The rally everyone loves to hate, including my work colleague who says "Sell!"

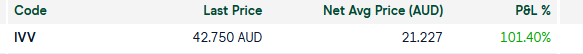

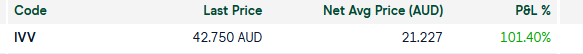

One bagged from an ETF after holding since 2017. Should show this to all the bears in the world predicting a market crash!

Have to also add the falling AUD giving a good free kick to the IVV share price

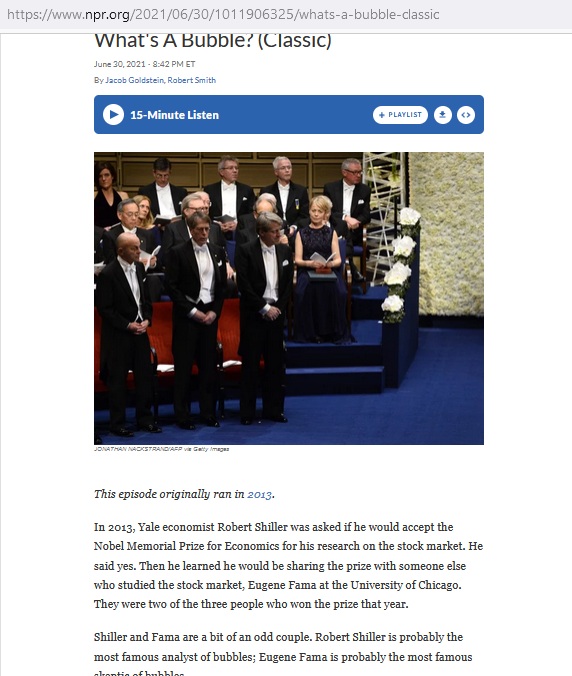

And also we need to give a big thanks to Eugene Fama for his work on EMH (Efficient Market Hypothesis) which laid down the foundations for index funds and ETFs that we see today. Not to mention winning the Nobel Prize alongside Fama skeptic Robert Schiller who was a big critic of EMH and big bubble predictor - must have been shocked when he saw Fama that day on the stage.

Can understand why Lars is standing between Fama and Schiller below.

Ok better not get too happy...

https://www.npr.org/2021/06/30/1011906325/whats-a-bubble-classic

https://www.theguardian.com/business/2013/oct/14/looming-us-debt-ceiling-deadline-leaves-markets-edgy

[held]