Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

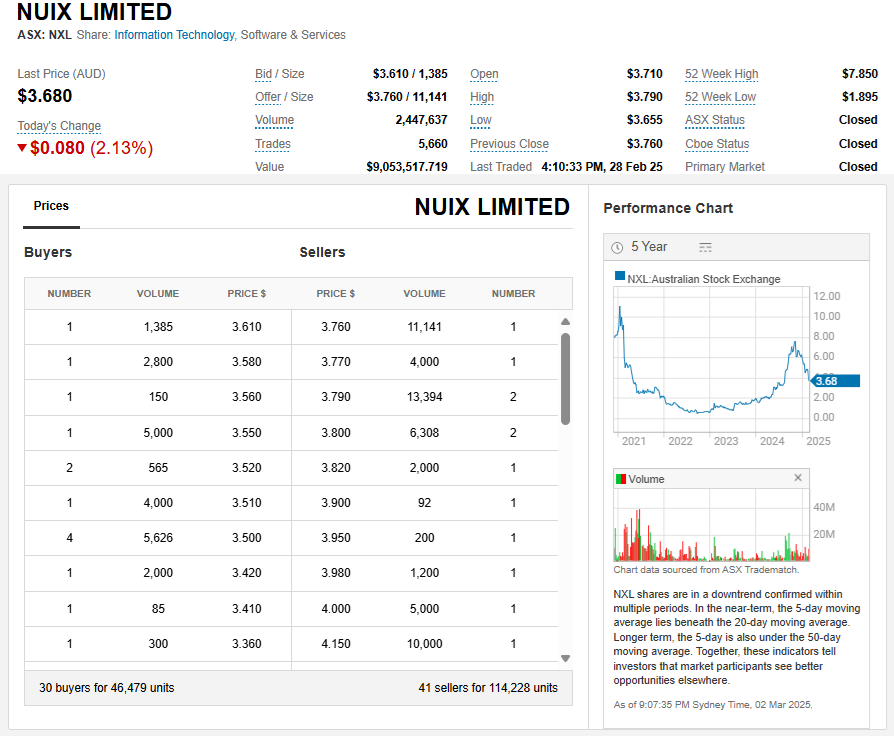

02-March-2025: Nuix (NXL) is a turnaround that DID turn around, then in the past few months they've done another U-turn and headed back south again.

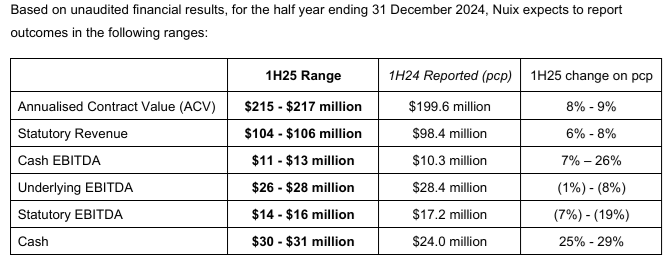

You can see on that 5 year chart (above, right) that they were powering back up at a very good clip, and then they had their AGM on 13-Nov-2024 and that was the end of that. Their SP dropped -22% on that day, then another -20% on 28th Jan (2025) when they released this: NXL-1H25-Results-Update-28-Jan-2025.PDF - Here's a snippet from that:

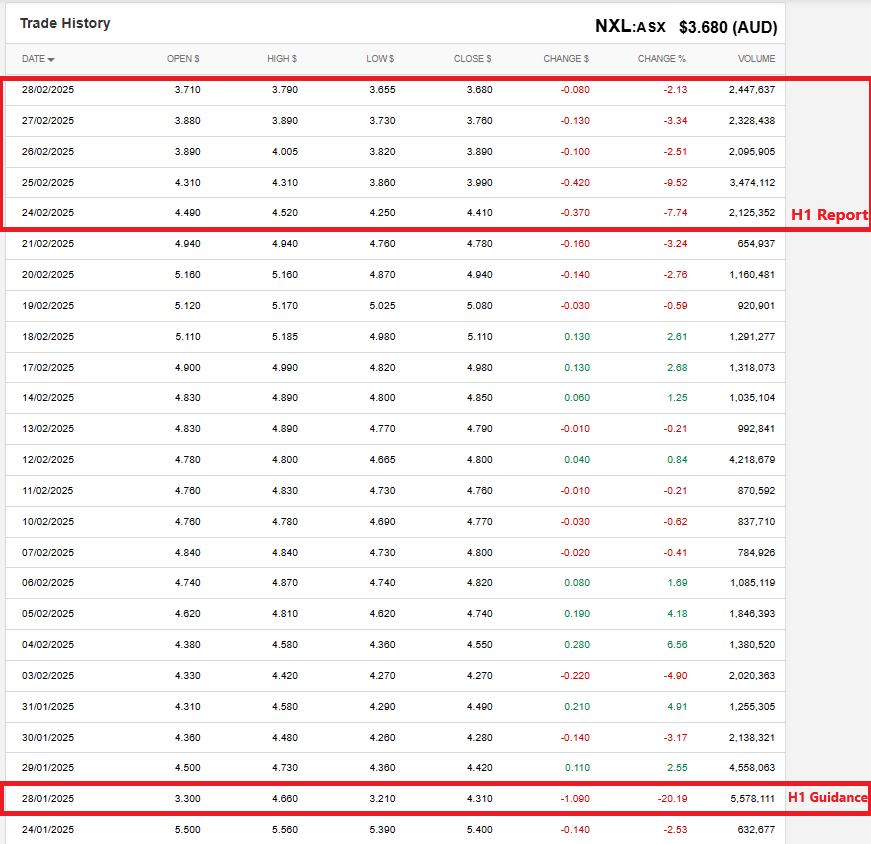

And after dropping -20% on that guidance downgrade in late January, they managed to drop again on the day they actually reported (24th Feb) and on every day since then as well:

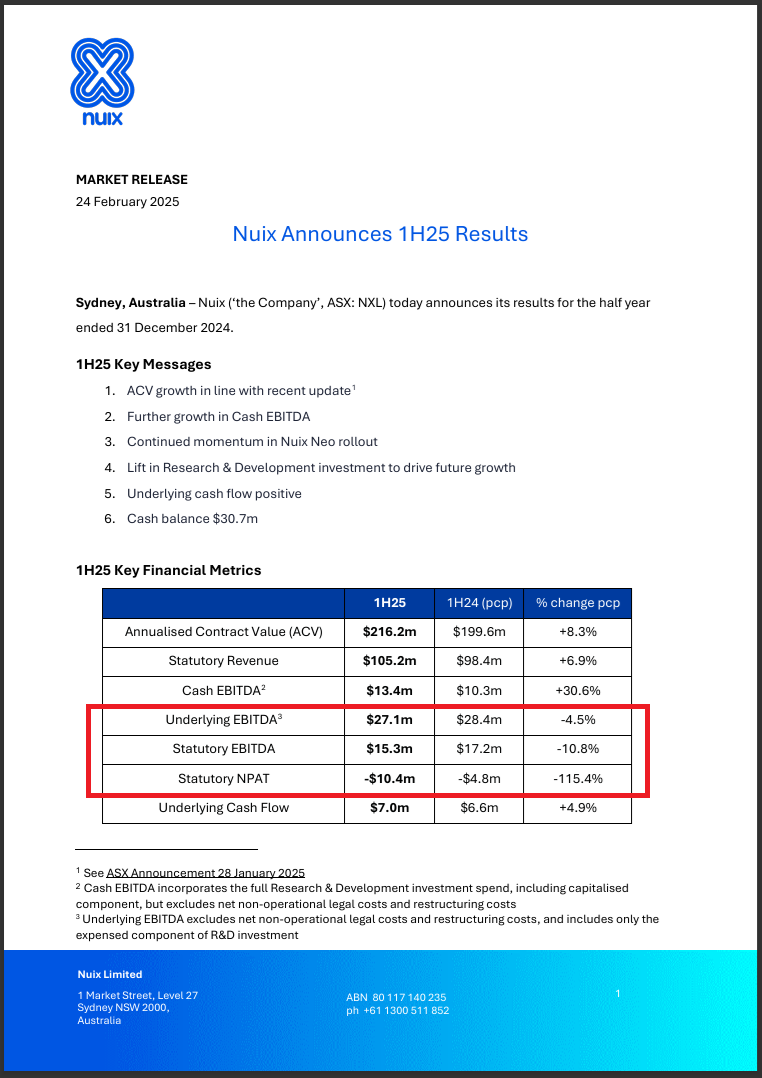

Was it really that bad? Well, it wasn't good:

Source: Page 1 of NXL-1H25-Results.PDF

They managed to land within the guidance ranges they provided in late January, except for narrowly exceeding their $11 to $13 million Cash EBITDA guidance (by 0.4m), but importantly that particular number does NOT include legal costs and restructuring costs, and they've got a few class actions ongoing, so there are substantial legal costs. And restructuring costs.

The thing that everybody is focusing on NOW, and rightly so, is the Statutory NPAT, i.e. bottom line profit number, and it was a 10.4 million LOSS, a whopping -115.4% WORSE than the $4.8 million LOSS that they had reported 12 months ago for H1 of FY2024 (the p.c.p.).

You may note that they did NOT given any Statutory NPAT guidance in January - they did give guidance for the 5 metrics above that one, but not that one, which, coincidentally, happens to be the WORST one, both in terms of comparisons with the previous corresponding period, and also in terms of how the business is travelling right now. Which is... not good.

To make matters even worse, as if it wasn't bad enough already, their "Outlook" Statement was...

As you can see, that consists entirely of "STRATEGIC TARGETS", rather than any substantive guidance. In other words, "this is what we'd like to happen, and what we're working towards, but we can't tell you what the odds are of us achieving any of these targets, but obviously we'll give it a red hot go". [paraphrasing]

Bottom line, they're still losing money, and they have not been great at setting realistic targets and achieving them over the past few years, so with every additional disappointing result, and guidance downgrade, they shake off even more of whatever true believers they've got left clinging on in the hope that there is a decent company among all of the rubbish management. It increasingly looks like even if there is, this management are going to run it into the ground anyway.

They might get some traders jumping on them when they're in an uptrend, but it seems that they go up mostly on hot air and then gravity brings them back down.

Still, if you look at them over the past 3 years against a couple of other companies that were also supposed to be turning around and heading north again, Retail Food Group (RFG) and Appen (APX), at least Nuix are still ahead of where they were 3 years ago; those other two are not:

The Orange line is the ASX200 Accumulation or Total Return (TR) Index (XJO.asx), which is the baseline ETF return.

From a starting point of 3 years ago - beginning of March 2022 - Nuix was bouncing along with a negative return and then went from -43% down on July 12th, 2023 to +463% up on the last day of October 2024, and despite it being all downhill from there, they're still trading at levels that are +167.6% higher than 3 years ago, but, that being said, they're also back in a strong downtrend, so... there's that.

Nuix's positive turnaround was clearly unsustainable.

Disc: Not holding these.

Here's the latest news in the continuing Nuix saga.

Tax authorities visit Nuix HQ to secure files in pre-IPO claims probe (afr.com) [28-Sept-2023]

Excerpt:

A 2020 presentation prepared by Macquarie and obtained by the Financial Review shows that Nuix needed to maintain a 5 per cent tax rate ahead of an IPO in December. “Nuix’s free cash flow is highly dependent on tax paid,” reads the presentation prepared by two Macquarie bankers.

“However, any budget miss will drive negative cash flow” and the gap between earnings and cash flow “may have a negative impact on the valuation that acquirers assign to Nuix”, the presentation says.

Macquarie noted the low 5 per cent tax rate was a result of paying tax on cash receipts and an R&D tax rebate. In Australia, technology companies can offset some of their research and development costs to incentivise innovation and development. Macquarie, which sold $565.7 million during the IPO, remains a 30 per cent shareholder of Nuix.

In 2021, a joint investigation by the Financial Review, The Sydney Morning Herald and The Age revealed that Nuix had claimed more than $70 million in R&D projects in early 2020. The company had claimed 55 per cent of that expenditure was in Australia, but it was closer to 9 per cent.

As it stands, the bulk of Nuix’s engineering is done in California and Pennsylvania, in the United States.

In June, Nuix said it had signed several major contracts that would push annual revenues higher. That was in part due to the ATO agreeing to sign a three-year extension to February 2026 for $6.8 million.

--- end of excerpt ---

And

Brother of Nuix CFO had swipe card for office before share sales (afr.com) [23-Aug-2023]

Excerpt:

The brother of former Nuix CFO Stephen Doyle was working out of the technology company’s head office with a swipe card that gave him access after hours when he raised $17.8 million in share sales before the 2021 half-year results triggered a crash in the stock price.

The Australian Securities and Investments Commission opened an investigation into $17.6 million in alleged insider trading by Stephen and Ross Doyle in May 2021 but closed its inquiry in September 2022 with no findings of insider trading against either of the Doyles.

Stephen Doyle, former CFO at Nuix. ASIC says he benefited from $17.8 million in share sales by his brother ahead of the disastrous half year results.

In a submission to the Senate committee inquiring into the corporate regulator, ASIC said it had established that Stephen Doyle as CFO was aware of Nuix’s half-year results before they were announced to the market, but it “did not identify any direct evidence that Stephen Doyle communicated the inside information to Ross Doyle or that Stephen Doyle had procured Ross Doyle to dispose of the Nuix shares on Stephen Doyle’s behalf”.

A former Nuix executive told the Senate inquiry that he believed ASIC was not aware that Ross Doyle was living with his brother at the time, or that he had access to the Nuix office. Ross Doyle, a former Glencore exec, had been unable to return to his home in Switzerland because of the COVID-19 epidemic.

“Ross Doyle sat outside my office for nine months,” Nuix’s former global vice president of technological services, Rolf Krolke, told the inquiry on Wednesday. “He was having a personal relationship with one of Stephen Doyle’s direct reports. And he had unfettered access to the company’s financial and corporate records.

“Ross Doyle had full access to the Nuix office. He had a swipe card to get himself in and out of his own free will.”

ASIC’s maladministration had allowed insider trading cases to go unpunished, Liberal Senator Andrew Bragg said. “The Senate heard ASIC did not interview key people at Nuix and therefore didn’t know all the information before dropping an insider trading case.

“Had ASIC undertaken proper interviews, they may have won the case in court. Unfortunately, ASIC’s failure to bother with law enforcement sends a green light to insider trading schemes. This is an issue of capability, not capacity.”

Mr Krolke said Nuix executives only learned of the share sales by Ross Doyle when he read a report in The Australian Financial Review on June 30, 2021, after ASIC executed search warrants on the Nuix head office.

In court proceedings at the time ASIC said that six days after the Nuix prospectus was released in November 2020 Ross Doyle set up a Singapore company, Black Hat Pte Ltd, with a single share owned by Black Knight Foundation in Liechtenstein.

ASIC said Black Knight’s beneficial owners were Stephen Doyle and his father Ronald, and another Liechtenstein company, Signa Consulting Treuunternehmen, linked to Ross Doyle.

Black Hat held 2 million Nuix shares that Stephen Doyle had transferred to his brother several years earlier.

Mr Krolke said at an executive meeting on January 15, 2021, 42 days after Nuix floated, CEO Rod Vaudrey said the company was tracking $11 million less than the prospectus forecast, a 6 per cent miss, and the company had to consider whether to update the market.

“We were told that would be handled by the CEO and the board,” Mr Krolke said.

‘Shredding documents’

Later that day a senior Nuix executive told Mr Krolke “there was no chance of Nuix ever hitting its prospectus revenue forecasts”.

Black Hat began selling down its Nuix shares on January 22. After stock sales raised $4.6 million on February 12 Ross Doyle instructed his broker to sell all of Black Hat’s remaining 1.55 million Nuix shares immediately.

Nuix announced the date of its half-year profit announcement on the following Monday, which would be February 26. ASIC said the timing of the Doyle share sales saved $5 million. Nuix did not downgrade its prospectus forecast until April 21.

While Ross Doyle did not attend executive meetings, “he was seen in finance staff meetings in Stephen Doyle’s office which was right next door to mine”, Mr Krolke said.

“At one point in time Stephen Doyle had two A4 document pouches couriered to Liechtenstein ... I did watch he spent a lot of time shredding documents.”

He said ASIC had failed to interview senior Nuix execs who had knowledge of problems in the prospectus and the failure to meet continuous disclosure requirements.

“I have not been interviewed by ASIC to this day,” he said.

ASIC said without direct evidence any case against the Doyles would be entirely circumstantial: “We concluded ... that the evidence obtained during our investigation was not sufficient to exclude alternative explanations for the communications between the brothers and other notable characteristics of the trades.

“While there was evidence that Stephen Doyle and Ross Doyle communicated around the time of the Nuix trades, there was no evidence that such communications were about inside information or that their communication patterns were unusual for brothers who lived together at various times and spoke regularly on the phone.

“There was also documentary evidence to support aspects of the explanations provided by the persons of interest in various section 19 examinations about their trading and the structure of their holdings of Nuix shares. Our investigation was comprehensive.”

--- ends ---

Yeah, sure it was!!

And

ASIC secretly investigated Macquarie over conflict of interest claims (afr.com) [22-Aug-2023]

Excerpt:

The Australian Securities and Investments Commission was investigating Macquarie’s handling of the Nuix IPO when the then treasurer, Josh Frydenberg, appointed its former chief executive Nicholas Moore to lead an independent review into the “effectiveness and capability” of the regulator.

ASIC’s investigation into how Macquarie Capital handled conflicts of interest in the December 2020 IPO had been under way for four months when Mr Moore was appointed chairman of the Financial Regulator Assessment Authority in September 2021.

Mr Moore left Macquarie in November 2018.

ASIC chairman Joe Longo at a parliamentary hearing this year. ASIC will appear before a committee again this week. Alex Ellinghausen

ASIC closed its investigation three months later, in December 2021, saying there was “insufficient evidence” that Macquarie Capital had breached Australian Financial Services licence obligations.

Macquarie raised $565.7 million by selling part of its 76.2 per cent stake in the former glamour software company as joint lead manager and underwriter of the IPO, which took the shares from $5.31 to touch $12 the following month before a spectacular fall below $1.

On Tuesday, the shares closed at $1.67.

--- end of excerpt ---

Today (Thursday 9th November 2023), Nuix shares closed down 7 cents (or -4.49%) at $1.49.

And

Nuix share price: CEO Jonathan Rubinsztein says he has ‘nothing to hide’ as losses narrow (afr.com) [17-Aug-2023]

Excerpt:

Nuix boss Jonathan Rubinsztein has defended his purchase of shares amid a possible takeover discussion, saying he has “nothing to hide” as the investigation software company narrowed losses for the year and reported a sharp uptick in underlying earnings.

Nuix, which sells investigative software for large enterprises, reduced its losses to $5.6 million for 2022, down from $22.8 million a year earlier. Underlying earnings before interest, taxes, depreciation, and amortisation came in at $46.4 million, up 59 per cent on the previous period.

Nuix chief executive Jonathan Rubinsztein says he has nothing to hide, after the company reported its latest earnings results. Louise Kennerley

“Our legal costs are lowering and we’ve been signing up more pharmaceutical and legal customers,” Mr Rubinsztein said.

“We’ve also just launched our new platform, from which revenue is likely to flow through to the bottom line within the next six to eight months.

Nuix shares fell 12 per cent in early trade to $1.40.

Nuix burned through $17 million in cash over the past year, but Mr Rubinsztein said most of that was through one-off legal costs and two acquisitions – natural language processing company Topos Labs and long-term Canadian technology partner Rampiva.

“We’re very comfortable with the cash position, and the current cash burn is not from operations, it’s from legal costs and acquisitions,” he said. Nuix has about $29 million in the bank, and Mr Rubinsztein said Nuix had no plans to go to market and raise further cash.

Nuix has been plagued by several ongoing legal battles, including an ASIC investigation into the company’s reporting following its 2020 IPO and another investigation into the purchase of shares by Mr Rubinsztein.

“I have nothing to hide,” Mr Rubinsztein said of the investigations. “We are working with ASIC to close it out quickly.”

Nuix has also been dealing with a five-year court battle against former chief executive Eddie Sheehy, whose appeal will be heard next week.

Earlier this year, the court dismissed Mr Sheehy’s claim that he was entitled to a stock split that would have allowed him to cash out during the company’s billion-dollar IPO.

“Hopefully that [appeal] will be dealt with very quickly,” Mr Rubinsztein said.

The tech stock reported a 19.8 per cent rise in statutory revenue to $182.5 million over the past year. Most of the new revenue was added during the month of June and the company benefiting from a currency tailwind.

Despite the jump in new customer sign-ups, multi-year deals fell from 40 per cent to 30 per cent for the financial year.

Contract values are a key metric for Nuix, which sells technology that analyses large swaths of unstructured data and is embedded within large companies such as banks, auditing firms and investigations units within the FBI and UK intelligence.

This metric rose 14.5 per cent to $185.5 million for the year, with the company pointing to growth in North America, Europe and Asia-Pacific.

Customer churn slipped from 5.4 per cent to 5.3 per cent for the year, though Mr Rubinsztein said increased upselling contributed to the boost in underlying earnings.

Excluding the legal bills, Nuix booked underlying cash flow of $9.1 million for the year.

--- ends ---

And

ASIC ‘addicted’ to secrecy, parliamentary committee claims (afr.com) [20-June-2023]

Excerpt:

The corporate regulator is “addicted” to secrecy and obfuscation, Liberal Senator Andrew Bragg says, after a parliamentary report rejected 11 of 13 claims for public interest immunity made by the regulator Joe Longo, who insists he is a transparency leader.

The immunity claims made by the Australian Securities and Investments Commission relate to questions by Parliament’s Economic References Committee, which is chaired by Senator Bragg and is examining the performance of the regulator.

ASIC has told the committee it is not able to provide any information about investigations into technology company Nuix, the use of sensitive insider information by superannuation trustees to maximise their personal gain and allegations of ‘fake coal’ testing by laboratory giant ALS.

ASIC chairman Joe Longo says ASIC is taking the lead in transparency. Alex Ellinghausen

The claims also relate to communications between ASIC and MPs and their staff when the inquiry was being established, which the report said left a “question of whether ASIC sought to interfere in the Senate’s work by influencing the terms of reference of the inquiry”.

Senator Bragg said an interim report tabled on Tuesday was “designed to end the secrecy and obfuscation to which ASIC is addicted”.

“Rather than engaging with the committee in a transparent and accountable manner, from the outset ASIC has chosen to attempt to undermine and influence the process of the inquiry before evidence had been gathered or hearings held,” he said.

ASIC said that releasing information about ALS may jeopardise its case against miner Terracom and former chairman Wal King, following claims about fake coal testing.

ASIC also said that despite an investigation into super fund trustees having been finalised, further information may unfairly damage the reputation of the individuals involved.

Senator Andrew Bragg says ASIC is shrouded in secrecy. Alex Ellinghausen

The report largely rejects ASIC’s immunity claims and argues the regulator is obstructing the committee’s work.

“The committee has formed a view that ASIC’s refusal to provide this information is obstructing the committee’s ability to conduct this inquiry,” the report says.

“The committee expects that ASIC will take this as an opportunity to reflect on its conduct to date and to reassess how it will better engage with the committee’s inquiry in an open and transparent manner”.

The report makes recommendations that the Senate order the provision of the information sought. The Coalition has three members on the committee, Labor two and the Greens one.

The disclosure stand-off comes after Senator Bragg accused ASIC of an “embarrassing cover up” earlier this year after Treasurer Jim Chalmers blocked an order requiring to hand over its investigation into allegations against ASIC deputy chair Karen Chester.

On Tuesday, Mr Longo gave a speech in Sydney that emphasised that ASIC is “taking the lead in transparency”.

“I encourage you to be ever more open and transparent with ASIC,” Mr Longo said. “This is not empty rhetoric, but a genuine and sincere call for further communication on a deeper level.”

“Transparency isn’t half-silvered. We don’t sit behind a one-way mirror like a detective watching an interrogation, seeing everything you do, while the market sees only its own reflection. No, true transparency must go both ways.”

But economist John Adams – whose report that ASIC investigates fewer than one per cent of complaints received helped spark the inquiry – shared the concern of the Citizens Party that Senator Bragg’s inquiry was being stonewalled.

“Labor Senator Deb O’Neill established an identical inquiry that same day through the Parliamentary Joint Committee on Corporations and Finance Services, and she accused Bragg of constructing a platform ‘to provide himself with an opportunity for media, not for the service of the Australian people’,” the Citizens Party said.

“Eight months later, Senator O’Neill’s inquiry has done absolutely nothing, while Senator Bragg’s inquiry has published 162 submissions, but that’s it - it hasn’t held hearings yet, or taken any other action.”

Mr Adams recently obtained Freedom of Information documents which revealed that Treasury officials concluded that his claims about ASIC’s enforcement record were “substantially correct”.

--- ends ---

And

Nuix board split under insider trading cloud (afr.com) [27-May-2023, updated 14-June-2023]

Excerpt:

The first signs of trouble came in September, when officials from the corporate regulator started searching for evidence that the company’s chief executive, Jonathan Rubinsztein, traded shares while possessing confidential information.

Since that moment, the company’s board has been bound up in animosity and suspicion. “I am paranoid and don’t want to use email if I can help,” wrote one director, Sue Thomas, in a text message as she complained of being kept in the dark by Nuix then-chairman Jeff Bleich.

--- end of excerpt ---

Sue Thomas has now quit the Nuix Board, effective from the date of their AGM, which was 19-Oct-2023, as explained in their Director-Retirement.PDF announcement on 13-Sept-2023. She was up for re-election and chose to retire from the board instead.

Of the remaining 7 Nuix Board members, three have no shares, and only their CEO, Jonathan Rubinsztein, has a decent amount of shares, and some of those were bought just before Nuix revealed that they'd had some M&A interest from North American software group Reveal, a trade that was investigated by ASIC for possible breaches of Insider Trading laws, after it was highlighted in the AFR. As usual, ASIC did bugger all and JR got the benefit of the doubt, as they always do.

While they're certainly still alive and kicking...

...it hasn't exactly been a wonderful story or an inspired journey, particularly for any early shareholders who held on expecting things to get better...

Disclosure: I do not hold NXL obviously, and I've recently fully exited SNC (Sandon Capital) IRL, because I have become increasingly concerned with their investments into companies like Nuix and MFG, so now, as an ex-SNC-shareholder, I no longer have that indirect exposure to Nuix either.

16-Sep-2022: I posted a straw here a few days ago called "M&A Rumours" highlighting that while Nuix (NXL) had just released an announcement in reponse to "media speculation" and were actively hosing down market speculation resulting from media reports of M&A interest in Nuix, it was the Nuix CEO who started those rumours. Well, wouldn't you know it, there's even more to that story. He also bought Nuix shares himself on-market (over $200K worth) immediately before or around the time that his Chairman (Nuix Chairman Jeff Bleich) was having discussions with overseas company "Reveal" about their interest in acquiring Nuix assets - and those discussions were then subsequently reported in the media. All apparently a series of coincidences.

Here's the query letter that the ASX sent to Nuix on the 9th September:

I'm sure there's a perfectly rational explanation...

Source: NXL-Response-to-ASX-Query.PDF

Well that's clear then, the CEO asked the Chair for permission to buy shares, the Chair gave permission, the CEO bought Nuix shares on-market in the 3 days leading up to the Chair having discussions regarding potential M&A with "Reveal" (who were interested in buying one or more of Nuix's assets) and at no time did the Chair disclose to the CEO that these discussions were occuring, or at least not until after the CEO had bought the shares. No insider trading. Nothing to see here. Move on. Nothing to see here!

Glad that's sorted then.

Nuix CEO Jonathan Rubinsztein unaware of takeover bid when buying shares (afr.com)

Plain Text: https://www.afr.com/technology/nuix-ceo-unaware-of-takeover-bid-when-buying-shares-20220915-p5bi6h

Nuix CEO unaware of takeover bid when buying shares

by Jessica Sier, Journalist, AFR, Sep 15, 2022 – 7.55am

by Jessica Sier, Journalist, AFR, Sep 15, 2022 – 7.55am

Nuix chief executive Jonathan Rubinsztein denies he knew of a potential takeover bid by US-based legal software company Reveal when he bought Nuix shares through his super fund in early September.

Mr Rubinsztein, who has been in the top job for just over six months, bought a total of 800,000 shares worth around $236,269 in the embattled technology company in three parcels throughout September 6, 7 and 8.

Nuix’s new CEO Jonathan Rubinsztein maintains his purchase of shares in the same week a takeover was discussed is coincidental. Louise Kennerley

In a letter to the ASX late on Wednesday night, Nuix said Mr Rubinsztein had sought approval to buy the shares from Nuix’s non-executive chairman Jeff Bleich on September 1, which Mr Bleich had granted.

Nuix has confirmed that Mr Bleich then had a confidential discussion with Reveal’s chief executive officer Wendell Jisa on September 6 (September 7 AEST) while on a trip to the United States.

During the conversation, Mr Jisa inquired whether Nuix would be interested in potentially selling some of its assets.

Nuix technology allows customers to understand and interrogate large swaths of unstructured data and is often used by law enforcement agencies.

Mr Bleich ultimately knocked back the suggestion saying Nuix wasn’t interested in exploring any transaction at that time, and the company says no proposed transaction was defined nor committed to writing.

Mr Rubinsztein’s purchase of Nuix shares was announced to the market on September 8.

Mr Bleich told the Nuix board and Mr Rubinsztein about the conversation with Mr Jisa on September 9 (AEST).

That same day, shares in Nuix were put into a trading halt as press speculation had emerged around a potential takeover deal with Reveal.

Shares in Nuix had rocketed 27 per cent higher to 87¢ on the news and the company was forced to confirm it hadn’t received any bid or written proposal from Reveal.

Also, on September 9, Mr Bleich had another conversation with Reveal’s Mr Jisa where he re-confirmed Nuix wasn’t interested in selling any of its assets at that time and reiterated the conversations were confidential.

Nuix said Mr Bleich was unaware there was going to be any discussion around takeovers or bids when he began that first meeting with Mr Jisa on September 6.

In the statement to the ASX, Nuix said Mr Rubinsztein’s purchase of shares, made in an open trading window for directors following the release of the company’s annual results, was coincidental and Mr Rubinsztein wasn’t aware of any takeover discussions when he bought them.

In a day where shares were broadly higher, investors sent the Nuix stock tumbling 6.7 per cent to 77¢ in late afternoon trade.

Nuix investors are sensitive to insider trading allegations, given the company is still embroiled in several legal battles following its much-hyped, but ultimately disastrous IPO in early 2020.

In addition to inquiries from ASIC regarding its disclosure after the company’s IPO, and three class actions from investors insisting they were misled during the lead-up to listing, allegations of insider trading are still floating around.

Former Nuix chief financial officer Stephen Doyle is facing allegations he took home $17.8 million from insider trading Nuix shares during the company’s float. Mr Doyle left the business in June 2021.

It is understood Mr Doyle will refute the allegations.

---

Jessica Sier writes on technology, internet culture, cryptocurrencies and software from our Sydney newsroom. She has previously covered global capital markets and economics. Connect with Jessica on Twitter. Email Jessica at [email protected]

RELATED

Is embattled tech minnow Nuix in play?

That August 22nd article by Adele Ferguson begins with the following line:

"When Nuix boss Jonathan Rubinsztein was quoted in the media last week saying the embattled tech company was “very cheap” and a “very attractive acquisition target”, it whipped up speculation that he was either fishing for a bid – or one was coming."

What a strange series of coincidences...

RELATED

Nuix fails to score new customers, shares fall 10pc

Yeah, nah. Not with a 20 foot pole...

#M&A Rumours. 12-Sep-2022. Saw this today - from Friday (9/9/2022): Nuix-Notes-Press-Speculation.PDF

So they're hosing down rumours, but who started the rumours? They (Nuix's CEO) did!

Nuix results: Is the embattled tech minnow in play? (afr.com)

AFR - Opinion

Is embattled tech minnow Nuix in play?

The scandal-ridden data analytics company is facing myriad issues including a near-record low share price and unhappy shareholders. Is it a sitting duck or more likely to be a target for asset sales?

Adele Ferguson, Investigative journalist and columnist

Aug 22, 2022 – 5.00am

When Nuix boss Jonathan Rubinsztein was quoted in the media last week saying the embattled tech company was “very cheap” and a “very attractive acquisition target”, it whipped up speculation that he was either fishing for a bid – or one was coming.

Rubinsztein’s well-timed comments to The Australian Financial Review on Thursday came shortly after the data analytics group reported a net loss of $22.8 million, a 190 per cent fall on the previous corresponding year, and a negative free cash flow of $21.5 million.

Sharing the bad news: Jonathan Rubinsztein, CEO of Nuix. Louise Kennerley

His comments may well have played a role in the small uptick in the share price, which closed on Friday at 71¢, up almost 4 per cent on a day when the overall market barely moved.

“Calls about potential acquisitions would be expected given how low the price is,” Rubinsztein told the Financial Review, adding that “the real value of Nuix is obscured by regulatory and legal issues”.

Rubinsztein joined the company more than eight months ago and has been trying to reset it with a new strategy and structure – and focus on the future.

His comments last week fuelled the market’s rumour mill that vulture private equity firms or a big legal tech player might be sniffing around.

But rumour and reality are two different kettles of fish. An operator willing to bid for Nuix, lock, stock and barrel could well be wishful thinking. Nuix, as it stands, isn’t an attractive proposition with declining revenue, haemorrhaging cash flow and massive legal and regulatory baggage overhanging the company.

In light of the many issues facing Nuix, a more likely scenario is a strategic player enters the fray and makes a tilt for the assets, particularly the Nuix Engine, which generates an estimated 80 per cent of total revenue. This would allow the acquirer of the assets to dump the Nuix brand, salvage the IP and customer relationships and dodge the litany of problems and liabilities that plague the company.

Whether Nuix and its shareholders go for this is the big question. Macquarie still holds 30 per cent of Nuix and therefore plays a key role in deciding its destiny.

The reality is an asset sale would put shareholders in the unenviable position of having to vote for a deal that could potentially deliver them little to nothing.

Meanwhile, the issues facing Nuix are significant. They include a legal battle with its former chief executive, Eddie Sheehy, over a $183 million options claim. The case concluded last week with final submissions heard. Next will be the judgment.

A 519-page affidavit lodged in the Federal Court by Sheehy proved to be a riveting read. It describes a culture where some staff allegedly had “extraordinary” expenses during a period of savage budget cuts.

There were also allegations of an affair between then-chief executive Rod Vawdrey and his head of human resources, which made it difficult to make complaints about the CEO.

The affidavit also referred to a $100 million funding package with a super fund that was “killed” in mid-2016, around the time Nuix founder Tony Castagna believed he was about to be charged with tax evasion and money laundering. “I do not want to tell UniSuper. I am going to kill the deal instead,” he allegedly told Sheehy.

After killing the deal, Castagna then brokered a deal with Macquarie which resulted in Macquarie gaining a controlling interest. Sheehy’s days were numbered, with allegations he was bullied out of the company.

Other issues facing Nuix include the long-awaited outcome of an investigation by the corporate watchdog into whether Nuix breached its continuous disclosure obligations. If the Australian Securities and Investments Commission finds against Nuix, it could be slapped with a fine and embolden the class action law firms that have filed in the courts, alleging breaches of continuous disclosure obligations among other things.

The story of the Macquarie-backed Nuix has been a tale of woe since it listed at an issue price of $5.31. In the IPO Macquarie sold down some of its shareholding and collected more than $565 million, contributing to bonuses for some Macquarie executives in 2021.

Within weeks of the December 2020 listing, the Nuix share price peaked at $11.86, putting it on a valuation of more than $3.7 billion as investors lapped up a 330-page prospectus that pitched the forensics software company as a growth stock.

By February 2021, the share price had crashed 32 per cent after releasing an interim result that blindsided investors.

Dogged by unfolding scandals

Since then, Nuix has been dogged by missed forecasts and unfolding scandals, including allegations of insider trading against former CFO Stephen Doyle.

It is understood Doyle will refute the allegations.

According to a well-placed Nuix insider: “Nuix is almost certain to need a cash injection in the next 12 months. It is burning cash on management overheads, legal expenses and its strategy. Its cost base befits that of a multibillion-dollar market cap company, not the $200 million minnow it has become.”

In its preliminary accounts for 2022 it includes a note as a going concern, which is worth a read.

“Important to the assumptions used regarding a return to operating net cash inflows in full-year 2024 are the potential outcomes from the litigation matters … and the access to other funding sources should they be required to achieve the group’s strategy,” the note says.

“The uncertainties attached to funding sources, the unknown outcomes of the litigation matters together with the potential business impacts of the ongoing litigation matters, gave rise to the group concluding that while there are uncertainties related to events or conditions that may, in the event of any materially adverse outcome, cast doubt on the entity’s ability to realise its assets and discharge its liabilities in the normal course of business at some point in the future, it remains appropriate that the preliminary final financial statements be prepared on a going concern basis.”

The note also addressed judgment day in the $183 million litigation against Sheehy. “It may seek a stay of judgment pending the outcome of any appeal which, if granted, would delay any obligation to pay any liability arising from a judgment until an appeal is determined, which is likely to be at least 12 months beyond the date of signing of this financial report.”

As the Nuix train wreck rolls on, Rubinsztein’s serial optimism has only ramped up. After reporting a loss for the year, he wrote in a letter to staff: “We have a big, exciting FY23 ahead of us, and I’m incredibly energised by the results that we’re already seeing from our efforts to execute excellently and return Nuix to strong growth.”

His optimism turned to tone deaf on Saturday when he took to LinkedIn and had a rant about Qantas and its frequent flyer program. “The one asset that has depreciated more than any other in my personal portfolio is the value of my frequent flyer points,” he lamented.

“Three years ago the points were worth possibly 3-6 times more than they are today (my guess based on how many points it cost to book an international classic rewards ticket combined with the lack of availability of these tickets).

“I do acknowledge that airlines have had an incredibly difficult time during COVID, and it was a super tough leadership challenge ... However, I still have these questions: are the schemes being regulated? What obligations does Qantas have to maintain value to these points?”

Shareholders who bought into the Nuix float at $5.31 – or, even worse, bought at $11.86 – compared with its current 72¢ a share, have a lot more to complain about.

RELATED

The infighting behind the $2.7b Nuix meltdown

Adele Ferguson is a Gold Walkley Award winning investigative journalist. She reports and comments on companies, markets and the economy. Connect with Adele on Twitter. Email Adele at [email protected]

Nuix results: Is the embattled tech minnow in play? (afr.com)

Here's a link to the Australian Newspaper article referred to in Friday's announcement by Nuix: https://r.search.yahoo.com/_ylt=AwrUimQ3LR9jnH4Aexg36At.;_ylu=Y29sbwNncTEEcG9zAzgEdnRpZAMEc2VjA3Ny/RV=2/RE=1663016375/RO=10/RU=https%3a%2f%2fwww.theaustralian.com.au%2fbusiness%2fdataroom%2fus-software-company-reveal-expected-to-lob-bid-for-nuix%2fnews-story%2f5945a22f3a88720b0c2f7a4a4b82d204/RK=2/RS=Ci_HxbS_LehrgHYTjiFMErKKdAM-

It's behind a paywall and I don't subscribe to The Australian.

Disclosure: I do NOT hold Nuix (NXL) shares, and would not touch them with a barge pole. They're a toxic meltdown! If they get taken over, that's probably the best possible outcome for their embattled remaining shareholders, so I hope that does happen, for the sake of those shareholders, but as Adele points out, that is far from certain, and they don't look like a great opportunity from the outside to most people. Too many problems. Too much baggage. Possibly an asset sell-off scenario, but unlikely to be a full takeover I imagine. There is certainly no guarantees that people buying Nuix here at this point are going to do Ok even if they do sell off their main assets. They could still end up underwater.

07-Sep-2022: I've been reasonably critical of Nuix Ltd (NXL) over the past little while, which is, I admit, not a particularly brave stance to take; it's an easy option, because there's a lot to be critical of, and the majority of the world seems to agree, but I have just found it not just ironic but almost comical that a company that prides itself on being a world leader in software designed (and sold to major corporations and government departments) specifically for the purposes of uncovering and exposing fraud and corruption has been accused of so much insider trading, fraud and corruption themselves, and has lost so many of their key management personnel because of those allegations, as well as the majority of their credibility and their share price.

That's a current webpage of theirs, selling Nuix Technology that "helps you meet your information governance and regulatory compliance needs with software to identify high-risk and high-value information, clean up messy data, comply with regulations and respond to requests."

I particularly like that "comply with regulations" bit.

It goes on...

YOUR CHALLENGE

Your organization’s data contains all kinds of threats and opportunities. You need to know the facts about where it is, how much of it there is and what it contains to minimize risks, grasp opportunities and maintain regulatory compliance.

OUR SOLUTION

Nuix compliance and information governance solutions help you understand your unstructured content, classify it for records, protect and secure it, answer difficult questions about it and transform it to maximize its value.

---

Emphasis added by me, i.e. the "maintain regulatory compliance" bit.

Good-O! So, people should buy Nuix's software to help them understand and maintain regulatory compliance.

On the very last day of August, on the last allowable day, Nuix released their Full Year Statutory Accounts (FY22 Financial Statements). Two days later, on Friday 02-Sep-2022, they released them again, with the following cover page:

OK, so they had inadvertently left out one of the Directors' resolutions that were made and voted on at the Directors meeting convened to consider and adopt the Full Year Statutory Accounts (FY22 Financial Statements) and conduct all other necessary company business to ensure that they were complying with all relevant rules and legislation (from ASIC and the ASX).

No biggy. What was the resolution then? See if you can spot it. Hint - I've circled it in red - you can't miss it!

The ONLY difference to the two sets of financial statements is page 104, and here's page 104 from the 31-Aug-2022 version, followed by page 104 from the 02-Sep-2022 version.

They crack me up!

Perhaps they weren't sure if it had to be passed unanimously or just based on a majority of directors...

Simple mistake. NOT!! That's the single thing that most often sends a company to the wall, and the main thing that directors later get taken to court over in subsequent class actions by disgruntled shareholders. And they just... forgot to include it?!?

Wow!

Just... Wow!

Might not be a red flag. It might be a red flag that's actually on fire! This is a company that just doesn't have ANY credibility left in my view and for those who are still in this one, you are either very brave, or... at the very least you have a much higher risk tolerance than I do.

When there are so many options to invest in, why would somebody choose Nuix? Like, now? Knowing what we know, and watching them unravel like this? I still don't get it. But we can't all be the same I guess, otherwise they'd be no market.

18-July-2022: I've written a fair bit about Nuix (NXL) in the Nuix nosedive forum thread. My most recent post was on June 9th, so around 6 weeks ago, and that was around their inclusion in a portfolio of stocks managed by Australian Ethical Investments (ASX: AEF) which has had a rough trot over the past 7 months or so...

We had a discussion then about why a fund that used "Ethical" in their name would consider investing in a company that was being investigated for insider trading and where there had also been questions (from ASIC) about their prospectus and potentially misleading guidance that had resulted in shareholders losing millions while some of the key people (and companies, like Macquarie) involved in the float made off like bandits (with millions in profits). In short, what AEF focus on is the end product that the company produces or the services that they offer to their clients, they are not overly concerned with the Governance side of things (i.e. the "G" in ESG). Which is a good thing to know if you thought AEF was a fund with strong ESG filters. Not so much when it comes to looking at how companies are run and their track records of strong governance and being honest and upfront with their shareholders.

What we have seen from Nuix (NXL) is a series of downgrades, with another one today: Nuix-FY22-results-update.PDF

Each one comes with plenty of positive spin, and today's was no exception.

The market has become very adept at looking through the spin and focusing on the underlying numbers however, and the numbers continue to look bad, and getting worse.

That's a screenshot of the first page of today's update, with some yellow and orange highlighting added by me. As expected, legal costs continued to balloon out, eating into their already meagre profits. They may end up with a slim positive statutory EBITDA, but their NPAT is likely to be negative or if it is positive it will be so small as to be virtually useless. Certainly not anything that could sustain a dividend.

The worst thing is that they've said that even if you EXCLUDE their legal costs and Topos acquisition costs and trading losses, their underlying operational cashflow for the financial year was still negative. Negative $3m.

Yep, they're still going lower! In terms of their share price, the only floor is $0.

They may have had $46.8m of cash at June 30th, but they're burning through cash due to poor acquisitions that lose money and massive legal fees, with more to come. They have negative cash flow even if you do NOT include those acquisitions and legal fees. They are being investigated, and they are being sued. On multiple fronts. There are class actions and there is the big one, the Nuix-Trial-of-the-legal-proceedings-brought-by-former-CEO.PDF which could get very interesting because of who is expected to give evidence and about what, as explained in my previous forum posts about Nuix.

Nuix looks to me like a value trap, but not a very well concealed trap. Just an out-in-the-open trap. Despite the quality of their software products and services, why would you want ANYTHING to do with this company with the world of pain that they're in?

Yet, a LIC that I'm invested in, Sandon Capital (SNC), have decided to take a position in Nuix, and so have AEF. So has Manny Pohl's ECP Asset Management, who hold 5.06%. Macquarie still own a big chunk. Perhaps they all know something we don't know. But from all of the publicly available information, including press coverage, WHY would you go near them? And if you already held, why would you keep holding?

30-Nov-2021: Funny ol' World this'un... So, Nuix released an announcement yesterday (Monday) morning titled, "Second Class Action Claim" - see here - and their share price went UP, albeit only by 2 cents to close at $2.56/share. And it wasn't a positive announcement. Here's the guts of it:

Second class action claim: Sydney, Australia – Further to the announcement on 22 November 2021, Nuix Limited (‘Nuix’; ASX:NXL) has become aware of a second class action claim filed against it in the Supreme Court of Victoria on 23 November 2021. While the claim has not been served on Nuix and there has not been any contact from the plaintiff or his lawyers, the second claim has been commenced by Phi Finney McDonald on behalf of Daniel Joseph Batchelor and persons who acquired interests in Nuix shares by subscription in its IPO or in the period between 4 December 2020 and 29 June 2021. The claim relates to information contained in Nuix’s Prospectus and Nuix’s disclosure concerning forecast FY21 revenue and alleges that Nuix contravened provisions of the Corporations Act 2001 (Cth) and the Australian Securities and Investments Commission Act 2001 (Cth). The claim covers similar subject matter to the claim filed by Shine Lawyers which was announced on 22 November 2021 and does not identify the amount of any damages sought. Mr Batchelor’s claim has also been commenced against Macquarie Capital (Australia) Limited and Macquarie Group Limited as co-defendants.

Nuix disputes the allegations and will be defending the claim in the event it is served.

--- end of snippet ---

They held their AGM the next day - today - Tuesday 30th November 2021 - and the Chairman's address started off pretty upbeat:

It actually continued along that way, i.e. with plenty of positive spin, but they unfortunately had to address their sad performance in their short history as a listed company and the many questions over their governance and the loss of key personnel (such as their CEO and CFO both moving on - or being moved on) - and the other issues around their prospectus and prospectus forecasts (that now seem with the benefit of hindsight to possibly be a tad optimistic, at best, or worthy of a class action or two, at worst).

And on the back of their AGM speeches and presentations, Nuix closed down -11.72% today, meaning their share price dropped from Monday's $2.56 close to finish today (down 30c) at $2.26.

Not the best IPO of recent times... For anybody who held on past 25-Feb-2021, it is unlikely to have been a pleasant ride.

Probably the thing that moved the SP the most for NXL today was their trading update (found on pages 9 & 10 of the announcement):

TRADING UPDATE

We are now several months into the new financial year, and in a position to provide some commentary on trading for the four months to the end of October. I’ll first provide an overview, followed by some more specific detail.

We have seen a lift in revenue compared to the same time last year, driven by multi year deals, although it is worth noting that Nuix’s revenue profile does fluctuate, and this revenue growth is not necessarily predictive of growth over the remainder of the year. Our Annualised Contract Value (ACV) is flat compared to the FY21 Result.

As flagged at the FY21 Results, Nuix is investing in, and accelerating, our product development pipeline, including Engine as a Service. In addition, we are building and enhancing our Sales and Distribution capability as planned. The labour market, particularly for engineers, remains very tight, and this has contributed to a lift in our employee retention and recruitment costs. We have also experienced a large increase in non-operational legal costs. All of these factors have contributed to a material increase in our cost base in the financial year to date.

Accordingly, pro forma EBITDA is down on the prior corresponding period, as a result of the large and ongoing increase in our cost base. As an organisation, Nuix is investing for growth, with the benefits of this increased level of investment to flow in future periods.

Getting into the detail a little more, Statutory Revenue for the four months ending October was up circa 10% on the same period last year, in both reported and constant currency. This increase has been driven by the re-signing of a major advisory contract on a multi-year consumption licence, along with other significant multi-year deals with existing customers. In addition, this period also saw the benefit of some deals which had slipped from the previous financial year.

Offsetting this, new customer revenue is currently tracking around 40% lower than the same time last year.

As I touched on earlier, Nuix’s revenue profile is variable over the course of the fiscal year, with December and June being particularly critical months for contract signing, so this level of growth early in the financial year is not necessarily predictive of the remainder of the year.

As we discussed at the FY21 result, Nuix is leaning forward to invest in further sales, distribution and development capabilities, given the medium-term opportunities available to us. In addition, we are continuing our work on migration of the core engine to a SaaS offering and other development work. Given this investment, Pro forma EBITDA for the four months ending October is down around 27% in both reported and constant currency, compared to the same time last year. As mentioned, we have seen a material increase in legal costs, of about $4m this year to date. These costs will reduce over time but are ongoing while investigations and claims are underway.

Annualised Contract Value, or ACV, is a measure we use to consider the run-rate of our business, and is particularly useful in that it strips out the sometimes volatile impacts of multi-year deals on revenue. Our ACV is tracking in line with the run rate we reported at the FY21 results in both reported and constant currency. Subscription ACV, which is a subset of total ACV, is also tracking in line with the FY21 result, highlighting the recurring nature of the majority of Nuix’s revenue streams.

We’ve mentioned before the transition occurring to consumption-based licences. Our Consumption ACV has grown in excess of 20% since the full year result, again partly due to that big contract change I mentioned earlier.

Churn remains low and is in line with our very low rate at the full year result, to now sit at 3.6%.

Net dollar retention has improved since the result, at 97.5% in reported currency and 102.6% in constant currency.

Nuix’s balance sheet remains robust with net cash of $57m as at 22 November. The reduction since the FY21 result incorporates the approximately $7m initial investment in Topos Labs as well as the overall increased investment in the business.

--- end of excerpt ---

So, if we ignore the positive spin once again (and there's plenty of it to ignore), they are spending more, quite a lot more ("a material increase in our cost base" in the FY to date, including a large increase in legal costs) however their new customer revenue is currently tracking around 40% lower than the same time last year and their Annualised Contract Value (ACV) is flat compared to the FY21 Result. And the big one - their Pro forma EBITDA for the four months ending October 31 is down around 27% in both reported and constant currency, compared to the same time last year.

They are placing a fair bit of the blame on the extra $4m worth of legal costs YTD, however clearly their sales are going backwards despite them spending more on development, distribution and sales.

So they missed their prospectus forecasts with their maiden result, then things have gotten worse from there clearly, with less sales revenue (especially from new customers, coz new customer revenue is down 40% vs. the pcp) and much higher costs. And we shouldn't expect those legal costs to reduce any time soon. If anything, I would expect them to increase from here, despite their spin. And they've clearly signalled that they intend to spend more to "capitalise" on the vast opportunities that lie before them.

I think the market was kind to them today actually. It could easily have been a lot worse than -11.7% down, although that is admitedly off a pretty low base now. It reminds me of what I used to say about RFG a couple of years ago. No matter how cheap you think they look now, they can still go a LOT lower, in fact they COULD go to zero. They did go a lot lower, but they did not go to zero (yet). The people that make money off stocks like RFG are a fraction of the number that lose money thinking they are a value play and then finding out that the value isn't real. In RFG's case, their largest asset was intangible, being goodwill, or brand value, and everybody found out that the value of those brands wasn't even close to the value that RFG had been attributing to them. NXL is nothing like RFG. For one thing, NXL do not have net debt. They claim to currently have $57m of net cash. However their current market cap is still over $800m. I think that goes lower from here.

But hey, what do I know? I'm still holding ZNO shares...

[edit: Nah, I'm NOT holding ZNO shares. They are another mangy dog stock, and it took me WAY too long to realise that their so-called upside potential would likely never be realised - because they lacked quality management - and had not been entirely honest about their products and the effectiveness of those products - IMO - and they CERTAINLY hadn't been up-front about losing so many contracts - I sold out of ZNO eventually at $0.28/share back on 01-Feb-2022 - and sold out here on the same day, getting the closing price of $0.285. So... no, I'm not holding ZNO now.]

22-Jan-2022: Thanks @Strawman for that comment on my bear case for Nuix from September last year (you'll need to scroll down through 3 or 4 straws to find it - it'll be the last straw, no pun intended). NXL closed yesterday down -22.82% at $1.59, and not a truer word was spoken: No matter how low they go, they can always go lower - until/unless they reach $0.

I doubt Nuix is going to zero, because there is still a business in there, with no net debt, quite a few million in net cash, and some big customers. However, just because there's some value there does NOT mean that you should be looking at them as a possible value play. You CAN, if you want to, but you certainly do not HAVE TO. There's so much smoke with this one that you can barely see anything BUT smoke. It's enough to almost bring a tear to your eye.

What COULD send them to zero however is multiple class actions, what appears to be a governance vacuum that allowed what certainly looks like serious - alleged - insider trading to occur, certainly with regard to their former CFO, his father and his brother, as I detailed in my Bear Case straw, the ASIC investigation into possible law breaches concerning their prospectus and disclosures, the heavy involvement of Macquarie Group in the whole thing which is a particular focus of the ASIC investigation, and the likely loss of client confidence in Nuix as a suitable service provider to them, considering that Nuix's whole business case is "Finding Truth in a Digital World", a slogan which they seem to have backed away from lately, with new slogans such as "Turning Messy Data into Actionable Intelligence" being used on their website now.

Their core offering is "Investigative Analytics and Intelligence Software" - see here: Products | Nuix

If you are a bank or other large corporation that has used Nuix, are using Nuix, or are considering using Nuix for your forensic data investigation work, you would be well aware of what's going on with this company, and I would imagine that you might be looking for an alternative services provider. And they do have competitors. They are not the ONLY company in the world that provides these services. They claim to be the best, but then they would, wouldn't they?! However their numbers don't lie. Their revenue is declining. They are either already losing market share or they will lose market share. Everything that is going on with them is hurting their core business, and probably a lot more than they care to admit. They have serially put out all of their bad news thickly coated with positive spin. But the market is getting pretty good at looking through that spin at what the numbers are saying, and the numbers are bad, and getting worse.

There is substantial irony in a company that promotes itself as having the world's best software for forensic investigation of data (for the purposes of uncovering crime and shady dealings) now being at the centre of Australia's largest insider trading investigation as well as a major ASIC investigation into whether they misled investors with both the prospectus and their other disclosures (including guidance provided prior to actual results being announced, results which were considerably lower than their guidance had suggested they would be). The shady dealings with shares in this company both before and after the float is astounding (detailed in my Bear Case Straw). It probably should not come as too much of a surprise that the "Millionaires Factory" (Macquarie) were so heavily involved, there were a number of parties that DID make millions out of all of this, and they were all insiders. This won't take down Macquarie, but it could take down a couple of their executives that were also appointed to the Nuix board to oversee the float (and were therefore directly responsible for the prospectus accuracy).

The other broker involved was Morgan Stanley, and in my Bear Case straw I detailed how they have continued to promote Nuix as a buy and maintained a price target that while it has reduced gradually, has always remained at least 100% above the actual Nuix share price ever since Nuix's SP started to head seriously south. I provided some overview of the Morgan Stanley calls up until 31-Aug-2021 at which point they still maintained a $6.40 PT (price target) for Nuix and still called them a buy ("Overweight" call). Interestingly, that was the LAST time Morgan Stanley sent out any client notes about Nuix. Here's a recap of what they said back in August (their last word on Nuix to date):

Morgan Stanley - 31/08/2021: Overweight, Price Target: $6.40, Gain to target: $3.86

While FY21 revenue met recently lowered guidance, Morgan Stanley highlights it was -9% below original prospectus estimates while earnings (EBITDA) beat guidance and prospectus. No FY22 guidance was provided.

The fall in churn business and new customer wins are indicative of a company growing slowly, not collapsing, points out the analyst. It's felt product innovation, expansion into new verticals and a faster SaaS take-up is required for a re-rating.

Morgan Stanley retains its Overweight rating and $6.40 price target. Industry view is Attractive.

Target price : $6.40 Price : $2.54 (31/08/2021) Gain to target $3.86, being +151.97%

(excluding dividends, fees and charges - negative figures indicate an expected loss).

--- ends ---

Nuix closed at $2.54 that day (31-Aug-2021). They closed at $1.59 yesterday, so Nuix would have to rise +302.52% from here to reach MS's $6.40 PT.

So who would take Morgan Stanley's comments and Price Target seriously? Possibly their clients, who Morgan Stanley put into Nuix during or after the float. And also possibly anyone who didn't know the history and how Morgan Stanley was one of the two brokers who floated Nuix on the ASX.

And that's why my warnings and Strawman's warning in his forum post on this today are worth taking note of. We are both warning people to always take broker comments, broker calls, and broker price targets with a grain or three of salt, because they often have a vested interest in the company they are covering, and they are oftentimes biased and are talking up their own book. This is not to say that they are necessarily dishonest, they may well believe everything they are saying, hand on heart, but they could be looking through rose-coloured glasses. If you floated a company and put a bunch of your clients into that company either as part of the float or after it when the stock price went on an initial tear, it would be incredibly difficult to eat humble pie and say, "Actually, this company is a dog with fleas, worms and possibly rabies, and everybody should stay well away from them until this incredible amount of smoke clears and the business can be properly valued based on their real fundamentals without all of this drama and distraction, which could take a LONG time."

It would be pleasantly refreshing to hear, but we're just not going to hear it from them. So keep that in mind when reading broker reports.

21-Jan-2022: Not a particularly good day for another guidance downgrade from Nuix...

As at 2pm Sydney time...

Disclosure: Not holding. Not even with a 20 foot barge pole would I touch this one...

Firmly in a downgrade cycle. Significant governance issues. ASIC investigations. What's to like?

30-Sep-2021: Yesterday (Wednesday September 29th), Nuix dropped another -4.31% (or 11c) to close at $2.44. It's been a shocker for shareholders, after listing back on 4 December 2020 at an IPO price of $5.31. Nuix spiked up moments after floating and by close of day had surged 50% to $8.01. By the end of January, the stock price was at $11.86, its all time high. Now it's $2.44/share.

Some background reading:

Stockhead, March 24th, 2021: https://stockhead.com.au/tech/the-asx-biggest-ipo-of-2020-is-back-under-its-ipo-price-so-is-nuix-a-buy-or-bust/

IG, June 1st, 2021: https://www.ig.com/au/news-and-trade-ideas/why-morgan-stanley-remains-overweight-nuix-despite-fresh-downgra-210601

Sydney Morning Herald (Adele Ferguson and Kate McClymont), July 3rd, 2021: https://www.smh.com.au/business/companies/black-hats-tax-havens-australia-s-biggest-insider-trading-probe-revealed-20210701-p5863c.html

If you only have time to read one, read that last one. It's some quality journalism, as we have come to expect from Adele and Kate. And as the title suggests, this has now turned into Australia's biggest insider trading investigation.

The latest three announcements to the ASX by Nuix were:

- 13-Sep-2021: Nuix acquires Natural Language Processing Company

- 03-Sep-2021: S&P DJI Announces September 2021 Quarterly Rebalance (Nuix was removed from the S&P/ASX200 index on 20-Sep-2021)

- 02-Sep-2021: ASIC update

Here's a bit of that last one, well, all of it really, as it was only a single paragraph:

"Further to Nuix’s announcement on 10 August 2021 in relation to ASIC’s investigation concerning the financial statements of Nuix Limited for the period ending 30 June 2018, 30 June 2019 and 30 June 2020, Nuix’s prospectus dated 18 November 2020 and Nuix’s market disclosure in the period between the period 4 December 2020 to 31 May 2021, Nuix can confirm that it has today received notices from ASIC seeking documents potentially relevant to those matters. Nuix will of course co-operate fully with ASIC’s investigation."

Macquarie was obviously heavily involved in the Nuix Float and were the single largest financial beneficiary of the float, and Macquarie have sensibly ceased broker coverage of Nuix. The other broker involved, Morgan Stanley, have not done the same and they currently have an "Overweight" call on Nuix and a $6.40 price target, which was $7.50 until they lowered it in mid-June. And that was lowered from $10.75 back in April - and was previously $11/share (details below).

Here's some excerpts from an article by Neil Chenoweth (senior writer at the Australian Financial Review) published by the AFR back on June 30th this year - titled "Explosive insider trading claims as ASIC turns torch on Nuix IPO":

Broadening investigations into alleged insider trading at fallen technology star Nuix now threaten to embroil Macquarie, Morgan Stanley and PricewaterhouseCoopers over their role in the technology group’s IPO last December.

Court action by the Australian Securities and Investments Commission relating to former Nuix CFO Stephen Doyle, who is accused of realising $17.8 million from insider trading, has revealed a second ASIC investigation into the Nuix prospectus and into its accounts from 2018 to 2020.

The corporate regulator has said it is investigating whether Mr Doyle helped to release a prospectus for the tech company’s December IPO that was false and misleading, raising questions as to broader liability by advisors to a float which saw Nuix shares shoot up before plunging, costing investors more than $3 billion from the January peak.

Macquarie, which owned 76 per cent of Nuix before the float, was the principal beneficiary of the IPO, taking $586.7 million of the $953 million raised.

In addition, Macquarie and Morgan Stanley earned $19.6 million as joint lead managers and underwriters for the Nuix IPO, and PricewaterhouseCoopers $1.7 million for its role as auditor and investigating accountant.

The Nuix float - which saw shares surge from their $5.31 issue price to peak at $11.86 in January - has become a spectacular failure which has seen Doyle terminated as CFO by “mutual agreement”, CEO Rod Vawdrey announcing he would resign, and a consultancy agreement with former chairman Tony Castagna ended, after a joint investigation by The Australian Financial Review, The Sydney Morning Herald and The Age last month.

Sensational details of the ASIC investigations were tendered in an affidavit by ASIC markets enforcement senior lawyer Jenny Truong, which was tabled in the Federal Court Wednesday last week as part of a secret move by ASIC to prevent Stephen Doyle’s brother Ross from leaving the country.

“ASIC is investigating, among other things whether Stephen Doyle gave to the ASX, or permitted to be given to the ASX, a prospectus including information about the forecast revenue of Nuix for the financial year ended 30 June 2021 that was false or misleading in a material particular, without having taken reasonable steps to ensure that it was not false of misleading,” Ms Truong said in her affidavit, which was released by the court on Tuesday evening.

In regard to insider trading, “I believe that Stephen Doyle was aware of the inside information before 12 February 2021 and possibly as early as 31 December 2020,” Ms Truong said.

She said the inside information was that Nuix’s revenue in the December half was 4 per cent below the previous year, and that it was tracking at 44 per cent of the full year revenue forecast in the prospectus—information which would knock 32 per cent off Nuix’s share price hours after Doyle and CEO Rod Vawdrey released the results on February 26.

Justice Brigitte Markovic, who made a suppression order on ASIC’s ex parte application last Wednesday, heard that Stephen and Ross as well as their father Ronald Doyle were the centre of an insider trading investigation triggered by ASIC’s market surveillance team after Ross Doyle sold 2 million Nuix shares between January 22 and February 12, shortly before Nuix reported that it had fallen short of its half year forecast.

Ms Truong revealed that on June 18 ASIC opened a second investigation into suspected false and misleading information in the Nuix prospectus and its annual accounts filed for 2018 to 2020.

June 18 was the day that new ASIC chair Joe Longo told a Senate committee that two investigations into Nuix were on foot, the morning after Labor senator Deborah O’Neill had lashed ASIC in parliament over its lack of action over Nuix.

The twin investigations raise fresh questions over Macquarie Group’s role in marketing the IPO, from which it realised $565 million, and the oversight of Macquarie Capital executives Daniel Phillips and David Standen, who as Nuix directors helped oversee the sale process.

Mr Longo pointedly said at the time that a prospectus was the responsibility of directors.

“So it’s been their responsibility to ensure that the prospectus is full and complete, and it’s the company, the directors and the underwriters that are liable for loss and damage caused by a defective prospectus,” he said.

Ms Truong’s affidavit pointedly notes Macquarie Capital and Morgan Stanley’s role in the Nuix IPO, and PricewaterhouseCoopers’ work as auditor and investigating accountant.

Ms Truong’s affidavit describes an elaborate strategy that she said Stephen and Ross Doyle used to mask the sale of 2 million Nuix shares.

But the strategy came unstuck when they decided to dump the rest of their shares on to the market ahead of the release of the disappointing first half earnings—a move that flagged the unusual trades to ASIC Market Surveillance.

Central to the saga is a package of 50,000 options that Stephen Doyle received after he became Nuix CFO in June 2011, which was revealed by The Sydney Morning Herald and The Age last month.

Stephen paid $301,500 to convert the options into shares in September 2012 worth $321,000 and Nuix internal documents show he continued to own them until late 2015, when their value had jumped to $4 million.

However in December 2015 he filed a notice saying that he had sold the shares to his brother Ross, who lived in tax-friendly Switzerland, in July 2012 for $326,500.

Ross Doyle went on to sell a fifth of these shares to Macquarie in 2016, before a 50 for one share split left him with 2 million shares, which were valued at $10.6 million in last December’s IPO.

Ross Doyle had been in Australia since March 2020. On November 24, six days after the Nuix prospectus was released, he set up a Singapore company, Black Hat Pte Ltd, for which he was one of two directors, with its single share owned by Black Knight Foundation in Liechtenstein.

Truong said Black Knight’s beneficial owners or those with significant control were Stephen Doyle and his father Ronald, and another Liechtenstein company, Signa Consulting Treuunternehmen, which has the same business address as one of Ross Doyle’s companies.

On 30 November, four days before Nuix floated, Ross Doyle transferred his 2 million Nuix shares to Black Hat for a total price of just $2, then on December 9 set up trading accounts for himself and Black Hat with broker Moelis Securities Australia. Later he transferred 200,000 Nuix shares from Black Hat to his own trading account.

The Liechtenstein shareholding obscured the real beneficiaries of Black Hat’s share trading and the links to the Nuix CFO.

In January, Ross Doyle told a Moelis broker that Black Hat was “overweight” in Nuix and would sell down. From January 22 to February 11, Ross sold 453,110 Nuix shares held in Black Hat as well as his own account, raising $4.6 million at an average price of $10.22.

But on February 12 Ross Doyle abruptly told his broker to sell all of Black Hat’s remaining 1.55 million Nuix shares. He agreed to sell them below market price, realising another $13.2 million at an average price of $8.54.

Selling them below market price on Friday February 12 cost Doyle at least $278,000 measured from the day’s low, and up to $464,000 measured against the trade weighted average price that day.

ASIC says this was because Ross Doyle knew that Nuix’s half year figures would be bad. Nuix announced the date of its profit announcement on the following Monday, which would be February 26.

Nuix shares crashed after the disappointing results. ASIC claims that the Doyles made a $5.7 million profit by using inside information to sell before the results were released—the difference between their average $8.92 sale price and the $6.06 closing price on February 26. Today the 2 million shares would be worth just over $5 million.

Ms Truong says that much of the $17.845 million realised from the Nuix share sales was used to buy and then sell STW units (which are tied to the ASX 200 Fund), a process which further obscured the payout from Nuix.

However when ASIC Market Surveillance examined trading records ahead of Nuix’s disastrous share plunge on February 26, the Black Hat sale of 1.55 million shares on February 12 stood out, even in the heated Nuix market.

The Black Hat sales accounted for 57 per cent of sales volume on February 12. It was greater than the total volume traded on 10 of the 14 days prior.

ASIC opened a formal investigation on May 4, and traced the proceeds of the Nuix sales through a series of bank transfers between Ross, Stephen and Ronald Doyle.

After the SMH on May 25 revealed the date discrepancies over when he sold his Nuix shares to his brother, Stephen Doyle was reported to have stopped coming to the Nuix office and flew to Queensland.

Ms Truong said on June 9 Ross Doyle applied for permission to fly home to Switzerland on June 27, stating, “I need to return home as I have been stuck in Australia during COVID.”

The suppression order on the travel restraint order and Ms Truoung affidavit was lifted on Tuesday this week, after Federal Police executed search warrants last Thursday on Nuix’s head office, Stephen Doyle’s penthouse in Pyrmont, and Ross and Ronald’s holiday location in Queensland.

Truong said ASIC intended to question Stephen and Ross Doyle this week but that further questioning was likely after ASIC reviewed the findings from the search warrants. Ross Doyle’s interim travel restraint order has been extended until October 25.

Neil Chenoweth is an investigative reporter for The Australian Financial Review. He is based in Sydney and has won multiple Walkley Awards.

I think it's important to note that while Morgan Stanley made money out of the Nuix IPO, and presumably sunk a fair chunk of their own clients funds into the IPO and enjoyed the subsequent SP rise from the moment of the IPO - until late Feb when Nuix reported and the SP sank like a stone - it was Macquarie Capital (part of MQG - Macquarie Group) that made the bulk of the money, as 76% owners of the company prior to the float. It's not just a case of having ink on their fingers, they are actually up to their necks in this one. Macquarie Capital executives Daniel Phillips and David Standen were appointed to the Nuix board as directors to help oversee the IPO, and as directors they are responsible for what was in the prospectus, the same prospectus that ASIC are now investigating for possible misleading or false statements.

As I said above, Macquarie aren't still spruiking Nuix to their clients, but their partners in crime (just a saying there, not an accusation, I'll leave the allegations and investigations to ASIC), Morgan Stanley are. Here's a few titbits from a few of Morgan Stanley's client notes this year (Source: FNArena.com):

Morgan Stanley - 11/01/2021:

Initiation of coverage with Overweight, Target: $11.00

Morgan Stanley has initiated Nuix with an Overweight rating alongside a maiden price target of $11. The broker considers the newly listed owner of a proprietary forensic and investigative platform an attractive, long duration, structural growth story.

Among the risks cited is the fact that much larger competitors in the space have access to much larger R&D budgets. There is also the risk of multiple compression as many peers are seen trading near all-time high valuations.

Target price : $11.00, Price : $8.89 (11/01/2021), Gain to target $2.11 or 23.73%

Morgan Stanley - 01/03/2021:

Overweight, Target: $11.00

In an initial assessment, it looks like Nuix's first half results missed Morgan Stanley's expectations. As a result, the broker notes the risk profile around full-year earnings delivery has increased.

Going in the second half, the company considers its new business pipeline strong and reiterates all full-year FY21 prospectus numbers. The broker also remains confident due to an opportunity to expand into new verticals, shift to SaaS and accretive M&A opportunities.

Overweight rating with a target price of $11.

Target price : $11.00, Price : $6.30 (01/03/2021), Gain to target $4.70 or 74.60%

Morgan Stanley - 02/03/2021:

Overweight, Target: $10.75

For Morgan Stanley's early assessment of Nuix's interim report, which turned out to be disappointing, see yesterday's Report.

The broker did state it remains confident due to an opportunity to expand into new verticals, shift to SaaS and accretive M&A opportunities and therefore, on second consideration, has only made minor changes to forecasts while advocating investors should treat share price weakness as an opportunity to get on board.

Morgan Stanley believes a considerably stronger second half is achievable. Overweight rating retained while the price target drops to $10.75 from $11. Industry view is Attractive.

Target price : $10.75, Price : $5.95 (02/03/2021), Gain to target $4.80 or 80.67%