Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Kina Securities released an excellent FY22 result despite NPAT including provisions for a 45% tax rate. I exited large positions in KSL entirely IRL and on SM when the PNG Government released draft legislation to introduce the 45% bank super tax (up from 30%). If it weren’t for the super tax I would still be holding. Kina is an excellent business with ROE increasing to 17.9% and now trading on less than book value (x 0.9).

Results summary:

Full Year Result 2022 - Kina Bank delivers strong growth and ROE

• Underlying NPAT increased by 10% to PGK 106.1m.

• Net Fees and Commissions increased by 30% to PGK 116.2m primarily by continued development and build out of Kina’s channel network. Organic growth and digital expansion resulted in an increase of 78% in channel fees

• The Loan book grew by 11%.

• Kina grew its customer base by 19%, which delivered strong low-cost transactional deposit growth of 27.7%.

• Digital Channel growth of 89% year on year, due to expanded EFTPOS and terminal of choice strategy.

• Cost to income ratio remained flat at 58.7% with investment in a middleware API layer, and further investments in core technology and enabling infrastructure.

• Underlying ROE was 17.9% demonstrating Kina’s ability to generate quality returns.

• Reduction in impairment cost to PGK 4.8m. The lower impairment in the current year is due to such factors as the continued application of the asset recovery program of work and security database improvements contributing to robust loan and asset quality measures.

• Kina Investment Superannuation Services recorded an increase of 10% in total revenue associated with an increase in total funds under administration to PGK 17.3b and an increase of 4% in total membership.

• FX customer volume increased by 19%, albeit the revenue reduction was significantly driven by transactions using lower margin USD currency.

PNG Tax Implications

Management said in regards to the PNG Corporate Tax implications:

“In December 2022, the PNG government announced the 2023 budget with an increase in Corporate Income Tax for commercial banks from 30% to 45%.

It was also indicated in the budget announcement that further consultations will continue with the banking industry in the first half of 2023 to consider whether other tax alternatives may be more appropriate for the industry.

For the FY2022 full year results, the impact of the budgeted corporate income tax increase is reflected in the deferred tax assets (DTA). This has resulted in a revaluation inline with IFRS in tax credit of PGK 10.4m increasing the statutory NPAT to PGK 116.5m.”

Incremental improvement in ROE

Disc: Not held

I don’t trust the PNG government to revoke the proposed 45% “one-off” bank tax after 2023. In response to the new tax Kina’s CEO Greg Pawson said "We will be forced to reassess our capital expenditure programmes and likely cut investment.” - Kina scraps expansion plans.

I have lost confidence that Kina will be in a position to perform well with a 45% tax dragging on its future profits. Today there was considerable strength in the share price at 80 cps. I took advantage of this underpinning support today to exit Kina entirely IRL and on Strawman.

I am disappointed to be forced to sell such a promising business just as it starts to recover from its failed Westpac Pacific acquisition. However, Kina is no longer on a level playing field and I think there are better opportunities elsewhere.

At this stage the increase in bank tax from 30% to 45% proposed by the PNG government is a “one off” for 2023. The Government has committed to launching consultations with the industry in the first half of 2023 on an alternative, "additional profits tax" that would apply from 2024. Given this additional information, I am now assuming an ongoing tax rate of 45% might be a worst case scenario for PNG banks. I am also expecting Kina to expand and grow revenue by over 20% per year over the next 3 years. Given the higher tax rate on profits, Kina could divert more revenue into expanding the business rather than producing higher profits. Although an additional tax is not desirable, the future outlook for Kina as a business is still very positive. At the current price it’s a hold for me.

Disc: Held IRL and SM.

Papua New Guinea Ramps Up Bank Taxes In 2023 Budget

Dec. 6, 2022

International

Papua New Guinea (PNG) has announced that the corporate tax rate on banking institutions will rise to 45 percent.

The measure was announced in the territory's 2023 Budget and will apply from January 1, 2023. The sector is currently subject to a 30 percent tax rate.

The Government described the tax as a one-off measure that will apply only during 2023. The Government has committed to launching consultations with the industry in the first half of 2023 on an alternative, "additional profits tax" that would apply from 2024.

Following my previous post, Kina has released an announcement clarifying the proposed lift in the tax rates for banks from 30% to 45%. This will be a big hit for shareholders if introduced. It effectively would mean NPAT for shareholders will be reduced by 21.4% ((70-55)/70 x 100) for the same earnings. This brings the expected dividend down from 12% to 9.4%. This would be OK if the share price didn’t follow in accordance.

If the proposal proceeds, this will not go down well with Australian investors supporting PNG companies. The two largest banks, Bank South Pacific (BSP) and Kina Securities (KSL) are both listed on the ASX.

It would appear from Kina’s Announcement today that this is not a done deal yet, and consultations are taking place between banks and the PNG government over the coming weeks.

BSP and Kina have both said the higher tax will reduce foreign investment and reduce competition for PNG banks. Hopefully the proposed talks come up with a fairer compromise. A 45% tax is extremely harsh and one of the highest tax rates for banks in the world,

Disc: Held IRL and SM.

Announcement Below:

Draft Budget Corporate Tax rate for Commercial Banks in PNG

Kina Securities Limited (ASX:KSL | PNGX:KSL) (Kina or the Company) is reviewing the proposed 2023 National Budget that was delivered on 2 December 2022. The National Budget included a proposed increase for Commercial Banks Corporate Tax Rate (CIT) from 30% to 45%.

Kina, in consultation with the Industry, PNG Treasury and Government bodies is continuing to evaluate the draft budget recommendations. This consultation period will occur over the coming weeks and is unlikely to be finalised this calendar year. There is no impact on the Full Year 2022 profit outcomes for Kina.

Kina’s Managing Director and Chief Executive Officer, Greg Pawson said: “We look forward to working with the relevant government bodies to understand and champion a productive solution for all our stakeholders in order to support the economic prosperity of PNG”

The Managing Director and CEO, Greg Pawson will be holding a zoom call tomorrow to allow shareholders to ask questions at 1:00pm (AEDT), details are:

https://mstfinancial-au.zoom.us/j/85131903577?from=addon Meeting ID: 851 3190 3577

Password: 524790

PNG banks are up in arms over a new ‘Super Bank Tax’ proposed from 2023. The goverment proposes to increase the company tax rate for PNG banks from 30% to 45%.

Initially the ‘Super Tax’ only applied to companies with more than a 40% share of the market, which affected BSP Financial and not Kina. Now the government is targeting all banks with the higher tax rate. It’s not clear if PNG banks have any opportunity for consultation, or to overturn the proposed higher tax rates.

The news sent Kina’s share price down over 6% yesterday.

Commercial banks in PNG oppose new increase in tax

“Two major commercial banks in Papua New Guinea have opposed the 45 percent tax on the banking sector to come into effect next year.

BSP Financial Group Limited chief executive officer, Robin Fleming said as BSP understands the government will be repealing the Additional Company Tax of K190 million per annum which applies only to BSP from 2023, and this is replaced by an increase in the company tax rate for all banks from 30 per cent to 45 per cent.

He said while the banking sector has been seen to be profitable in recent years, the sector has absorbed many costs associated with delivery of banking services to the people of PNG.

“These include inflation-related adjustments to operating costs, exchange rate driven costs in licence fees and other professional services that can only be provided from offshore, and costs associated with infrastructure-related services such as power and telecommunications,” he said.

Fleming said while it is pleasing that the additional company tax act will be repealed, the overall amount of tax paid by BSP will not change and the profits after taxation that are available for distribution to all of its shareholders by way of dividends, will still be negatively impacted.

“Our shareholders such as Kumul Consolidated Holdings, Nambawan Super, Nasfund, Teachers Savings and Loans, Credit Corporation and Petroleum Resources Kutubu will continue to receive reduced dividends as a result of the higher tax rate,” he said.

Fleming said banks in Papua New Guinea will now be subject to one of the highest tax rates globally.

He said the absence of competition in the banking sector has long been seen as an important issue for the Bank of PNG and the government and a tax rate at 45 per cent will be seen as a disincentive for potential new entrants into the sector.

Kina Bank chief executive officer, Greg Pawson said the banks have strongly opposed any increase in corporate tax rate for the banking sector and are disappointed in the lack of consultation by Treasurer.

He said the unintended consequences of such a move will be detrimental for the banking sector in PNG, which is already structurally imbalanced.”

Disc: Held IRL and SM.

No news out of Kina Securities that is!

So, what is going on with the Kina Securities share price? The share price closed up 4.5% today, and since June the share price has gradually crept up by 14%. There could be a number of things contributing to the recent buying strength.

Troubled PNG Election Now Over?

Perhaps it’s because Papua New Guinea's incumbent Prime Minister, James Marape, has been returned to the top job after following the country's controversial, and at times violent, national election? The election has been described by several analysts and MPs as the worst they have seen (ABC News, 9 August 2022).

Perhaps now the election is over there is more certainty and the people can get back to doing business once again?

New Government Focus on Agriculture?

Perhaps it’s because the government is more committed to expanding the key agricultural industries in PNG? For the first time Prime Minister, James Marape, has named dedicated ministers for coffee and palm oil.

“The appointments specifically spotlight agriculture in a very significant way, to see agriculture growth in the country,” said James Marape on Tuesday (The Guardian, 24 August 2022)

“Coffee production in the country is dominated by village-based small-scale farmers, who produce close to 85% of the country’s annual crop. It is a source of income for close to two million people – around one quarter of the population.”

“Coffee is the country’s second largest agricultural commodity after palm oil, accounting for 27% of all agriculture exports and 6% of the country’s GDP.”

“Marape said the coffee industry needed to be revived to bring in more export revenue.”

Are the planets aligning for Kina’s MiBank and regional agriculture?

Financial inclusion remains one of the most prominent structural issues for the PNG economy with over 70% of the population unbanked. Kina’s strategic investment with MiBank has been a key focus over the past year. Mibank onboarded 66,800 new customers during the year, resulting in 432,800 customers in total.

Progress in building digital services for the MiBank partnerships is steadily increasing productivity and ultimately accessibility to financial services and products. Our ability to onboard MiBank customers in Kina branches will materially improve accessibility across provincial areas.

A vital piece of infrastructure for Financial Inclusion and SME development is our branch expansion plans. We will look to open seven new branches in regional areas that will include a Commercial centre that will not only provide Lending products but will be a Hub for local business to utilise our expertise. Another important program is the rollout of our Point of Sale terminals to business in provincial areas. We will be adding another 1,000 terminals in 2022.

Is the market anticipating a healthy Q2 Report and a fat Dividend?

Kina is scheduled to deliver its Q2 report tomorrow (26 August 2022). Last year Kina’s statutory NPAT took a 26% hit due to one-off costs associated with the attempted acquisition of Westpac’s Pacific division, which was quashed by PNG’s competition watchdog. One analyst (S&P Global data) is forecasting underlying FY22 NPAT to increase by 15% to 111m PGK.

Earlier this year Kina said ROE had stabilised circa 16.7% and Net Interest Margin at 6.7%.

FY22 dividend yield is forecast to be a fat 13% (unfranked) based on the current share price. I expect the interim dividend to be upwards of 3cps (3.4% yield) paid early in October, similar to last year.

I am waiting in anticipation for the Q2 report tomorrow. Perhaps we’ll find out more about what has been driving the buying strength then?

Disc: Held IRL (6%) and Strawman (18%)

@DrPete123 I’ve expanded on the business and country risks for Kina. The Country risks are Moderate to High for most categories. Kina is not operating in a low risk environment and may not suit some investors.

Country Risks

Rather than repeat the PNG Country Risks in full here, this Australian Government -Export Finance Australia resource covers and rates the risks of doing business in PNG in some detail. I have summarised the risks below:

- Overall Country Risk - High

- Ease of doing Business - Low

- Risk of expropriation risk - Moderate

- Governance Indicators risk - High

- Risk of expropriation - Moderate

- Political risk - Moderate to High

Loan Default Risks

I think the biggest risk for Kina is loan defaults. According to SWS data Kina has a low allowance for bad loans (44%) and there is over 4% bad loans. .The ongoing impact of COVID19 on the economy could worsen bad loans.

Macro Environment

The PNG economy is dominated by the capital-intensive mineral and petroleum extractives sector and the labor-intensive agricultural sector. COVID19 has significantly affected PNG’s economy, which contracted by 3.3% in 2020, followed by a weak recovery to 1.3% growth in 2021. GDP growth is forecast to be 3.4% this year and 4.6% in 2022. https://www.adb.org/countries/papua-new-guinea/overview

Kina said “ Several key mining projects were put on hold and key resources such as coffee, vanilla and sugar experienced a slowdown due to COVID impacts. Despite this backdrop, growth in Kina’s targeted segments of corporate lending and FX products supported the strong underlying growth, demonstrating Kina’s expertise in the corporate market here.”

Competition

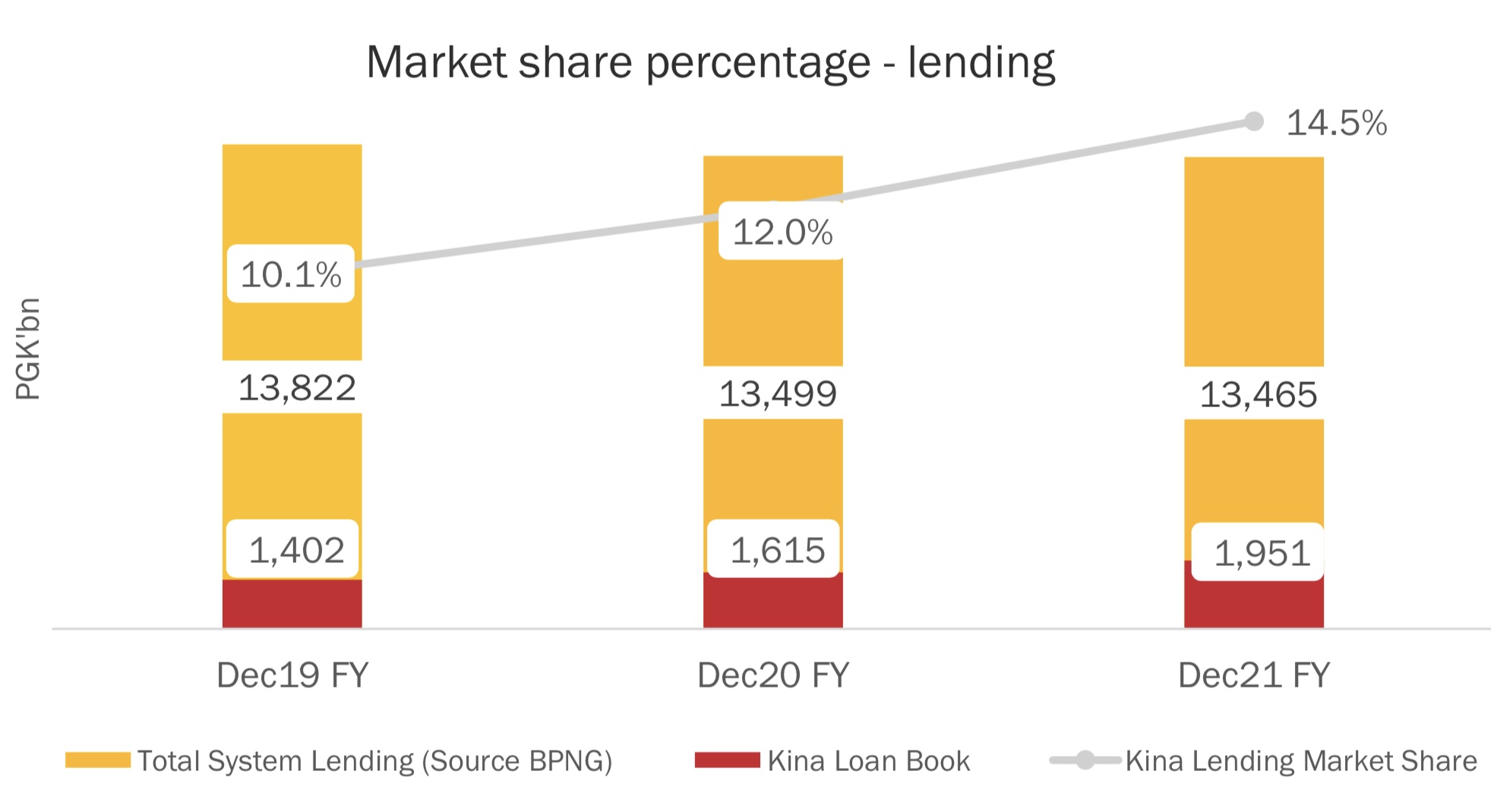

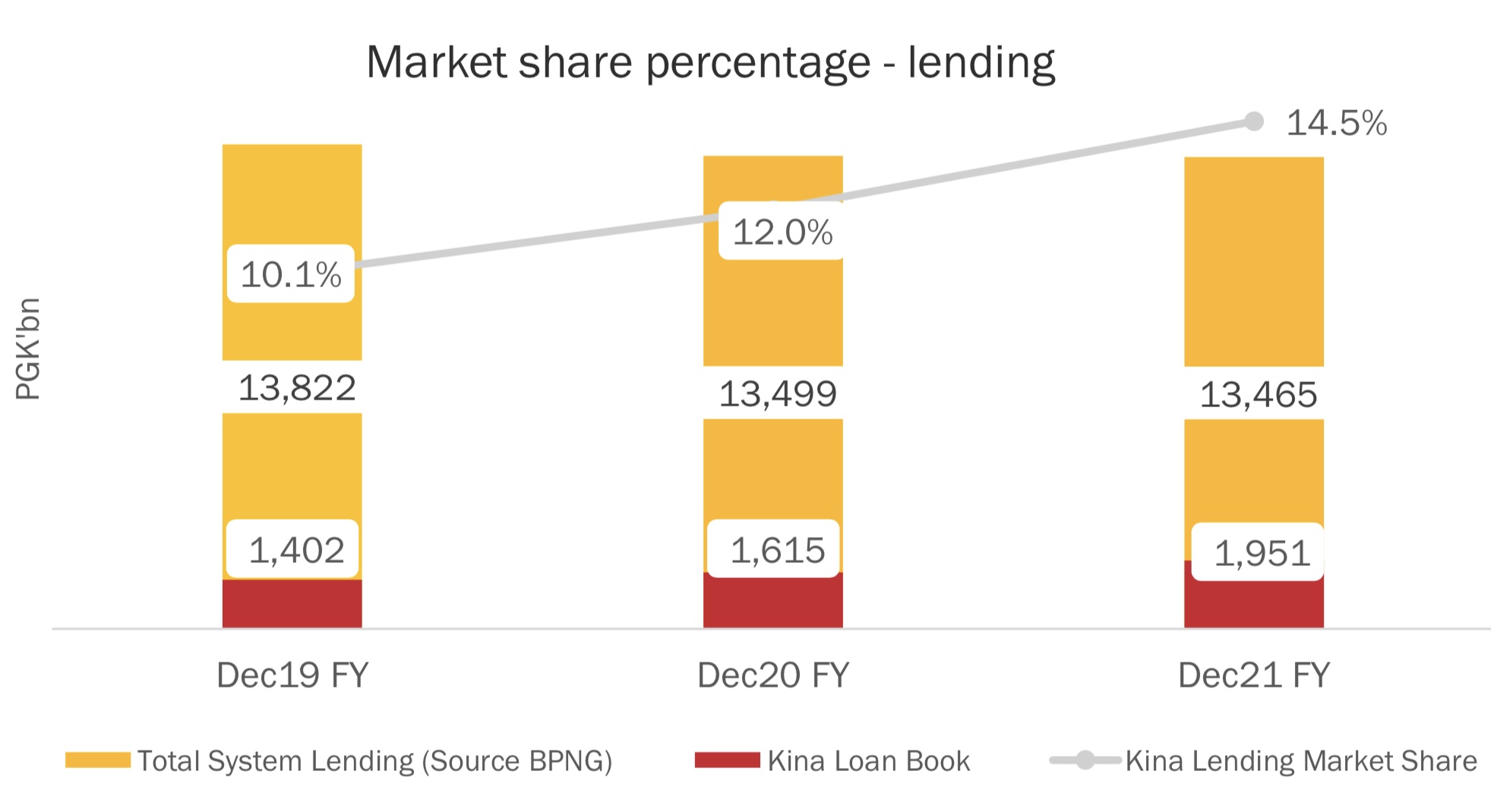

Kina has the second largest market share in lending at 14.5%. The largest bank is Bank of South Pacific at 65% and the remaining share is held by Westpac and ANZ.

Kina has increased market share in lending by 19% in FY20 and by 21% in FY21, a total increase of 45% increase over 2 years.

Disc: Held IRL and SM

It would appear I am currently the only investor in Kina Securities on Strawman, and there is a massive following of 10 Straw People! :) That’s what you call a lonely space on Strawman! The fact that Kina is currently my largest holding on SM makes my position even more contrarian.

I really like this business. I think it is one of the most overlooked, undervalued companies listed on the ASX.

Kina is holding its AGM today. The key takeaways for me are:

- Kina is doing something unique in PNG to continually win market share

- Kina is focusing on social inclusion and partnerships (first to introduce fee free banking) to increase market share

- Kina is focusing on digital technology to win SME customers, eg providing access to Xero through a partnership.

- Kina, PNGs largest fund administrator, has introduced an online banking platform allowing Kina to provide financial services and potentially lending products to the vast number of superannuants, via the major Provident Funds using our ‘Bank as a Service’ model.”

See the Chairman and CEOs addresses below for more insight:

From the CEO:

Our underlying NPAT compound growth rate has been year on year greater than 25%. We have grown our customer base from 25,000 three years ago to over 186,000, and with our strategic investment in MiBank - the nation’s largest microfinance organisation, we now reach over 625,000 Papua New Guineans. Most of this customer growth was organic as well as from the ANZ acquisition. Deposit and Lending growth across all segments was strong and pleasingly we have established a good position in the larger commercial and corporate sector. This growth pushed us to become the second largest bank in PNG by footings. FX revenue is up from PGK 20 million to over PGK 60 million. Our ROE has remained steady at about 17% with a capital ratio above 20%.

We continue to make headway in our strategy to be a genuine competitor to BSP’s 65% market share. We see a clear opportunity in PNG. Securing a higher percentage of the home lending and SME market will ensure we remain EPS accretive over the next 2 years. Ideally, I’d like to see us at around 25% market share for home loans and similarly for deposits by 2026. We’ll achieve this growth by two key projects. Firstly, through branch expansion in the growing commercial centres of Lae, Mt Hagen, Goroko, Madang and Kokopo. And by building our digital on boarding capability with electronic know your customer. The E-KYC trial program has been running to plan and we expect that to go live in September 2022.

“Our focus has been on delivering “always first” marketing leading propositions for both our consumer and SME customers. In 2021, we developed and launched our SME banking package incorporating enhancements to our corporate online banking platform. Utilising our partnering capabilities, we also have launched Xero offer for our SME customers.”

“Heading in 2022, digital acquisition will support our ability to build market share. Last week we launched “Single view”. As the largest fund administrator in PNG, we have access to data on all working Papua New Guinean’s and employers. Kina customers are now able to view their super balance on our retail online banking platforms. This creates an exciting opportunity for Kina to provide financial services and potentially lending products to the vast number of superannuants, via the major Provident Funds using our ‘Bank as a Service’ model.”

From the Chairman:

Our social agenda has delivered tangible differences. We aspire to be one of the most sustainable companies in PNG. For example, we were the first Bank to introduce fee free banking in PNG. Through our partnership with MiBank, we have included more than 196,000 people into the financial system. The impact of financial inclusion can’t be underestimated. In PNG we have more than 70% of the population who don’t have access to the security that the banking system provides or through micro credit opportunities that the banking systems allows. Strategically we will continue to explore more opportunities to work with MiBank over the coming year.

Disc: Held IRL and on SM

Kina Securities Limited (KSL) is a diversified financial services provider in PNG offering its customers end-to-end financial solutions including asset financing, provision of commercial and personal loans, money market operations and corporate advice, fund administration, investment management services and share brokerage. Kina group has two operating divisions, Kina Bank and Kina Wealth Management (Commsec, 2022).

I think Kina is a quality business yielding a whopping 12% dividend and it seems to be incredibly cheap for those who are willing to take on some risk.

What’s happened to the share price?

(Commsec, 11/5/22)

(Commsec, 11/5/22)

The KSL share price reached $1.53 in Dec 2019 and as with many companies plummeted with the onset of COVID in March 2020 to a low of 64c. Since then the KSL share price has had a bumpy ride reaching $1.15 in Feb 2020 and currently trading at 86.5cps (11/5/22).

Kina’s agreement to takeover Westpac’s Pacific Business was blocked by regulator

On the 7 December 2020 Kina announced that it had entered into a sale and purchase agreement to acquire 89.91% of the banking operations in Papua New Guinea and 100% of Fiji (together, the “Pacific Businesses”) of Westpac.

On 14 September 2021 (despite Kina putting up a case in response the draft ICCC determination) the PNG ICCC opposed Kina’s Acquisition of Westpac PNG due to likely reduced competition in the PNG markets.

Subsequently on 22 September 2021 Kina and Westpac mutually agreed to terminate the agreement.

Of the $42 million advance payment Kina Securities put up front to purchase Westpac, only $32 million was returned. Westpac kept $10 million, as a “cost reimbursement”.

Westpac said it will try to find another buyer later this year, and will meanwhile cease investment in the Pacific network (AFR 3 May 2022)

Impact on FY21 Results

Taking into account the costs incurred in the transaction and the expected revenue from the Acquisition not occurring, Kina’s full year 2021 results were impacted, but still OK.

FY21 Results

https://www2.asx.com.au/markets/company/ksl

Despite the impacts of COVID and the failed acquisition in FY21, underlining net profit after tax increased by 27% and Kina has been averaging a return on equity (ROE) of above 16% (FY21 Report).

Kina’s Managing Director and Chief Executive Officer, Mr. Greg Pawson said, “Whilst we are disappointed that the Acquisition has not proceeded, this in no way changes the Company’s strategy of seeking both organic and inorganic growth in PNG and the Pacific Region, and the outlook for the Company remains positive.”

Macro Environment

The PNG economy is dominated by the capital-intensive mineral and petroleum extractives sector and the labor-intensive agricultural sector. COVID19 has significantly affected PNG’s economy, which contracted by 3.3% in 2020, followed by a weak recovery to 1.3% growth in 2021. GDP growth is forecast to be 3.4% this year and 4.6% in 2022. https://www.adb.org/countries/papua-new-guinea/overview

https://www.adb.org/countries/papua-new-guinea/economy

Kina said “ Several key mining projects were put on hold and key resources such as coffee, vanilla and sugar experienced a slowdown due to COVID impacts. Despite this backdrop, growth in Kina’s targeted segments of corporate lending and FX products supported the strong underlying growth, demonstrating Kina’s expertise in the corporate market here.”

Competition

Kina has the second largest market share in lending at 14.5%. The largest bank is Bank of South Pacific at 65% and the remaining share is held by Westpac and ANZ.

Kina has increased market share in lending by 19% in FY20 and by 21% in FY21, a total increase of 45% increase over 2 years.

Fundamentals

There is not much you can fault about Kina’s fundamentals as far as a bank goes:

Net Interest Margin (NIM)

The NIM margin is much more attractive for banks in PNG than here in Oz. Kina’s 2021 NIM was 6.7%. This compares very favourably to Australian banks currently around the 2% mark. This is possibly due to less competition for lending in PNG.

Earnings and Return on Equity

Kina has a good track record for increasing earnings over the past 6 years, although COVID19 has been brutal to the people in PNG. Kina’s performance has also been impacted by additional costs related to the failed Westpac acquisition. Both earnings and ROE have been effected, but not as much as you might expect under the circumstances. FY21 ROE was a very respectable 17%. This compares to the average Aussie bank hovering around 10%.

(Commsec, 14/05/22).

Future ROE based on forecast earnings growth of 23% over the next few years (1 analyst S&P Global, SWS data) could be as high as 24%. With the trend in organic and inorganic growth over the past 3 years, I wouldn’t count this out as the PNG economy recovers. However, for valuation purposes I would rather work on a more conservative future ROE of 17%, similar to Kina’s historical performance.

Risks

I think the biggest risk for Kina is loan defaults. According to SWS data Kina has a low allowance for bad loans (44%) and there is over 4% bad loans. .The ongoing impact of COVID19 on the economy could worsen bad loans.

Valuation

Working on forecast earnings of 23c per share in 2024, and a PE of 7 and discounting at 10% per year:

V = 7 x 0.23 x 0.7= $1.12 per share.

Alternatively, using Brian McNivan’s StockVal formula and assuming:

APC = 17% (Conservative Future ROE)

E = 79c (Shareholder equity per share = Shareholder equity/outstanding shares = 226/286 = 79c, Commsec, 14/5/22)

DI = 20% (percentage Kina reinvests back into the business, ie. normally pays 80% of earnings as dividends)

V = (17/10 x 0.2 x 17 + 0.8 x 17)/10 x 0.79

= $1.53

What this means is that if Kina can maintain a forward ROE of 17% (this seems realistic to me) and effectively reinvest 20% of their earnings into growth, you could expect a 10% return on your investment if you paid $1.50 for Kina shares right now. This makes Kina sound incredibly cheap at 86cps.

If Kina were trading at $1.50 right now, that would put it on an historical PE ratio of 11.5 based on FY21 earnings (13cps). Doesn’t sound ridiculous to me, at least not as ridiculous as its current PE of 6.6 based on FY21 earnings.

The fact is that Kina will probably never trade on a PE that reflects its fundamentals, because it is based in PNG and it is viewed as a very high risk.

I think that’s OK, KSL is cheap to buy and will be cheap to sell (on a PE basis). However, while you hold KSL at 86cps it is likely to continue to pay a dividend of least 12% (no franking credits unfortunately) while reinvesting 20% of its earnings back into growing the business. If that’s not a cash cow, I don’t know what is!

Please don’t be afraid to critique my reasoning here on Strawman, including use of StockVal. I could be horribly wrong with my assumptions, and if that’s the case, I’d rather know now!

Disc: Accumulating IRL and currently my largest holding on Strawman.

This morning Kina Securities released its FY21 results. As expected statutory NPAT was slightly (7%) down on last year, impacted by one-off costs associated with the termination of the Westpac acquisition. Underlying profit (excluding separation costs) was up 27%.

Key performance across the business looks good and has improved on last year. Nice fat dividend too! Kina is paying a 7 cps dividend on 8 April 2022 bringing the total to 10 cps (11% yield). No franking credits, but not such a problem in a tax free super account. Underlying ROE was 16.7%, very respectable for a bank.

Key highlights:

- Underlying NPAT increased by 27% to PGK 96.2m

- The Loan book delivered a 21% growth.

- Foreign Exchange (FX) revenue grew by 19%

- Net Fees and Commissions increased by 17% to PGK 89.3m

- The performance in non-interest income from fees and commissions and foreign exchange income contributed 18% to Kina’s strong revenue growth

- Cost to income ratio (underlying) maintained at 58%

- Reduction in impairment cost to PGK 6.5m

- Kina’s Funds Administration business achieved NPAT of PGK 10.1m, which reflects a 22% improvement.

Disc: Held IRL.

ASX Announcement

Kina Securities Limited has announced that it has received notification from the Reserve Bank of Fiji (RBF) dated 29 July 2021, to conditionally approve Kina’s application to conduct business in Fiji as a commercial bank.

Kina has agreed to acquire Westpac Banking Corporation’s (Westpac) Assets in Fiji (Westpac Fiji), through Kina’s wholly owned subsidiary Kina Securities (Fiji) Pte Limited (KSF).

The Governor of the RBF noted that the acquisition of Westpac Fiji will not affect domestic competition Kina is also pleased to announce that it has received notification from the Fijian Competition & Consumer Commission (FCCC) that, in relation to the acquisition of Westpac Fiji by Kina (Transaction), the FCCC is satisfied that the Transaction will not harm or affect competition in the Fijian market and has therefore granted a conditional approval for the Transaction. The FCCC’s approval is granted under the provisions of the FCCC Act 2010.

Draft ICCC determination proposes to block Kina's aquisition of Westpac Pacific

After the close of trading yesterday Kina announced the ICCC had released its draft determination indicating it proposes to deny authorisation to Kina for the proposed acquisition of Westpac's stake in Westpac Bank PNG Limited.

This folllows the announcement back in December when Kina said they would acquire 89.9% of the Westpac Pacific Businesses – Westpac Fiji and Westpac’s stake in Westpac Bank PNG Limited for A$420 million.

Westpac and Kina are currently reviewing the draft determination and intend to make further submissions to the ICCC before its final determination is issued in September, following a public consultation period.

Both Westpac and Kina believe the transaction is in the best interests of Westpac's customers and staff and the people of Papua New Guinea and Fiji given Kina Bank’s commitment to financial inclusion and innovation, its proposal to retain all local staff and branches, and its intention to maintain two brands in PNG. However, the deal is very much up in the air until September.

It will be interesting to see what reaction the market has to the news today given the positive response the acquisition announcement received in December last year.

Disc: Held in RL

Post a valuation or endorse another member's valuation.