A high quality but cyclical large cap company. Again like AUB i mentioned a few months ago it is a large cap so maybe not of interest to many here.

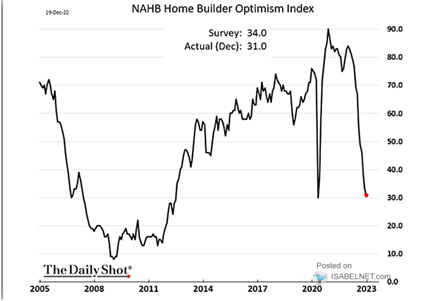

Interest was piqued again by this interview with Matt Williams at Airlie and hearing a pitch at Finfest from the analyst covering it- This Hall of Famer has uncovered a stock worthy of Warren Buffett’s portfolio | The Rules of Investing (podbean.com). They have got it very wrong thinking it wasn't cylical - shocker it is with recent downgraded guidance. Reminds me of semiconductor argument last year.

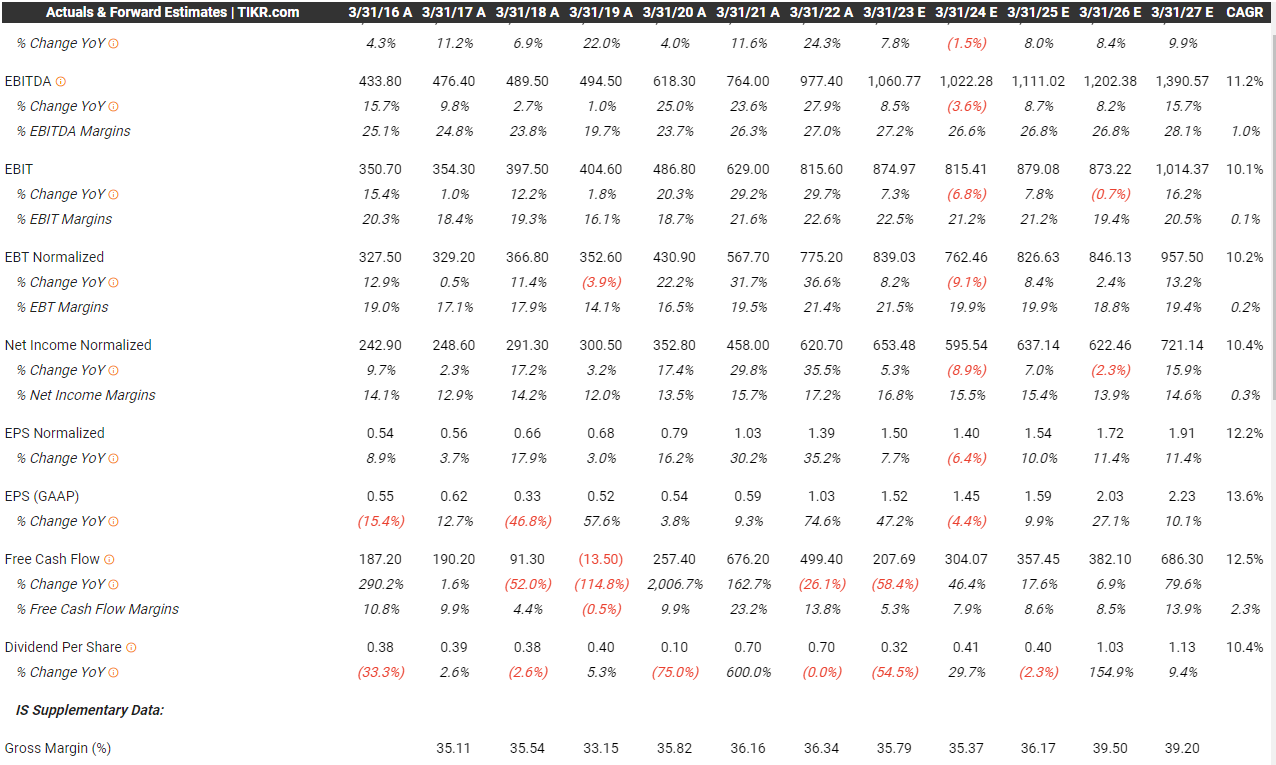

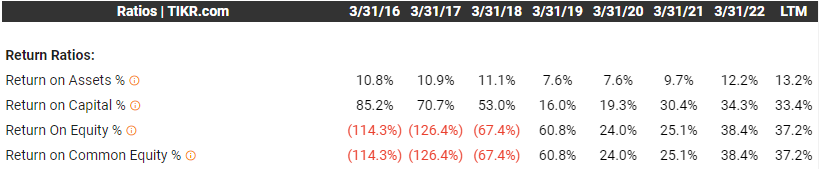

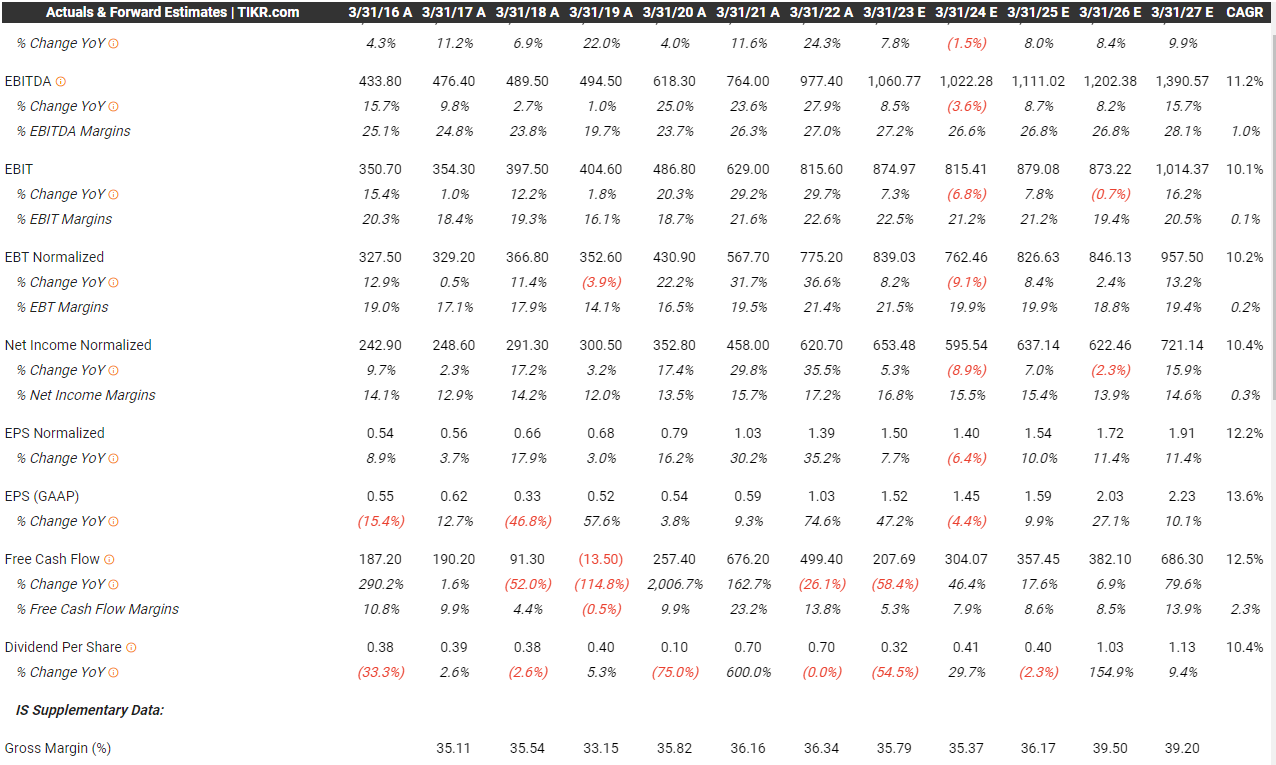

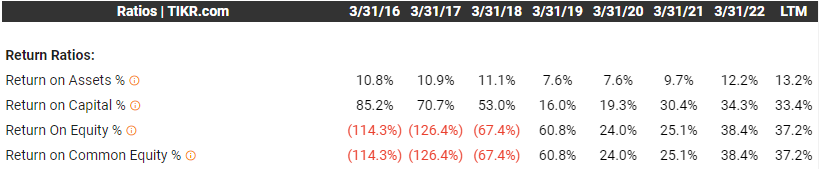

In any case some pretty interesting return metrics with eventual growth returning.

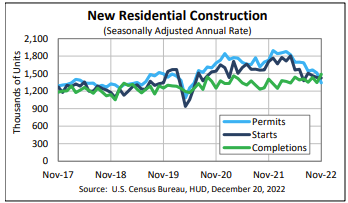

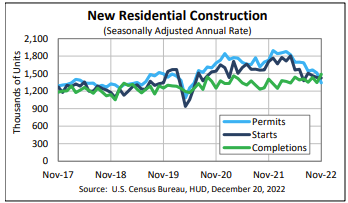

A lot of growth ahead and undersupply of housing in the US seems a long term driver as is the repair market from all the houses built inthe 60s and 70s. Product looks quite good. They've suspended their unfranked dividend to undertake a buyback. The Asbestos payments will continue until about 2045 but look well provisioned for.

It has dominant scale advantage position in the US and competes mainly with wood and brick as alternatives. Some concerns on market share in latest call which I don't yet fully understand. US is the dominant driver of earnings but there are operations in Australia and a presence in Europe.

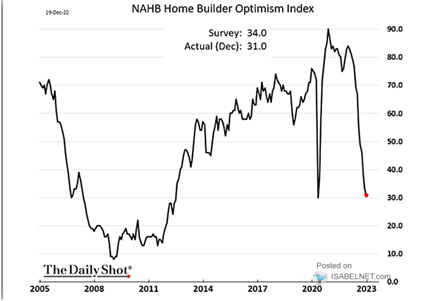

The US housing market is falling off a cliff. Home bulider confidence below:

JHX has halved but still looks pricey to me but below $20 I think this will be a great steal for a Buffett like company that will eventually see a recovery. Sherwin Williams (paint) in the US as well as other paint companies are often sought after by investors worldwide and can see JHX in the same vein there.

Again I think it is too early to enter now given the headwinds but worth keeping an eye on.