I felt sorry for this company given it's a microcap ($112M MC) that's been around for five years with zero straws and as far as I can see has never had a Strawman investor, so I felt like we should give it a look.

What does it do?

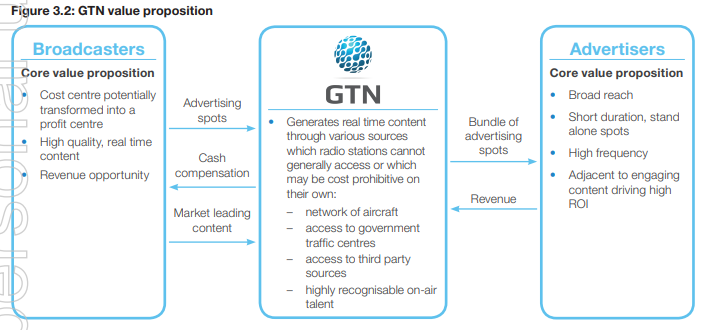

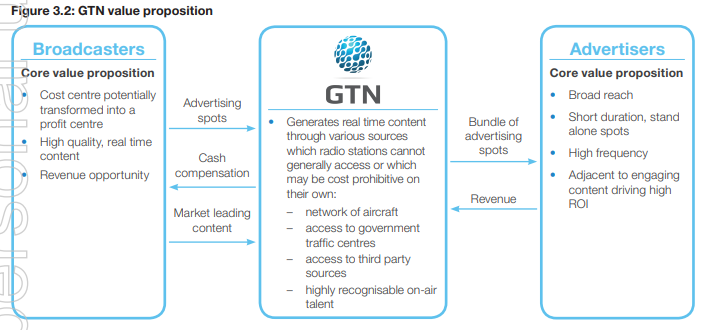

It supplies traffic broadcasts to radio and television networks. Think Arnie Pye in the Sky.

Typically they will bundle up the traffic update with some ads and pay a broadcaster for the privilege of filling up a few minutes of their airtime. They hope to make more from the ads than it costs them to make the slot plus what they pay to the broadcaster.

Does that actually make money?

When things are going well it does. In FY19 and FY20 FCF was $25-30M. If they get back to that they're only about 4x FCF. In FY19 it paid over $30M in (mainly franked) dividends!

Where do they operate?

Mainly Australia, the U.K., Canada and Brazil, which if I were being generous I'd call an ecclectic mix. But if I were being accurate I'd call bloody random.

Who owns them?

It's not management. The CEO owns a bit (1.3%) but other than him insider ownership is pretty low and hasn't really been building on price weakness. Virburnum Funds owns close to 30% and has been adding steadily.

Having said that Peter Tonagh is the non-exec Chairman and he is notable for having broad experience with Foxtel and News Corp. He recently became the deputy Chair of the ABC.

What about the Balance Sheet?

Gross debt is fairly high but they've been successfully paying this down to more manageable levels over the past 18 months, and net debt is minimal. I'm less worried about that than I am about the balance of their goodwill and intangibles, which at $136M is substantially higher than their enterprise value. That suggests the market does not rate their capital allocation. They also carry a $100M prepayment to Southern Cross Austereo, which provides them with exclusive traffic slots for a 30 year period. That's a big chunk of change that's locked up for a very long time and exposes them to a lot of counterparty risk.

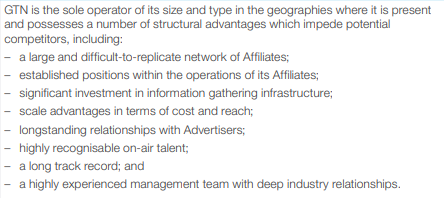

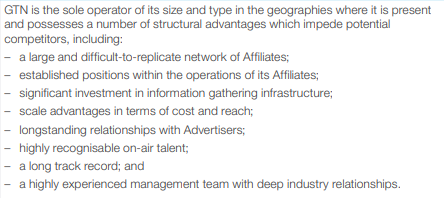

Do they have a moat?

Here's what they say:

I accept there are 'some' barriers to entry but if you have to pay an affiliate $100M to lock them in to a long term contract I would of thought that undermines your argument a bit.

Anything else?

A couple of things;

-they made an unsuccessful attempt to crack the US market a few years ago. Bigger is not automatically better.

-their prospectus stated the Board target a 100% dividend payout ratio. That's an amber flag for me.

Overall

For my style of investing the risks outweigh the opportunity at the moment. However, it's worth keeping an eye on - if it recovers to be anything like it was pre-COVID, it's hard to see the share price staying where it is now.