After hearing the rejected the buyout offer a few weeks ago, I was interested to log in this morning to see that they have sold off their OPS Business (Announcement) for a massive $1.775bn.

Its great to hear that they are focussing on the higher margin area of the business, and using $150m to go towards increasing the bottle and can area of the business.

Key Takeaways:

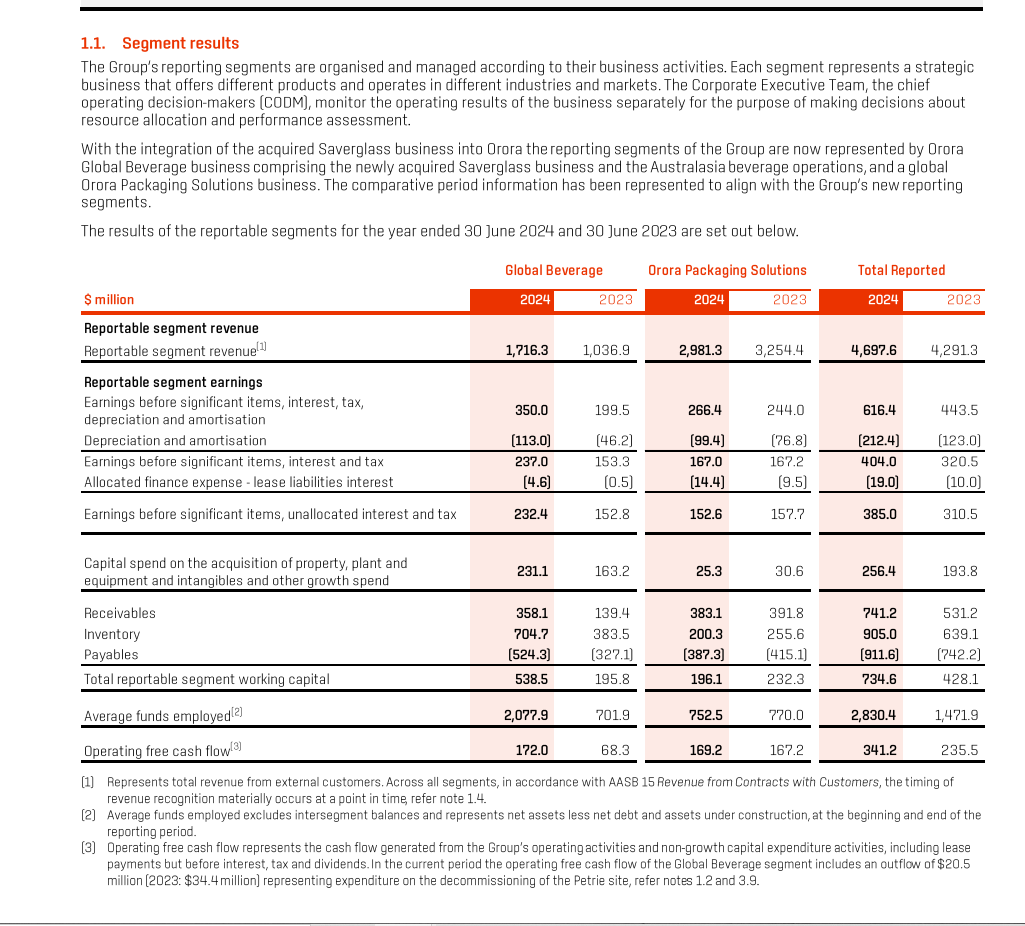

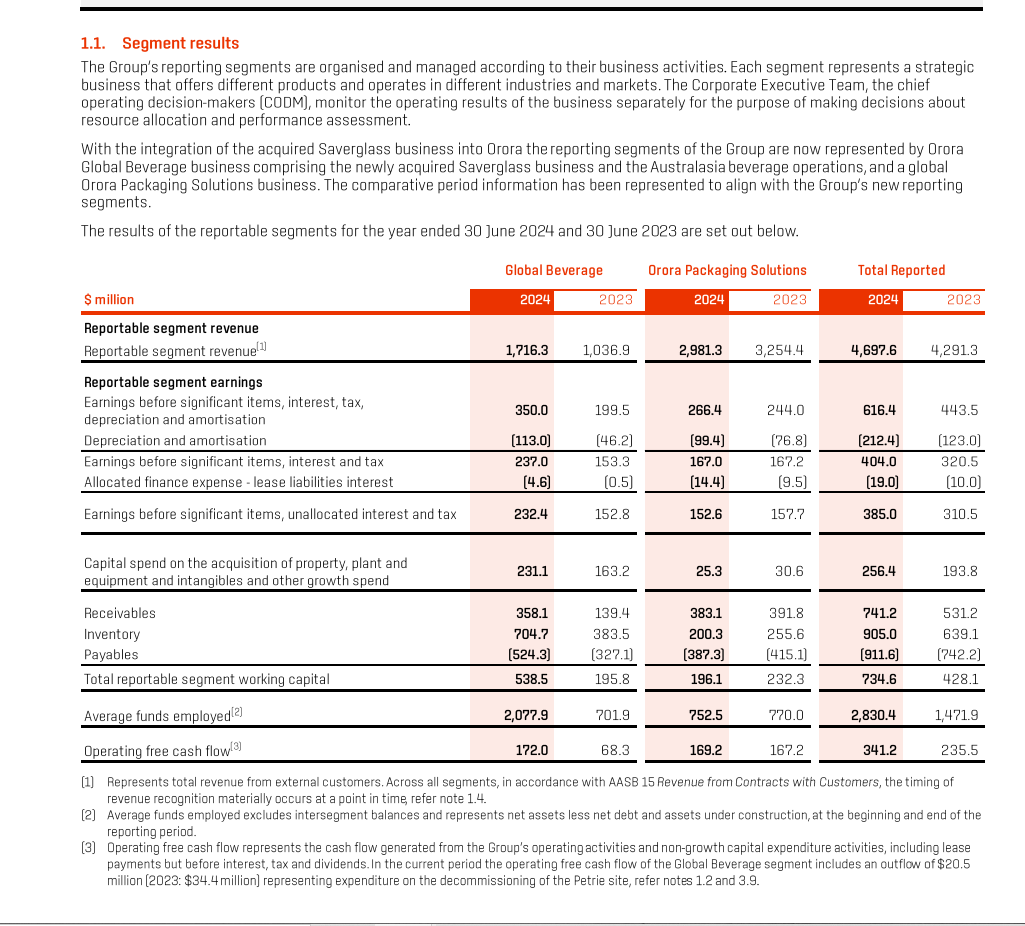

- Pivoting to become a beverage package business

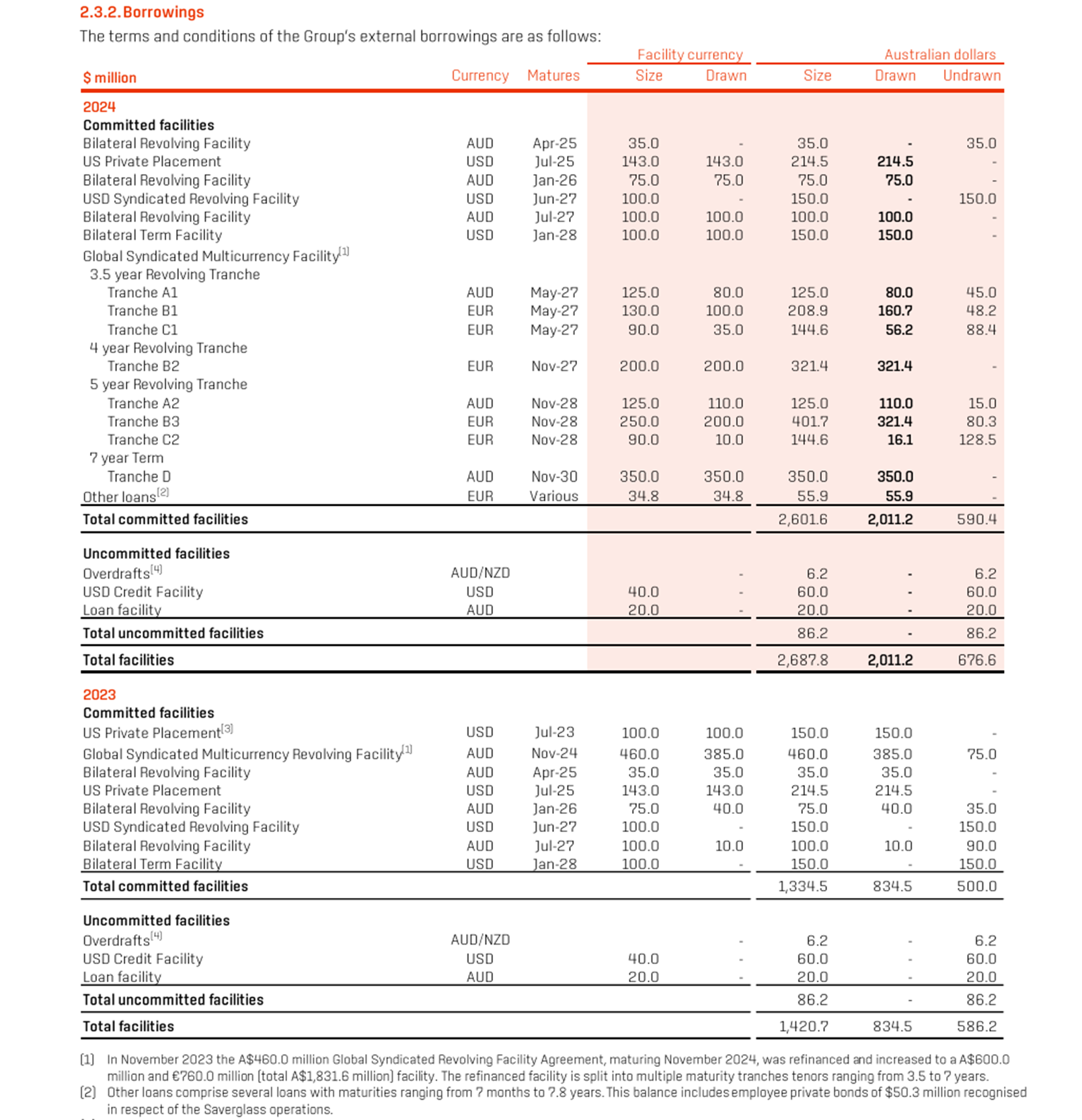

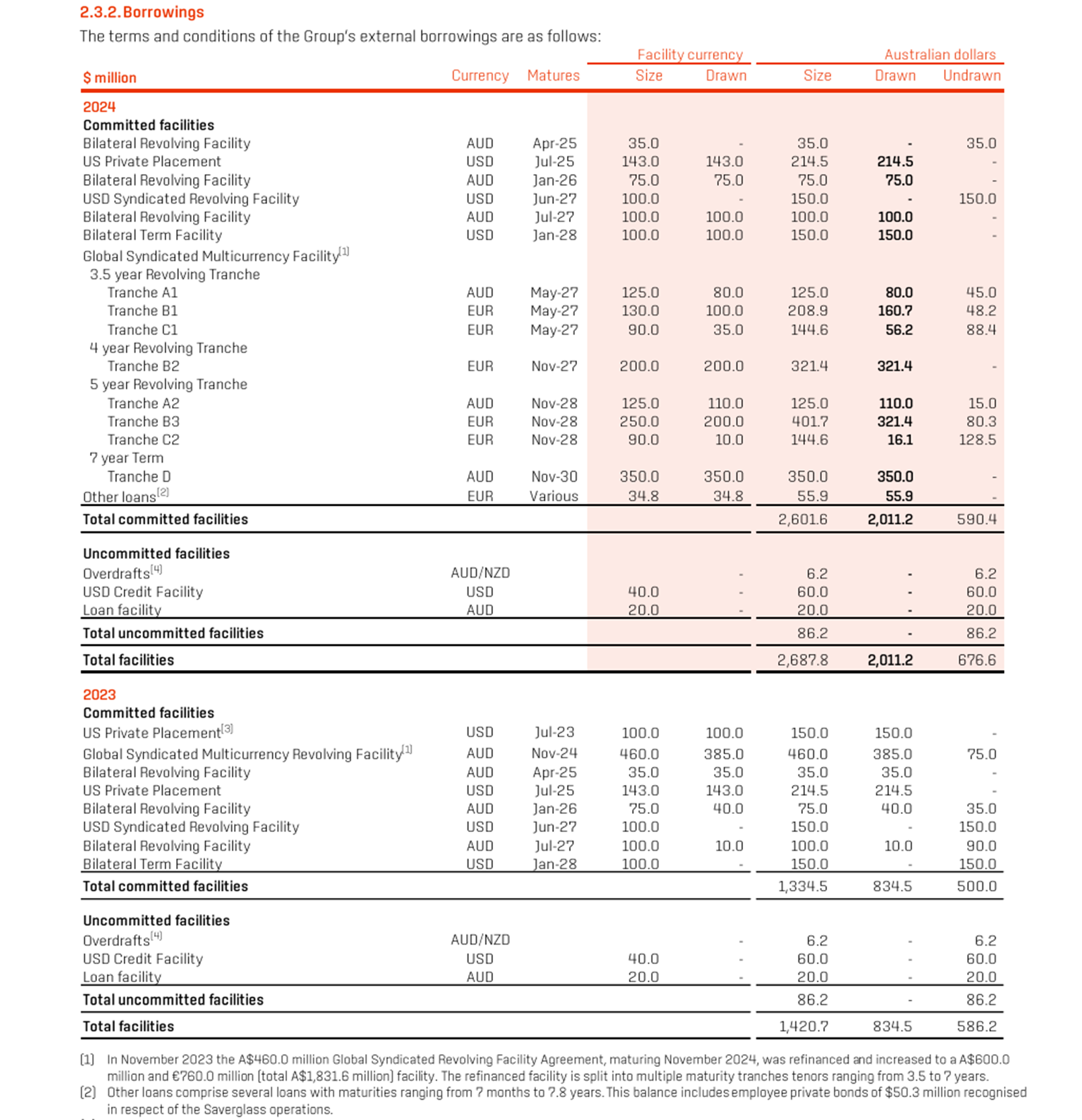

- Great balance sheet outcome with the ability to pay down some of the huge debt that funded the Saverglass transaction.

- A minimum of $62.5m if the deal doesn't go ahead

- Intention to distribute surplus proceeds from the transaction to shareholders over time in the best tax effective manner (likely to be increased dividend which is likely to be greater than the 5% at hand

From the latest figures in their Annual report, they will lose revenue of $1.9545b and EBIT of $109.5m USD per annum. They will also be making a significant dent in the debt, headcount and assets/equipment. The EBIT from OPS however represents a significant chunk of the current revenue that they generate for the business.

The sale also prompts me to think about the following questions:

- What will their EPS would look like next year?

- Are they just distributing the money or will they consider purchasing

- other companies that further expand their bottle manufacturing?

- Will they buy back some of the 498 million shares that were issued for the Saverglass purchase?

- How much of the debt can they (and will they) be paying down over the coming years (see image below)?

- What will their capital expenditure look like in 3-5 years post asset sale?

From my perspective, whilst the short term distribution might be a great sugar hit for investors, if they intend to just distribute the $$ to the shareholders it is likely that their EPS wont be huge over the following years. My gut feel is that NPAT post sale (excluding sale proceeds) and expansion opportunities would be around the $125-135m mark (based on current 66% EBIT margin) in a couple of years once the sale proceeds have been distributed. This would equate to EPS of 9c per share and with current PE of 12 applied, would work out to a valuation circa $1.20.

I will definitely be following future announcements about intentions with the capital before working out what to do with this one. Keen to see if anyone else has done any analysis, thoughts, or has been through something similar with another company.

Disclosure - Very small shareholding RL