Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

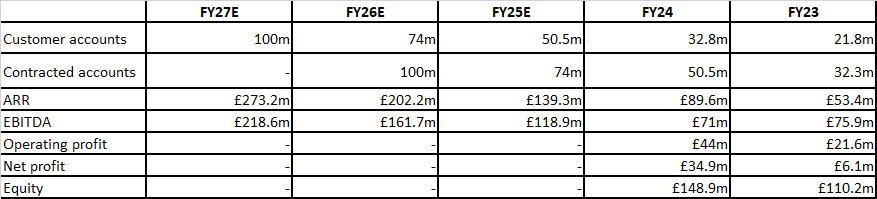

I have been watching Gentrack for a while (don’t hold), and so ahead of the annual results on Monday I have decided to put together some details on Kraken Technologies for comparison.

For some reason, I cannot find Kraken’s 2025 annual report. The 2022-2024 annual reports are easily accessible. Origin Energy’s FY25 annual report contains some details, so have made a lot of assumptions and guesses. Due to the accounting standards in the UK, they seem to be exempt from reporting on cash flow.

Notes:

- All figures in UK pounds.

- Contracted accounts include both paying accounts and signed accounts that will be billed in the future.

- ARR estimated on ARR/account from FY24.

- Origin Energy reported that 100m contracted accounts =500m ARR, which is well above my calculated 2.8/account from FY24. I have used my figure in FY25/26/27 to be conservative.

Overall thoughts: On the surface, Kraken looks like a much more appealing company than Gentrack. When it was announced in July 2025 that Kraken would be de-merged from Octopus the GTK share price began a steady sell-off signalling that other investors would rather wait and see and I feel the same.

Given that markets have sold off this week on tech stocks, GTK needs to post some seriously good numbers or guidance to avoid any further pressure.

https://fnarena.com/index.php/2025/08/01/in-brief-technologyone-gentrack-northern-star/

Some details on the customer going for Kraken

I want to point out that legacy product Velocity is different to G2.0 and a past velocity customer (tas water or tas power?) have gone with other providers. Therefore my conclusion is the migration from velocity to g2.0 might not be straightforward.

Also I need to dig deeper into MEZ (meridian)

Is Kraken cracking open the A&NZ markets?

Shareholders in Gentrack Group ((GKT)) have experienced a volatile ride over the last year, with the early December share price high of $13 now firmly in the rearview mirror.

Wilsons, who remains positive on the stock, was keen to point out UK Octopus-owned Kraken had seemingly forced its way into the domestic market by scooping up one of Gentrack’s key customers.

Wilsons found the announcement disappointing (of course) and evidence, at the margin, that competition is rising for the smart meter operator. Gentrack reported an existing customer had removed it from the process to modernise that customer’s existing billing solution.

Red Energy, with around 600k customers and over 1m meter points, is thought to be the one that got away. Red Energy had been using a legacy version of Velocity (its billing platform) and had been a customer for over ten years.

Kraken also pulled in Meridian (NZ) over Gentrack after writing off their internal solution. This was the first win for the offshore competitor in the A&NZ business-to-business sector.

The analyst believes Kraken will continue to concentrate on developed markets and is operating an aggressive strategy to “do whatever it takes” to justify its valuation, which is being targeted to incentivise new capital, with the mooted sale by Octopus Energy at an estimated valuation of GBP10bn, implying a total group value of more than GBP15bn.

Gentrack, in comparison, is seeking to expand into the rest of the world, including Europe and Southeast Asia. Management reiterated FY25 guidance at the update.

Wilsons has a target price of $11.21, compared to the FNArena consensus target of $12.833, with three Buy-equivalent ratings and one Hold-equivalent.

Held gtk ang org

Market Cap in Aussie dollars is $1.073B

Management Bio

Andy Green CBE - Chair

Andy has an extensive background in technology leadership including CEO of Logica, a £4bn turnover listed IT services Company, and CEO of BT Global Services, the enterprise arm of British Telecom. In 2020 Andy was awarded Commander of the British Empire (CBE) for his contributions to the Information Technology and British Space Industries. His passion to transform the industry to support sustainable water and energy resources is further demonstrated by his roles as the Chair of WaterAid UK and as as an advisor to the National Infrastructure and Service Transformation Authority. Spending time in both Australia and the UK, he contributes both a local presence and global perspective to Gentrack’s customers and shareholders. Andy is also the Chair of Lowell Group, a Permira backed credit management company, and Senior Independent Director at Airtel Africa.

Fiona Oliver - Non-Executive Director

Fiona is an experienced Director. Fiona’s board roles include being a Director of Freightways Limited (NZX/ASX), Summerset Group Holdings Limited (NZX/ASX), Kingfish Limited, Barramundi Limited and Marlin Global Limited and Director and Audit Committee Chair of the Clarus (previously First Gas) Group companies. Fiona’s former roles include being a Director of Tilt Renewables Limited (NZX/ASX), BNZ Life Insurance Limited and BNZ Life Services Limited, Wynyard Group Limited (in liquidation) and Crown entities, Public Trust, and the National Provident Fund. Fiona received the New Zealand Shareholders Association Beacon Award in 2021. Fiona has Executive level leadership experience in asset management, funds management and private equity, including holding the roles of Chief Operating Officer of BT Funds Management (NZ), Westpac’s investment arm, and General Manager, Wealth Management for AMP NZ. Fiona also managed the Risk and Operations function of AMP’s Sydney and (owned at the time) London based Private Capital division. Prior to her management career, Fiona practiced as a corporate and commercial lawyer at a senior level in Auckland, Sydney and London, specialising in mergers and acquisitions.

Darc Rasmussen - Non-Executive Director

Darc is a seasoned enterprise software professional with over 25 years’ experience successfully building and growing Software as a Service (SaaS) and cloud based businesses across global markets. Darc has spent his career working and living in Europe, the USA and Asia/Pacific, growing public and private companies including Infor, SAP, IntraPower (Trusted Cloud) and Integrated Research (ASX:IRI). Darc led the SAP (NYSE:SAP) global CRM line of business, building it from start-up to total annual revenues of US$1.5 billion, establishing SAP as the global leader in the CRM market. He was CEO at Integrated Research and led the company through a whole of business transformation strategy that delivered 70%+ growth in revenue and profits along with a 4x+ growth in the company’s market capitalisation.

During Darc’s tenure as CEO at IR he led the development and execution of a product and go to market strategy that won IR the distinction of Gartner “Cool Vendor” and established the company as the global market leader in the Unified Communications Performance Management market. Darc is currently a Non-Executive Director on the Board of Objective Corporation (ASX:OCL) and Gentrack (ASX:GTK).

Stewart Sherriff - Non-Executive Director

Stewart was appointed CEO of New Zealand mobile challenger 2degrees in August 2013, having served as the company’s Chairman for the previous 4 years, and interim CEO since April 1st, a position he held until he retired in June 2019. He left the Board of 2degrees in June 2022. Born in Scotland, Stewart began his 44-year career in telecommunications with British Telecom. He left the UK in 1984 to progress an international career, working in 20 countries for various Telcos. Stewart has learned mobile from the ground up, starting as a technician, progressing to a system specialist, field services manager, BSS specialist and senior engineer before entering senior management as Head of Operations for Hong Kong Operator Smartone. In 1997 he became CTO at mobile pioneer Western Wireless International, with responsibility for IT, Engineering, Marketing, Customer Care and Technical operations. Six years later, Stewart was seconded as CEO of Meteor, Ireland’s third entrant mobile operator. Under his leadership, Meteor became a successful third player challenging Vodafone and O2. In 2006 he rejoined Western Wireless founders John Stanton and Brad Horwitz at Trilogy International Partners. As CTO he oversaw Trilogy’s operations in Bolivia, Haiti, Dominican Republic and New Zealand. Prior to chairing 2degrees, Stewart chaired Vega Slovenia, was Vice Chairman of Telering Austria and served on the boards of Vipnet Croatia, Voila Haiti, Neuvatel Bolivia and jNetX USA.

Gary Miles - CEO

Gary joined Gentrack in October 2020 following an extensive international career in enterprise technology innovation and cloud capabilities, including serving on the leadership team of Amdocs (NASDAQ:DOX), a provider of cloud business software and services to the communications industry. At Amdocs he served as Chief Marketing Officer and prior to this role, was Division President and CTO, leading strategy development, building the product portfolio and sales organisation as well as overseeing Amdocs’ digital services, big data and mobile engagement divisions. He has also founded and successfully scaled several technology companies including jNetX, a next-generation intelligent network platform for communication service providers, prior to its acquisition by Amdocs in 2009. Gary is based in London.

Gillian Watson - Non-Executive Director

Gillian is an experienced chair and non-executive director with a portfolio largely concentrated on the energy sector and private equity/investment space across multiple geographies and ownership structures. A strategist with a background in corporate finance, Gillian started her career with Morgan Stanley working on IPOs and M&A, working both internationally and across sectors. She moved into the energy market in the UK with Eastern Group PLC in corporate finance strategy roles. She later joined Endesa SA, the BME-listed integrated energy business with assets across Spain, Portugal, Italy, France and Latin America. Her executive career culminated as CEO of life sciences company, Giltech.She currently serves on the board of two SMEs in the energy sector that focus on the green transition: she chairs the UK-based EV charging port business, char.gy, and is a non-executive director of renewables power system support business, Statera Energy. She also sits on two listed businesses: BME-listed glass manufacturer, Vidrala SA, and LSE-listed specialty agriculture and engineering company, Carr’s. Gillian leads origination and transaction execution for power and energy businesses at Scottish-headquartered investment bank, Noble & Co, in a part-time capacity. She has an additional non-executive role with DC 25 Investment Fund.Gillian brings past and present knowledge and connectivity in the global energy sector. With an executive career spanning roles in investment banking, corporate finance, strategy and general management, she brings a breadth of experience and a demonstrable track record of overseeing business growth and change at publicly listed companies.

Not sure why the near 10% jump on 28/3 to 10.55 but I'll take it!

I would have topped up at the lows but I have enough GTK already.

If the platform is claimed to be good as it is with significant momentum, why fund managers such as Milford, Anacacia, Australian Ethical and Regal are selling? And buying stuff like Opthea and Flight Centre.

Don't they have their own SMEs in their teams that look at these companies and try to understand the product? Or are they too concerned about financial metrics such as PE and EPS?

Just thinking out loud as I don't know about how these fund management businesses are organised.

[held]

Possibly good for Gentrack???

Eon Next pays out £14.5m for ‘unacceptable’ pre-payment meter billing failures

E.ON uses Kraken for their billing system which they have been using since 2021

But it seems the error has since got fixed:

It has also since updated its billing systems to resolve the issue and ensure final bills are sent to pre-payment meter customers, Ofgem said.

Held

Found this update from Intelligent Investor while doing a search

https://www.intelligentinvestor.com.au/recommendations/gentrack-quitting-a-winner/154082

They are speculating that Gentrack might acquire something in the US, but there was nothing I could find in the last conference call.

Unless there is something sinister such as hot air and no earnings (like mineral exploration or very early stage biotechs or tech companies), I think you should just let your baggers run?

Not planning on subscribing any time soon after the calls on PWH and MIN

[held]

Thought I'd do a quick update here.

A rare win after a very difficult period with IPD Group, PWR Holdings and Vysarn.

Gentrack really kept everything under wraps on their new business and kept everyone guessing in the last few months

# Revenue grew 25%. Excluding UK insolvencies, the underlying figure was nearly 50%

# EPS and EBITDA were flat but that may be due to vesting of LTI which I think is well deserved

# Wins in the Philippines and Saudi Arabia with NEOM

I was bracing for the worst when they did not hit the EPS number but my fears were unfounded.

I think everyone loved the revenue growth and the momentum into new regions from the call.

Those funds (AEF, Millford, Anacaia, Regal and Wilsons) must be spewing right now!

[held]

Regal and WAM have been sellers recently

So maybe this is too expensive as alluded by many?

One way I see it is they are making a profit despite the 145x PER.

Will continue to hold for reasons I will go into later.

And I can't see anything I can buy right now that could be better value.

(Held)

Apart from the Index inclusion, this MS report last week could explain the run to $10

Like the phrase "channel checks" which was also used to recently push up the price of Lithium.

The report is really big and comprehensive so only posting some of it.

[held]

FWIW, I was listening to this podcast yesterday from Intelligent investor:

I don't own either stock. I have been watching HSN a long time.

Intelligent Investor have apparently done very well with GTK and will continue to hold the stock. But they see better buying in HSN at the moment.

"So, the way I think of it is that Gentrack is trying to get to Hansen's size and yet, you're already paying Hansen's price for it. You're getting three times more for the same share price basically with Hansen, which unless you feel that Hansen is somehow doomed, which I don't think it is, because Gentrack's going to completely overtake the industry and every possible utility will be switching to it instead of Hansen, then there might be a case for favouring Gentrack over it. In fact, there certainly would be a case for favouring Gentrack. That doesn't seem to be the case, Hansen's still growing, Hansen still has an excellent set of staff, it's got a much more diversified revenue base and so is also much more stable because of the change in business or the different business model, so it's not as if it's - yeah, I think it's a bit of an ugly duckling at the moment because Gentrack's suddenly got all the glamour around it, but in terms of valuation, Hansen wins hands down in my opinion. "

Apparently Jefferies thinks Gentrack should go higher even after the near 20% rally

The link is paywalled.

And another target from Goldman Sachs of NZD 10.55 (also paywalled)

I did see the content somewhere on the DJ morning notes but now can't find it (must be archived)

Just a few guides but take the targets with a grain of salt.

[held]

One I bought at a $1.20 two months ago and wish I had held and built a bigger position - now up close to 100%! Clear turnaround in what should be a high quality business. Still some risks but appear to be executing.

Shaw and Partenrs - Gentrack Group (GTK)

Rating: Buy | Risk: High | Price Target: $4.50. A high-quality growth stock on a sub 10x EBITDA multiple. Reiterate Buy.

Event: GTK has delivered an impressive FY22 result. While the beat and FY23/24 raise was welcome, what really caught Shaw’s attention, was management see double-digit growth persisting through FY27. This firmly positions GTK as a growth stock. Management have shown their hand, investors can now either view these forecasts as fanciful or start pricing the stock appropriately. With GTK trading on just 9x FY24 Cash EBITDA Shaw’s believe a massive re-rate is coming. Shaw’s increase their PT to $4.50 (was $2.90) and believe a multiple of 23x is more reasonable for GTK’s growth and margin profile. GTK is a top pick. Reiterate Buy.

Recommendation: Shaw’s reiterate their Buy rating and increase their PT to $4.50 (was $2.90). The key driver of their upgrade is higher medium-term cashflows. On Shaw’s forecasts, which are now in-line with guidance, GTK is trading on 9x FY24 Cash EBITDA multiple. Shaw’s PT implies 23x which Shaw’s believe is reasonable for GTK’s growth and margin profile through FY27.

Nice to see an earnings upgrade after years of falling earnings.

I have just started researching GTK so have not formed an opinion and don’t own any shares. My interest was piqued by just how far the company has fallen for what should be a relatively stable business – similar to Hansen Technologies. It is probably one of the most hated tech stocks and in a clear downtrend on the share price. There was a large cross trade today which could mean the big seller is out.

The difference between Hansen and GTK appears to be that GTK has usually served the smaller utility providers, who are of course more vulnerable to energy market fluctuations. In fact the UK has been a particular headwind due to government imposed price caps which look to be about to be reversed as numerous utilities enter bankruptcy including one of GTK’s large customers – Bulb. Bulb is looking to be sold and is in special administration with the government so this could be major hit to earnings near term. The other headwind was in the aviation sector which of course was hit by COVID impacting ‘Veovo’ product. The product also appears to have been recently revamped. These two headwinds appear on the verge of reversing.

Reading through many glassdoor reviews the issue has been the legacy and outdated tech stack which as @Strawman has pointed out in the past is what tech developers hate the most. This appears to being corrected under the new management team and indeed a recent ASX announcement they launched a next generation platform built on AWS – announcement here pdf (markitdigital.com).

NZ power company Mercury which is majority owned by the NZ government has already signed up as a customer and is migrating their customers across Gentrack partners with Mercury and launches g2.0 solution (itbrief.co.nz) One customer does not make a trend but it is promising.

Keen to know if anyone knows anymore on the company as it is exceptionally cheap if they can turn margins around and would be great to meet the CEO.

Poor Gentrack, i havent checked in with it for a while but it's clearly not been doing well.

Shares are down ~80% since 2018, and EBITDA (operating profit) has dropped from $28m in FY18 to an expected $11m for the current FY20 (its financial year ends in September).

In today's ASX announcement, Gentrack said the second half was ahead of the first and that cash flow would be positive for the full year.

But they also said that increased costs and added competitive pressure would mean the revenue run rate for FY21 would be "well below" the H2 FY20 run rate, and that EBITDA would be closer to break even.

COVID is clearly having an impact and it seems industry conditions remain tough. There's a new CEO coming on board who will try and turn things around, but it looks like it could be a tough job.

Assuming around $100m in FY20 revenue, shares are on only 1.4 times that. Pretty cheap if they can revive margins. If not, and the top line remains stagnant, the current 12x EBITDA isn't cheap at all.

Until things can be shown to improve, it's an avoid for me. But I do think there's a good business here, just don't have a good handle on the competive landscape and direction of the major profit drivers at this point in time.