Results released for year ended 31 March 2024 - my key takeaways

Pretty solid result across all investments, 13cps final dividend declared.

Sitting at around 23% debt which is lower than the 30% usually aimed for an allows for the team to look for favourable opportunities.

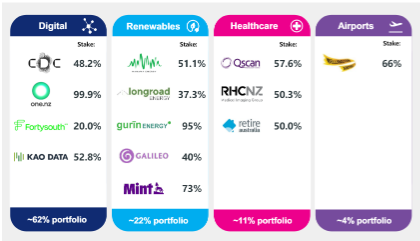

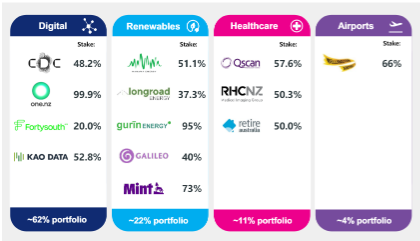

Digital infrastructure is taking up a hefty chunk of the portfolio with more growth expected. Although diversified within the sector it is a risk to keep an eye on an ensure its not too heavily weighted within my overall portfolio.

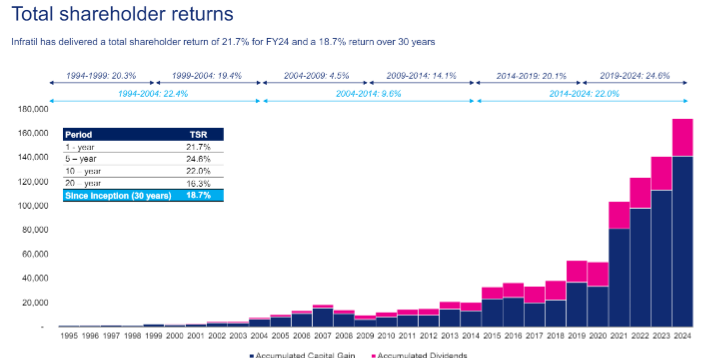

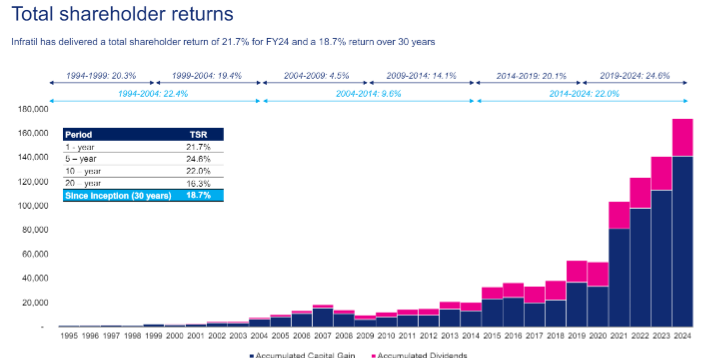

They provided this nice little chart to help with the investor feel good factor (Jason Boyes will surely take this into his performance/renumeration review).

Had been a bit concerned with what feels like fairly regular announcements of increased independent valuations of the companies investments. They have explained their valuation metrics in the report.

Valuing this more like a fund than a company. Will continue to $ cost average into Infratil IRL so I'm only looking for a ballpark figure to stop me buying if it gets way above a fair value.

Net asset value per share of $14.35NZD and reduce it by 20% to account for bias/incentives of valuers, cost of sale etc.

Current valuation of Infratil shares $11.48 NZD/$10.60AUD

Held SM and IRL