Hi @Gprp,

In short, I've taken a starter position here because:

- This is a world-class resource ("tier 1") (significantly larger in size than Sunrise [SRL] and also higher grades). It is by all measures a global top 10 nickel resource

- It is trading at only a fraction of the market cap of comparables: NC1 at $100m MC, SRL at $290m MC, ARL at $320m, and

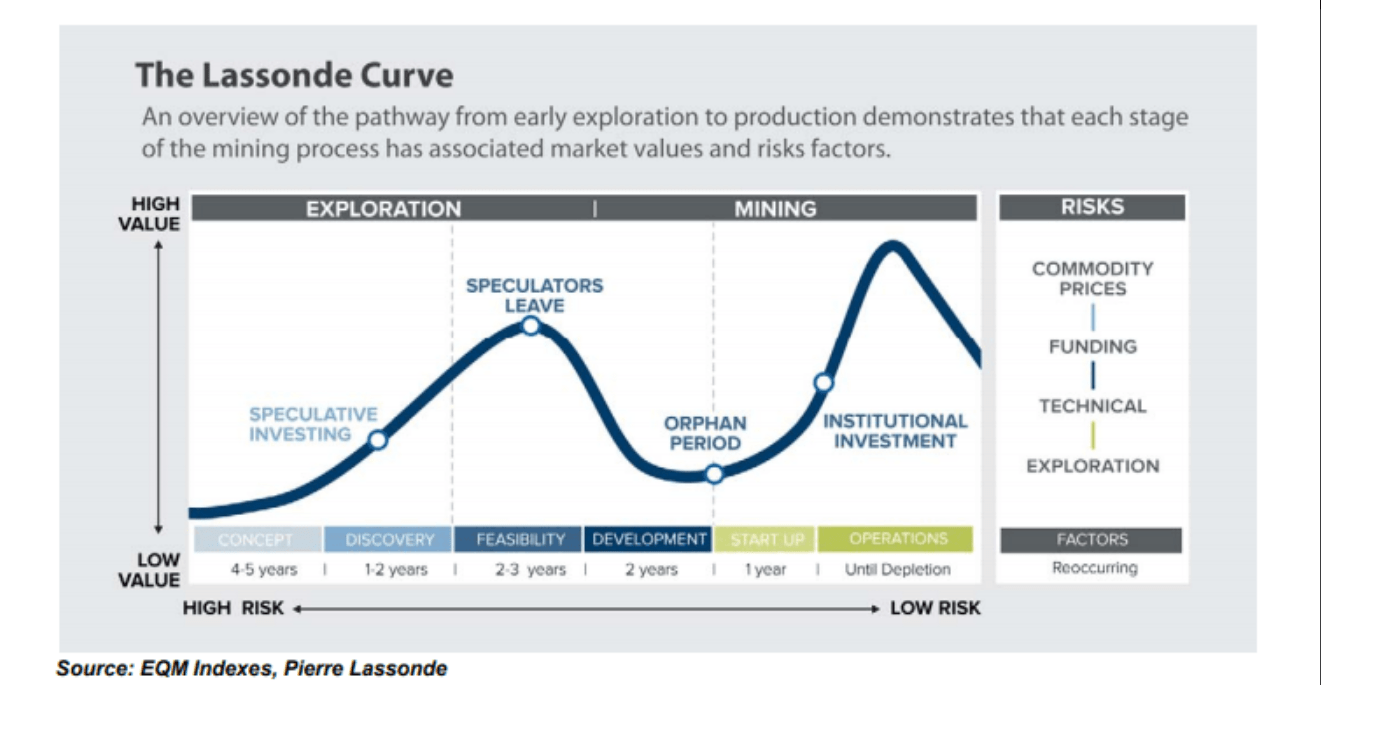

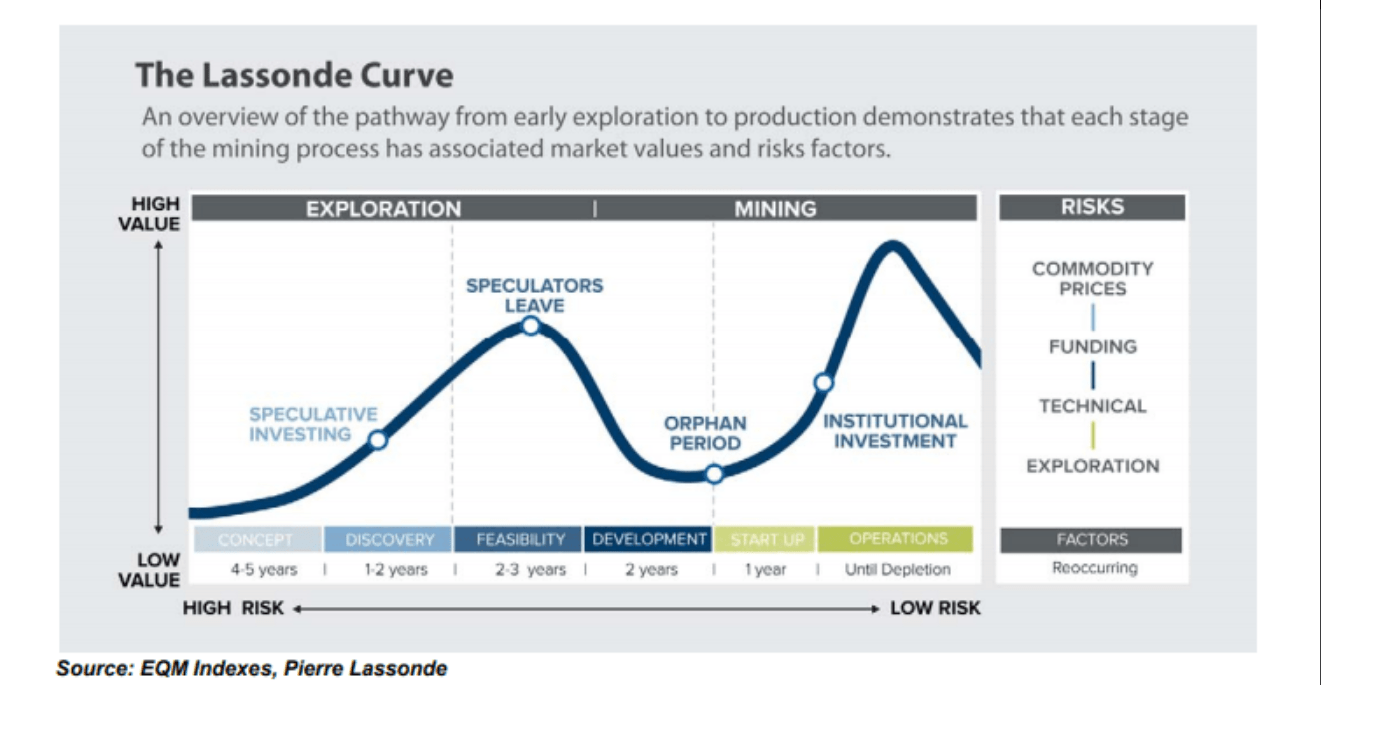

- Because this company is in the "right stage" of the mining lifecycle (the Lassonde Curve) unlike SRL/ARL/QPM, in that it is still in the early speculative phase with further drilling to come + an updated PFS as opposed to the others in the orphan period (either awaiting the DFS or awaiting funding)

ADN and SRL highlighted the risk of holding a stock just before a DFS/BFS release, particularly in the current inflationary environment. Edison revealed a downward trend of IRRs from PEA to PFS to BFS in a 2017 study (n=63). There are of course exceptions — but important to be aware of. QPM is also at risk of a disappointing DFS due to inflationary cost pressures, although they have the benefit of scaling up (compared to PFS throughput).

The nickel sector is notoriously difficult for financing projects because it is so CAPEX intensive. That is a challenge that the market will be less worried about in the short term for NC1 and more worried about in the medium term. That was also the case with SRL when it had its early speculative run to a billion-dollar market cap, before crashing back post-DFS.

Across the nickel mining industry, there are very few projects that can be brought onstream within the next 5 to 10 years. Many of them face significant permitting timeframes and study phases before you could even consider having them financed.

Conversely, China is building new capacity in Indonesia, but that capacity comes with some serious problems, such as deforestation and their plans to dump their waste directly into the ocean. Australian players are certainly well-positioned with respect to alternatives but financing remains problematic at this stage (because joint venture arrangements will be required and the EV players have been cautious of vertically integrating, at this stage).

So yes, SRL/ARL/QPM are all further advanced than NC1, but these companies have currently stalled (at the financing stage) and I expect NC1 to rise to a similar (or higher) MC (circa $300m) across the next 12-18 months as NC1 also catches up to the DFS/financing stage. At that point, I'll be keen to take profits while the market awaits financing (always a key risk).

Cheers,

Tom