23-Aug-2022: NGE is a LIC - a Listed Investment Company - and I would call them either Deep Value or Contrarian investors, which often means roughly the same thing. These investors tend to look for value in companies that are very much out-of-favour with the wider market, and being sold off strongly. One of the more prominent proponents of this strategy is Allan Gray Australia.

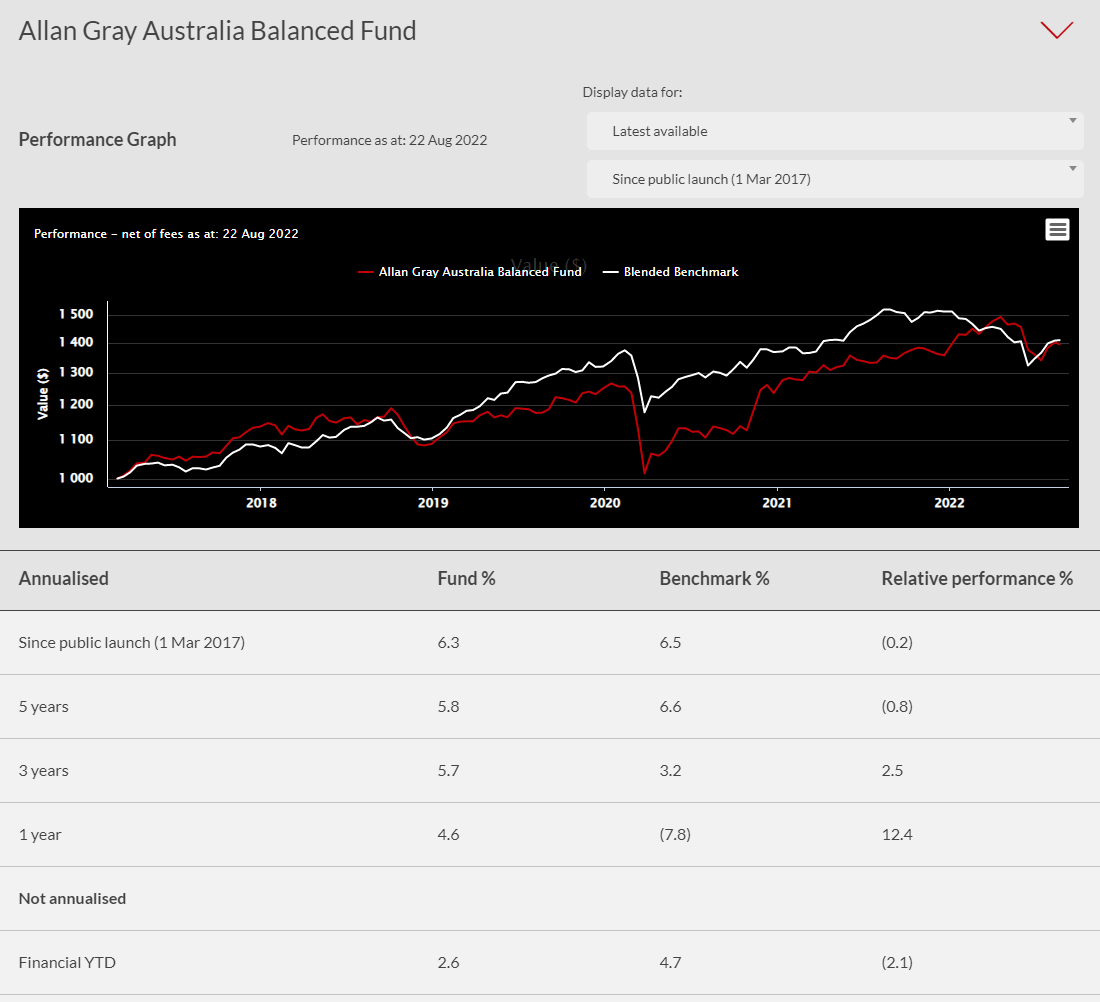

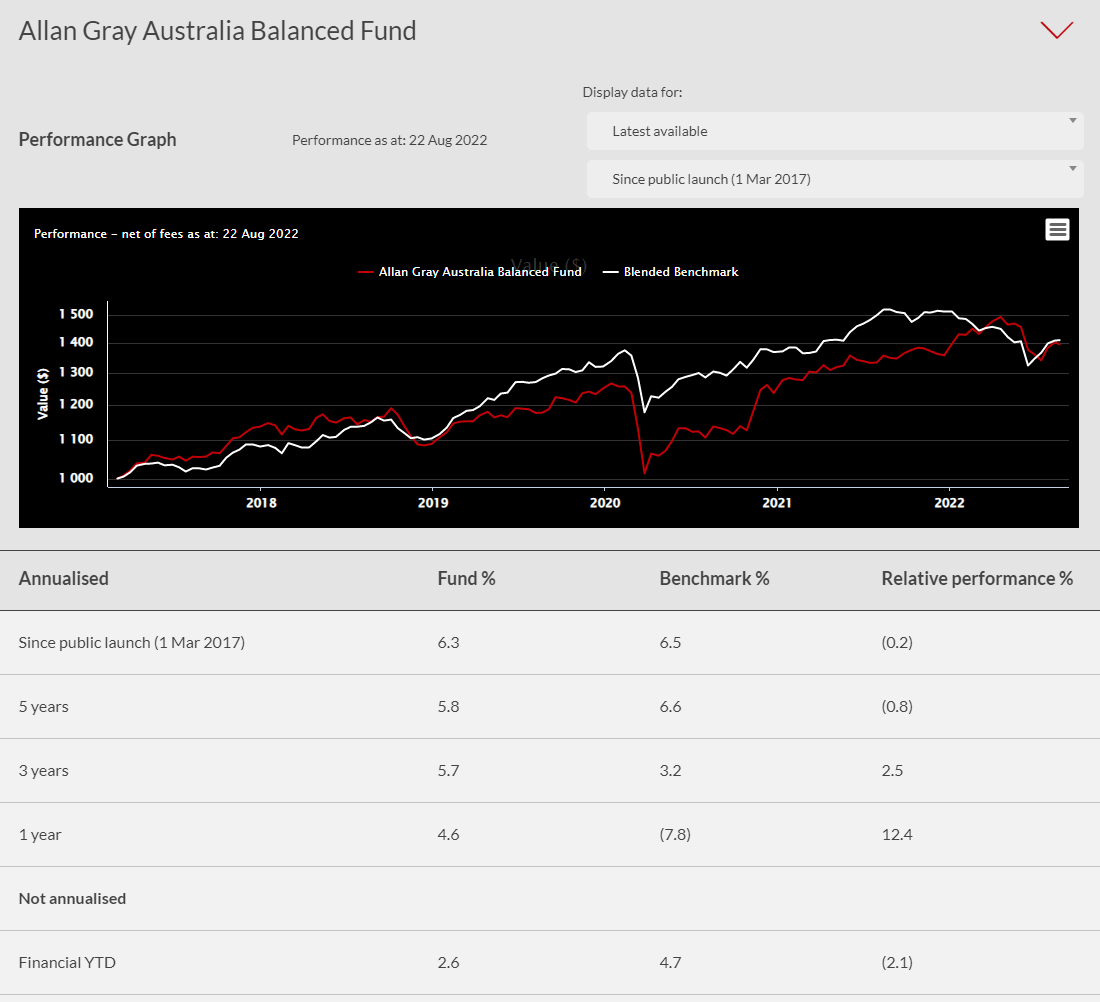

The contrarian approach CAN work, but often doesn't. Allan Gray's "Allan Gray Australia Equity Fund (Class A)" has managed to stay above the ASX300 Accumulation Index (their benchmark) for most of the past 16 years (since inception in May 2006) (see here), however their "Balanced Fund" has often underperformed their benchmark, despite shorter periods of outperformance, as shown here:

And that fund's benchmark is a blended benchmark which contains the S&P Australian Government Bond Index (24%) and the JP Morgan Global Government Bond Index (16%) as well as the ASX300 Index (36%) and the MSCI World Index (24%), as shown below, so many people (including myself) would consider it a relatively low bar to be able to jump over, and for the most part, they haven't managed to beat it for the majority of the past 5 years (since inception in March 2017).

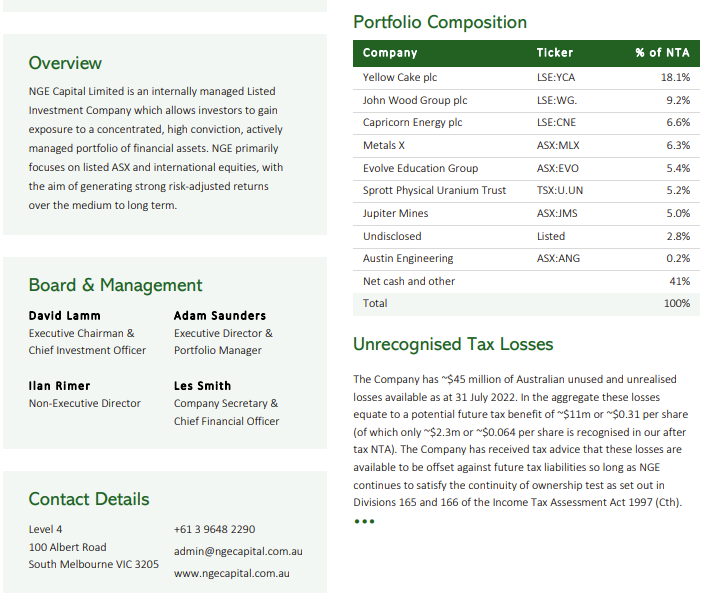

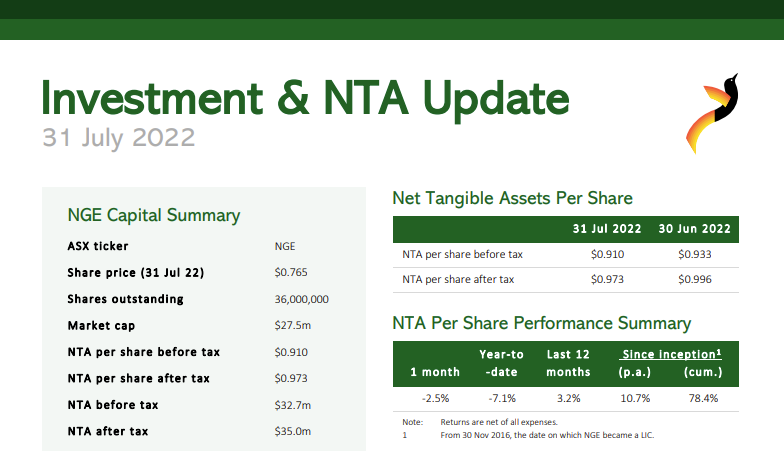

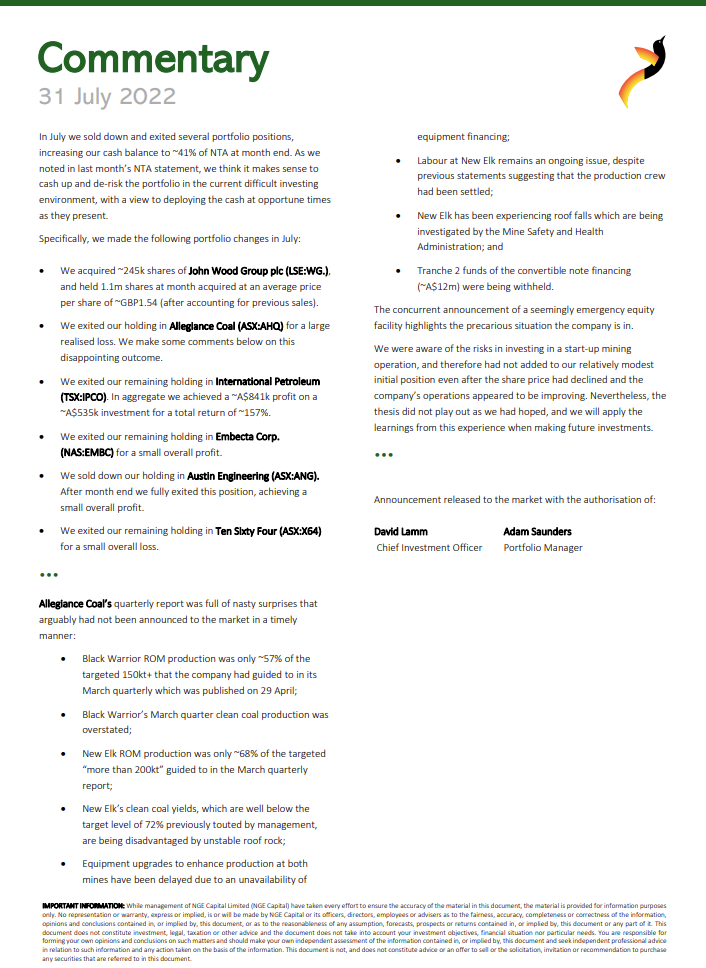

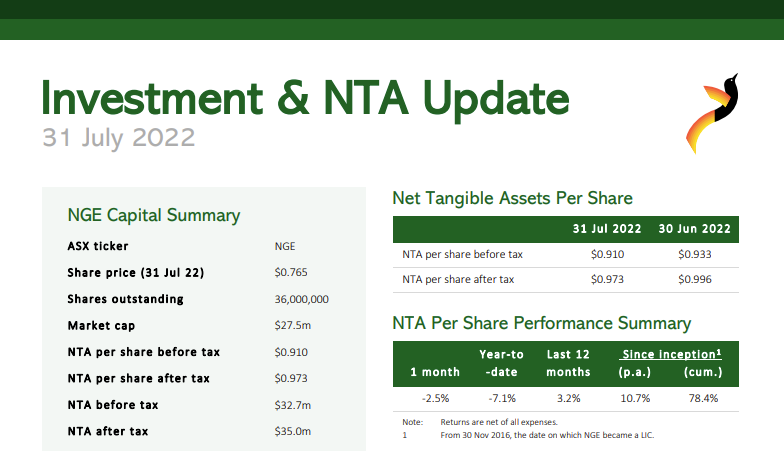

However, back to NGE. Have a gander at NGE's latest (July 2022) report: NGE-July-2022-Investment-NTA-Update.pdf

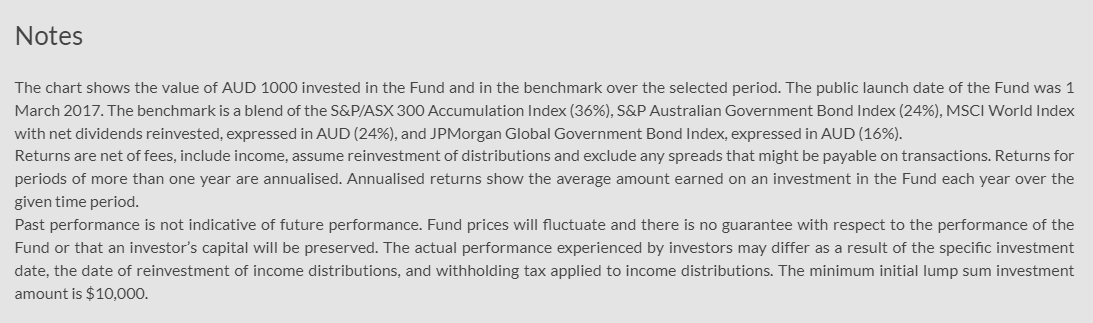

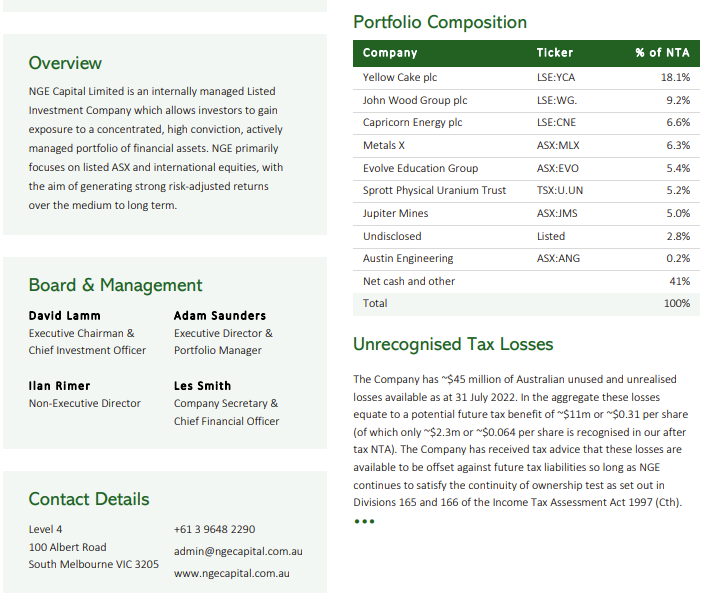

The NGE Capital website does not refer to them as Contrarian or Deep Value investors, but rather as a fund that offers investors exposure to an actively managed, concentrated portfolio of high conviction investments.

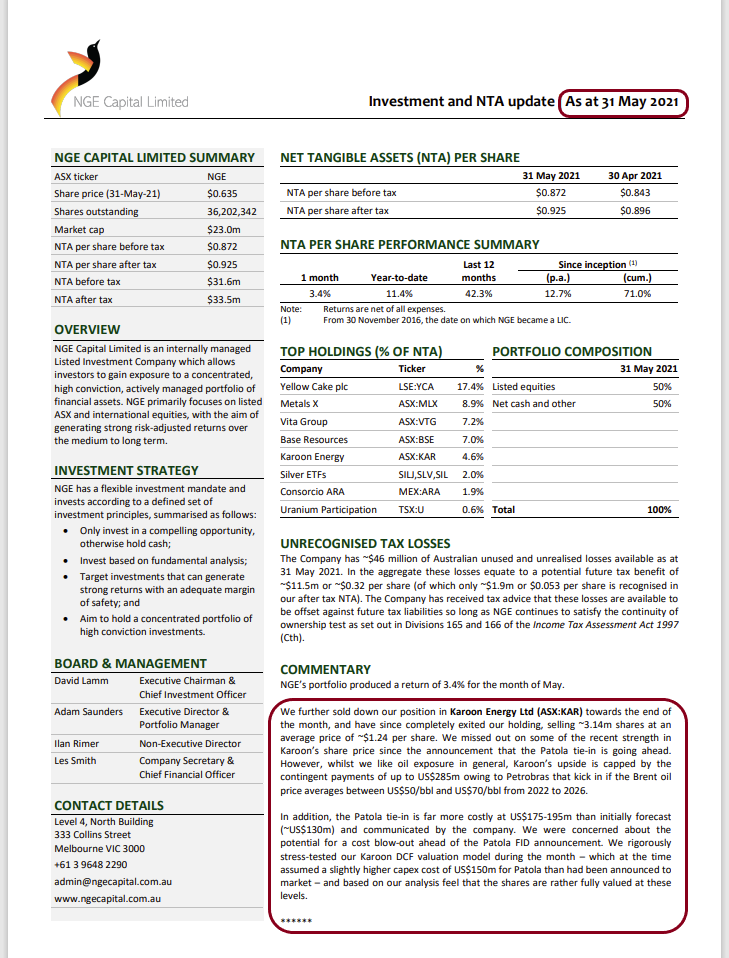

However, when you look at their portfolio, it's easy to see why they might be considered contrarian or deep value:

There is a fair bit of exposure there to Uranium (Yellow Cake plc, 18.1%, Sprott Physical Uranium Trust, 5.2%, total 23.3% of the fund's assets) as well as South African Manganese mining (Jupiter Mines, JMS, 5%), as well as a couple of Australian listed companies that have been serial underperformers - Metals X (MLX, 6.3%) and Austin Engineering (ANG, 0.2%), although they have now sold their remaining ANG shares. As the commentary that I've included below (from that July 2022 report) explains, NGE have also just sold out of Allegiance Coal (AHQ) "for a large realised loss".

Large realised losses seem to feature with NGE as they have (as explained just below their "Portfolio Composition" table above under the title, "Unrecognised Tax Losses") around $45 million of Australian unused and unrealised losses available as at 31 July 2022, worth around $11m (or 31 cents per share).

That's not so good for some longer term NGE shareholders but might seem more positive for people getting into NGE now, particularly considering only ~$2.3m or ~$0.064 per share is recognised in their after tax NTA, which was $35m or 97.3c/share. It means they won't be liable for Australian tax for some time (until those losses have been fully recognised/offset against future gains) however the flip side of that is they won't be generating any franking credits during that period as they won't be paying any tax. That's not really a problem though, because they don't pay any dividends.

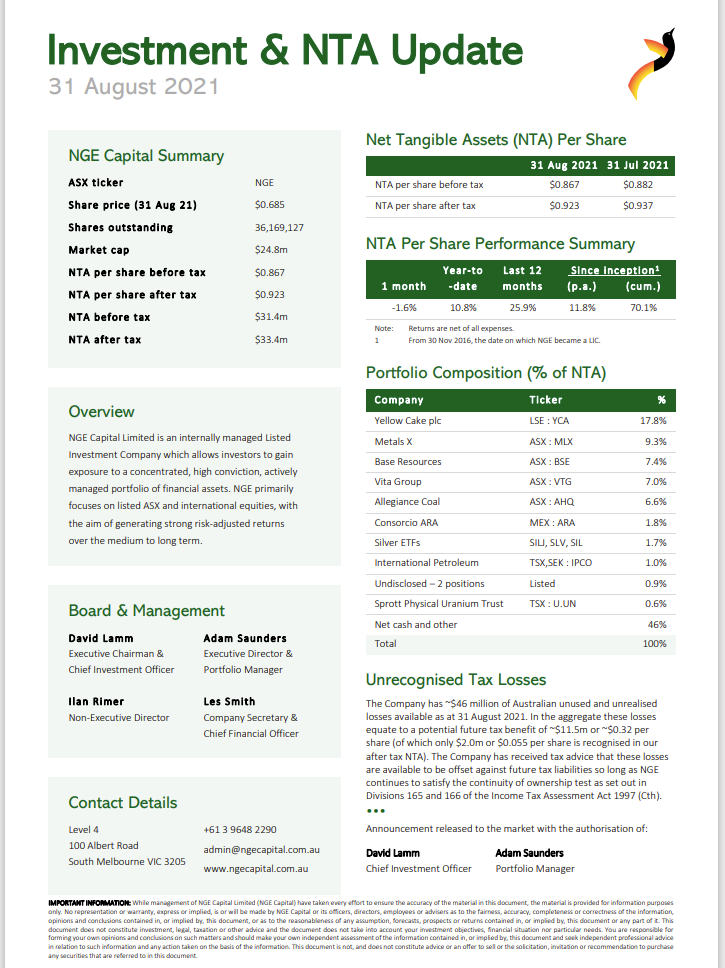

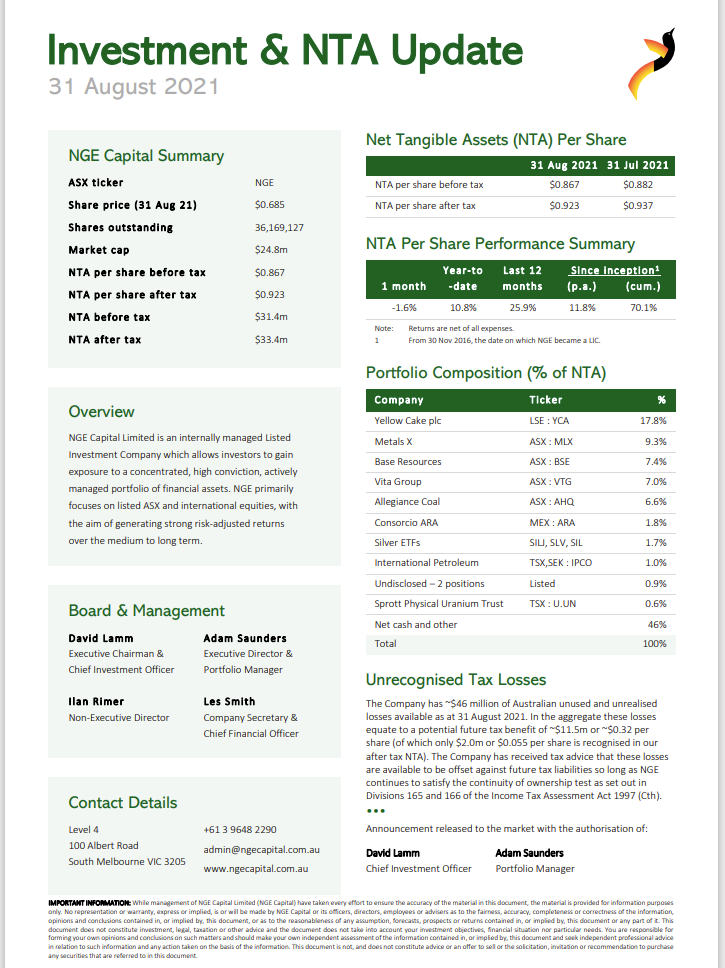

Here's a snapshot of their portfolio 12 months ago:

As you can see, they tend to hold positions for multiple years, notably their uranium positions (Yellow Cake, Sprott Physical Uranium Trust), Metals X and Allegiance Coal (which they've just sold out of for a "large realised loss").

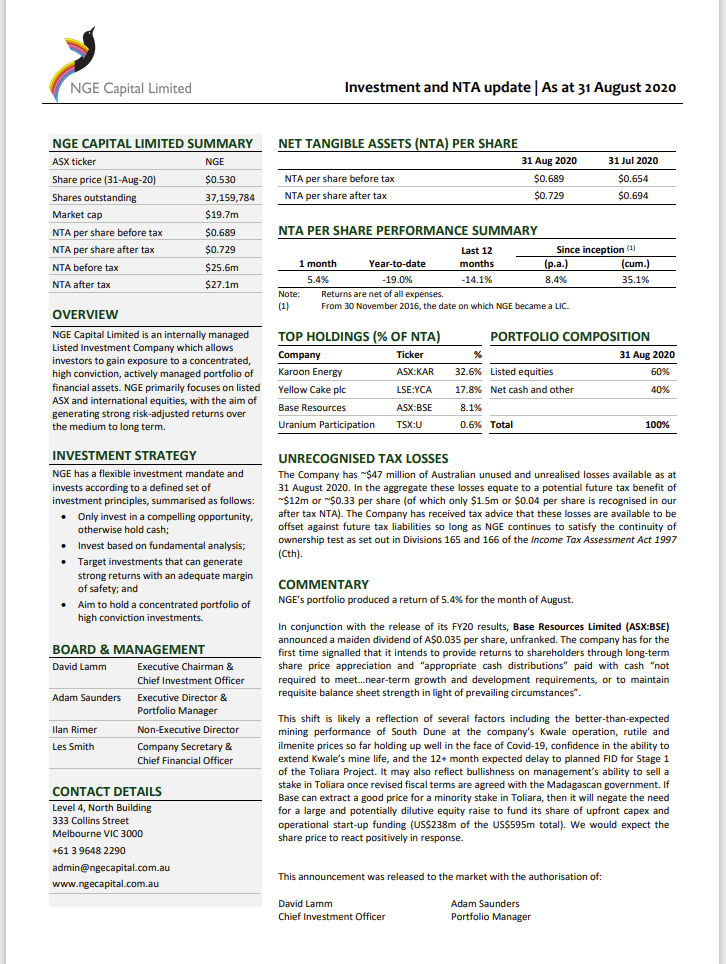

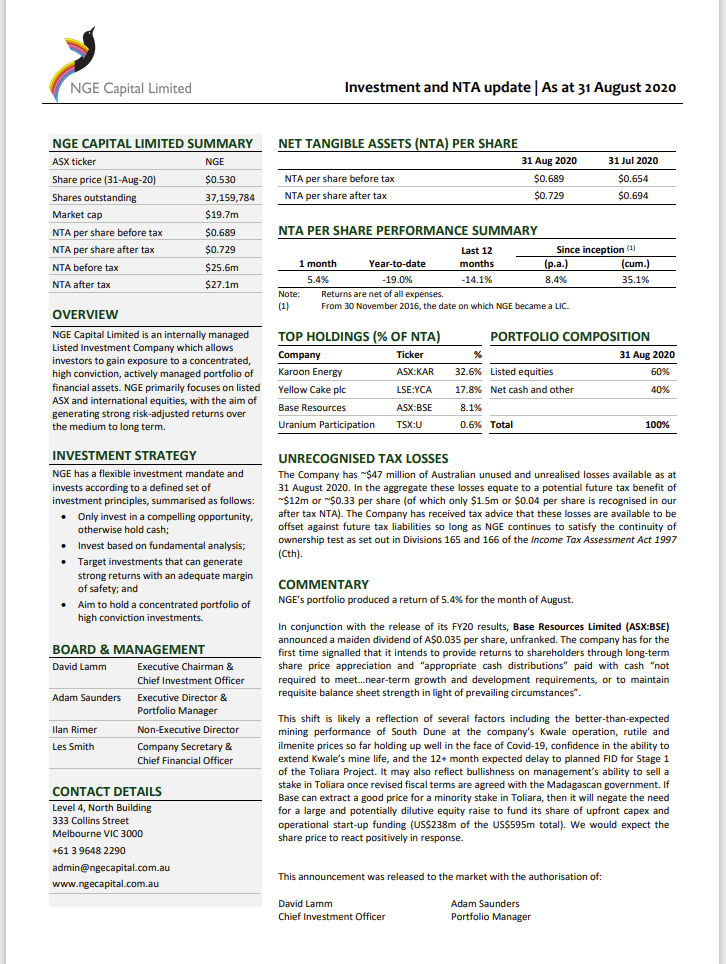

Here's what they held two years ago:

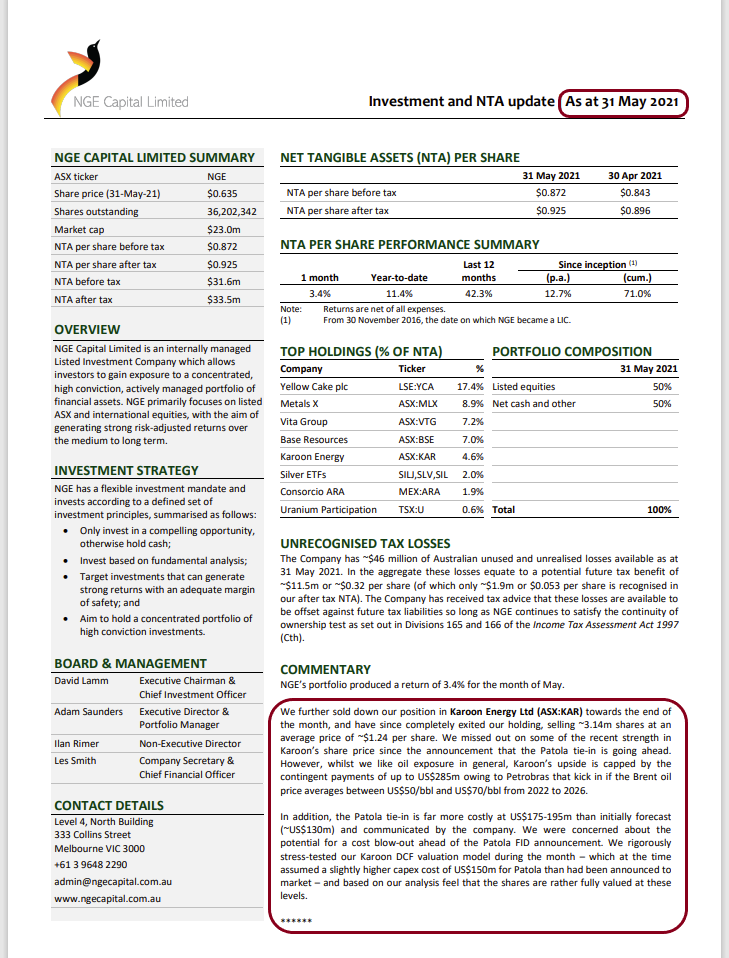

Their largest position then was Karoon Energy (KAR, 32.6%), which they sold down in early 2021 and fully exited in early June 2021:

KAR closed today at $1.95/share.

Legendary fund manager Howard Marks, who does enjoy a bit of bottom fishing himself and currently runs one of the world's most high profile "Vulture Funds", Oaktree Capital, said in his book "The Most Important Thing", in the book's final chapter, "Being too far ahead of your time is indistinguishable from being wrong. It requires patience and fortitude to hold positions long enough to be proved right."

This has often been requoted as the abbreviated version, "Being too early is indistinguishable from being wrong."

However Howard also said (on the same page of that book), "You must recognise when the odds are not in your favour and tread carefully."

Further HM quotes: https://www.linkedin.com/pulse/being-too-far-ahead-your-time-indistinguishable-from-wrong-lyons/

At the end of the day, you can take a contrarian view and indeed invest in a contrarian manner to the majority, but for those effort to be financially successful, you still need to right, and the market (the majority) need to be wrong. And that generally means you need a edge, some information that provides you with an advantage that the others do not have. It is not enough just to have strong conviction. Strong conviction is great, but it usually only results in a profitable outcome when it's based on assumptions that ultimately prove to be correct.

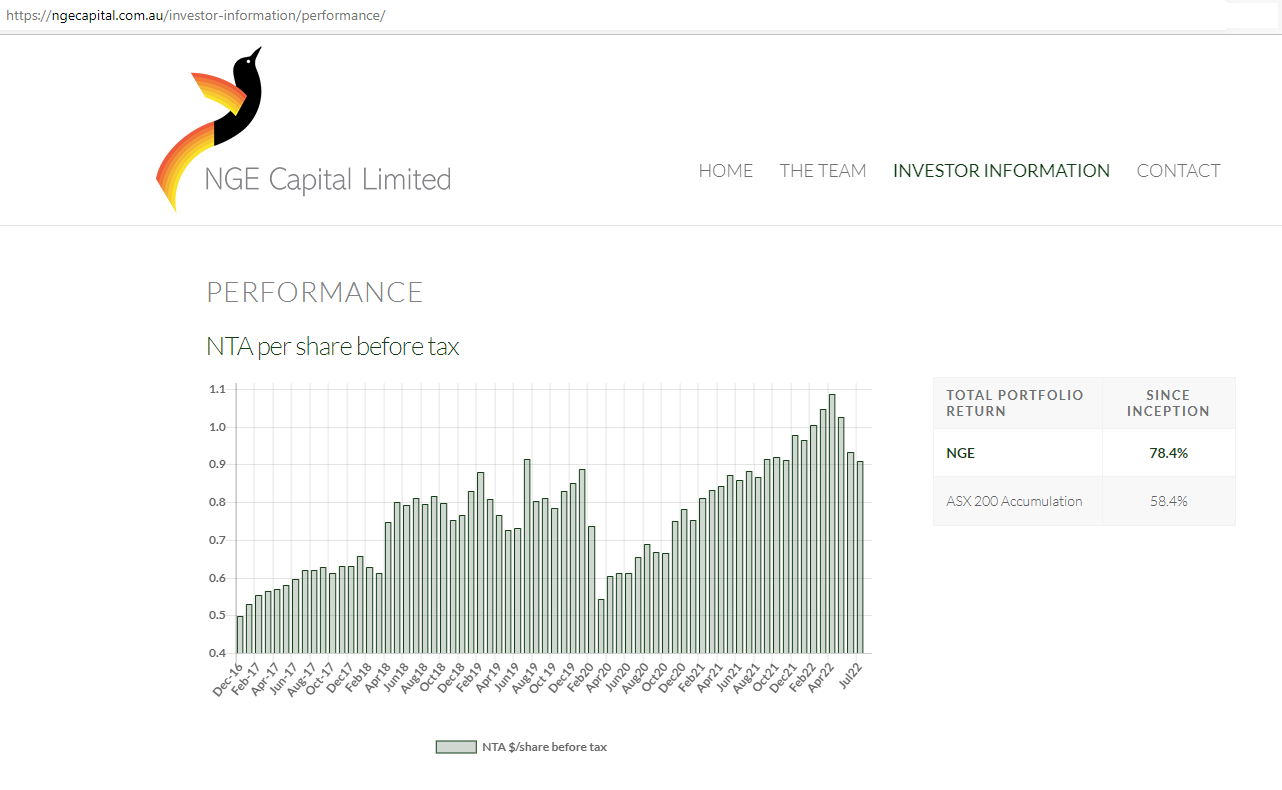

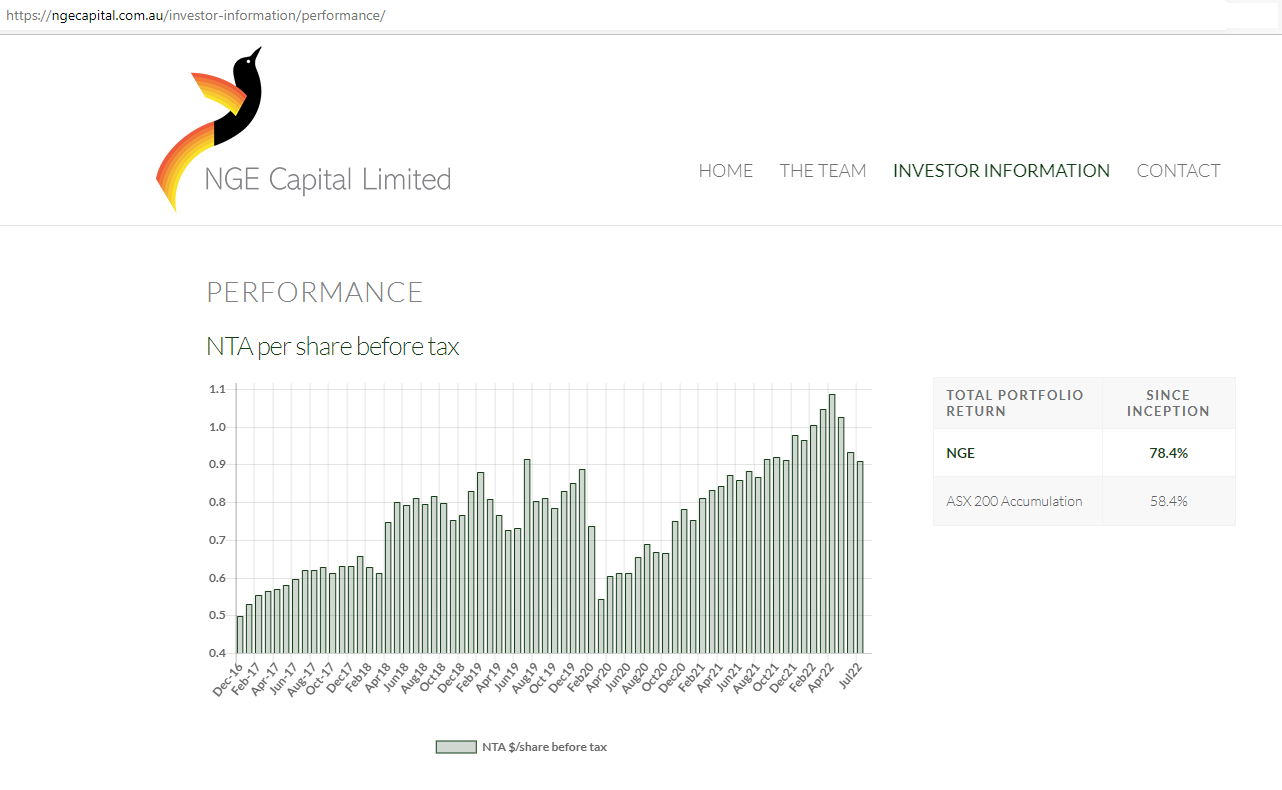

NGE say that despite periods of underperformance, they have outperformed their benchmark index, the S&P/ASX200 Accumulation index since inception:

Source: https://ngecapital.com.au/investor-information/performance/

Source: NGE-July-2022-Investment-NTA-Update.pdf

However, the concentrated nature of their portfolio and their long-term exposure to uranium and underperforming miners and mining services companies is enough for me to continue to avoid them.

Howard Marks said about diversification: "Football players wear helmets, soccer players wear shin guards, and investors diversify their portfolios — it’s the primary way to guard against the risks of the market. Diversifying your holdings helps make sure that your portfolio’s performance isn’t dependent on a single company or industry, and that you stay on track to meet your goals."

“We diversify to protect against what we don’t know,” Marks says. And since there’s an awful lot most investors don’t know, diversification is a key concept to understand. “I’ve never met anybody who has a one-stock portfolio.”

Stick to these guiding principles, Marks says, and you’ll be in a better position than many investors. But, he warns, “I would discourage you from doing the thing that you think makes you the most money.” Instead, make sure to do your due diligence as an investor.

Source: https://grow.acorns.com/howard-marks-advice-to-a-high-school-investing-club/

Also,

- Successful investors have a sound approach to the subject of risk that goes well beyond the academics’ singular definition of risk as volatility.

- Diversification is not equal to holding different things. Diversification = holding different things that can be counted on to respond differently to a given development in the environment.

- Defensive investing = avoid the losers, and the winners will take care of themselves.

- Risk control lies at the core of defensive investing.

- It takes margin for safety to render outcomes tolerable when the future doesn’t oblige.

- It’s only in the bad years the value of defense becomes evident.

- Few people know more than the consensus about what lies ahead in the macro future. Time is better spent trying to gain a knowledge advantage regarding “the knowable”: industries, companies, and securities.

- Investing on the basis of strongly held but incorrect forecasts is a source of significant potential loss.

Source: https://www.linkedin.com/pulse/being-too-far-ahead-your-time-indistinguishable-from-wrong-lyons/

Further Reading: https://www.linkedin.com/pulse/10-lessons-from-howard-marks-oaktree-capital-thomas-chua/

To be clear, Howard Marks (pictured above) has no connection to NGE Capital. I'm just comparing some of his famous quotes to the makeup of the NGE portfolio.