Graincorp is a commodity business, which earns about 15-20% commission on Australian grain & oilseed sales, as well as producing some grain & oilseeds itself. It's moat is the storage and transport infrastructure, and relationships with producers and grain buyers.

On February 7, 2022, Graincorp upgraded profit guidance significantly to $235 - $280 million (FY21: $139 million). This represents an 85% increase on FY2021. Since this upgrade, the following three significant events have occurred:

- At the end of February, ABARES released the March edition of the Australian crop report. ABARES has reported the 2021 Winter crop, is the highest on record. Total Winter crop production is estimated to be 61.9 million tonnes, up 6% form its previous guidance in December, with wheat, barley, canola breaching national records. Summer crop production is forecast to rise by 64% to 5.3 million tonnes, the fourth highest on record.

- Ukraine invasion. Russia & Ukraine is the worlds 1st (23%) and 5th (9%) largest grain exporter. 90% of all Russian and Ukrainian grain exports are shipped via the Black Sea, with much of the grain traditionally shipped through the Ukrainian port of Mariupol. Currently, commercial shipping in the Black Sea has halted, and the Ukrainian sowing season is 3-4 weeks away.

- Ongoing droughts in South America and North America. El Nino / La nina Impacts.

Item 1 above means grain sales will be at record levels, and items 2 & 3 potentially means there will be a global shortage of grain, depending on how the war progresses, which is highly uncertain. Wheat futures have surged around 50% over the past few weeks.

I sincerely hope this war ends soon, and Ukraine farmers are not impeded from sowing their Winter crops, as if they fail to do so, thee world will be in for some significant instability, given African and Arab nations are the ones that will suffer the most from a shortfall in Ukrainian / Russian production.

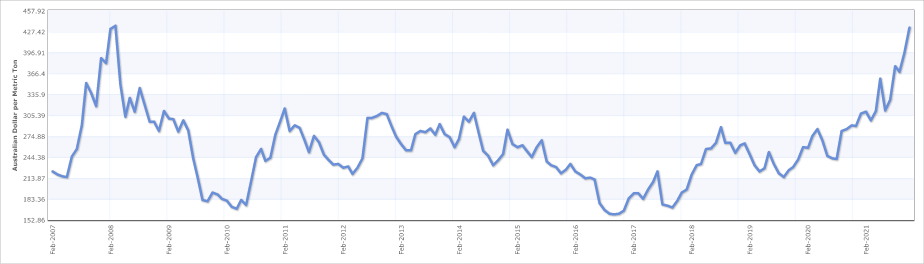

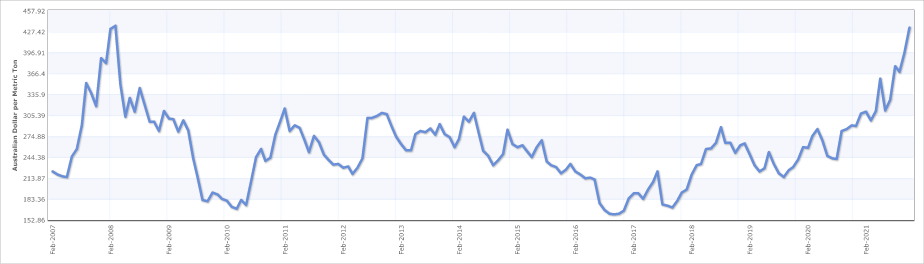

I don't consider Graincorp a long term holding, more of a macro hedge against commodity inflation. As can be seen from the grain price chart below, Wheat grain was hitting all time highs before the Ukraine war, noting that the last time wheat was at these prices. Grain futures are indicating prices may rise far higher over the coming months, especially if the war drags on for more than a month.