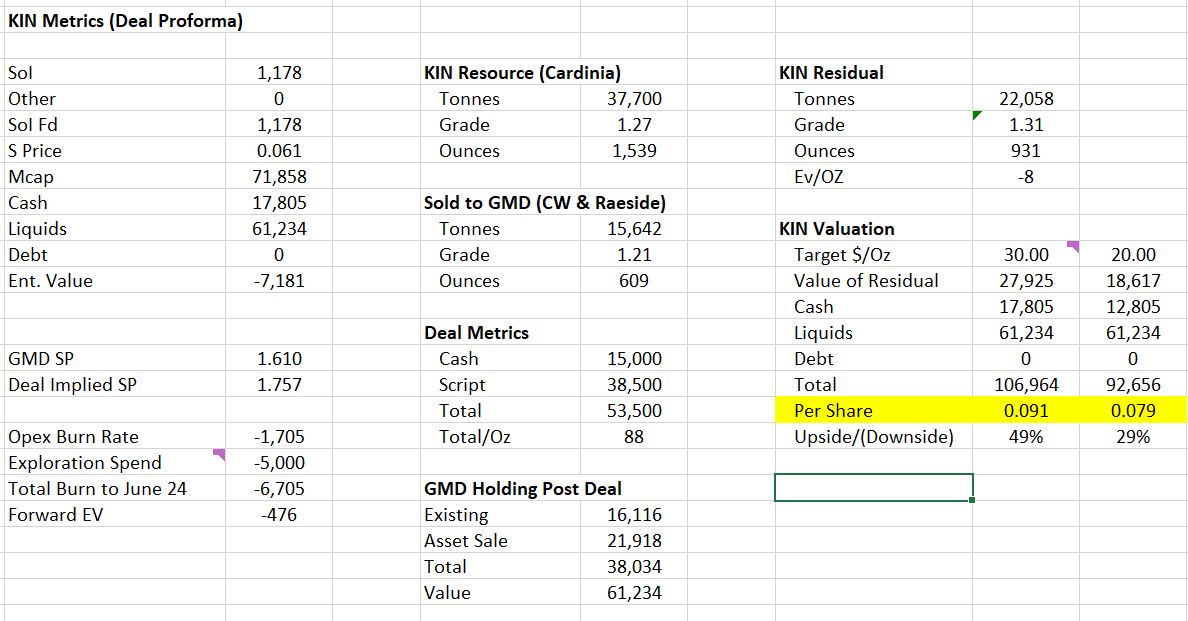

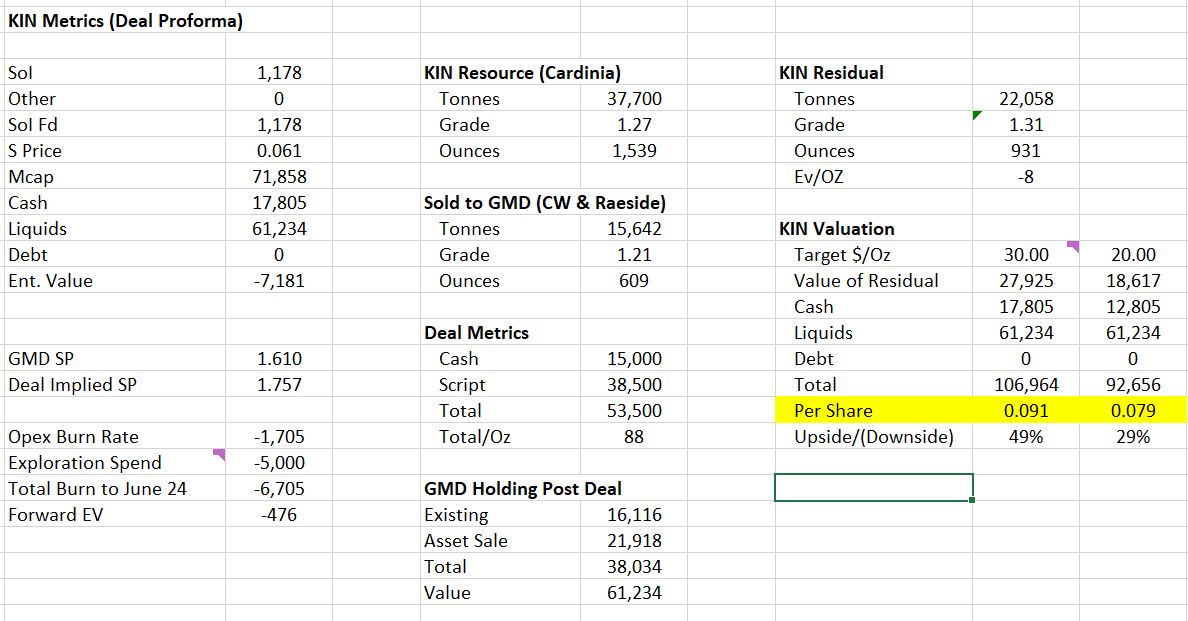

KIN sold some ounces to GMD last last year for $15m cash and $38.5m in GMD script (no escrow). Deal expected to close towards end of Feb or early March. KIN left with 931koz post deal on the eastern part of the Cardinia project.

Now cashed up, KIN is looking to improve the quality of the remaining ounces (real test of depth and upgrading indicated level, mine planning and permitting) so as to either support a standalone or make those ounces marketable to a 3rd part.

More excitingly is that post a little refresher of management, they did a blank slate on exploration thinking with a view to consider any and all potential on the tenements. This led to the reassaying of a hole from late 2022 which was only tested for gold. At the time, the sulphides encountered were marked largely at pyrite and associated with the gold hit. Upon reanalysis in late 2023/early 2024, assay returned 5.7m @ 5.3% Zn, 0.34% Cu, 0.3% Pb, 40 g/t Ag, 1g/t Au whilst broader analysis led to the view this was likely a VMS style system that was encountered. Follow up drilling on the target, now named Albus, is currently underway. This program also includes a few deeper holes on the nearby gold deposits of Helens and Cardinia East.

In essence, post deal closure, KIN trades at a discount to cash + liquids whilst it offers company making potential with a sniff of a VMS discovery to follow up on. If a proper commercial discovery is made, KIN can fully fund an aggressive drill out. This is a case of heads I win a lot or tails I lose a bit as the downside is protected with tangible and liquid assets.

Some would this is aKIN to the STK trade set up from mid 2023.

Risks include GMD deal flopping on the last mile, Albus follow up drilling disappointing, subsequent downhole EM showing weak conductors and deeper gold holes coming up light.

Latest preso: https://announcements.asx.com.au/asxpdf/20240201/pdf/05zzj7n8njf5tt.pdf

Albus update: https://announcements.asx.com.au/asxpdf/20240129/pdf/05zt2kc1r2h01d.pdf

Albus assays: https://announcements.asx.com.au/asxpdf/20240108/pdf/05z7nvns2l87x3.pdf

GMD deal: https://announcements.asx.com.au/asxpdf/20231214/pdf/05yjyrlpxr95bj.pdf