8th October 2025: Don't know what this one's worth, but after some research today Kal Gold did look to me like a good inclusion for my smaller speccy portfolio, so I added $12K of them this arvo (200,000 shares @ 6 cents each).

What got me interested was watching this MoM podcast with Ed Eshuys last night:

Here's the link to that podcast: https://www.youtube.com/watch?v=LGfF46yezTE

A legendary explorationist, Ed Eshuys, has been widely credited with the Plutonic, Bronzewing and Jundee gold discoveries. All massive gold discoveries. He's getting on now but is still involved in "discovery". Ed says he's always hated the terms "project" and "exploration". He says that the companies that he has run have been in the business of discovery, not exploration, and developing and running mines, not projects.

His attitude is that you have to define your purpose and strive to achieve that purpose, and that's why those terms are important to him. He said that there are geo's who like the work, and that's fine, but he prefers to work with geo's who live for the big discoveries rather than the process.

He worked for decades with Joseph Gutnick (pictured below) with Joe providing the capital and Ed spending it wisely to discover decent economically viable mineral deposits. While they didn't have too much success with diamonds, they did have plenty with gold and other metals.

Joe Gutnick, who worked with Ed Eshuys for many years. They were very successful and both made a lot of money, especially Joe who provided the capital and would therefore have taken most of the profits.

Ed Eshuys has also worked with and/or negotiated deals with Mark Creasy and Robert Champion de Crespigny whose son James is now the CEO & MD of Catalyst Metals (CYL) who I owns shares in (in my SMSF).

Ed owns 5.03% of Kal Gold (Kal) - the subject of this post - and also owns 8.61% of Yandal Resources (YRL) - both of those holdings through a company he controls called Alianda Oaks Pty Ltd.

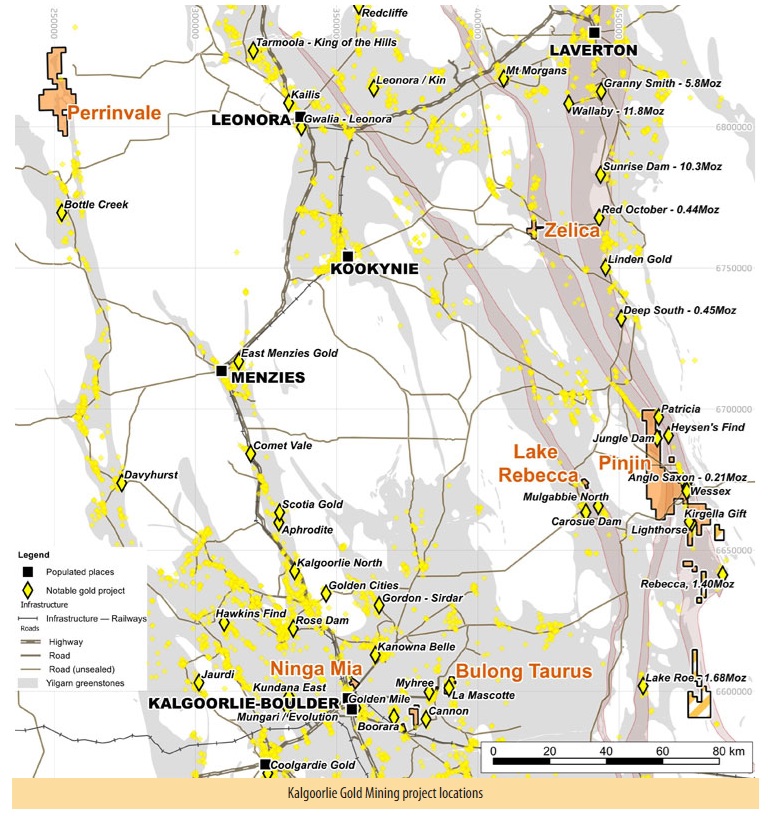

Ed likes to back companies who own a decent amount of land that is highly prospective for gold and who have capable management teams who are serious about discoveries and are proving that by their actions, i.e. they are actively drilling and being smart about it.

Ed points out that drilling is a waste of time and money if it's not effective, an example being holes that were abandoned because they hit unexpected rock or clay at a certain depth and a serious deposit was later discovered a couple of metres below where those drill holes had been sunk to and considered to be useless at the time. So he stresses that you need to plan the drilling well, and then you need to drill what you planned to drill even if it costs more than you initially expected. He particularly hates shallow drilling - he prefers to drill often and deep.

Ed today (above) and a few years ago (below):

That last image sourced from: https://thewest.com.au/news/wa/aphrodite-tempts-eshuys-ng-ya-375024 [31-July-2014]

Short excerpt from that WA News ("The West Australian") article from mid-2014:

- Just like his former mentor Joseph Gutnick, Ed Eshuys is finding it hard to resist the lure of gold riches in the Goldfields.

- The former St Barbara and Apex Minerals boss yesterday returned to the region as a consultant and technical adviser of Aphrodite Gold to review the geology of the company's namesake project, 60km north of Kalgoorlie-Boulder.

--- end of excerpt ---

As well as being the Executive Chairman of Apex Minerals (2012 - 2014) and the MD & CEO of St Barbara (SBM) between 2004 and 2009 (both mentioned above), Ed has also been Executive Chair of DGO Gold (2010 - 2022) and has been a NED (Non-Executive Director) of NTM Gold (2019 - 2021), Dacian Gold (2021 - 2022) and De Grey Mining (2019 - 2022).

He has also run his own company, New Hampton Goldfields, however most of Ed's success in recent years has been through his substantial involvement in DGO Gold as the company's Executive Chair for 12 years until DGO Gold was acquired by Gold Road Resources in mid-2022, becoming a subsidiary of Gold Road, and since the recent acquisition of Gold Road (GOR) by Gold Fields Ltd, DGO Gold is now owned by Gold Fields Ltd (which is listed in South Africa and New York, not on the ASX).

However, Ed has kept an interest in some of the assets that DGO Gold accumulated back when he was running the company, including a position in Yandal (YRL), and I believe Kal Gold (KAL) is one he's gotten into more recently. He mentions why they (DGO) bought into Yandal and De Grey Mining here, and he briefly mentions Yandal and Kal Gold here.

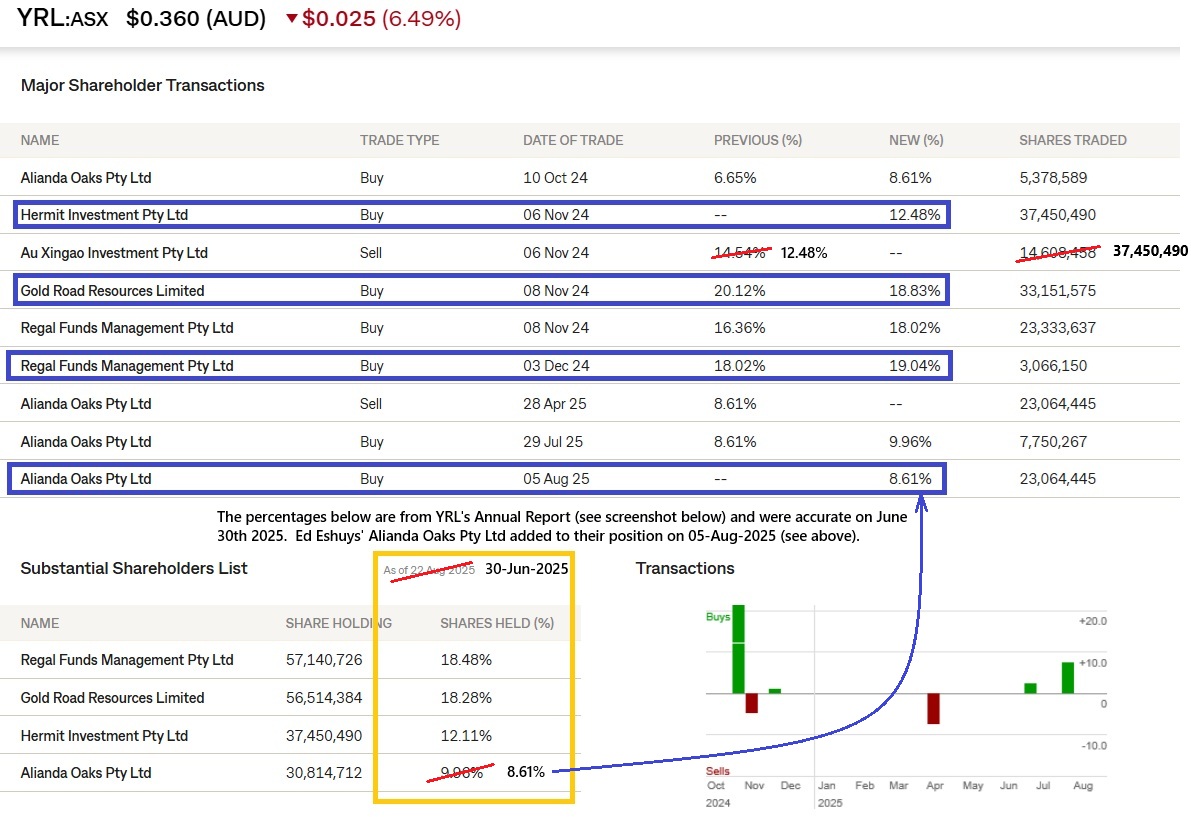

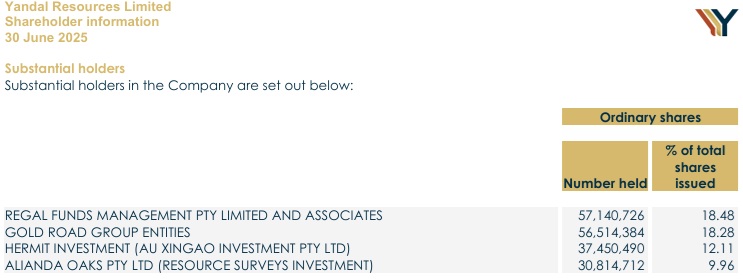

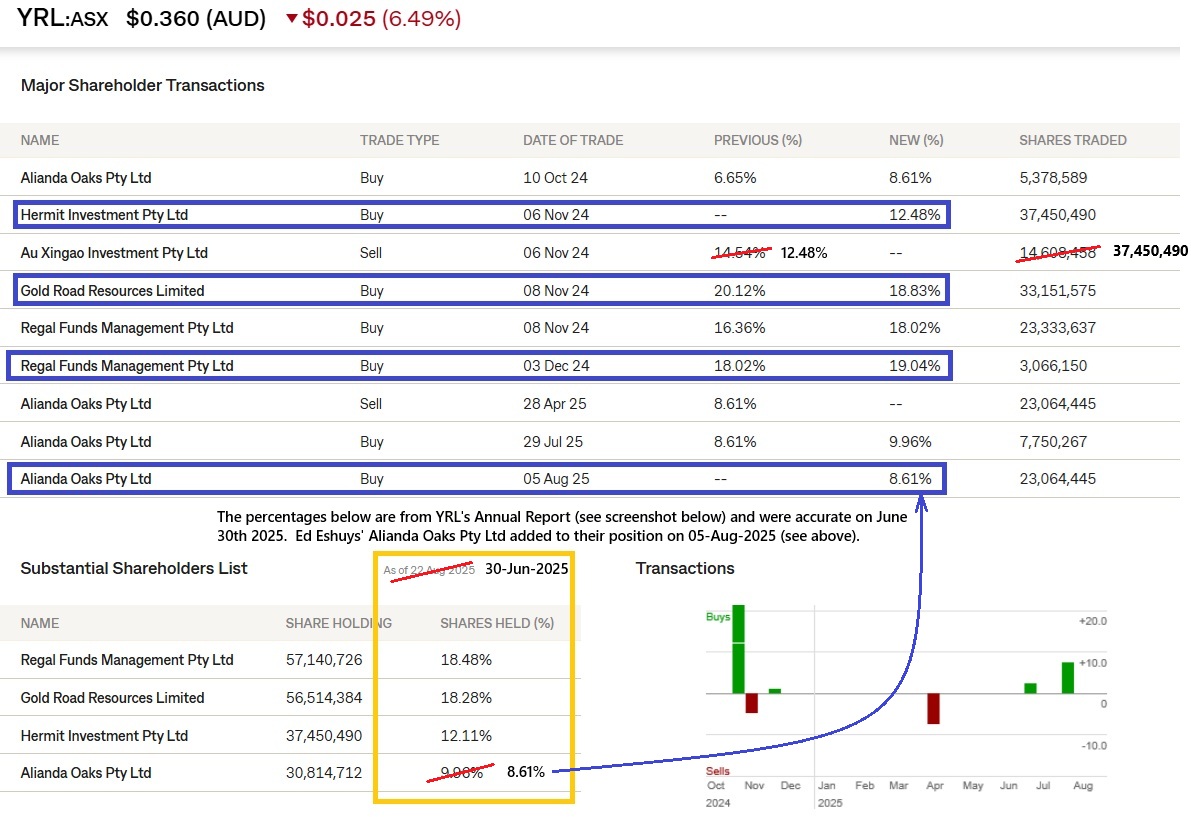

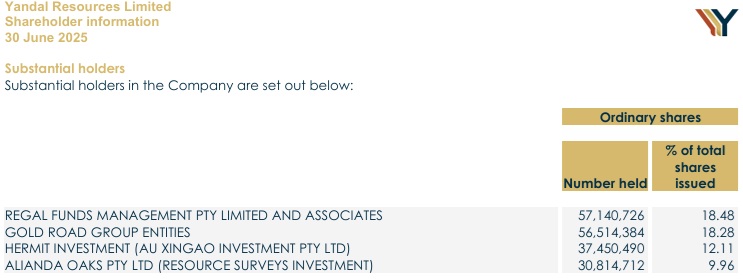

I've briefly looked at Yandal today, but decided against taking a position because while Ed's Alianda Oaks Pty Ltd owns 8.61% of YRL, Gold Fields now owns the 18.28% of YRL that Gold Road Resources owned, and Regal Funds Management own another 18.48% of YRL. And if that share register isn't tight enough already, another 12.11% of YRL is owned by Hermit Investment Pty Ltd, formerly Au Xingao Investment Pty Ltd, based in Hong Kong.

My concerns are that (a) YRL has just had a sharp spike up on positive drilling results and immediately called a trading halt for another CR, so their SP could well come back down over the coming weeks if they can't match that recent positive news with more of the same, (b) there's a tight register with not much of a free float, and (c) Gold Fields will most likely be looking to divest the investments in ASX-listed gold explorers and development companies that Gold Road (GOR) had which includes that 18.28% of Yandal, so that could happen at any time now that Gold Fields' acquisition of Gold Road has completed (or will this week), and that potential divestment by Gold Fields of their 18.28% of YRL could drive the YRL SP down significantly if Gold Fields sell their YRL on-market instead of via a block trade. In fact it could provide negative pressure on the YRL SP either way.

I'm waiting to see what Gold Fields do with that 18.28% stake in YRL before I take a position in YRL. It's an overhang I'm not entirely comfortable with being there while I don't know Gold Fields' intentions.

Above is from Commsec today, with notes and corrections by me. The Gold Road Resources stake is now owned by Gold Fields Ltd because they have just acquired Gold Road Resources. Below is the "Subs" list from Yandal's 2025 Annual Report as announced to the ASX on 23rd September (2 weeks ago).

Source: Near the end of Yandal's 2025 Annual Report, 23rd September 2025.

There has been some dilution from options being exercised, which is the reason for the variance in numbers, plus YRL have just announced another CR ($135 million placement) on October 1st (one week ago) - see here: YRL-$135m-Placement-to-Expand-and-Accelerate-Exploration-(01-Oct-2025).PDF which they said "was bid in excess of the amount sought to be raised with strong support from major shareholders, domestic and international institutional, sophisticated and professional investors", so we can expect further changes ("Change of..." notices) once those shares are issued. So all of the above numbers will change again during the next couple of weeks.

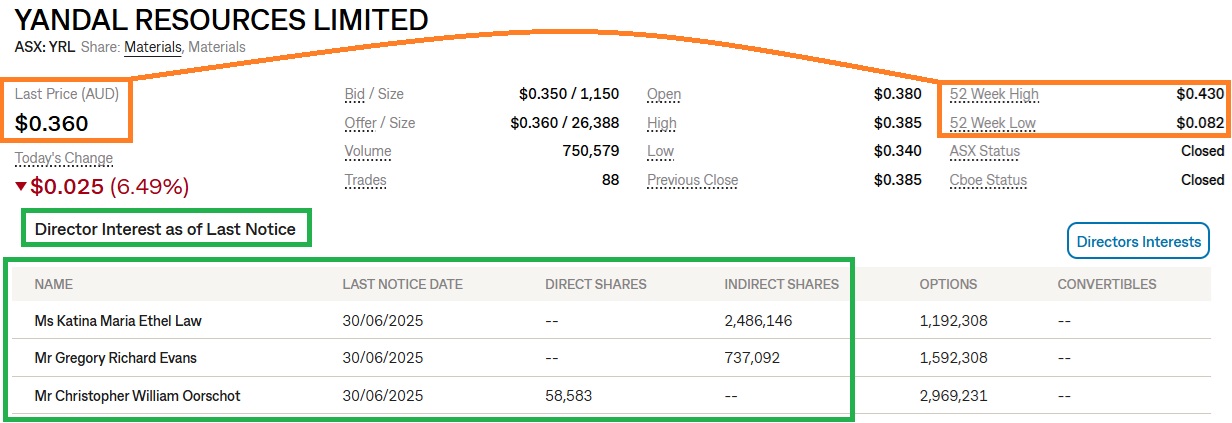

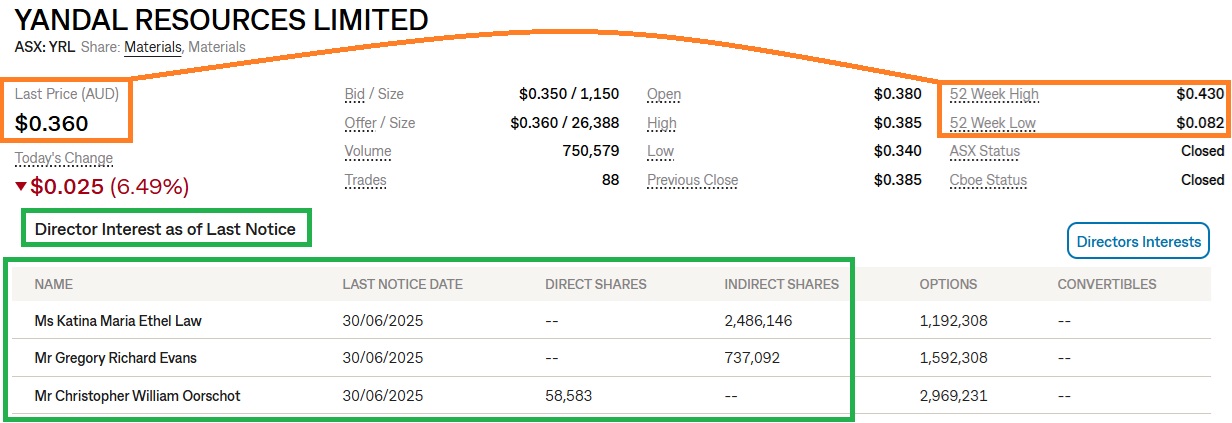

While I'm talking about YRL, it's probably worth noting that they have a small 3-person Board (which is appropriate for a small company with a $119 million market cap) and that those three Board members all own shares and options.

Source (above and below): Commsec tonight.

So I don't want to be buying into YRL when their share price has just doubled on some drilling results - I'll wait for some gravity to kick in first. Today was an example of that - with a -6.49% drop. The chart above uses weekly rather than daily data points, so it doesn't show the recent top of 42 cents per share that they got to on Monday (two days ago).

But that's Yandal, one I spent some time on and then declined to buy shares in today.

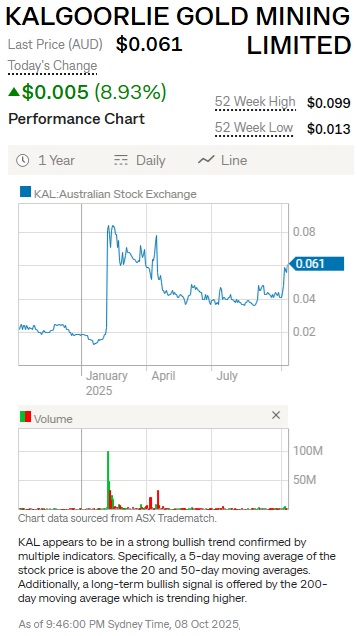

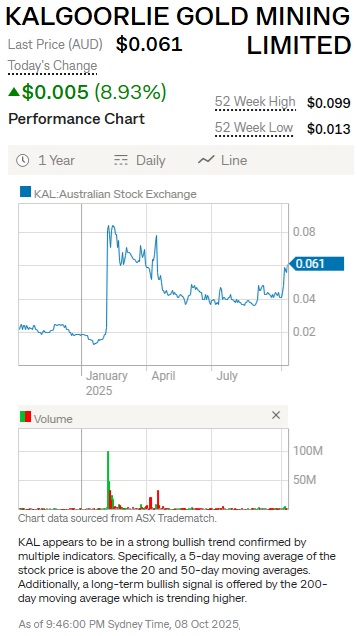

The one I did buy shares in today is Kal Gold, which has a better looking chart in my opinion.

They still have upward momentum, but nothing rediculous, and still plenty of upside potential IMO.

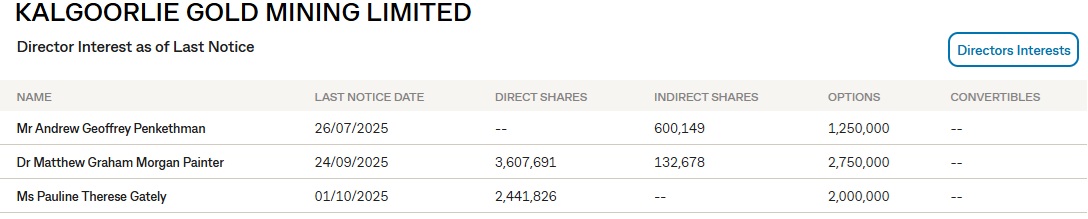

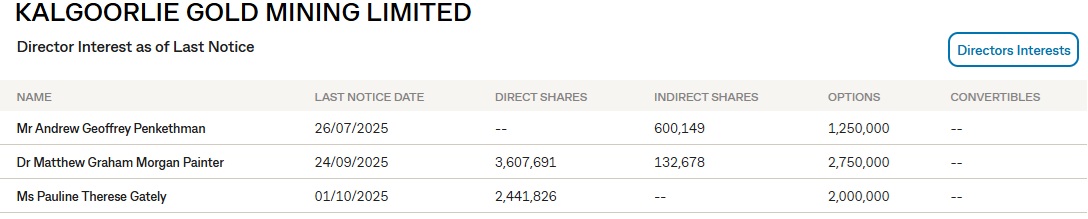

KAL are even smaller than YRL (KAL's m/cap is only $25 mill) and KAL (Kal Gold) also have a 3-person Board who all own shares and options (have skin in the game, as YRL's Board do):

Source: Commsec tonight.

Probably the best way to decribe what I like about Kal Gold is to watch this video:

There's a link to that one on their website home page (https://www.kalgoldmining.com.au/) as well as to the one below:

Link: https://youtu.be/aokzlh0tG4s

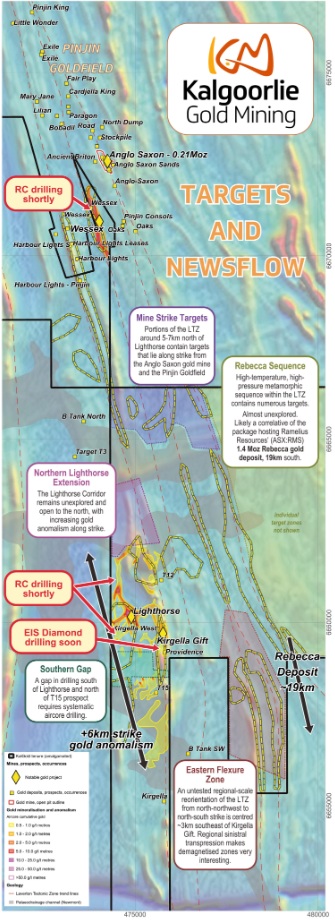

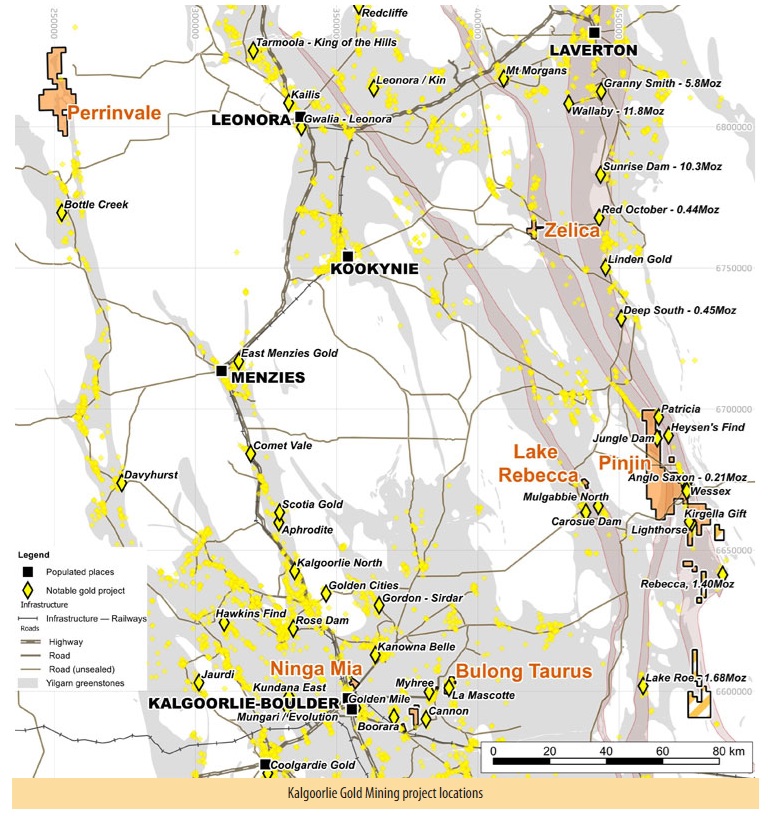

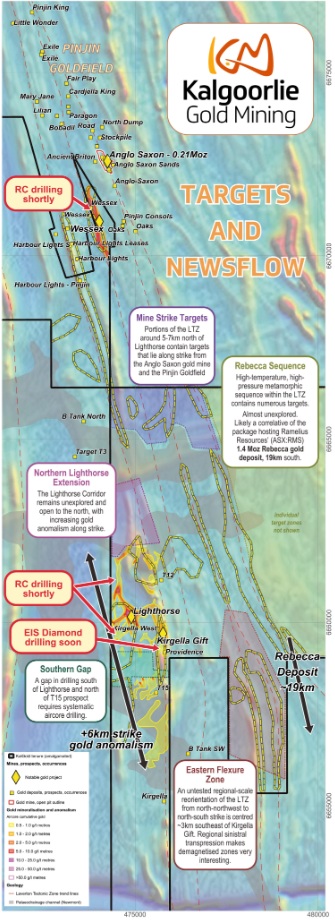

See: https://www.kalgoldmining.com.au/projects

Here's a link to their latest announcement concerning upcoming newsflow: RC drilling commences at Wessex continuing to Lighthorse [30-Sep-2025]

Something I do like about Kal Gold is that their website is up-to-date and modern. I understand that some smaller companies don't have the resources to make their website a high priority, but it's an important way to communicate with both shareholders and prospective shareholders, especially dinosaurs like me that hardly use social media at all.

Anyway, it's getting on for 11pm and I'm going to try for an early night (early for me anyway), and I've probably waffled on enough about both Yandal and Kal Gold already, especially considering that there's probably only somewhere between zero and 4 people here who might be even vaguely interested in a tiny little $25 mill gold explorer like Kal Gold who is burning cash, as explorers do, because they don't produce anything except drill cores, assay results, reports and presentations. And a decent website.

Definitely another high risk play. My speccy portfolio has now grown to $100K and contains (from largest to smallest positions): MEK, BC8, HRZ, GG8, KAL, TCG, TR2 and BLG (BLG being the only non-mining company in it) and I'm looking to add two more companies to it, one being ENR which I just sold out of @ 59 cents on Monday and I'm looking to re-enter again at lower levels - closer to 40 cps if possible. (I can wait.) The other one is another gold explorer/developer who have an ASX200 gold producer as their largest shareholder (with 20.53%) and who did a presentation at D&D in Kal in August which unfortunately included way too many bad equine puns. I've likely let the cat out of the saddlebag already there, but I'll talk about that company more when I've secured my position - I want to pay less than their current SP level, but that intention might change with new news.

In my income portfolio I'm currently down to just three companies, LYL, GNG & GOR, and once I receive my money from Gold Fields for those GOR shares, I'll likely be topping up GNG and probably adding another company to that portfolio.

In my SMSF I'm currently holding eleven companies, from largest to smallest positions: RMS, NST, CMM, GOR, BGL, EVN, CYL, GMD, NWH, MAQ and ARB. I've got a sell order in for one of those, which almost got hit on the open this morning - it got up to my price but not to my order, before the share price fell away. And GOR will be removed soon and I'll have that cash to deploy elsewhere also.

My SMSF is limited to ASX300 companies, and I've been looking for value across the ASX300, and it's hard to find right now, especially in the gold sector. I may add one or two ETFs/ETPs instead. There's a few companies I'd like to increase my shareholding in, like Genesis (GMD), but at lower levels, not up here. It's a good problem to have in one way, because my SMSF is making new highs a few times each week, but it's a bit of an issue when you need to put some cash to work and most of the ASX300 looks fully valued to expensive, to me anyway,

So, I find myself focusing more on my other two portfolios where I don't have any such restrictions.

Disclosure: KAL is held in my speccy (speculative company) portfolio only. I do not hold YRL at this point.