RHY approved to sell their ColoSTAT test in New Zealand. No word yet on when it receives TGA approval. I think the lack of update on TGA and FDA approval is a bit of frustration for shareholders including myself. But maybe a small positive although we don't know how big the market could be in NZ.

Having said that there had been some options conversions which gives RHY more cash but also puts pressure on the share price

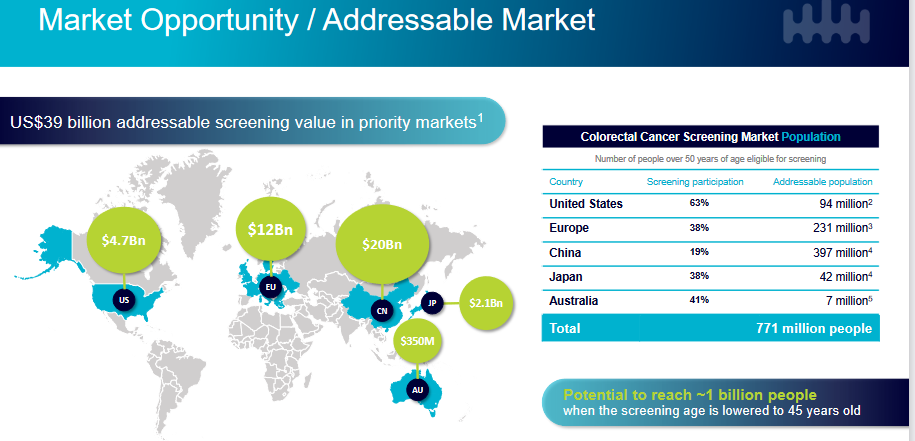

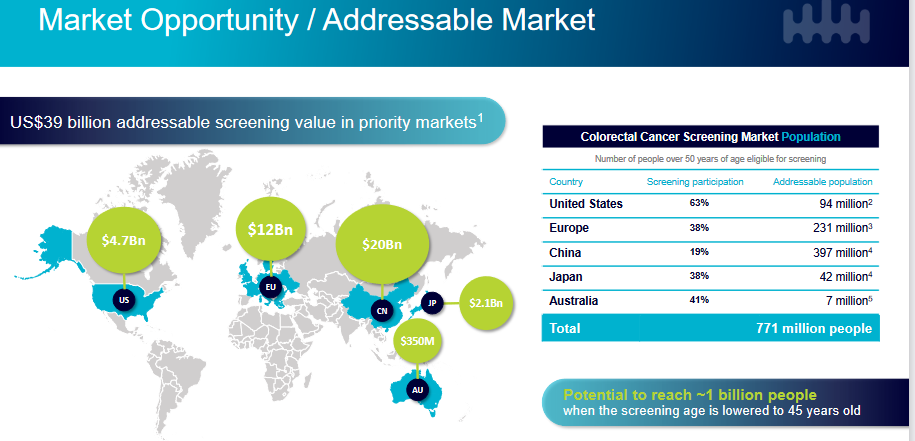

As always, committing the proverbial sin of TAM from the recent Bell Potter healthcare conference. No word on the important TGA approval which also could be hurting the share price. Line on the sand is $1.05 hit in June.

Commentary below from this weeks announcement:

Regulatory Approval in New Zealand

Medsafe is the New Zealand Medicines and Medical Devices Safety Authority. It is a business unit of the Ministry of Health and is the authority responsible for the regulation of therapeutic products in New Zealand.

As a manufacturer of ColoSTAT®, Rhythm has registered with Medsafe and listed ColoSTAT® to its Web Assisted Notification of Devices (WAND) database.

Rhythm has completed the process to achieve authorisation as a manufacturer of ColoSTAT® in New Zealand. The regulatory milestone means that the Company can now:

▪ market ColoSTAT® for sale in New Zealand;

▪ progress pre-sales activities immediately; and

▪ commence partnership discussions.

Commenting on the regulatory milestone, Rhythm CEO and Managing Director, Glenn Gilbert, said:

“Rhythm is pleased to expand its international regulatory approval footprint into New Zealand which enables the Company to commence marketing and sales activities for ColoSTAT®.Bowel cancer is the second highest cause of cancer death in New Zealand and a growing issue with 1 in 10 now diagnosed under the age of 50.ColoSTAT® is a simple blood test which has the potential to make a material impact on health outcomes through mass screening for higher participation to achieve early diagnosis. We look forward to working with the Ministry of Health’s National Screening Unit to enhance New Zealand’s National Bowel Screening Programme

[held]