Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

MTM in a hurry

First comes the announcement of the initial US listing via sponsored ADRs, and the proposed move to a 2nd level NASDAQ listing.

Then comes four executive appointments.

More details on each person follows in the announcement. I note that the four appointment is a senior advisor specifically to manage US government relations and engagement.

Interesting developments at a the rapid pace.

So this is what the Trading Halt was about.

I’m not sure that in most situations, securing a steady supply of feedstock is all that big a deal, meaning worthy of a trading halt, but given the position of Glencore as “one of the world’s largest recyclers of end-of-like electronics,” and MTM's need of a steady supply of feedstock to properly do their commissioning, perhaps this deal is sufficiently noteworthy.

More usefully, I found the explanation of the e-waste situation in the US and the PCB recycling context helpful in getting some perspective on MTM’s potential. For me, it is one to watch.

Held IRL.

The below is extracted from a 29/12/25 investor email/ASX announcement. My read of this is that the company is progressing faster than I expected along the road to commercialization.

I was also interested to note their target metals for their initial commissioning - all metals with an established and at present lucrative market. Seems a wise choice. By altering the conditions of their process, they can focus on virtually any metal present in their feedstock, so a Ga and Ge line is next, although I suspect next is after full commissioning of the initial processing line..

I assume that a large part of the rush to get to fully-commissioned state is to be able to say they are the first US commercial operation for ripping metals out of old printed circuit boards.

They’ve already got plans for at least 2 other facilities in other states, both located conveniently close to Federal e-waste dump sites.

And as of Friday, MTM is in a trading halt, pending an announcement of a feedstock deal. Returning to trading on Tuesday 6th if not sooner.

Discl: Held IRL.

On Friday morning, MTM released the announcement that had seen it go into a trading halt on Tuesday.

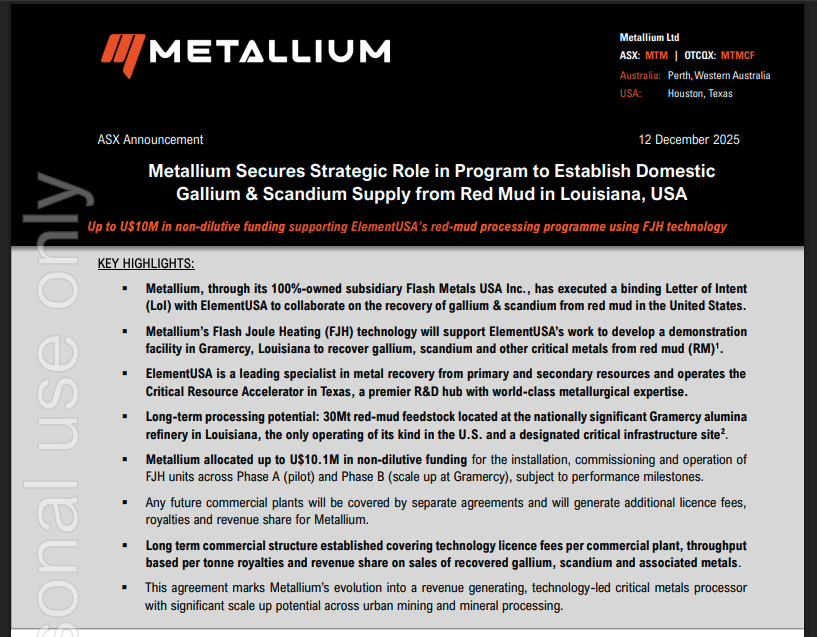

They’ve executed a Binding Letter of Intent to collaborate with ElementUSA to extract gallium and scandium from bauxite tailings in Louisiana. The Gramercy tailing dam is said to be the biggest source of red mud in the USA.

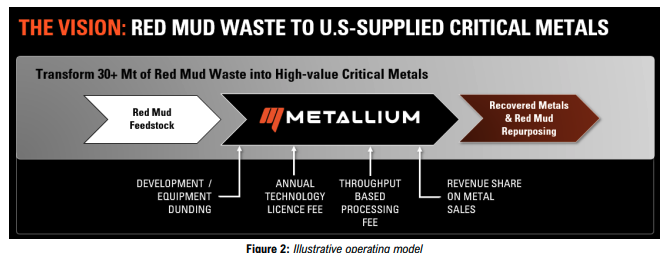

What I found particularly interesting was the explanation of how MTM is proposing to gain revenue from this facility, from the initial development funding (they get 1US0.1M, it seems upfront), and subsequently:

I found it noteworthy that, past that initial development funding, MTM have 3 different on-going revenue streams.

- An annual technology licensing fee - which presumably would be paid regardless of the activity or otherwise of the works

- A throughput-based processing fee

- A revenue share of the recovered metal sales.

The implication in the announcement is that this is going to be their revenue model going forward, not just with this project but with others in the future.

This seemed a smart way of setting up their revenue structure, with 3 different points at which they tap into the project. Perhaps this is the norm in this area, but regardless, knowing that this is how they’re approaching deriving revenue from projects is reassuring given that their primary input is IP, combined with the engineering know-how to make the IP work.

Of course, they have to get this Gramercy facility up and running before they’ll see any fee-derived income, and who knows how long that will take.

So far, the market has yawned and the SP has drifted southwards.

Discl: held IRL (1.3% Aus-SMID segment, 0.4% total PF)

Although MTM appears to be making progress on FJH technology for various metals, past record has been poor at Michael's previous CEO role at Voltaic Strategic Resources or VSR

However you have to take into account that he was also presiding over a period where Lithium was very unloved

Anyway it is something to be aware so I'm putting here as a reminder in case things get pear-shaped at MTM that this could also be a reason as I look at the share price drift lower after the recent sell off from the critical minerals hype

.

[held]

MTM signed an Supply and offtake MOU for eWaste with Glencore yesterday sending the share price up 20% at one stage.

It's only an MOU (memorandum of understanding) but "could" be binding by December 2025. Must emphasise the word "could" but without sounding too positive Metallium seems confident otherwise why would they put a date for this.

It's also sailed past my free carry trade order of 1.15 which fortunately did not happen due to the suspension on Monday which would have flushed out the order.

But there are so many of these stories not living up to the hype, notable ones include NMT (Neometals) and ASM (Aus Strategic Materials) so I need to be cautious and reassess my sell order.

[held]

Well the best 10 baggers are the ones that go up for more than a year if you see the chart.

After entering the all ords index yesterday I believe it's time to free carry soon and get my lunch money back - even if there is the possibility I am going to regret it later on.

[held]

MTM who had a meeting with Strawman recently announced the appointment of Travis Langster who was a former Deputy assistant secretary of defense to Metallium subsidiary Flash Metals US inc to the advisory board.

Lots of info when you search for Langster and he works in lots of places. Example below.

https://elaranova.com/team_member/travis-langster/

Seems like a solid appointment but doesn't justify the price rise

As aside Soul Pattinson also has a holding

Must be all good then?

(Held)

MTM announced a phase I deal with the US department of defence

While not a big deal ($100k 6 months), the news was still enough to send the share price up to 10% at one stage. If Phase I succeeds, this gives MTM an opportunity to access larger million dollar contracts known as Phase II and Phase III.

[held]

Recently MTM completed a capital raise at the price of 55c to sophs and institutions.

Funds will be used to construct the FJH module which will process around 1 tonne per day.

IMHO it's not much but MTM thinks it is enough to generate a decent return.

Maybe time to sell?

Then maybe not. Looking at the latest presentation apparently Knighthawk took an equity stake in MTM in exchange for fees.

At 28c back in March 2-25

MTM or Mount Monger Exploration will also be renamed Metallium

MTM has some similarities to Calix so at market cap of $300m need to tread with caution. Only difference is MTM have a long list of partners and offtakes which include Vedanta (a FTSE listed mining co like BHP) so there must be some vote of confidence there.

I'm not sure what the status of the exploration tenements in Gold and REE. Will need to look into those

[held]

MTM is interesting. Promising tech with huge market opportunity and strategic/geopolitical tailwinds (in terms of demand and funding), $60m in the kitty and taregting cash flows in the coming 12 months.

The meeting recording is in the usual place, and the transcript is here

..but some initial thoughts:

- It holds the exclusive global licence to use Flash Joule Heating (FJH), which allegedly enables ultra-fast, low-carbon, one-step recovery of valuable metals from complex ores and waste -- avoiding the need for smelting or acid leaching.

- is focused on recovering critical and strategic metals, including rare earths. As i understand it the US has a massive shortfall in these key commodities, and that their military supply chains are embarrassingly dependent on Chinese sources, and as Michael was saying, there;'s a lot of push from the new administration to onshore a lot of this stuff as is evidenced by the DOJ funding.

- The tech is not just an ESG narrative (although there is that), but the unit economics and monetisation options for customers make it compelling in its own right

- It all really hinges on being able to successfully scale up the tech and prove the commercial viability. If that happens, this is off to the races. And, honestly, its hard not to get a bit excited about what michael was saying. But, the ASX is a graveyard for exciting companies with promising tech, which should at the very east suggest caution.

Surprising rally after the capital raise

Voting machine in full action

Maybe it is this slide?

Or this slide?

Dr James Tour is the holder of the 20m shares under the name "InvestJTech" in the previous straw.

[held]

Looks interesting, but a bit out of my wheelhouse

They basically got a license to use Flash Joule Heating from Rice University. In exchange, the university got 17m shares in MTM

Seems they are switching from being a mining explorer to a metal refiner/recycler.

There's lots going on here so maybe write more another day.

Became a holder "by accident" when the share price dived from 7c to 6c.

The holding is mega tiny though. MTM only have 2.6m so I expect a raise as that amount of money doesn't get far enough even though they have 3-4 quarters of cash remaining.

Now back to 8.5c, so a flukey return for me...

[held]