ASX - For immediate release 11 November 2025 PRO-PAC PACKAGING LIMITED (ADMINISTRATORS APPOINTED) REPORTING AND AGM OBLIGATIONS

Pro-Pac Packaging Limited (Administrators Appointed) (ASX: PPG) (Pro-Pac) refers to its announcement of 23 October 2025 confirming the appointment of McGrathNicol partners Keith Crawford (all entities), Rob Smith (AU entities only), Andrew Grenfell (NZ entities only) and Kare Johnstone (NZ entities only) as Joint and Several Voluntary Administrators (Administrators).

The Administrators announce that, as a result of the appointment of Administrators and their role in managing and overseeing Pro-Pac, the role of Chief Executive Officer has been made redundant. Ian Shannon’s last day with Pro-Pac was Friday, 7 November 2025.

PRO-PAC PACKAGING LIMITED (ASX:PPG) - Ann: Redundancy of CEO, page-1 - HotCopper | ASX Share Prices, Stock Market & Share Trading Forum

PRO-PAC PACKAGING LIMITED (ASX:PPG) - Ann: Quarterly Activities/Appendix 4C Cash Flow Report, page-1 - HotCopper | ASX Share Prices, Stock Market & Share Trading Forum

31 July 2025 Pro-Pac Packaging Limited (ASX:PPG, “the Company”) provides the following update on its activities for the quarter ended 30 June 2025. Summary

Revenue was $62.8 million, an increase of $0.3 million compared with the previous quarter ($62.5 million).

During the quarter ended 30 June 2025, the Company received $3.5 million (plus GST) proceeds from Government Grants. As at 30 June 2025 the Company had cash on hand of $3.8 million and unused facilities of $6.1 million (refer to Item 7.5).

On 31 July 2025 the Company entered into a short-term financing facility of up to $3.0 million with its major shareholder Bennamon Pty Ltd (Bennamon).

Cash flows from operating activities for the quarter represented an inflow of $0.9 million, which included $3.0 million of monies received from a long-standing customer for sales made prior to December 2024.

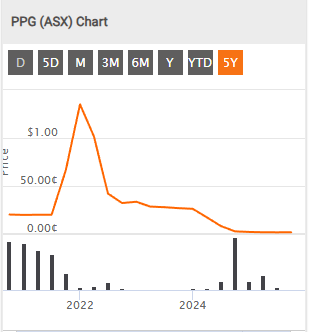

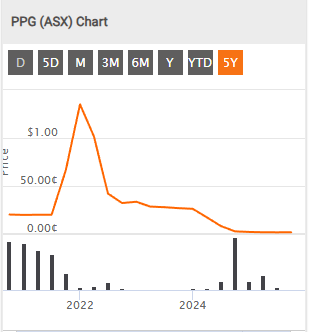

5 year chart