There is quite a bit of coverage regarding the increasing adoption of robots in various and increasing parts of the economy. The presence of robots in manufacturing has been around for some time, but they are now being increasingly utilised int he service industry. Korea has 1000 per 10,000 workers. Most developed economies have increased from ~100 to 300/10,000 workers over the last few years - so there is a clear trend upwards. Most of the companies destined to benefit from this trend are in the US and Japan, so direct investment is challenging.

Here is a recent podcast outlining the trend

https://podcasts.apple.com/au/podcast/money-talks-the-rise-of-the-robots/id420929545?i=1000603497203

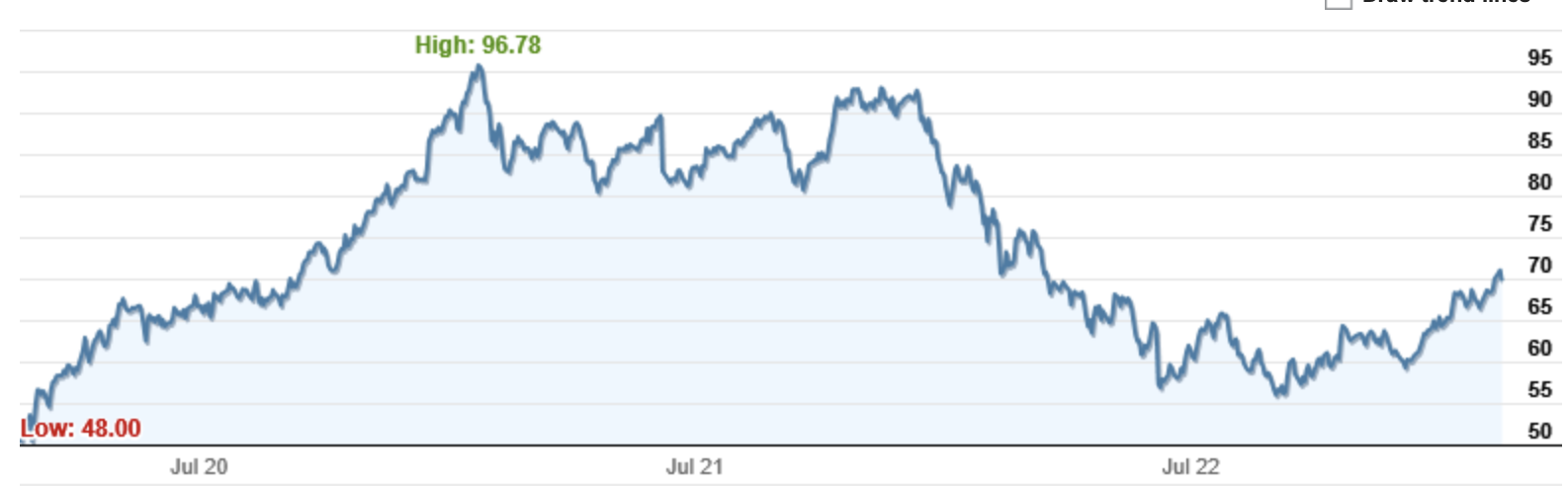

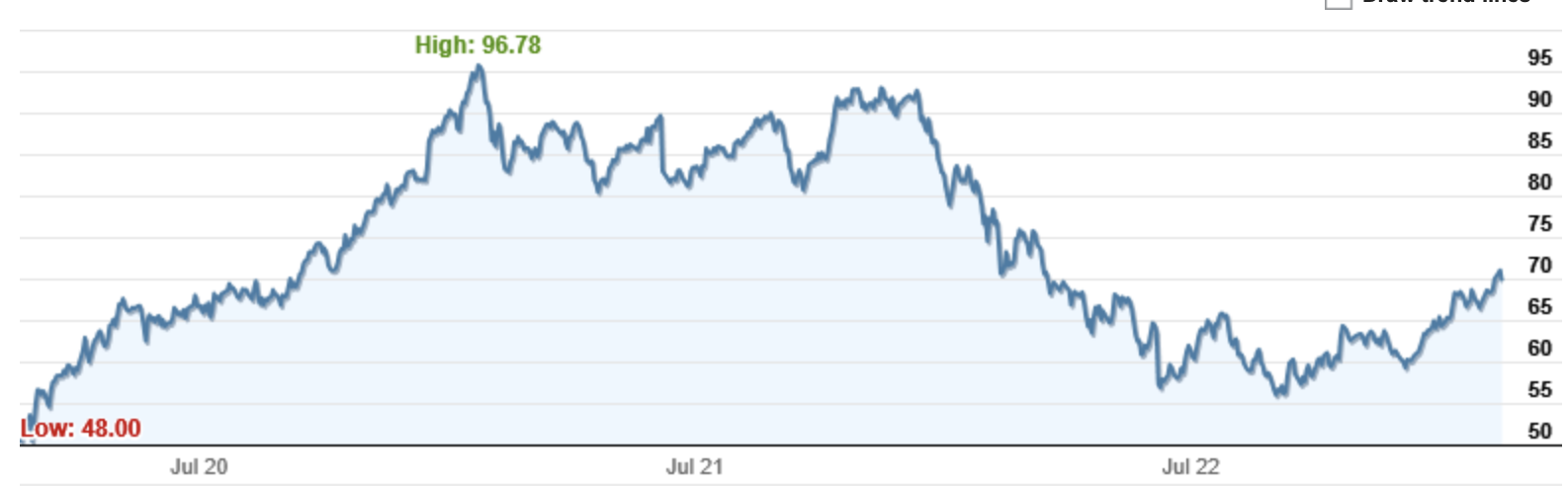

It should also be noted that this trend has become a favourite of financial advisers to clients of late, as evidenced by the recent uptick in the price of the ROBO thematic ETF, even though it is well off its highs from the go-go years of late 2020 and 2021!

It is not difficult to imagine a world in 10 years where robots of varying kinds are becoming ubiquitous. I don't own, but this is a global trend and there may well be momentum in this.

It's on the watch list, current TTM PE is ~27. Management expense ratio 0.69%. Thematic ETFs are not without their problems though.