Another one these companies that look expensive with elevated valuation metrics and with little or negative growth plus uncertain future growth.

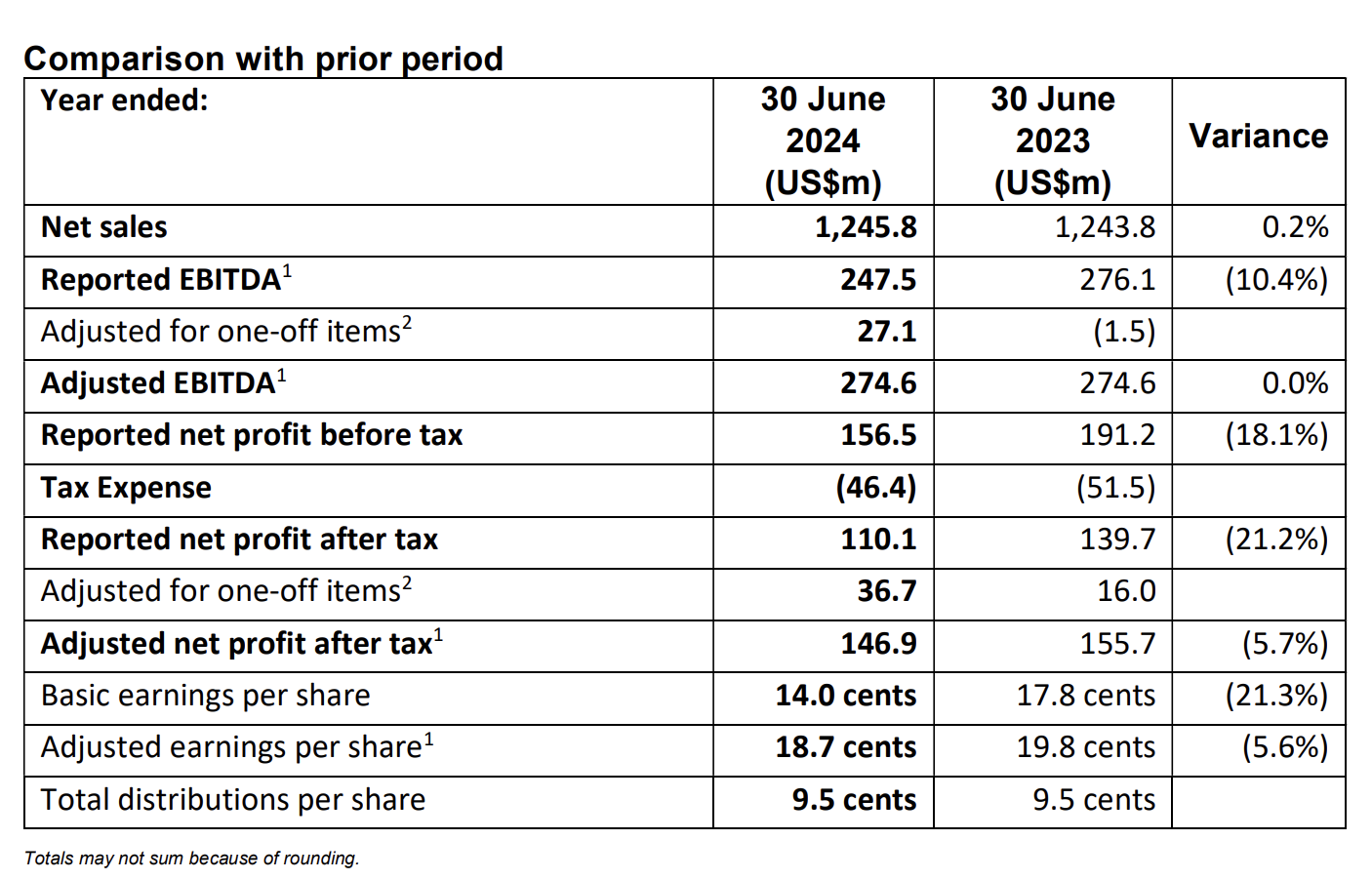

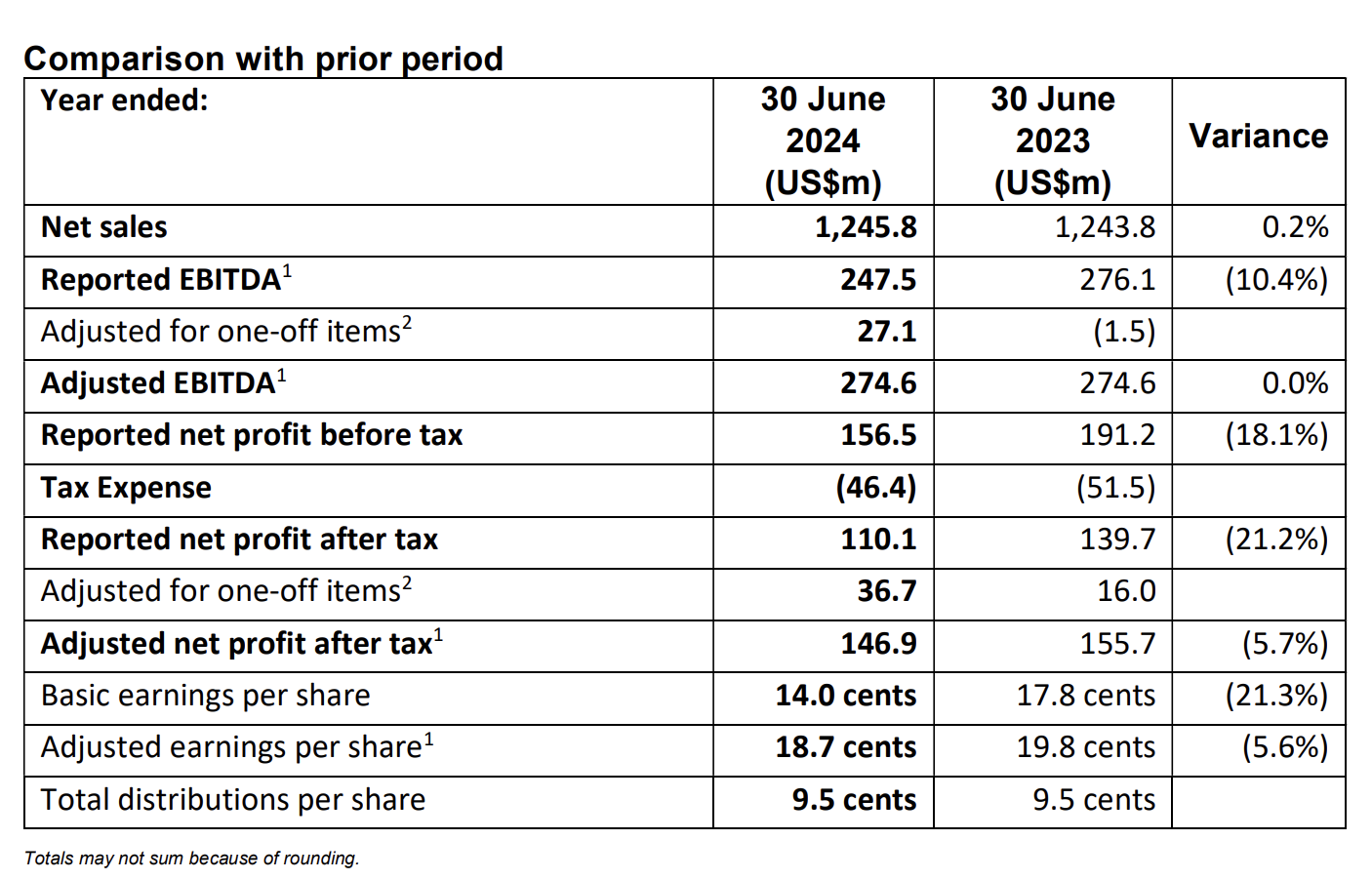

- Lots of negative growth though at least adjusted EBITDA is flat

- Company has experienced 11% growth in EPS over past 5 years, so this could be one of those rare down years

- In saying that, this is the lowest annual profit the company has reported since 2020

- At share price of $4.70 the PE is 26 (based off adjusted EPS)

- Market might be pricing in some future growth

- Non-quantitative guidance is bearish with little growth expected:

'For the first six months of trading in FY25 RWC expects group external sales to be broadly flat, within a range of up or down by low single digit percentage points, relative to the pcp, excluding the impact of Holman and Supply Smart. RWC expects a similar trajectory in each region.'

The company did not issue any FY25 quantitative guidance because of uncertainties