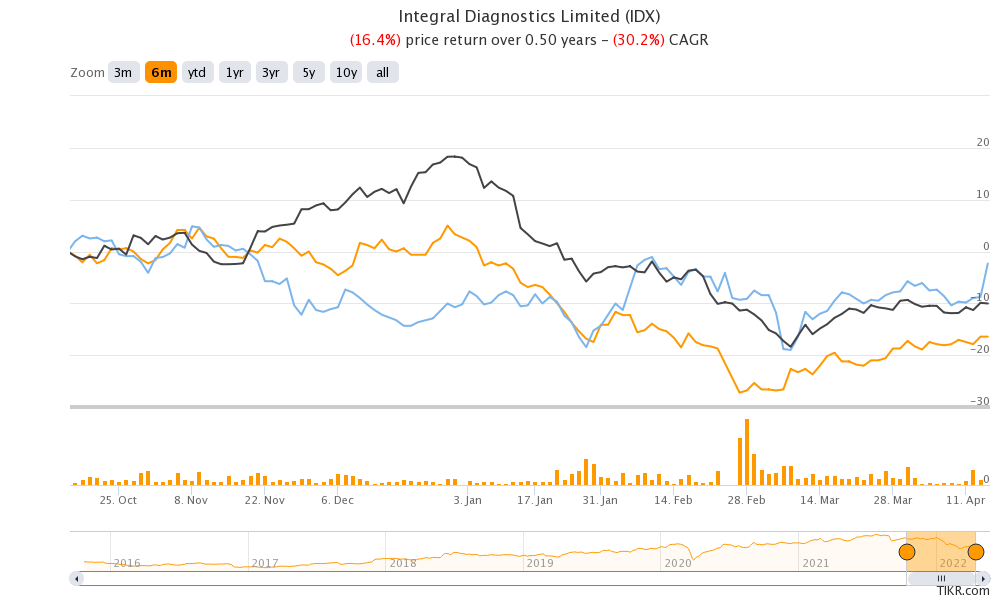

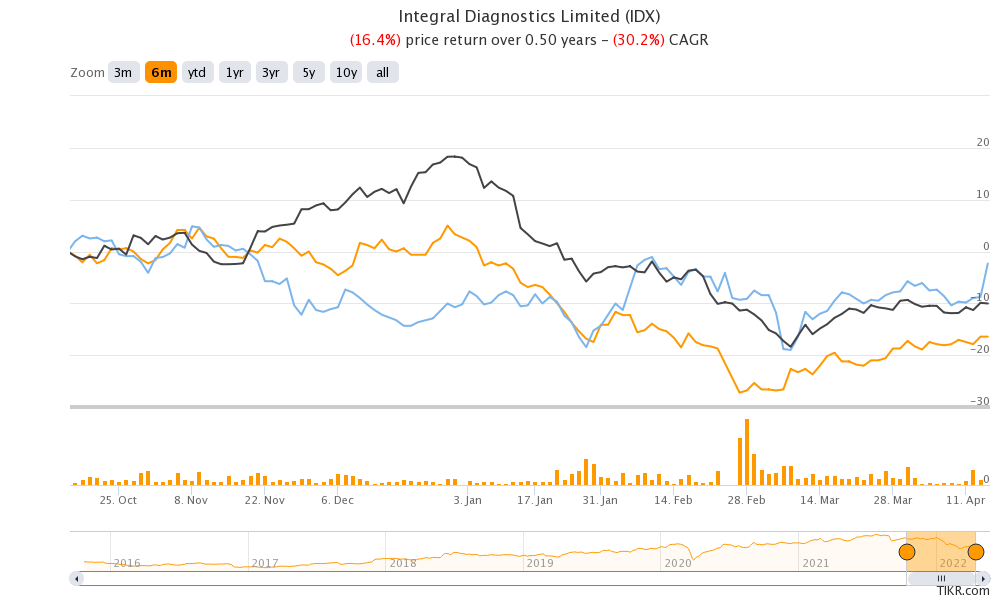

Apr 22 Update - OK so not sure anyone saw it or even cared but I thought I had better see how my bold statement re Qantas Vs IDX was looking. Not so good - yet!

IDX shareprice hasnt kicked as yet and Qantas has but am still much more comfortable with a IDX over QAN in the medium and long term and I feel the thesis is still good. Something like SHL which has a pathology business as well has obviously held up better with the increase in COVID testing although the big change to RAT rather than PCR testing has probably had a big impact on their share price this year.

While purely imaging companies like IDX have not yet seen a big change in profitability I believe the backlog of work remains although the COVID impacts have lingered longer than I had expected for businesses like these. I am expecting to see some improvement in revenue in the next reporting period and GM may remain subdued due to staff and ancillary costs associated with COVID but in the next 2 years I expect we will see a good jump in profitability. IDX is still my preferred exposure. I believe it is yet to fully capitalise on some of the synergies with the recent acquisitions - I expect we will see these in coming to light in the next 2 reporting periods.

The last Medicare CPI Index did not keep up with the health sector CPI but am expecting the next indexation to be higher which will assist in increasing organic revenue growth. The recent acquisitions continue to grow the footprint in areas with a higher than average ageing population which should help organic growth rates. I believe it is yet to fully capitalise on some of the synergies with the recent acquisitions - I expect we will see these in coming to light in the next 2 reporting periods.

Image below has SHL shareprice since my bold prediction in Black, Qantas in Blue and IDX in Gold.

Original Post - I believe companies like IDX have a significant informal backlog building with COVID minimising discretionary use by GPs and Specialists. Difficult to guage how quickly or how much this will be when it starts to kick in.

Also cant help but be impressed with how resilient the financials have been given the restrictions. I believe the market is underestimating the "opening up" impact and results to date have been good. I would rather play an IDX over a QAN for a post COVID boom.