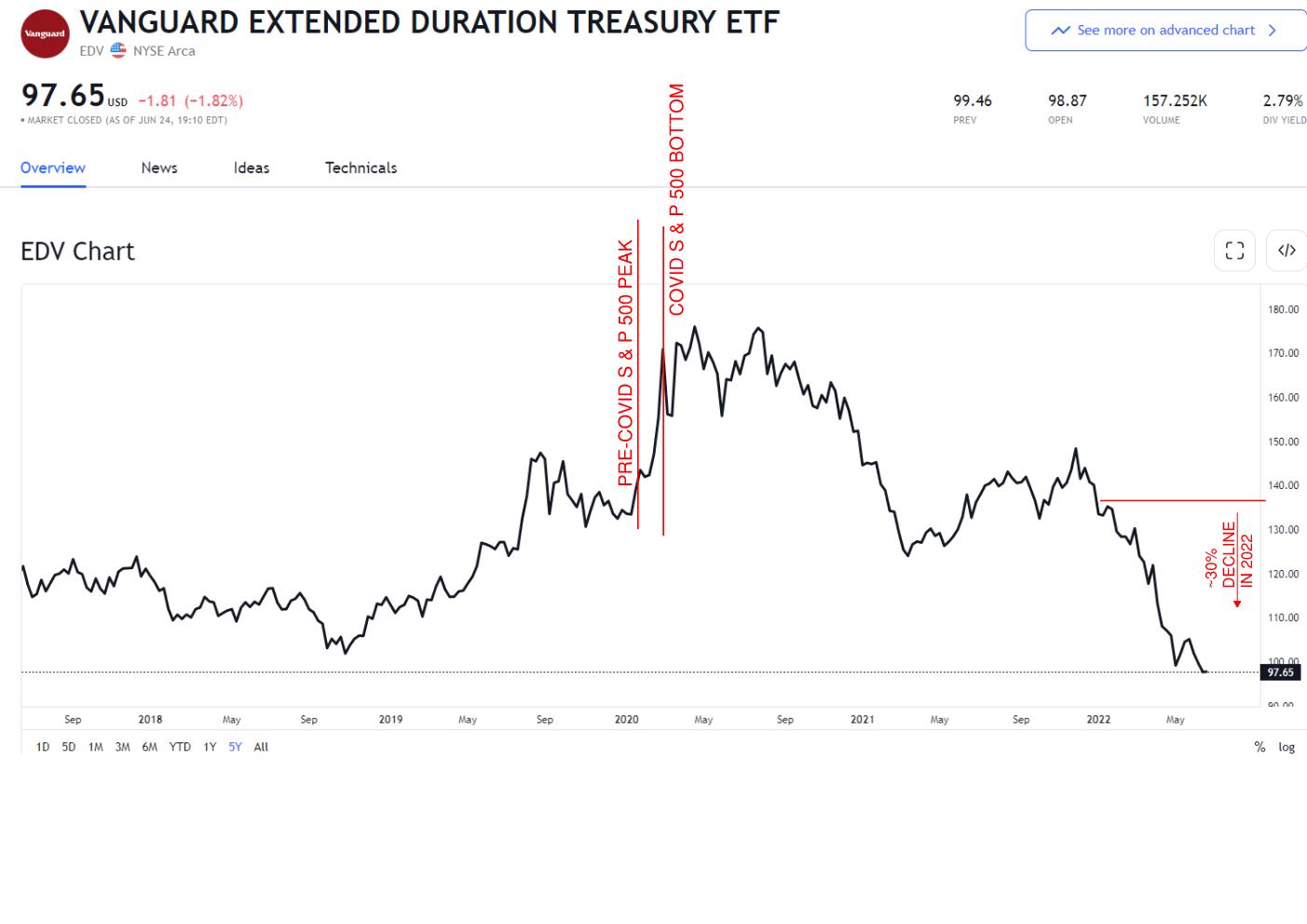

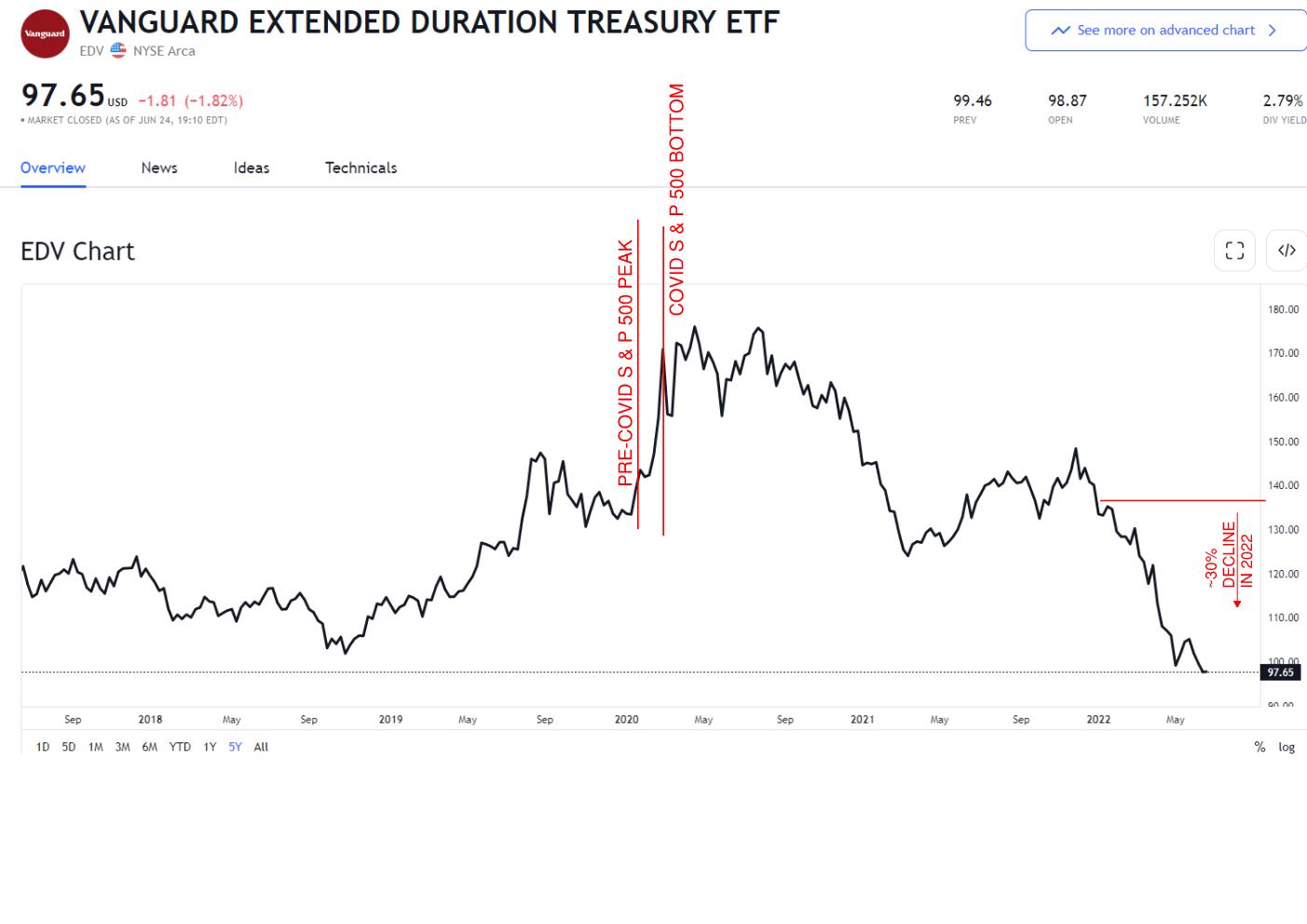

Long duration bonds have been hammered in 2022, as rising inflation expectations pushed long duration yields ever higher. EDV is currently yielding 3.3%. Refer to chart below. The COVID crash demonstrates the utility of long duration bonds in times if tightening liquidity, where the EDV ETF rallied 25% during the COVID meltdown:

Now, the Philadelphia Fed's latest long term inflation expectations (10 year) is 2.8%, up from 2.5% last quarter.

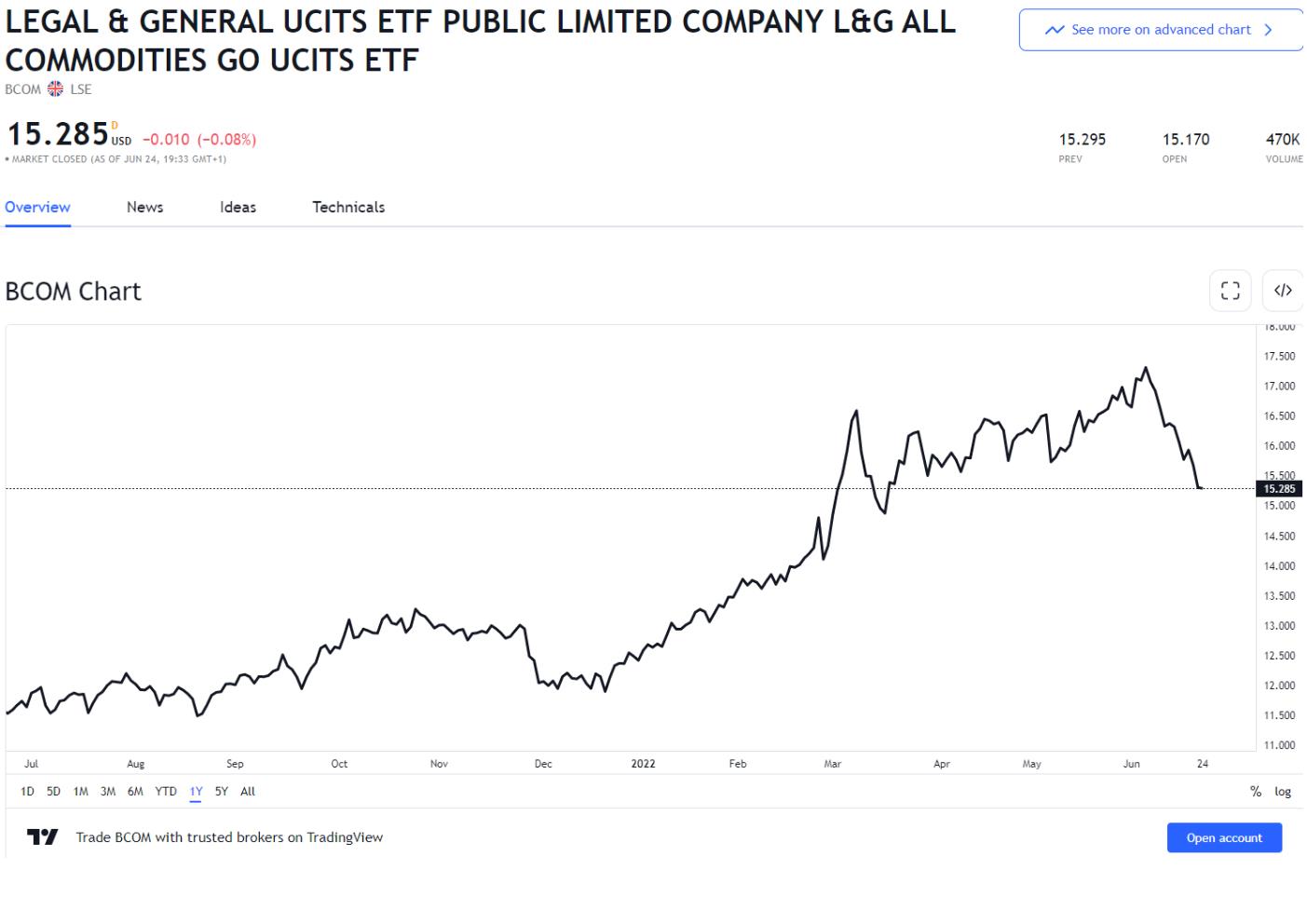

There are signs of demand destruction, with Industrial Metals, a leading indicator of a slowdown in demand, falling off a cliff since early June (see below):

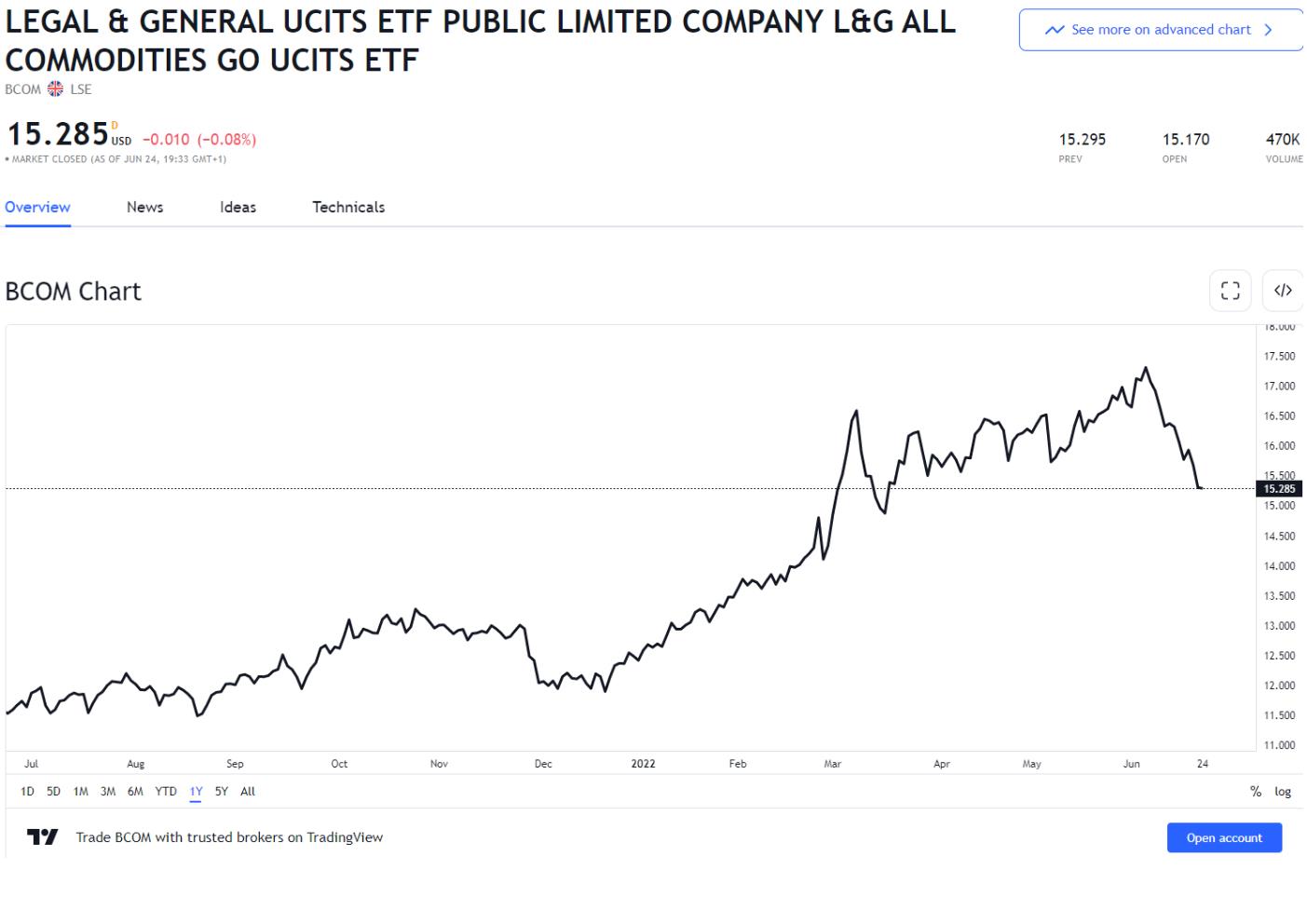

Even Agricultural commodities have come off the boil:

If long term inflation expectations moderate over the coming months in tandem with a recession, long duration bonds will rally.

Risks are:

- Japan end YCC - a large chunk of this ETF is Japan bonds. Also, if Japan ends YCC, it will likely trigger serious capital flight from the US to Japan. The Japanese Central Bank Chair has another year to run, and it appears any policy change is very unlikely over the next 3 months or so....

- The US Fed pivots dovish too early, allowing inflation to run above trend for longer. This will lead to rising long term inflation expectation, high long term yields and falling long duration bonds. Hawkishness is increasing (ruling in 100 bp raise next month) - and jobs data is unlikely to trigger a pivot until late in 2022 at the earliest.

The problem with long duration bonds will be that when it is obvious long term inflation has peaked, and the long bond trade will be a goer, the long bond horse would of well and truly bolted.

Given the aggressive stance of central banks, having some exposure to long duration bonds makes sense....