As mentioned previously, Lunnon Metals has started looking at potential for Gold on their Nickel tenements.

So at a market cap of 58m, you buy a company with:

1. 20m in cash reserves raised at higher prices giving an EV of 38m (ok I bought when the market cap was 52m on morning of 2oct)

2. Nickel/ Base metals project with NPV leading to FID for free

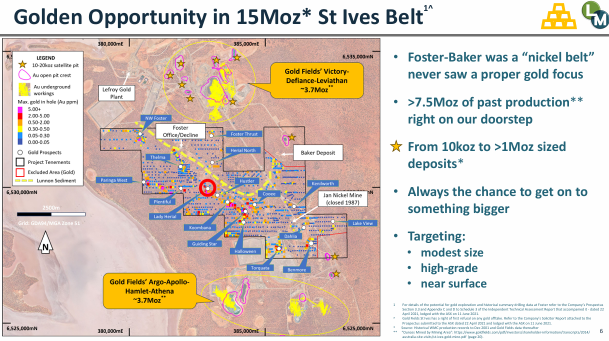

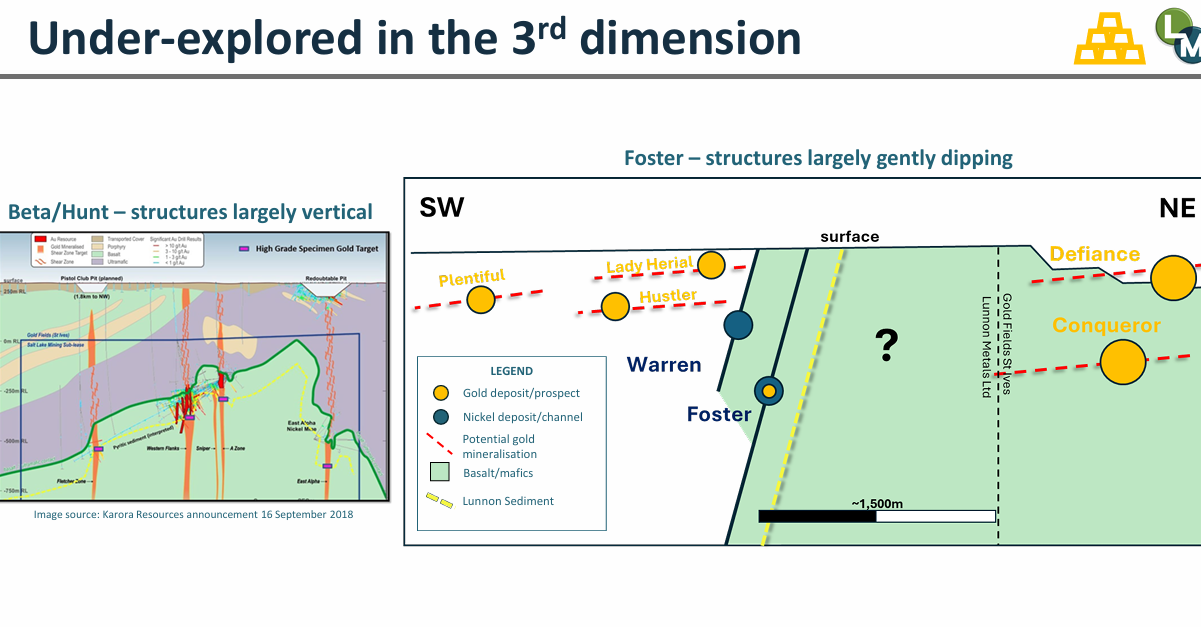

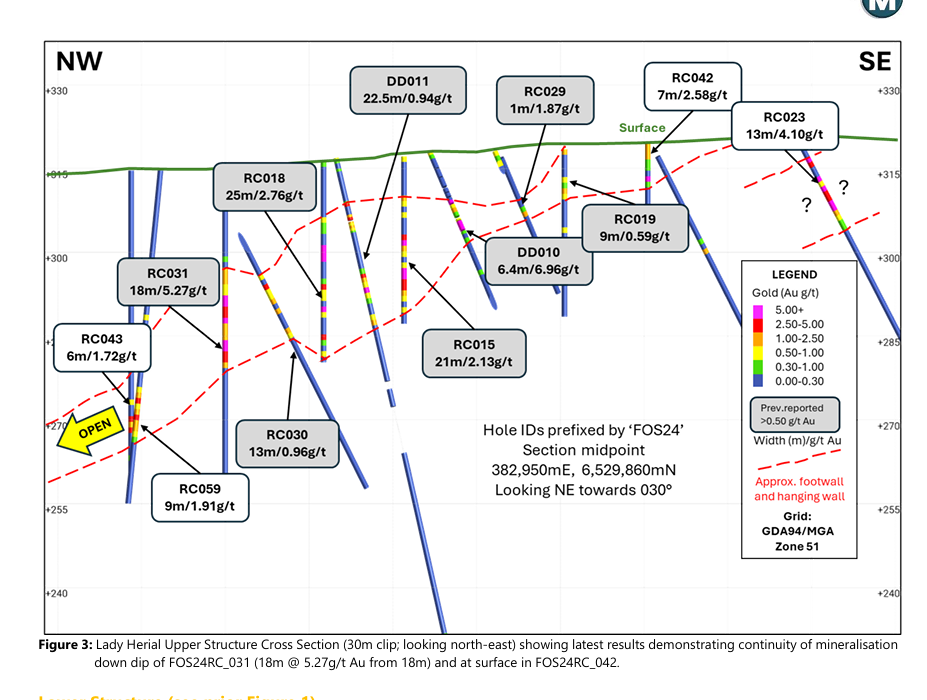

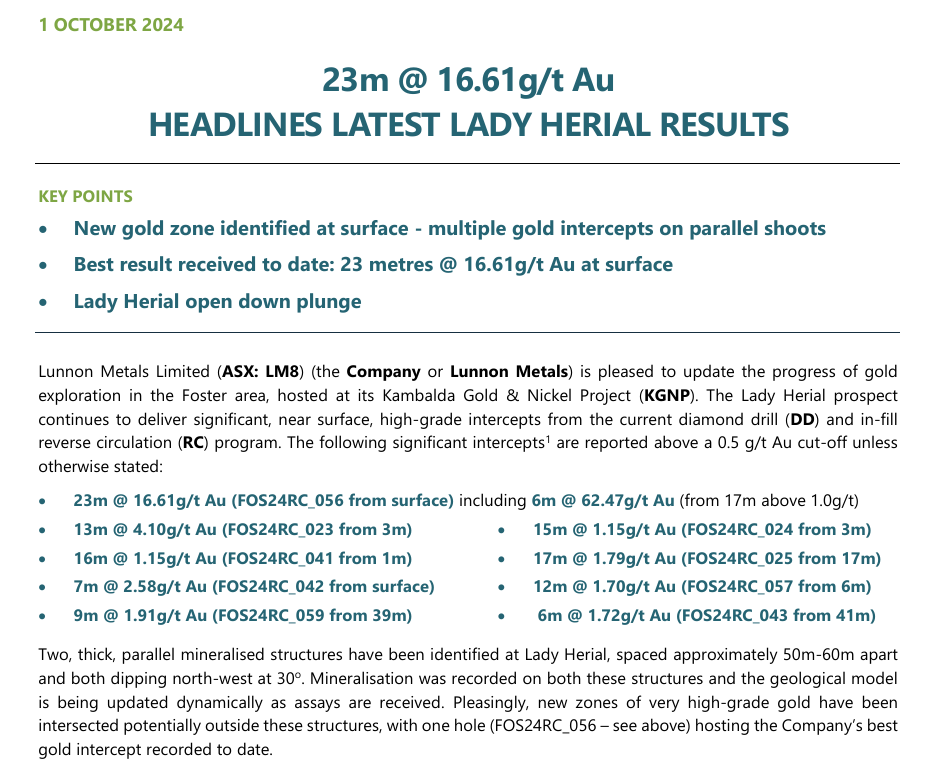

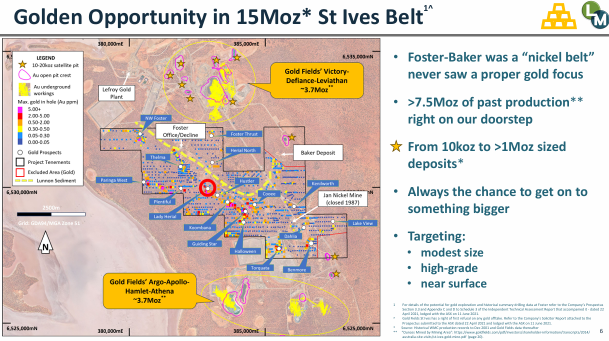

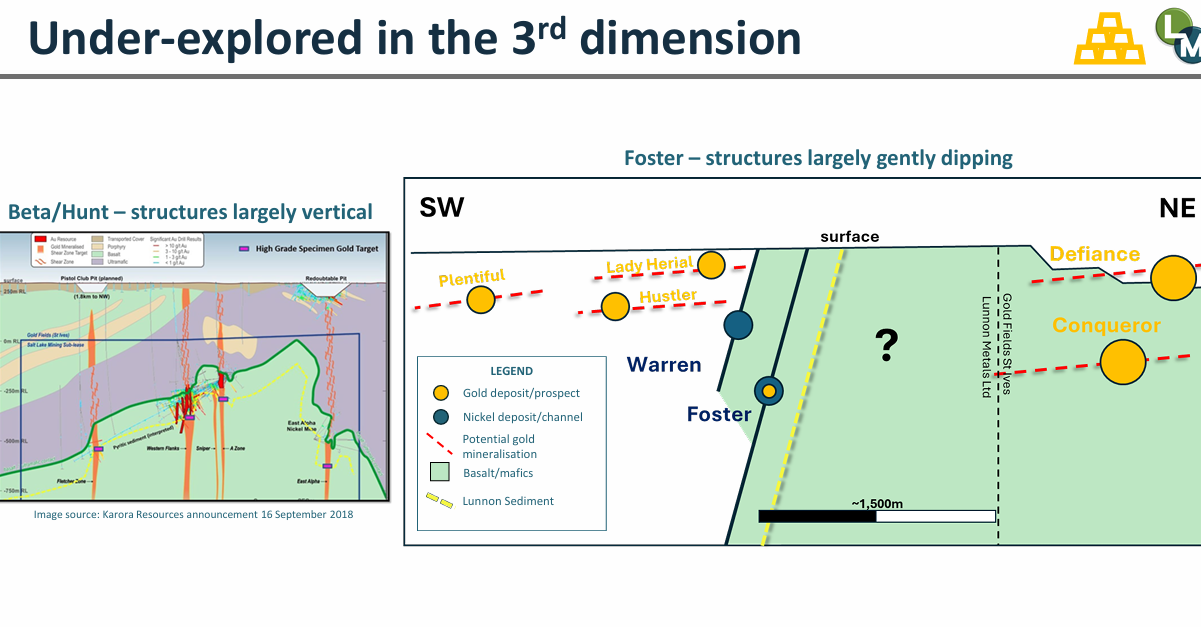

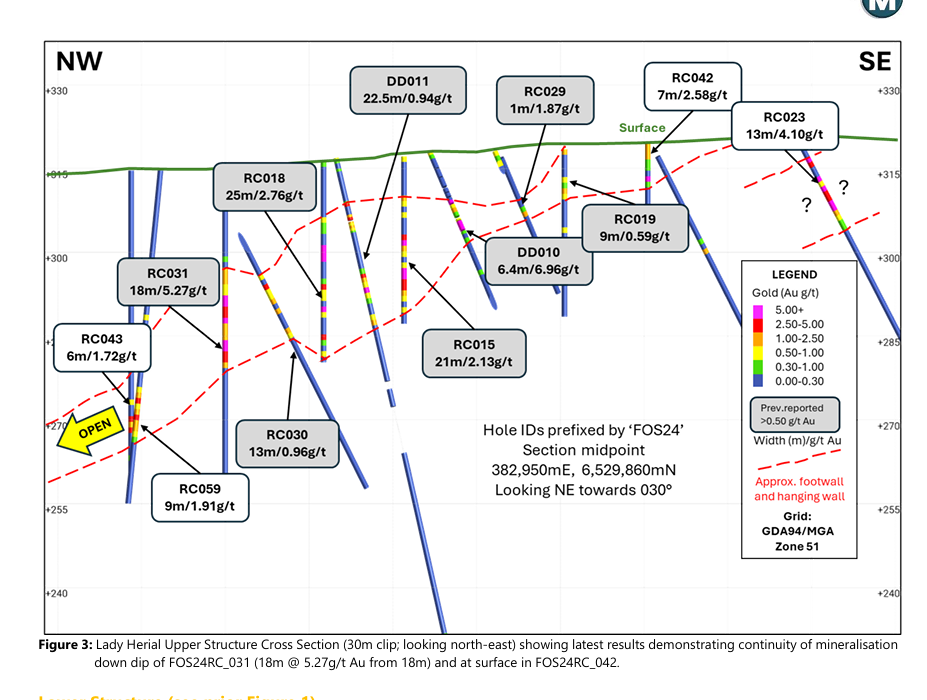

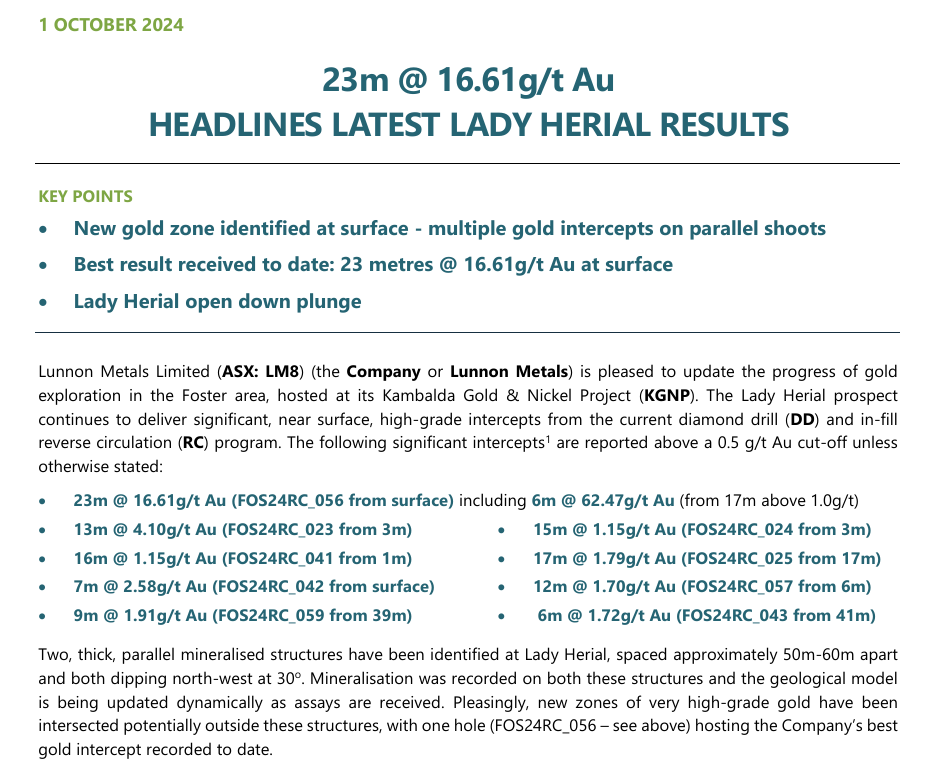

3. Interesting gold intercepts of more than 10 m at Lady Herial near surface

4. Surrounded by large multinational gold companies such as Goldfields

5. Camp scale opportunity ??? with prospects short distance from each other.

6. Director buying including the CEO on market.

7. Company restructured with CFO not replaced

Can't believe I sold at $1 for a profit and now can get this at 23c with gold potential!

Or the majority thinks this is not worth anything and I am totally incorrect for swinging back into LM8.

There are exclusion zones for gold exploration by Goldfields. And nickel is in the dumps with the BHP closure. Maybe that's why it's still not getting attention

[held]