Summary of key news and points/warnings.

Manuka resources announced recently they will undergo a strategic review.

Dr Nick Lindsay also recently resigned as non-exec director

Not intending to downramp but instead trying to present some key lessons.

So what went wrong?

- Reading through some old annual reports, while there is a resource statement, I could not find a reserve statement anywhere regarding Mt Boppy and Wonawinta.

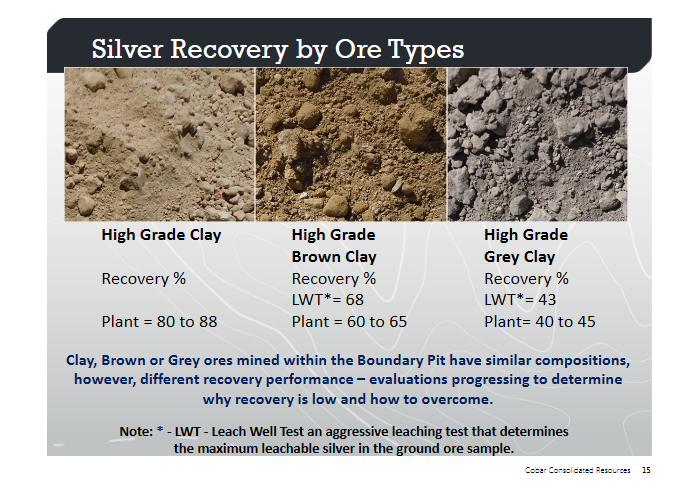

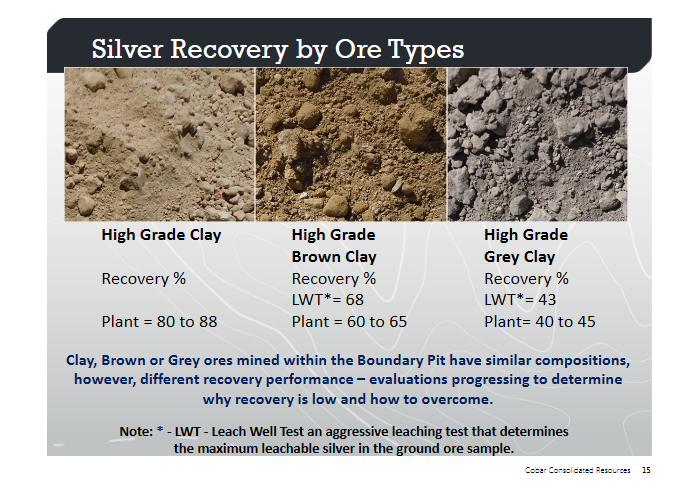

- Metal recovery has been average at Wonawinta due to the clays blocking the chemicals required for leaching out the metals

- They acquired a new project in New Zealand that involves offshore mining of titanomagnetite sands?? I haven't gone into detail on the acquisition as I want to concentrate on Wonawinta.

To really find out the problems, we have to go back to some of the old announcements and presentations made by Cobar Consolidated (ASX CCU) that was once headed by Ian Lawrence (who was from WMC). In one of the pressos I found a few things that got my attention.

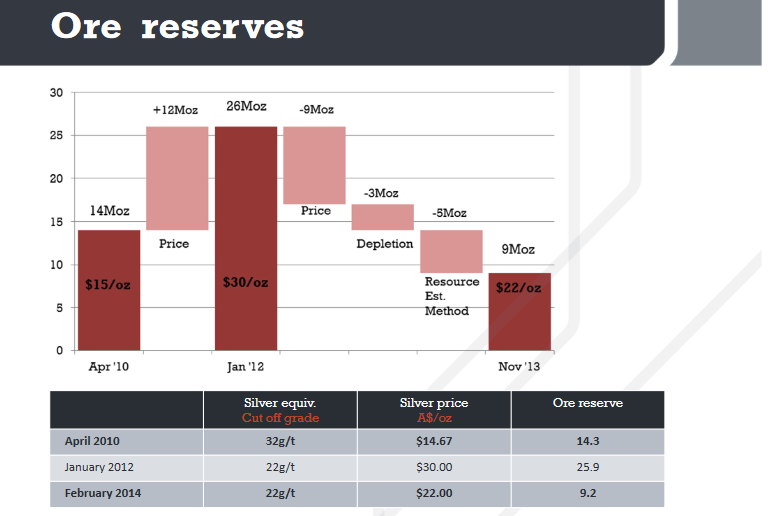

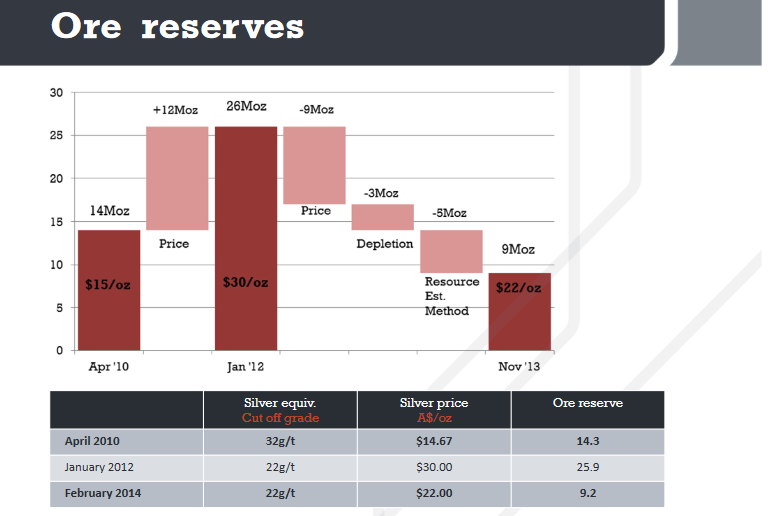

Reserves graph over time had been trending down since Cobar Consolidated started mining from 26M Oz down to 9.2M Oz(Investor presentation 5 March 2014). Looks like the reasons could be due to falling price of silver and/or flawed estimation.

With only 9M Oz reserve from 50M Oz resource, doesn't look like there is much of a return.

Manuka came with this project as they believed they had a solution to the issue of getting around the clay to extract the silver more economically. But after announcing their strategic review it seems this is no longer the case.

The resignation of Dr Lindsay is also a big loss despite only being a non-exec, as he said he had some experience on how to recover silver locked in clay in the Americas (unfortunately I can't find the link)

Despite my doubts, in all honesty, I hope one day the Wonawinta 50MOz of silver would become a success since so much work was done in discovering and scaling the deposit from Cobar Consolidated down to present owners Manuka Resources. Would be such a waste if no one can make Wonawinta a success given it is one of the largest silver deposits in Australia.