Any deep cyclical lovers out there?

Cyclicals are a favourite for me – if you haven't read "Capital Returns" then you really should.

MCE is a deep, deep cyclical. If you've been around a while you might remember back in the last offshore boom shares got to $11. Then right as they built out their new production facility at Henderson the boom turned to bust and they were left with a factory that could produce $200m a year in revenue but revenue went from $158m in 2015 to $19.5m 3 years later. The cycle had started to turn by 2019, and then covid killed the oil price and offshore development died off again.

So now they're sitting with a 10 year old "brand new" production facility. A significant amount of capacity has left the offshore O&G space more generally, and in the space where MCE sits around 40% of production capacity has exited since 2014. There are really only two companies in this space globally with MCE being the dominant manufacturer.

At their core MCE is a pretty simple fabrication business. They get an order, they price it up, build it and ship it. When I think about what levers drive the economics of this business it is almost all about gross margin. They don't have massive sales teams, vast stores networks, or marketing budgets.

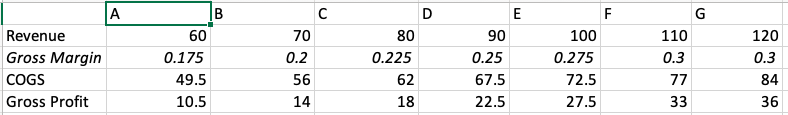

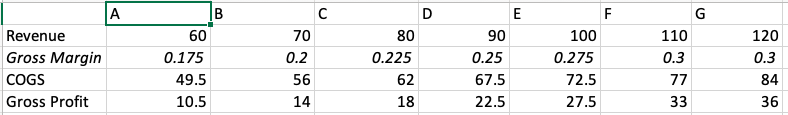

Historically they were able to hit 30% gross margins and on the call last week said they were adding marginal production at greater than 30%. There was a question asked about what that translates to at a total GPM level for every incremental $10m of revenue and management seemed happy with listeners thinking about it adding 2%-3% to overall GPM.

We entered FY24 with $55m of revenue already secured and with yesterday's contract win FY24 revenue is sitting at $68m. Importantly the pipeline is pregnant with $100m in near term contract opportunities, and as I said above, there are only two players in the space so the chances of MCE picking up a good amount of those contracts is high.

Putting those pieces together, we can kind of get a rubbery understanding of where GP will sit at various levels of revenue.

As can be seen there's a fair bit of operating leverage that will be released as orders start to flow.

As I said above, there isn't an awful lot of opex in this business. For reference, back in 2011 when they maxed out revenue at $174m their total opex was $8m. In the most recent year it was $8.69m, so let's assume they add a couple of million as revenue scales. At $70m the business is probably earning ~$3m NPBT; we are already at $68m for FY24. I think importantly though, there is no significant investment required to be made into PP&E to get revenue up to $200m (blue sky outcome) and a significant (by historic standards) investment has already been made into working capital using the proceeds of the March cap raise. Ergo, FCF is probably going to look a lot more like gross profit - cash operating costs for the next few years. They also have over $100m in tax losses, so paying tax isn't something that will concern them for a long time.

I have a rubbery idea of value in my head, but it's one where it's far enough beyond the current SP that I'm happy to just see how things roll out from here. Held IRL and on SM