Hey @juneauquan, @dominator

https://hotcopper.com.au/threads/ann-receivers-update.8428521/

News

https://www.abc.net.au/news/2025-02-01/the-demise-of-mid-range-fashion-rivers-millers/104876424

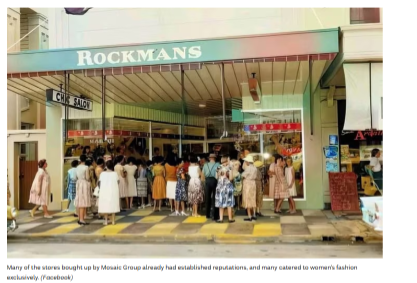

The empire is built

Mr Kindl and his partner set up 38 Noni B stores in New South Wales and Victoria by 1989, and he told the Australian Financial Review his philosophy:

"Find out what the buggers want, and give them all you can," he said.

Mr Kindl later bought out his partner for $1.2 million with a view towards expanding the Noni B brand.

"I close my eyes and I can see a five-foot-four woman, size 12 or 14 and how she looks, and that is our customer," he said.

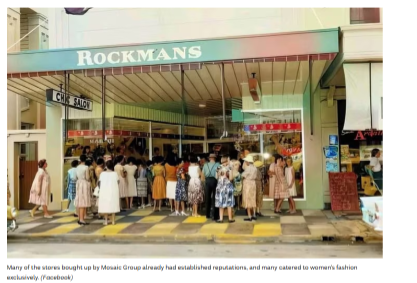

Noni B wasn't the only brand targeting the new working class of Australian women.

So, to conclude >>>>

Fashion and business expert Dr Carol Tan said the outcome was not unexpected.

"Given the current retail environment and the financial struggles of Mosaic Brands, it is understandable that no buyers were found for Millers and Noni B," she said.

Photo shows A Noni-B online store is seen on an i-pad

Mosaic's receivers have failed to find new owners for Millers and Noni B, the last two brands with any hope of a future following the fashion group's collapse

"The retail sector has been facing significant challenges over the past few years, including economic pressures, changing consumer behaviours, and the rise of online shopping.

"This outcome shows the tough conditions in the retail market and the difficulty of turning around struggling brands in such an environment.

"While there might have been hope to find a buyer, the reality of the situation made it a challenging prospect."

Mosaic Group said it expected to close all its remaining stores down by mid-April.

The total number of job losses is expected to exceed 2,000.

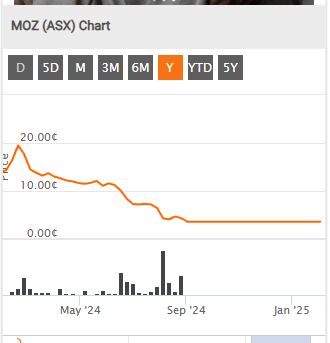

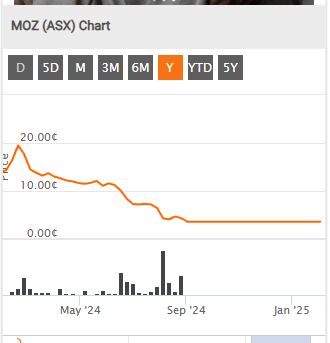

The share price for Mosaic Group is currently $0.036.