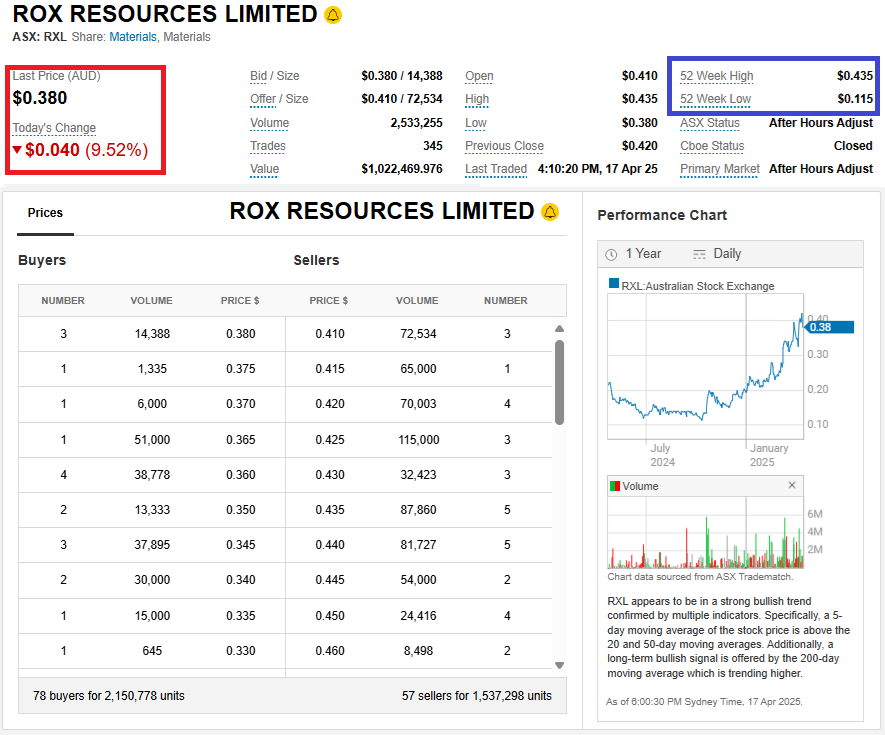

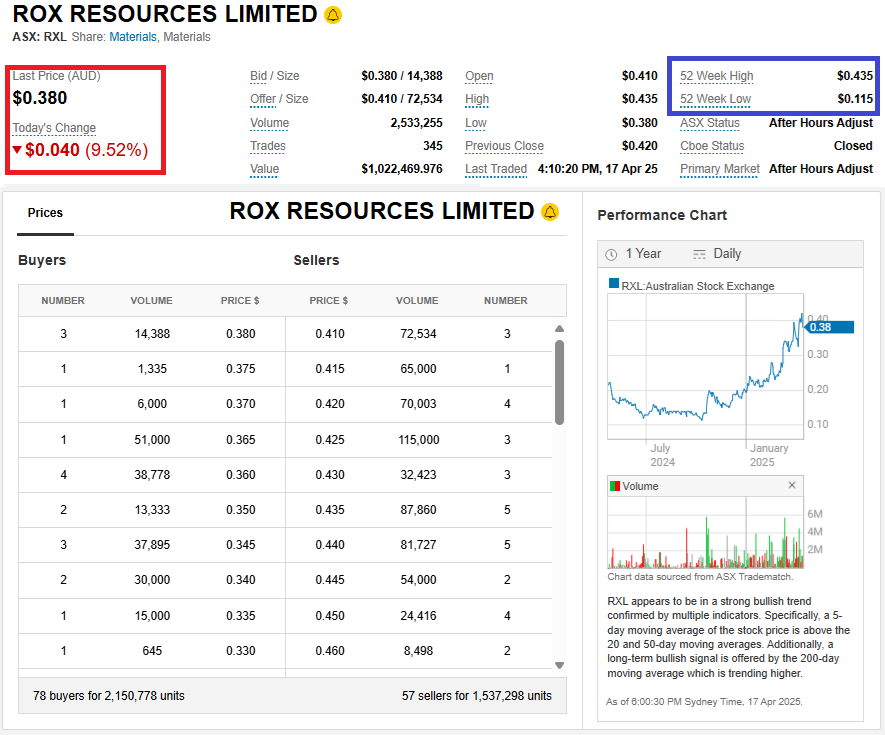

17th April 2025: Rox Resources, RXL, a company I was interested in briefly around 5 years ago, was the worst performer across the Aussie gold sector today, with a -9.5% SP drop:

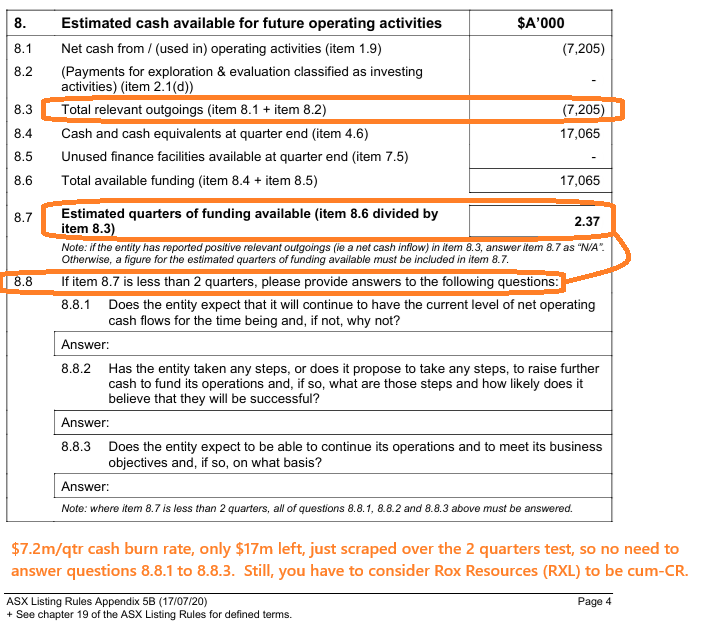

They have had a good run over the past 6 months (the second half of that 12-month chart above right) however two things look like being responsible for their -9.5% SP fall today, the first being their low liquidity, with the highest bid being @ 38 cps (where RXL closed today) and the lowest offer being almost 8% higher than that at 41 cps, and only $1m of shares changing hands today (lightly traded); the second factor, and perhaps the more important one, is their cash burn rate vs their bank balance:

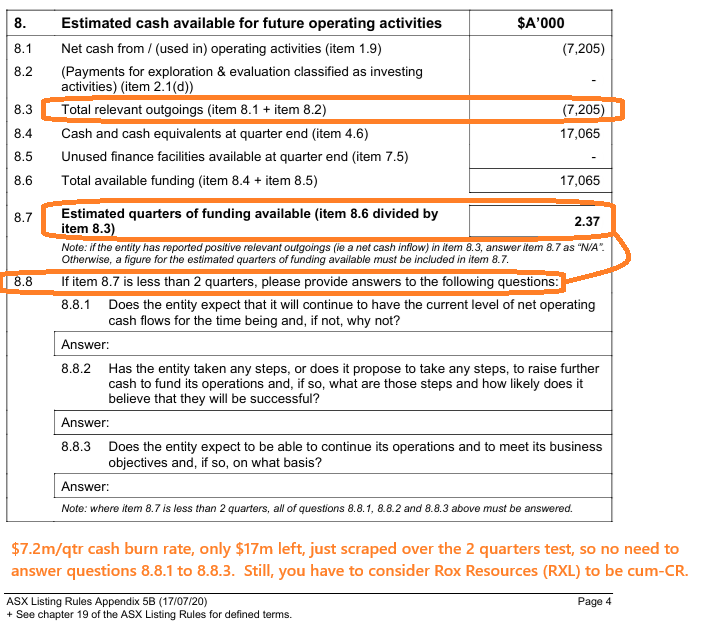

Source: Quarterly Activities/Appendix 5B Cash Flow Report [17-April-2025]

Obviously, if you're interested read the whole report, however, here are the main points, IMO:

With the location of Rox's Youanmi project being so close to Mt Magnet and RMS's Penny, Rox (RXL) look to me like a logical acquisition for Ramelius Resources (RMS) (at some stage) who own the Penny gold deposit and the Mount Magnet gold mill and mine.

The nearby Kirkalocka Gold Mine is privately owned by Adaman Resources which was placed into administration in May 2021, however Kirkalocka apparently continues to operate with financial support from a secured creditor. I think we can discount Adaman Resources as a potential acquirer of Rox (RXL) seeing as they remain in Administration.

The Golden Grove gold mine is currently owned by 29Metals (29M) [https://www.29metals.com/about]. 29Metals acquired the mine from EMR Capital in 2021, who had previously acquired it from MMG Limited. There's an outside chance of some sort of tie-up between Rox and 29Metals, however I tend to think that RMS is the natural owner of Rox's Youanmi gold project.

Whether that pans out or not, and over what timeframe, I do not know, but that's what I'd expect to happen at some stage, most likely via a takeover of RXL by RMS.

No guarantees of course, which is why I do NOT hold RXL (or 29M), but I do hold RMS which is a good gold producer now without Youanmi.

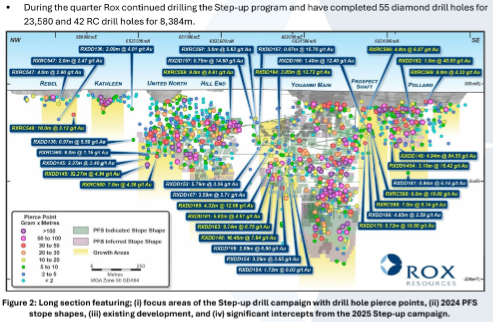

That said, Youanmi has plenty of gold:

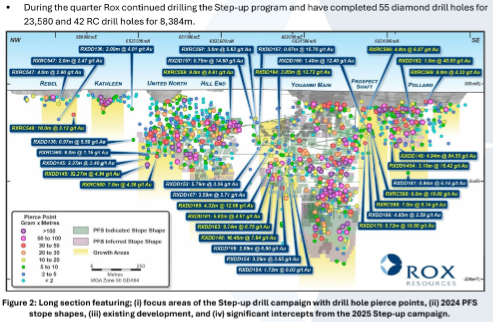

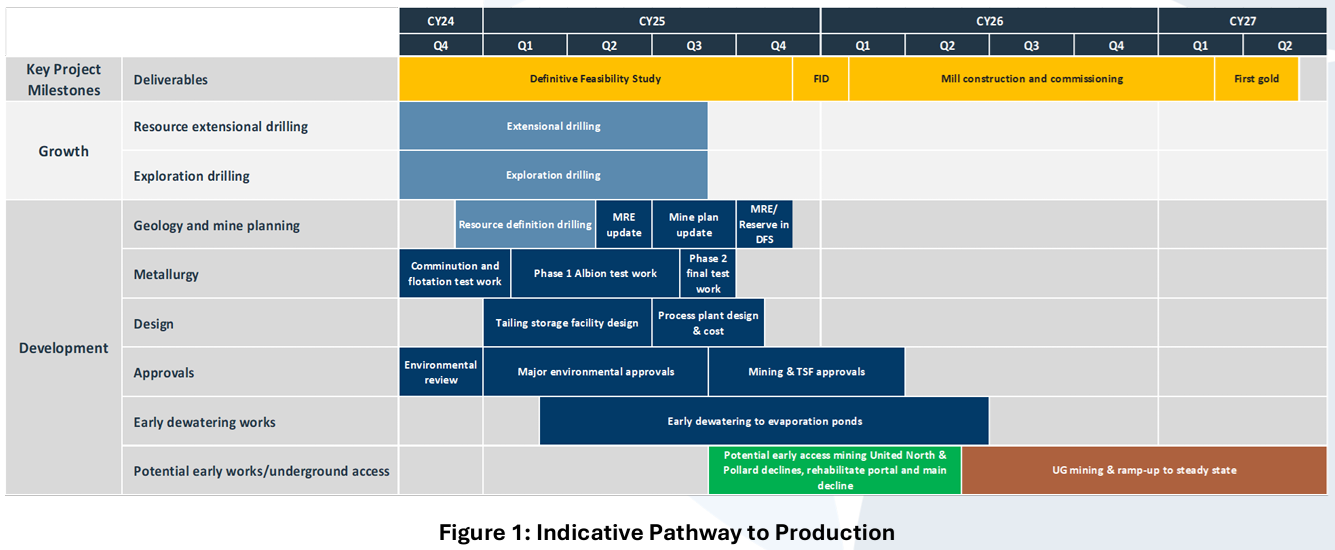

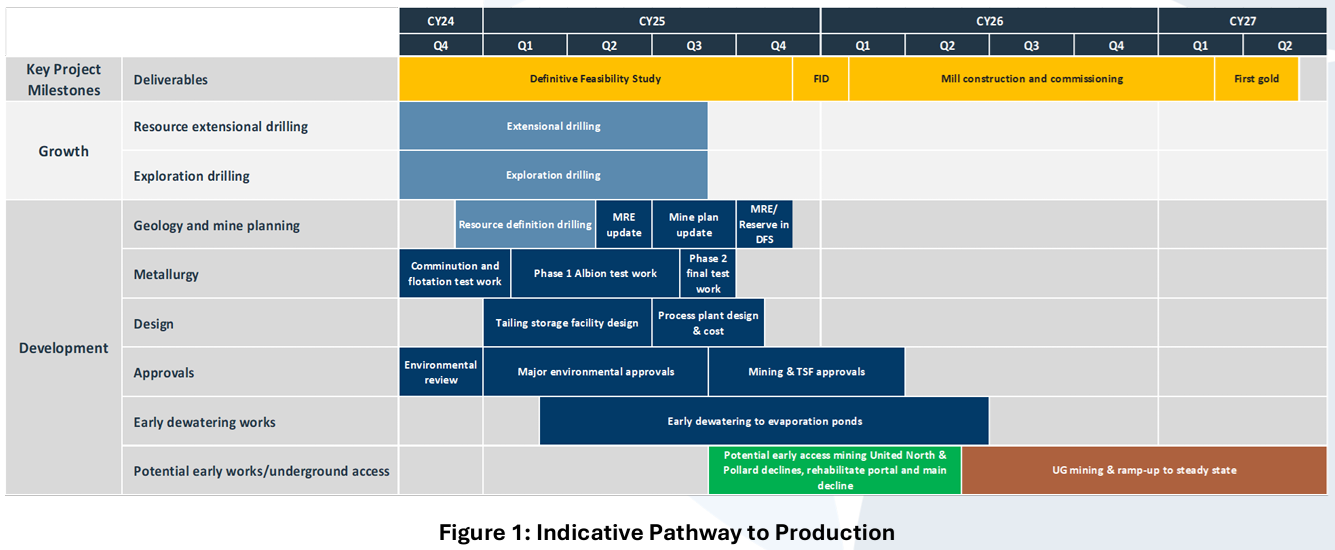

But the timeline that Rox are giving us (below) suggests they won't be producing any gold before Calendar 2027:

So you could hold RXL (Rox Resources) in the hopes that they either get taken out at a decent premium OR they manage to get the finance and actually get this thing into production themselves over the next couple of years.

But you have to accept that they will need to raise capital regularly just to keep the lights on, as demonstrated by their quarterly cashflow report (extract reproduced above), and they will also need to raise a HEAP of capital, via either debt, or through issuing more shares, or a combination of the two, to actually build the processing plant and associated infrastructure and then get the mill producing gold at nameplate capacity to provide cashflow - and that wouldn't be before 2027.

Assuming they build a mill. They might instead manage to arrange a toll-treating agreement to have one of the surrounding gold mills process their ore for them for a fee.

I reckon they actually have something valuable there at Youanmi, espcially at current AU$ spot gold prices of over $5,000 per ounce, but there's much water to flow under this bridge before "investors" (speculators) get to see a decent return, UNLESS someone makes an offer to acquire RXL in the meantime.

Personally, the risk/reward equation doesn't suit me at this point, so I'm on the sidelines with Rox Resources (RXL), but they might be worth further investigation by somebody with a higher risk tolerance.