Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Whilst PTN still trades at a discount to valuation, upon a review post conference last week, I have take the opportunity to sell the recent pump and have cash ready for the next opportunity.

I think there will be ongoing challenges with governance and effort in progressing assets at the company.

They have proven to be very slow and doing very little and communication isn't overly consistent. A lack of execution makes An example is the scoping work at the WA gold which was first flagged late last year, by mid this year there was little mention whilst now its highlighted again. It feels like a carrot dangle tool as needed because it shouldn't take a year to do a study on mining to toll. Another is the deep drilling Thunderball, very light on detail on what is or has happened around that and it has taken forever to still be month away from a big drill out.

I also have a feeling PTN is cannon fodder to set up a contested bid for GPR. Whilst the deal was technically accretive, it has ultimately been very favourable for SBM whilst the Germans that effectively run PTN, didn't pro-rata the set up.

Overall, I think PTN may end up being a stock that trades at a permanent discount of some size as a function of these challenges. For me, it was a risk I took but the opportunity cost has piled up, only making a meagre return in such a strong gold bull market.

n.b. I may have put the low in for a big re-rate lol.

Current (June 25): lifted val to $0.13 post the share swap deal with SBM

Apr 26: updated to include ERM holding plus tweaked a few other asset value assumptions and corrected one error from a data pull through issue. Success on Koi ET can add $0.008 to $0.043/sh to this value. Valuation methodology also understates value of WA gold resources if they were to be toll treated.

Feb 25: Update to last val to incorporate a year of moving and shaking from PTN (formerly KIN). Increased from $0.079 to $0.11/sh despite the dilution of the PNX acquisition.

I tell ya what, PTN was one of the most boring and uninspiring presentations last week on the GC but the boomers have frothed it. Will take closing the valuation gap any way it comes!

PTN announced a deal with SBM whereby PTN will give SBM ~459m shares in GPR (PTN held 500m) for SBM's holding of ~158m shares in PTN. This lifts the val of PTN to $0.130/sh from $0.119/sh. Assuming $0.20/sh for GPR, this implies a value of $0.058/sh for PTN which is modest premium to the price prior to the deal. Accretive hence the uplift in NAV for PTN.

Next thinking is that maybe this sets up GPR to be bid by SBM and with a residual holding of ~41m, PTN can still get some upside on a deal for helping to facilitate it through the sale to SBM.

PTN released an exploration target (ET) on the Koi shoot sitting underneath the Mertondale orebody. ETs are growing in popularity given the tightening of estimation under the JORC code due to RPEE considerations.

The quality of the ET depends on the inputs and parameters of estimation. As such, ETs sit of a spectrum with robust at one ends and loose as fuck at the other. In the case of PTN, the inputs used (15 RC and 7 diamond holes) and the way they detail estimation parameters, makes me think this ET is somewhere on the robust half of the spectrum.

The ET details that the Koi target to range between 150koz and 800koz. Tonnage and grade vary to get these estimates and that it typical of an ET estimation.

The next thought is about “Turning Exploration into Valuation”. Ascribing immediate value to an ET is hard and the shorthand way is to slap a $/oz metric on the midpoint of the range. This is the method I have used to build out the SOTP valuation I have for PTN.

Given its and ET, that value will be low and I would say under A$20/oz (note there are juniors with defined JORCs, albeit small, that trade in the A$10-20/oz range). Using A$10/oz, the range is A$1.5m to A$8m with a midpoint of A$4.1m of $0.003/sh which barely moves the dial. And so it probably should.

Next step is valuation upon success of converting the ET into JORC defined resources. PTN states it has commenced further drilling to support converting the ET although the scope of the drilling required to do this remains unclear.

On a success basis, what would these ounces be worth. I use A$88/oz to value the existing Mertondale JORC resource, which is based on the last sale of gold in ground PTN did with GMD and is lower than the medium valuation of Aussie gold M&A since 2020. This gives a low and high unrisked valuation of A$13m to A$70m or $0.008/sh to $0.043/sh respectively. The midpoint is A$36m for $0.022/sh. This shows how exploration success can become meaningful to the valuation for PTN.

I note a few million will have to be spent on drilling (will include several deep diamond holes) but the RoI on exploration spend on proving out the Koi Target is likely asymmetric to the upside. With $64m cash on hand, PTN has the capital to do it.

At current, PTN is best value using a SoTP method given its a mix of cash, equity investments and gold in the ground. The breakdown to achieving a valuation of $0.111/sh is below. EV of PTN is marginally higher than the value of the existing cash and equity positions. As such, the gold is free and has some decent value if sold off to a nearby producer or if PTN changes tack and embarks on doing its own mining and tolling which is super in vogue atm.

11-Aug-2024: Strategic Consolidation to Create a Diversified Resources Co

https://www.patronusresources.com.au/

Disclosure: I do hold some KIN shares as a punt rather than an investment - interesting name change - don't know what the deal is with changing their name to "Patronus Resources" but "Kin Mining" wasn't a particularly inspiring name so perhaps they're trying to "conjour up" some interest amongst a new demographic...

Video from KIN's consultant for the VMS targets.

https://www.youtube.com/watch?v=X1gf1YqwBMc&ab_channel=TheAustralianInstituteofGeoscientists

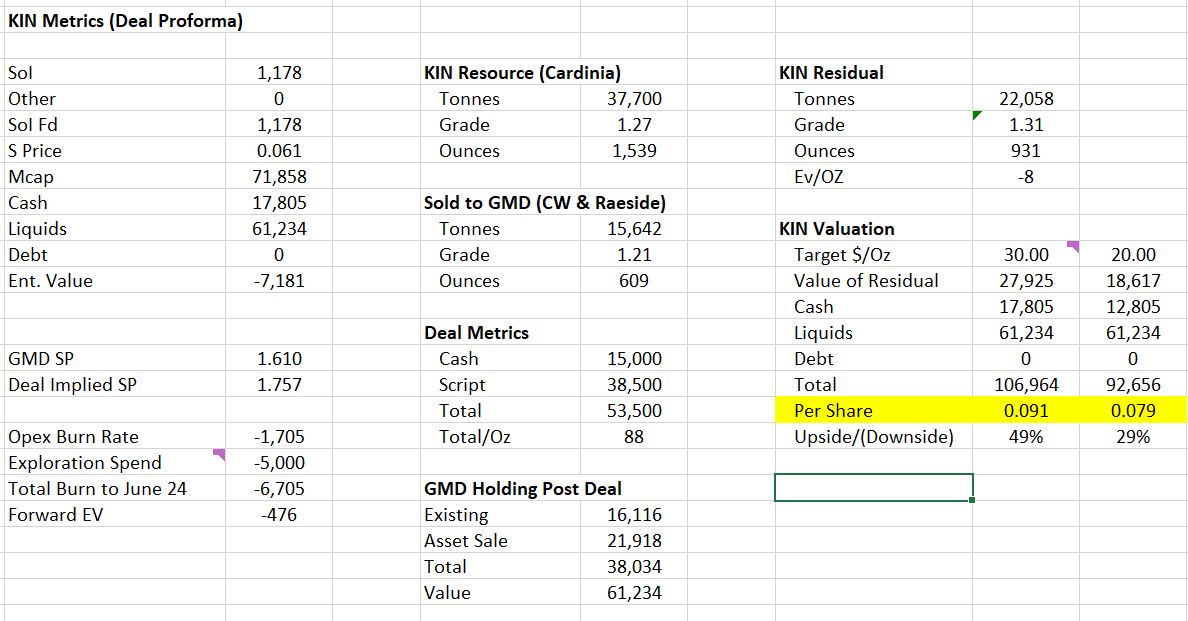

KIN sold some ounces to GMD last last year for $15m cash and $38.5m in GMD script (no escrow). Deal expected to close towards end of Feb or early March. KIN left with 931koz post deal on the eastern part of the Cardinia project.

Now cashed up, KIN is looking to improve the quality of the remaining ounces (real test of depth and upgrading indicated level, mine planning and permitting) so as to either support a standalone or make those ounces marketable to a 3rd part.

More excitingly is that post a little refresher of management, they did a blank slate on exploration thinking with a view to consider any and all potential on the tenements. This led to the reassaying of a hole from late 2022 which was only tested for gold. At the time, the sulphides encountered were marked largely at pyrite and associated with the gold hit. Upon reanalysis in late 2023/early 2024, assay returned 5.7m @ 5.3% Zn, 0.34% Cu, 0.3% Pb, 40 g/t Ag, 1g/t Au whilst broader analysis led to the view this was likely a VMS style system that was encountered. Follow up drilling on the target, now named Albus, is currently underway. This program also includes a few deeper holes on the nearby gold deposits of Helens and Cardinia East.

In essence, post deal closure, KIN trades at a discount to cash + liquids whilst it offers company making potential with a sniff of a VMS discovery to follow up on. If a proper commercial discovery is made, KIN can fully fund an aggressive drill out. This is a case of heads I win a lot or tails I lose a bit as the downside is protected with tangible and liquid assets.

Some would this is aKIN to the STK trade set up from mid 2023.

Risks include GMD deal flopping on the last mile, Albus follow up drilling disappointing, subsequent downhole EM showing weak conductors and deeper gold holes coming up light.

Latest preso: https://announcements.asx.com.au/asxpdf/20240201/pdf/05zzj7n8njf5tt.pdf

Albus update: https://announcements.asx.com.au/asxpdf/20240129/pdf/05zt2kc1r2h01d.pdf

Albus assays: https://announcements.asx.com.au/asxpdf/20240108/pdf/05z7nvns2l87x3.pdf

GMD deal: https://announcements.asx.com.au/asxpdf/20231214/pdf/05yjyrlpxr95bj.pdf

27-May-2020: Bonanza Gold Intercept at Comedy King, CGP

Also, recently: 20-May-2020 (1 week ago): Investor Presentation

I held shares in KIN Mining a couple of years ago, but have not been following them recently. These drilling results are impressive, particularly the 4m at 113g/t Au from 0m (at surface!) from air-core drilling and the 2m at 8.10g/t Au from 37m from their RC (reverse circulation) drilling isn't to be sneezed at either. Might be worth another look. Not a producer yet, but their 100%-owned Cardinia Gold Project ("CGP"), 30km from Leonora in WA - a Tier-1 Australian gold mining district - looks promising. They also own a strategic 436 square kilometre land package, so there is certainly potential further exploration upside there. Time to dig a little deeper...