This is the first straw here for OM Holdings. @PortfolioPlus likes it and alerted me to it a few months ago. Since then the share price has had a terrible run, until just recently. I suspect it’s not on everyone’s watch list as it is a Malaysian based company with its operations in Indonesia. However, the metrics look interesting for a business that is trading on a PE of only 4.

OM Holdings Limited, an investment holding company, engages in mining, smelting, trading, and marketing manganese ores and ferroalloys in the Asia Pacific, Europe, the Middle East, Africa, and America.

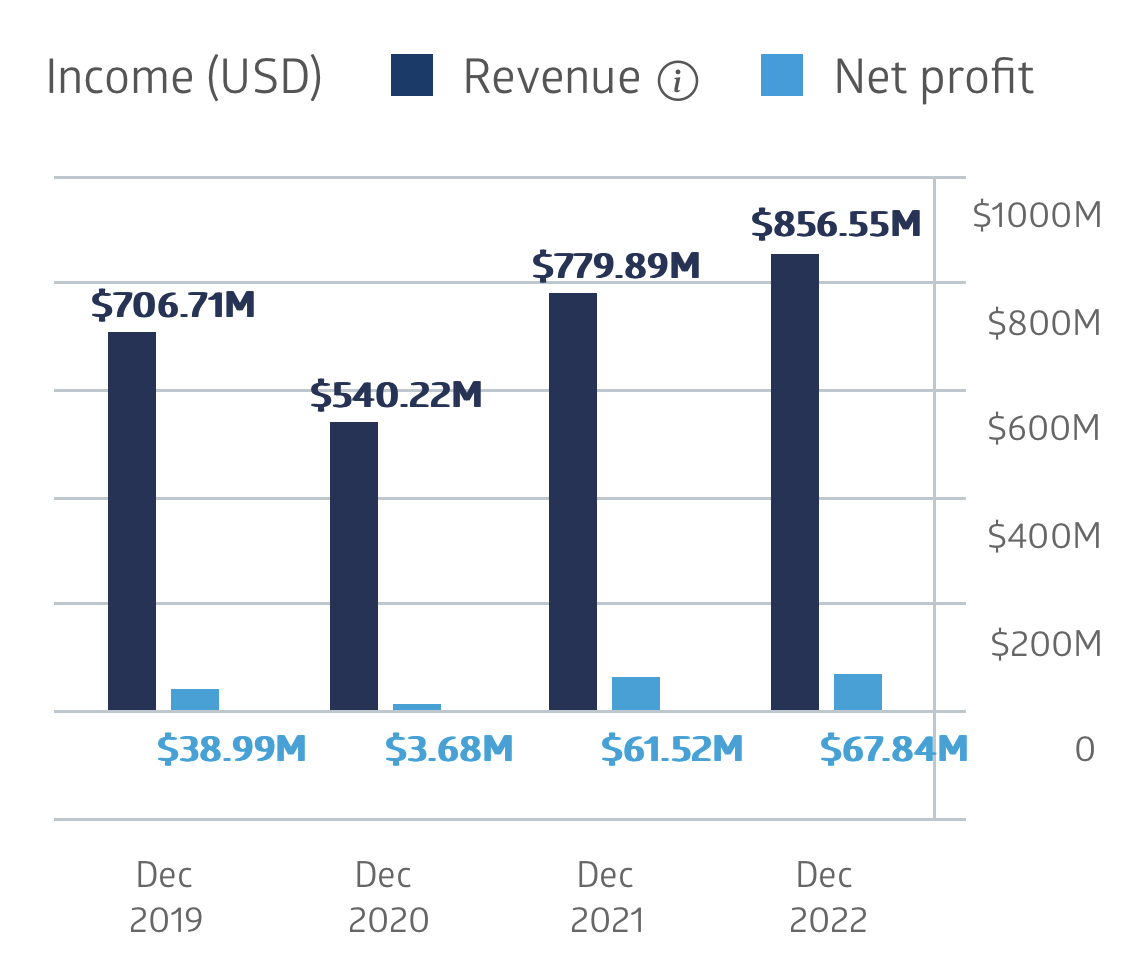

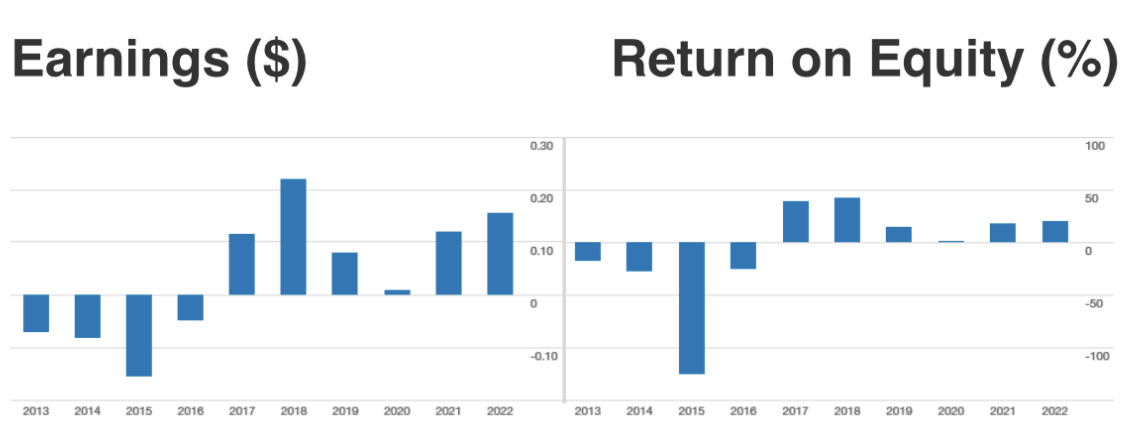

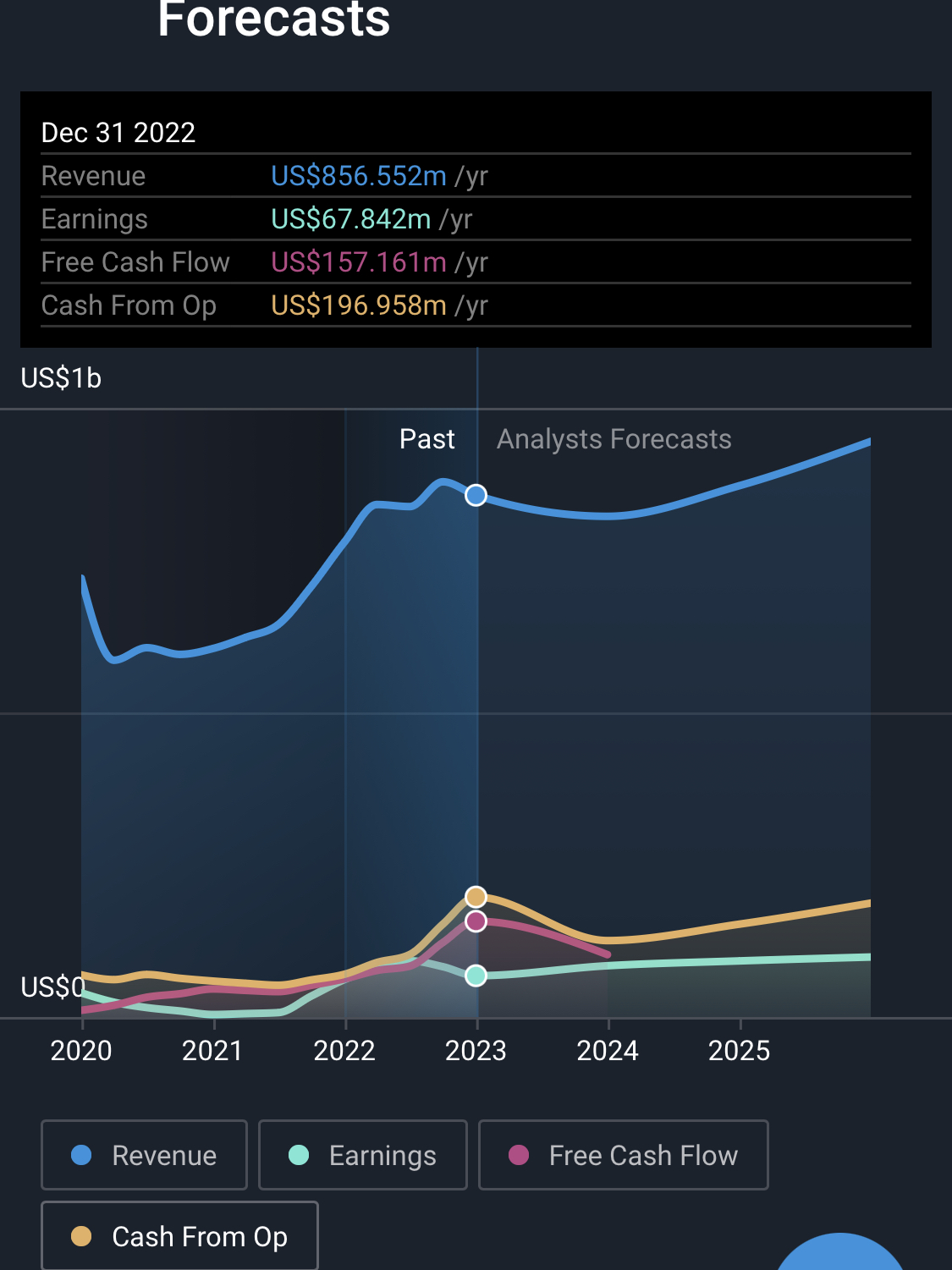

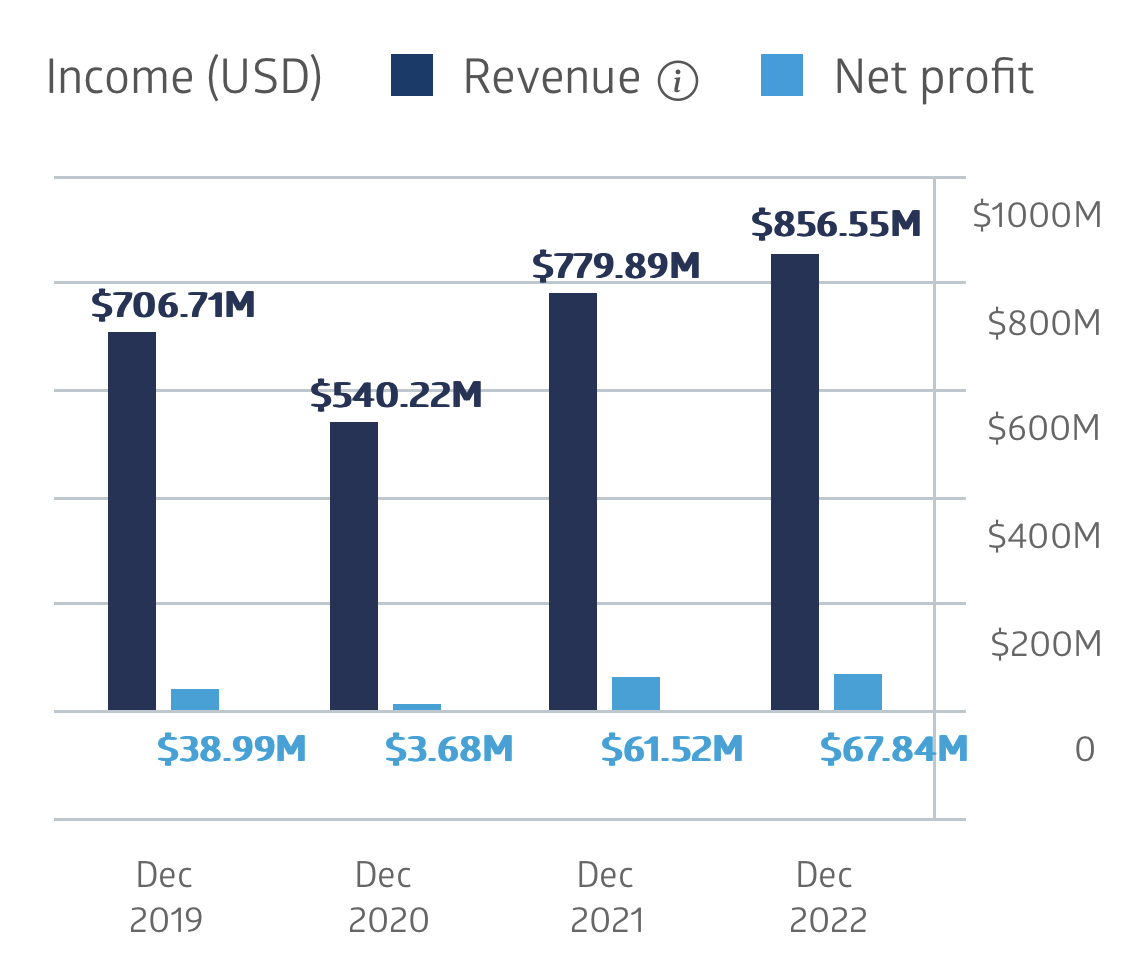

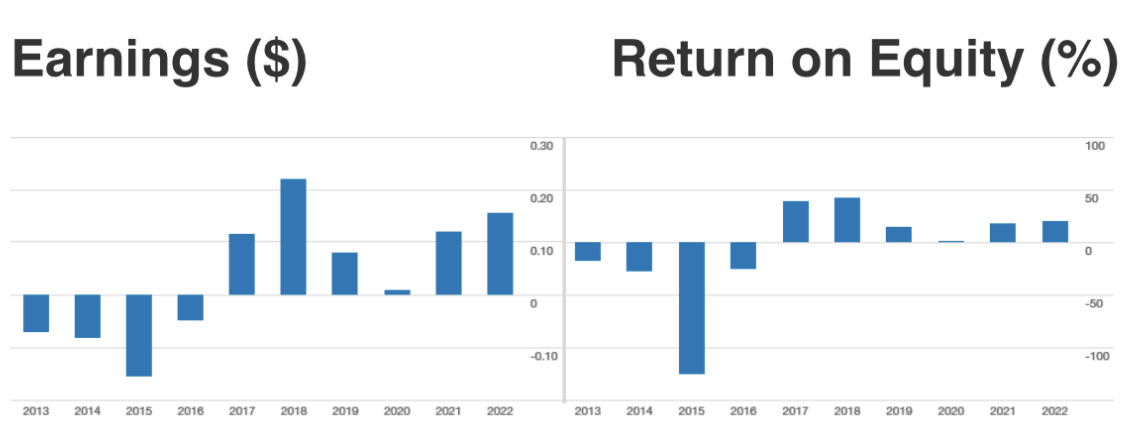

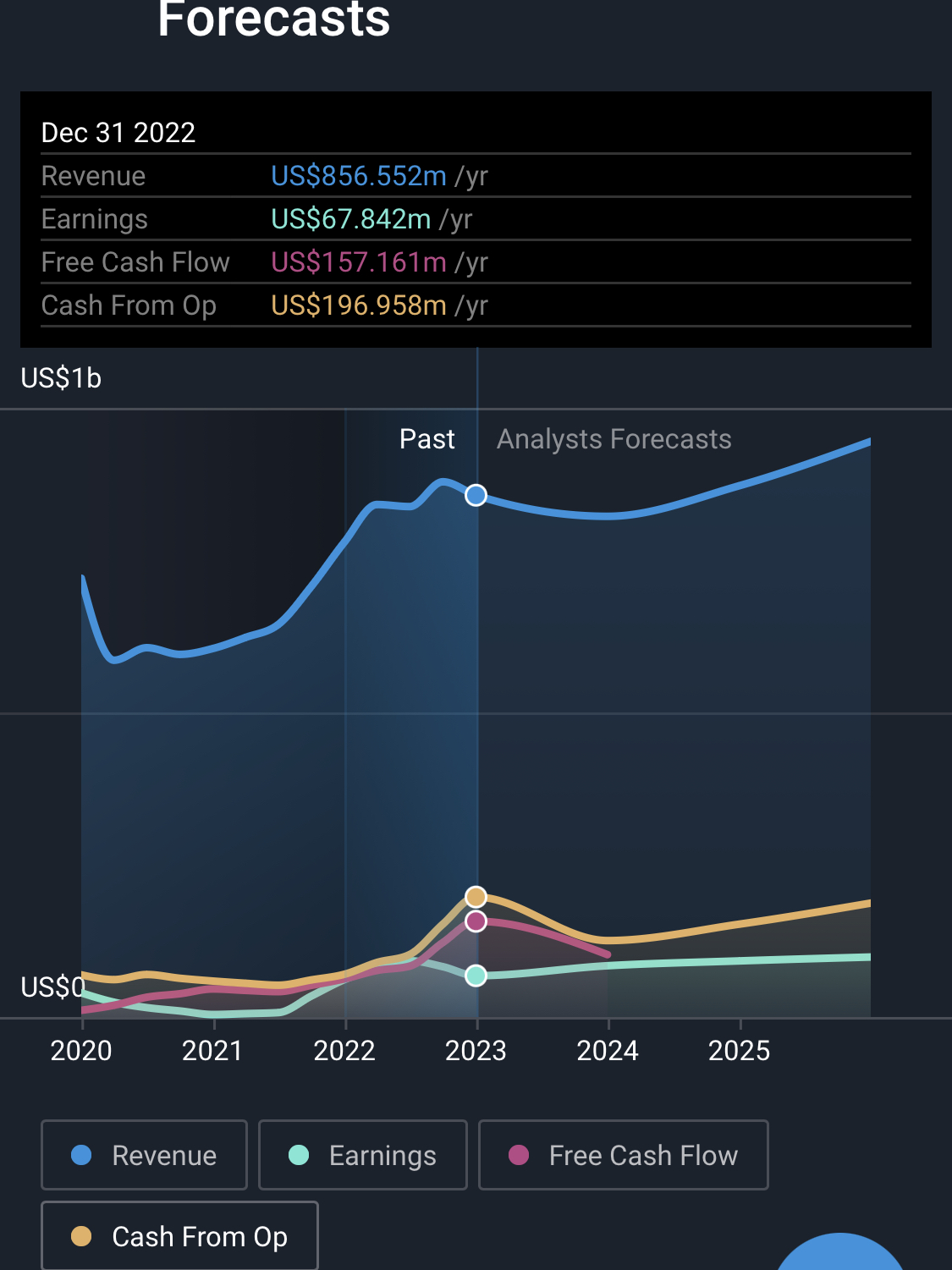

I don’t think this business is for the faint hearted however revenue growth, profits and ROE over the past few years have been very solid. I expect revenue and earnings could be choppy if the past is an any indicator.

ROE over the past 2 years has been 18% and 20%. There are only a few analysts covering it, but they think earnings will grow by 12% per year over the next year or two. That puts forward ROE at around 17%.

Debt on equity is high at 63.7% although it has been reducing debt over the last 5 years. Cash has increased to US $81.5 million which offsets some of the debt, net debt on equity of 48%. This is higher than I like in the current economy.

The forecasts are for strong free cash flows in 2023, over 10% of revenue. Gross margins are 24% and net profit margin is 8%.

The business is trading at 55 cps which is less than book value of 79 cps. It sounds incredibly cheap.

It pays an unfranked dividend of 2.7% at a low payout ratio of 11%. Around 90% of earnings are reinvested.

I thought it looked like an interesting business to follow so I took a nibble late last week. I will continue to explore and research it from here. I don’t think it will ever be a large part of my portfolio, until I see the debt come down at least.

@PortfolioPlus knows it much better than I do and might have more useful information to add! :)

Disc: IRL 0.2%