Many explorers don't go to mine due to many factors. Product Grade, Resource Depth, Geographic Location, License issues, Environmental Issues, Foreign Government Concerns, Cost to Mine etc etc Although RNU is still years away from mining product, its gaining momentum and many of the associated risks with general "investing in explorers" are being ticked off.

This summary on RNU i thought was well put together and worth the share.

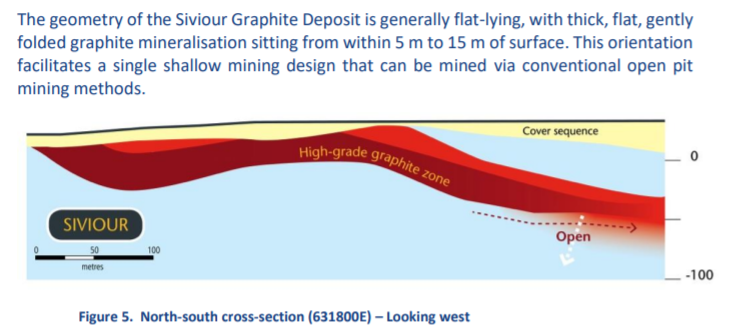

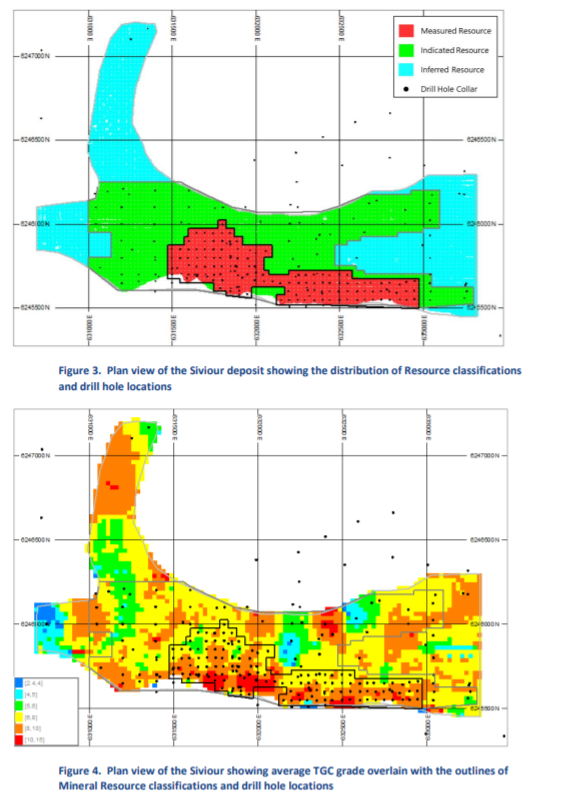

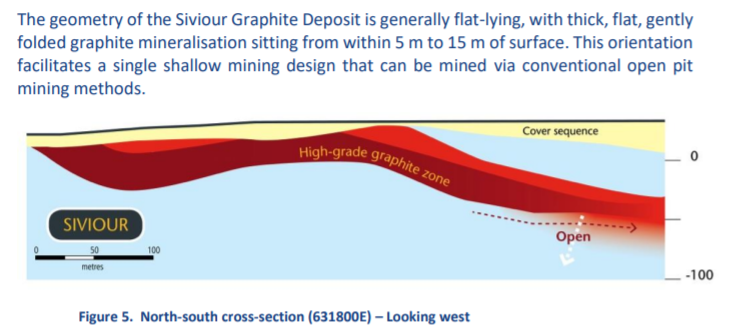

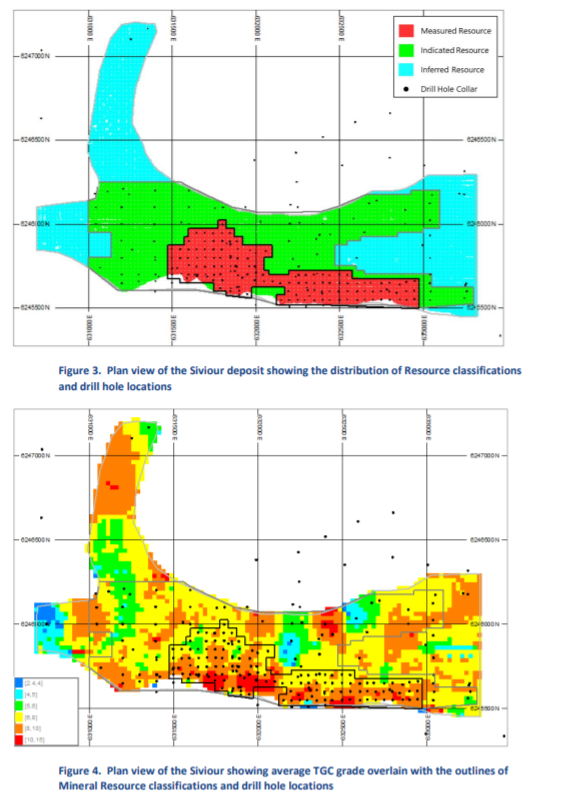

Geology- Without doubt the #1 factor that separates Renascor from its peers is the the flat horizontal in-situ deposit that is located near surface between 5-15m below surface (you can dig it with your shovel), it is a consistent thick band without variability within veins. This is a truly unique resource in the graphite space and resource space in general.

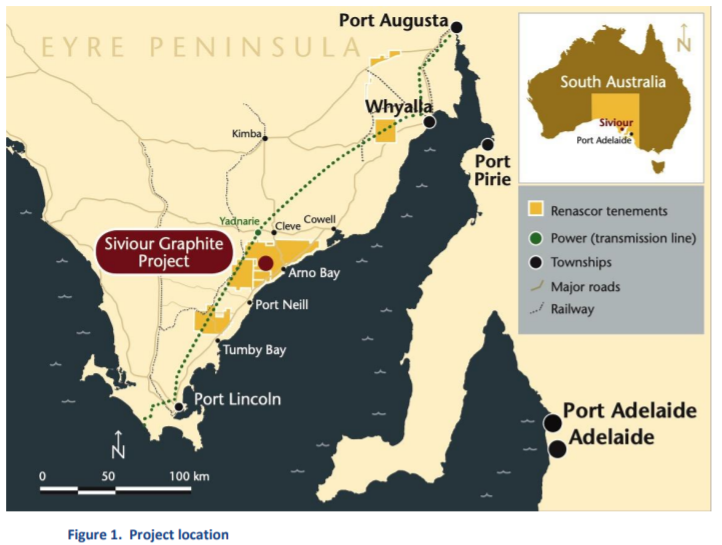

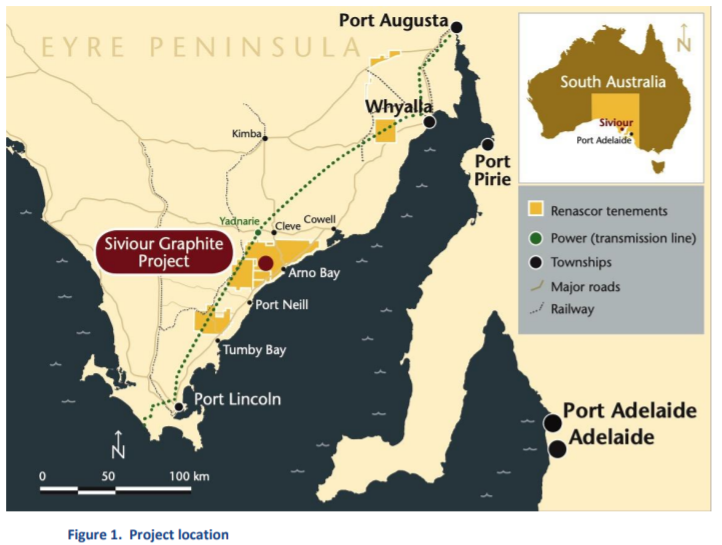

Located in Australia- You cannot in todays modern society undervalue the importance of being situated in a safe, secure and mining friendly jurisdiction such as Australia. Being in Australia provides investors certainty and confidence in the long term for any Company operating here.

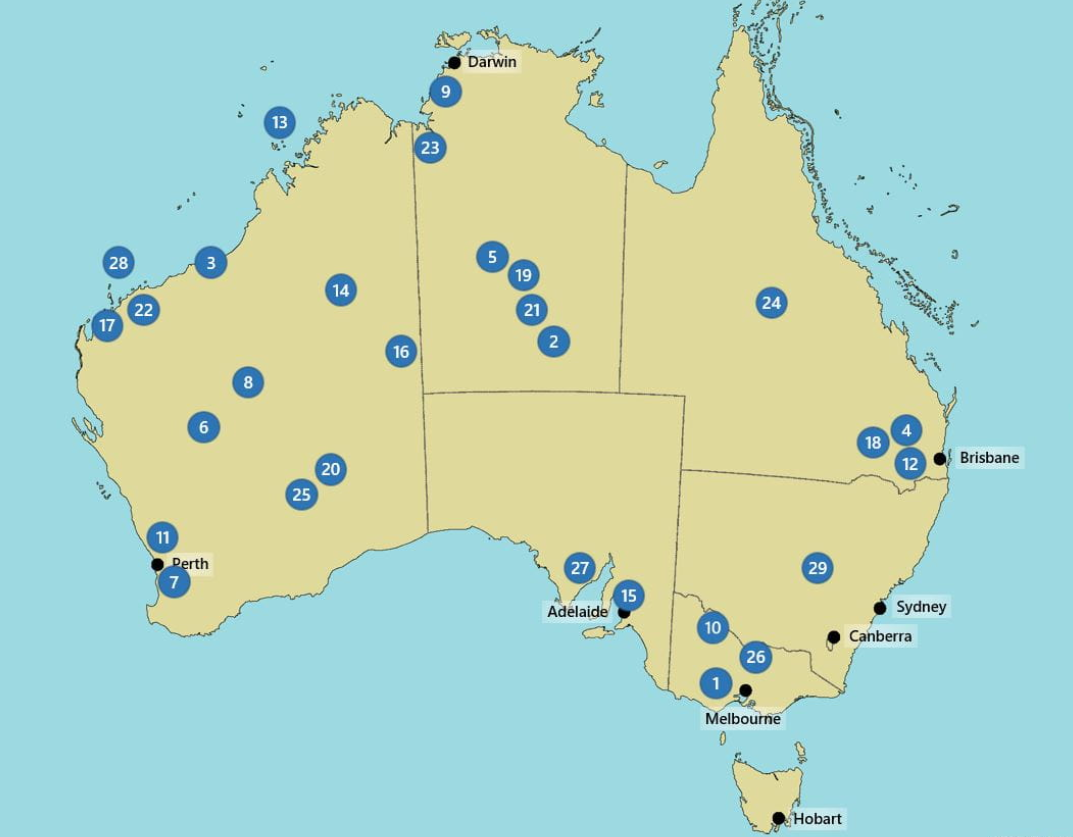

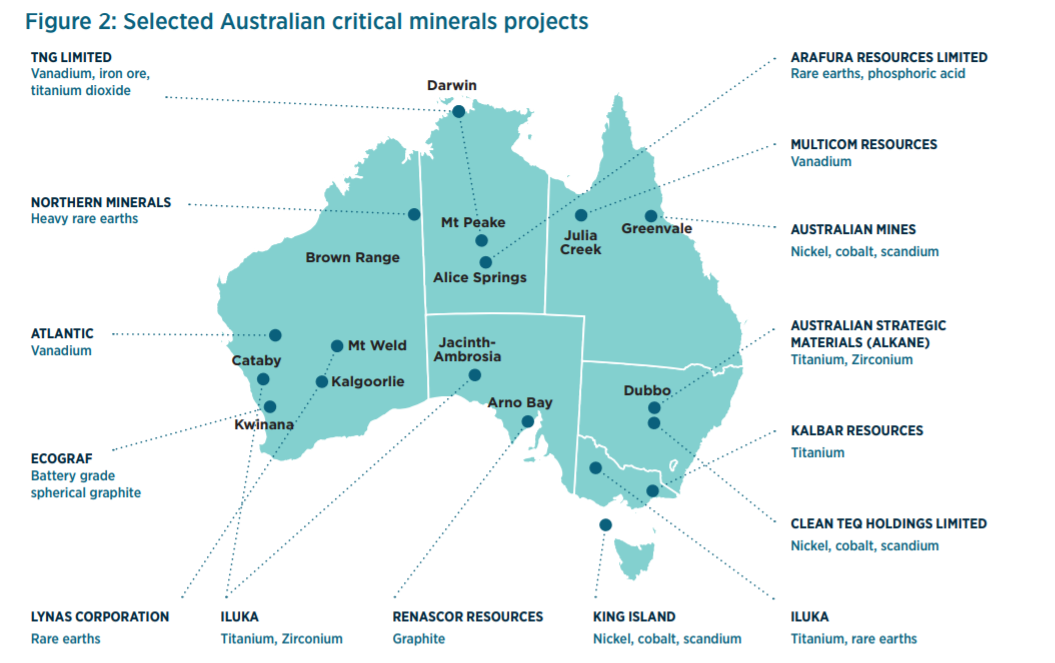

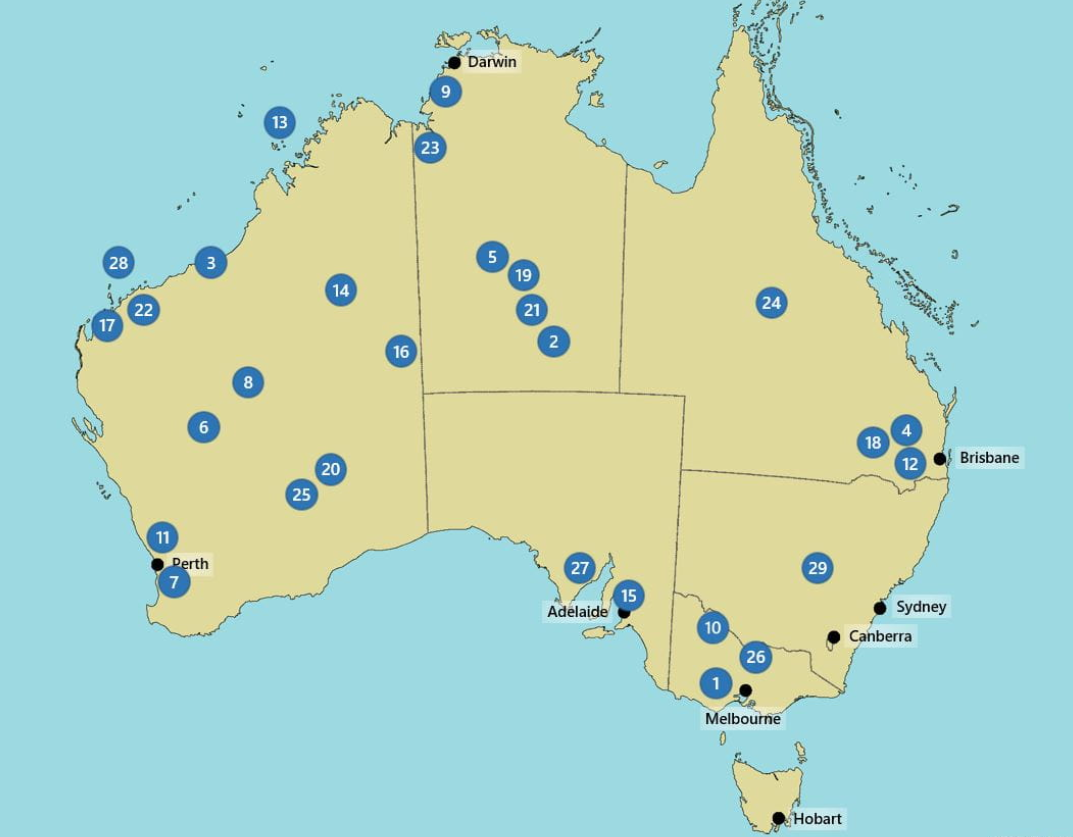

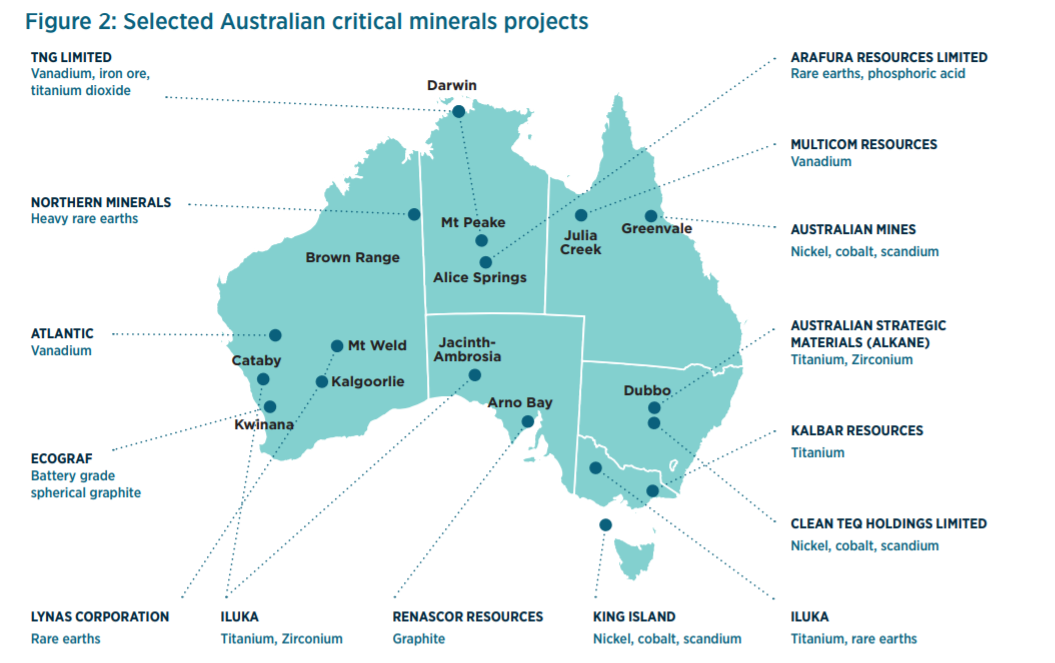

Major Project Status- Renascor is 1 of 29 Projects in Australia that have been granted Recognition from the Australian Federal Government as being economically important to Australia's future. The granting of Major Project Status is that the Federal Government works hand in hand with the 29 companies in securing all necessary state and federal approvals.

Australian Critical Mineral Listing- The Australian Critical Mineral Listing is vitally important for Renascor, it results in us being 1 of only 15 selected projects that are given access to the Department of Industry's AUD$1.3 Billion dollar slush fund to provide low interest finance opportunities for projects that provide critical minerals for Australias economic prosperity. The arrangement also ensures that the Australian Government can assist with various support to any of the 15 projects in terms of further finance, overseas trade negotiations, offtake discussions etc with the full backing of the Australian Government.

Being a Critical Mineral Project also opens avenues for Renascor to secure Finance through the Clean Energy Finance Corporation and Export Finance Australia funding arms (Of which the company already has in-principle support).

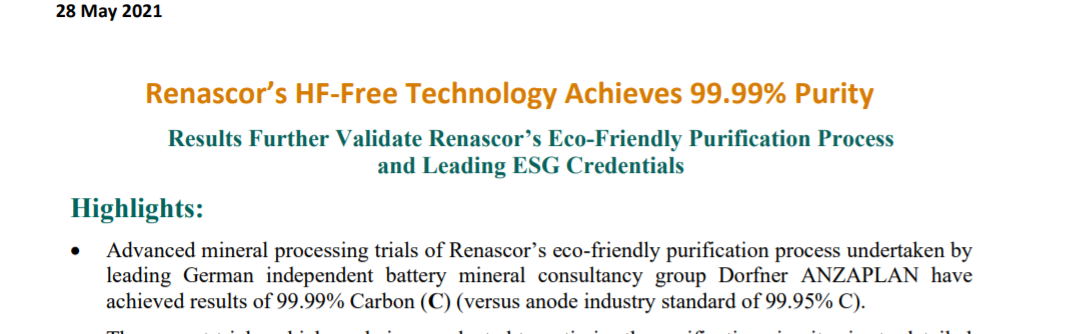

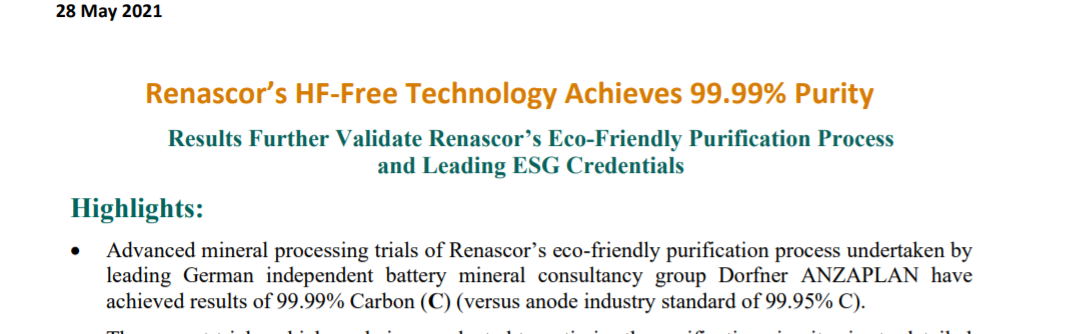

Downstream Purified Spherical Graphite -The company is entering the higher margin downstream processing industry by converting there already high 97.5% Purity Graphite Flake Product, into a world class leading 99.99% Purified Spherical Graphite. The company is unique from other ASX Players who are mining in Africa, then shipping concentrate to Australia or Europe or The USA and then processing, Renascor is on track to become the world’s first integrated, in-country mine and Purified Spherical Graphite operation outside of China i.e. The Mine and Processing Plant are an Hours drive away, not a week by boat.

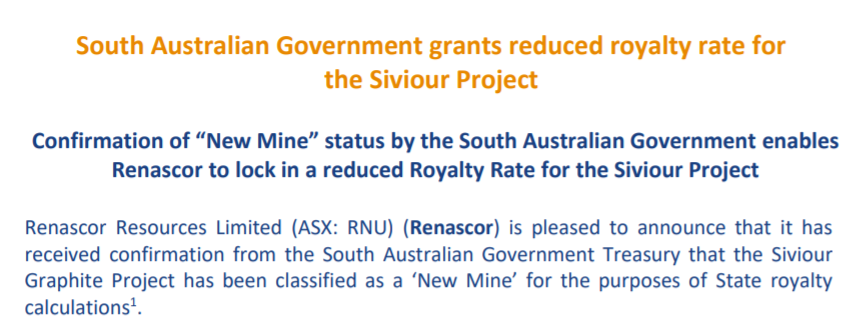

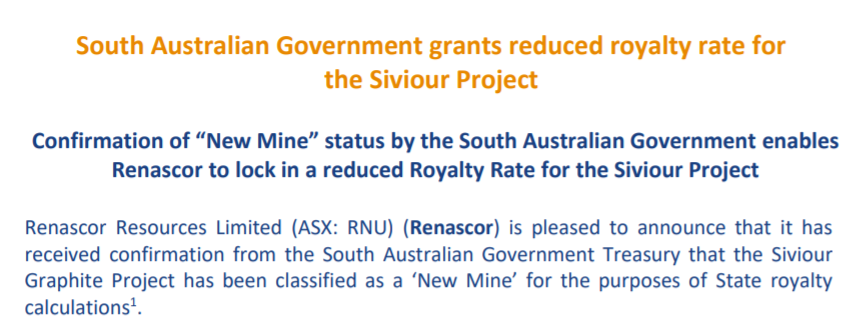

5 Year Royalty Relief from the South Australian Government- In a positive sign and show of support from the South Australian, they have agreed to provide a reduced 2% Royalty rate for a period of 5 years of the Siviour Project.

The Revised DFS- is due this Qtr and it shapes to be a real company maker. With PSG Recoveries increasing by a whooping 20%, and the currently planned Stage 1 of 825ktpa and Stage 2 1.65Mtpa throughputs likely to get a significant uplift given the increasing interest in PSG from outside China. The Currently planned annual production of 28ktpa of PSG is likely to fall in the range of 85-90ktpa PSG (2/3rds of which is already under non-binding offtake), with strategic interest leaving Rensacor in a positive position.

The company also has significant ability to complete further In-Fill drilling at a later stage to turn the below "Blue Inferred" resources into Indicated or Measured with an 8-9 hole shallow drilling campaign. The shallow ore body near surface is a real winner and what makes RNU my #1 Graphite pick.

Renascor’s Siviour deposit in South Australia contains the largest reported Ore Reserve of Graphite outside of Africa, and the second largest Proven Reserve in the world. When you stack it up against its ASX peers, Renascor is usually in the Top 2 or 3 for each category, it results in an extremely LOW Risk, Potentially high Margin Opportunity.

The Biggest Hurdle to overcome is gaining approval to operate, the company already has its ML locked away in 2019 and is on the verge of obtaining its PEPR for the Mine in the next month or two, it is open waters after that !

Mou's with POSCO and Hanwa who mention RNU on their webpage

https://www.hanwa.co.jp/en/csr/business/ev.html

Some costings from Bombers Maid on HC,

I would highlight numerous Assumptions have been made in these workings and the below should be considered general in nature and not financial advice, please always take what you read on HC with a grain of salt and complete your own research !!!

Assumptions

- Stage 1 Throughput of 1.65Mtpa vs Stage 2 of 2.25Mtpa

- 23 Year Mine Life on Current Measured + Indicated Resources (No Inferred Tonnage Utilised in Model)

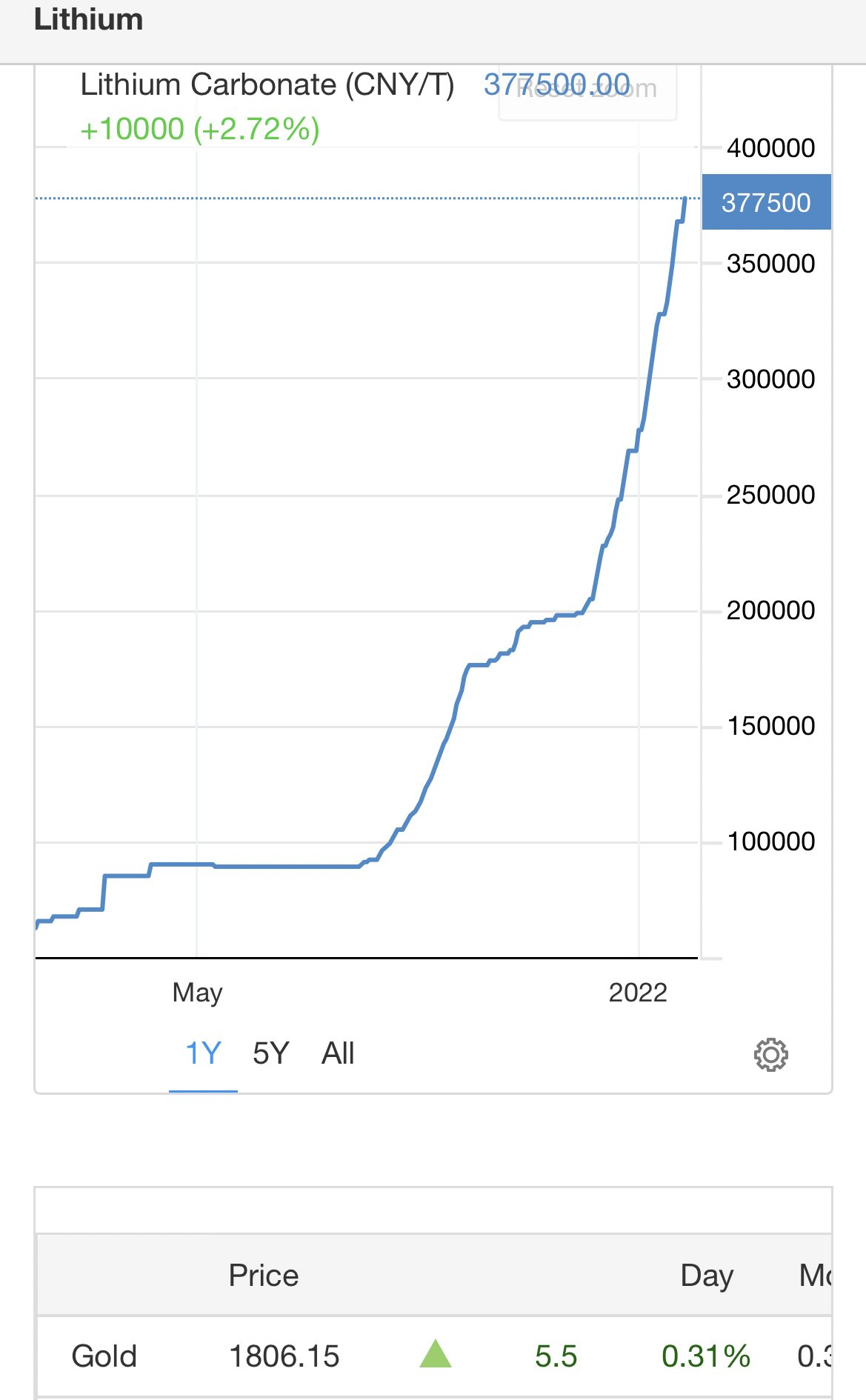

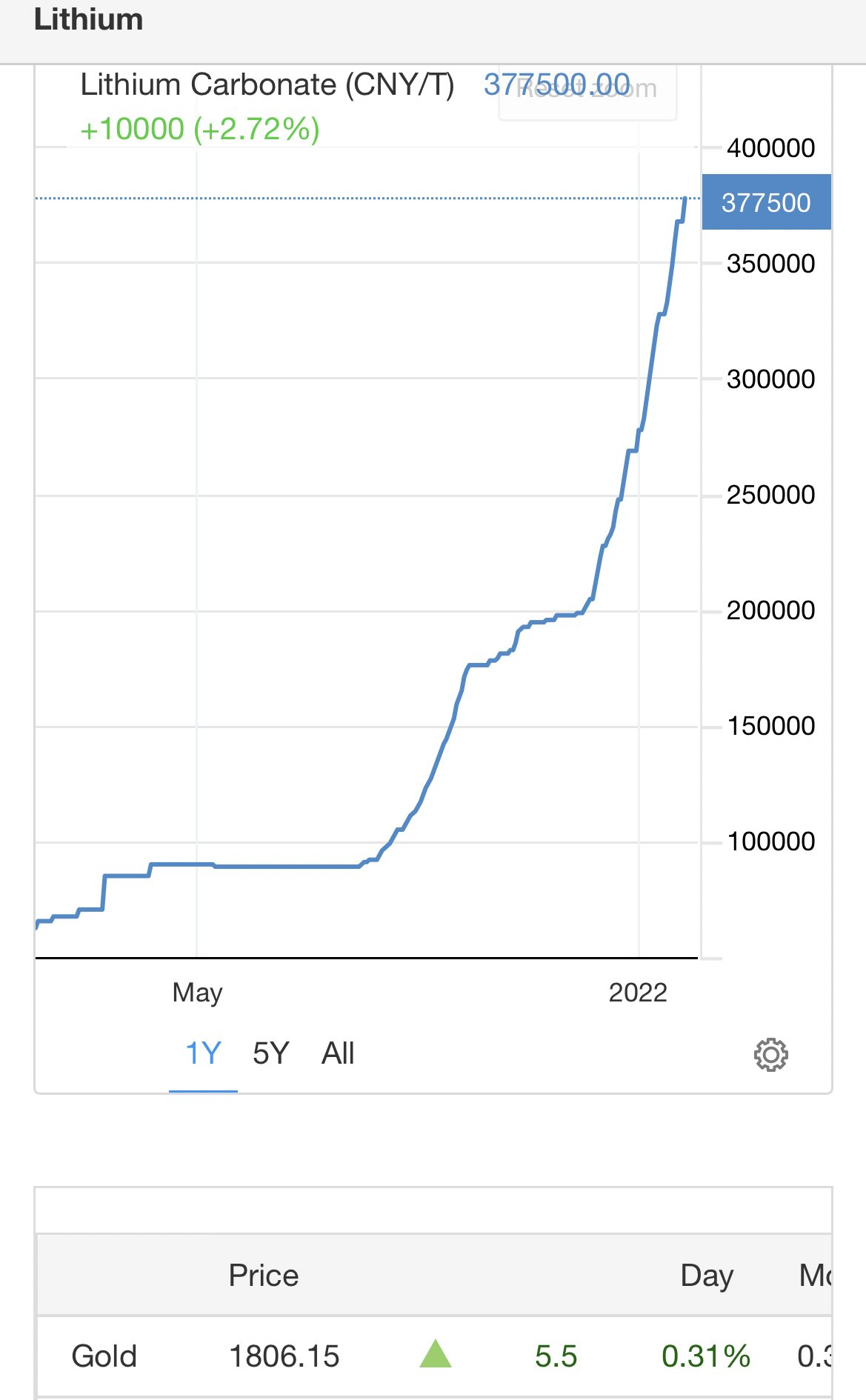

- No Changes to Benchmark Graphite Pricing from Previous Studies (If Graphite Prices Increase, Strap Yourself In )Lithium pricing has increased 5 fold in 6 months with Graphite shortage in a similar position over a similar expected timeframe.

- Initial CAPEX Increased from US$142m to US$215m (Allowance made for larger initial production + increase in equipment ie. inflation)

- Recovery Grades for Concentrate and PSG as per recent announcements

- AUD:USD= 0.72

Outputs Post Tax

- NPV10 of US$1.48B (AUD$2.1B)

- Payback Period of 1.4 Years

- IRR of 57%

- EBITDA LOM US$5.52B (AUD$7.75B)

Potential Share Value / EPS Ratio (2.25 Billion SOI Assumed Considering Majority of Capex from Export Finance Australia + Clean Energy Finance Corporation)

PE 10 - $0.92

PE 15 - $1.39

PE 20 - $1.85

PEPR is the next milestone and due shortly.

I will be closely watching the Graphite pricing and demand requirements throughout 2022-23 as i'm expecting a steady rerate to occur over the next 12-18 months.

If its anything like the Lithium pricing rerate of late, projects like RNU would be even more enticing.