Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

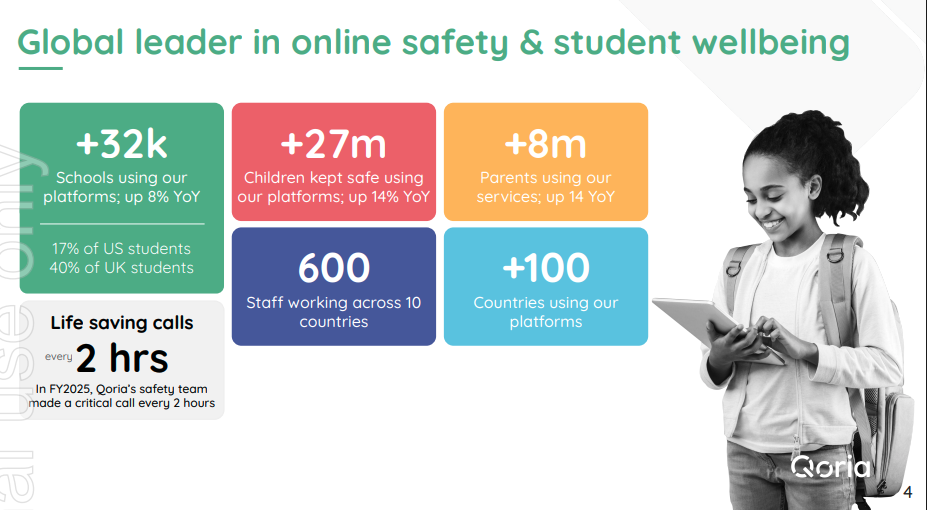

As the grandmother of 4 kids heading towards digital-age, my interest was piqued by Qoria. IR, I’ve held it for over 18 months, and so far, I’m pleased by the steady-as-she-goes execution.

Below are the highlights from the latest quarterly.

All good. What’s not to like? They also put up a detailed breakdown of their cashflow, line by line, which they went through in yesterday’s investor call. That really helped understanding where the costs in the business were and how the various items were changing with time.

I’ve checked out Qustodio (odd name but it resonates with what it does). Custodial control of your kids’ access to the internet (on any device) via an app (on your phone). I’m not surprised it’s ramping up in sales (annualized ARR growth of 33%).

During the call, they indicated they were expecting to inflect into profit this financial year (although they still expect Q3 to be negative). The numbers seem to support that outlook. Note: they have been a VERY seasonal business as so much of the K12 sales (max currently in the US) are to/via schools and school districts, and those tend to be finalized in the June quarter. In contrast, Qustodia sales/expansion peaks in the Dec quarter due to Black Friday and Christmas buying of kids’ new personal devices. So the growth in Qustodia is starting to smooth out their quarters.

Disl: Held IRL and on SM.

Current Market Cap of $833m

Management Bio's

Mr Tim Levy – Managing Director

Mr Levy is a successful telecommunications and technology entrepreneur. He is the founder of Vodafone’s largest Australian retail partner Mo’s Mobiles and was the former CEO and COO of listed Optus reseller B Digital Limited. Prior to working in commerce, Mr Levy was a management consultant at Andersen’s working in technology and change projects across Australia, South Africa, Zambia, Jordan and Saudi Arabia. Mr Levy is a graduate of the University of Western Australia and was a practising Chartered Accountant prior to his move into commerce.

Other current directorships of ASX listed companies

• None

Other directorships held in ASX listed companies in the last three years

• None

Mr Peter Pawlowitsch – Independent Non-Executive Chairman

Mr Pawlowitsch is an experienced ASX company Director. He specialises in technology businesses and the transition from startup to sustainability with over 20 years of experience. He has extensive experience in assessing and negotiating acquisitions, which has been important as Qoria has grown via organic and acquisition-led growth. Having lived and worked in 9 different countries, he brings valuable cross-cultural expertise. He is also a Fellow of the Governance Institute of Australia and holds an MBA from Curtin University. He has over 20 years of experience in accounting and business management.

Other current directorships of ASX listed companies

• VRX Silica Limited (Non-Executive Director, Feb 2010 – present)

• Novatti Group Limited (Non-Executive Chairman, Jun 2015 – present)

• Fortuna Metals Limited (Non-Executive Chairman, May 2025 – present)

Other directorships held in ASX listed companies in the last three years

• Dubber Corporation Limited (Sept 2011 – Dec 2024)

Mr Phil Warren – Independent Non-Executive Director

Mr Warren is a Chartered Accountant with more than 20 years’ experience in equity markets, M&A, and corporate finance. He is the founder and Managing Director of Quiddity Capital, an investment and corporate advisory firm. His experience spans multiple sectors with deep knowledge of ASX capital markets.

Other current directorships of ASX listed companies

• Rent.com.au Limited (Nov 2014 – present)

• Anax Metals Limited (Apr 2019 – present)

• Narryer Metals Limited (Aug 2021 – present)

• Killi Resources Limited (Aug 2021 – present)

Other directorships held in ASX listed companies in the last three years

• None

Mr Matthew Stepka – Independent Non-Executive Director

Mr Stepka is Managing Director of Machina Ventures, investing in AI startups. He is a former Vice President at Google, where he worked on strategy and operations, helping incubate high-impact new initiatives. He has also been a management consultant at McKinsey & PwC, a practicing attorney, and a lecturer at the University of California, Berkeley (Haas School of Business). He brings expertise in AI, technology disruption, and strategic growth.

Other current directorships of ASX listed companies

• None

Other directorships held in ASX listed companies in the last three years

• None

Mr Georg Ell – Independent Non-Executive Director (Independent from Jan 2025)

Mr Ell was the CEO of Smoothwall (UK), acquired by Qoria in 2021. He was formerly Director, Western Europe at Tesla, scaling operations across 5 countries, and GM EMEA at Yammer until its acquisition by Microsoft. He is currently CEO of Phrase, a SaaS AI-driven localisation platform (Carlyle-backed). He brings strong SaaS scaling, M&A, and customer success expertise.

Other current directorships of ASX listed companies

• None

Other directorships held in ASX listed companies in the last three years

• None

Dr Jane Watts – Independent Non-Executive Director

Dr Watts has over 30 years’ experience in banking and financial services, having held senior executive roles at Westpac, Macquarie, and Lendlease. Most recently she was Chief Customer Engagement Officer at Westpac/BT Financial. She also serves on the board of Orygen, the world’s largest youth mental health translational research institute, giving her unique insight into youth wellbeing — directly relevant to Qoria’s mission. She brings risk oversight, governance, and P&L leadership expertise.

Other current directorships of ASX listed companies

• Liberty Financial Group Limited (Non-Executive Director, Jul 2022 – present)

Other directorships held in ASX listed companies in the last three years

• None

Qoria (QOR) has just broken through the 50c barrier on good volume - it's made a couple of attempts at it over the last few months. So a nice bullish chart, and popular with the fund managers too I gather:

"Qoria provides filtering and monitoring technology... Teachers are struggling to control what their students are looking at, and also bullying and cyber safety are huge issues not only in the US but globally as well. Qoria is a market leader in that segment - they've got a 13% market share in the US, and just under 40% in the UK. They're quite large in Australia as well, with a 20% market share."

https://www.livewiremarkets.com/wires/18-stocks-backed-by-a-fund-that-returned-42-in-12-months

“We have Qoria, which is a stock I've been hearing a lot about lately. A lot of fund managers are liking it right now. It's the old Family Zone business focused on cyber safety for kids.”

“You've got 120 million ARR, which is huge. It's a global business with legislative tailwinds, the balance sheet is strong, free cash flow is growing. As I said, the best shape it's been in there a long time.”

“I think it's a takeout target, so hence why it's a buy for us.”

https://www.livewiremarkets.com/wires/buy-hold-sell-5-of-the-asx-s-fastest-growing-small-caps

(I hold QOR in RL)

I came across Qoria from listening to the “Talk to Me Money” podcast. I was impressed at the CEO (founder led) who was very bullish on its future.

Although, It has been suggested as a potential take over target I think it fits nicely into a Strawman small cap portfolio.

With the company approaching cash flow positive status and a MC of 500m it seems to be entering its de-risking period making it an interesting stock to potentially hold.

With child safety (bullying) a growing issue (concern) I took a starter position in my SM account to encourage me to do further analysis on the merits of owning this in real life.

Look, I like the FZO story, I really do, but are we being overly enthusiastic about growth?

I think the best representative of past growth and thus some form of marker for future gorwth is the Appendix slide which appeared at the end of the AGM presentation.

Yep, handy growth but not as dazzling as the ARR graph much earlier in the preso which would suggest they are shooting the lights out. Check out the comparisons.

Certainly not suggesting it was deliberate, but might be misleading to a novice or a speed reader who simply scans.