Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

01-Dec-2020: Sandfire Approves Development of new Long-life Copper Mine plus Investor Update and Outlook Presentation - A New Era

Also: High-Grade Copper-Silver Intersections in Latest A4 Drilling plus Maiden Mineral Resource for A4 Copper-Silver Deposit

Finally: LYL: Award of EP Contract for Sandfire's Motheo Contract

So, what happens when you release all of that in one day, and the copper price has just hit a new 7.5-year high overnight. Well, your share price rises by +9.82%, that's what.

Further Reading: MiningNews.Net: Copper sector perks up ["The copper price hit a fresh 7.5-year high overnight. Among the companies to release news this week are Sandfire, Hot Chili, Aeris, Aurelia, Copper Mountain, Azure, Sunstone and Alderan – and it’s only Tuesday.]

Clearly, SFR aren't Robinson Crusoe today. AMG (Ausmex Mining Group) rose +12.82% and CBE (Cobre) went up +23.33%.

How's this for timing. I sold all of my SFR yesterday to top up 3 of my gold company positions. I was happy to see that all three of those gold companies' SPs rose strongly today, but, unfortunately, not nearly as strongly as SFR's SP rose on the back of all of this news. I finally came to the conclusion yesterday that the market just doesn't like Sandfire much, and I couldn't see what was going to change that situation. [hint: positive news about the FID and completed DFS for T2 in Botswana might do it, along with a fresh company presso that reminds people about the global copper producer that SFR plan to be within a few years, with high-grade copper mines operating in 3 countries... That's what we got today anyway.]

The two main decent-sized pure-play copper exposures on the ASX are SFR and OZL (OZ Minerals) and the market just loves OZL (look at their 12-month chart) and doesn't care much for SFR (look at their 12-month chart!). Today might be the start of a positive market re-rating of SFR at last. If so, it's not before time! It probably will be. That's usually what happens right after I cut my losses on an investment that I'm underwater on.

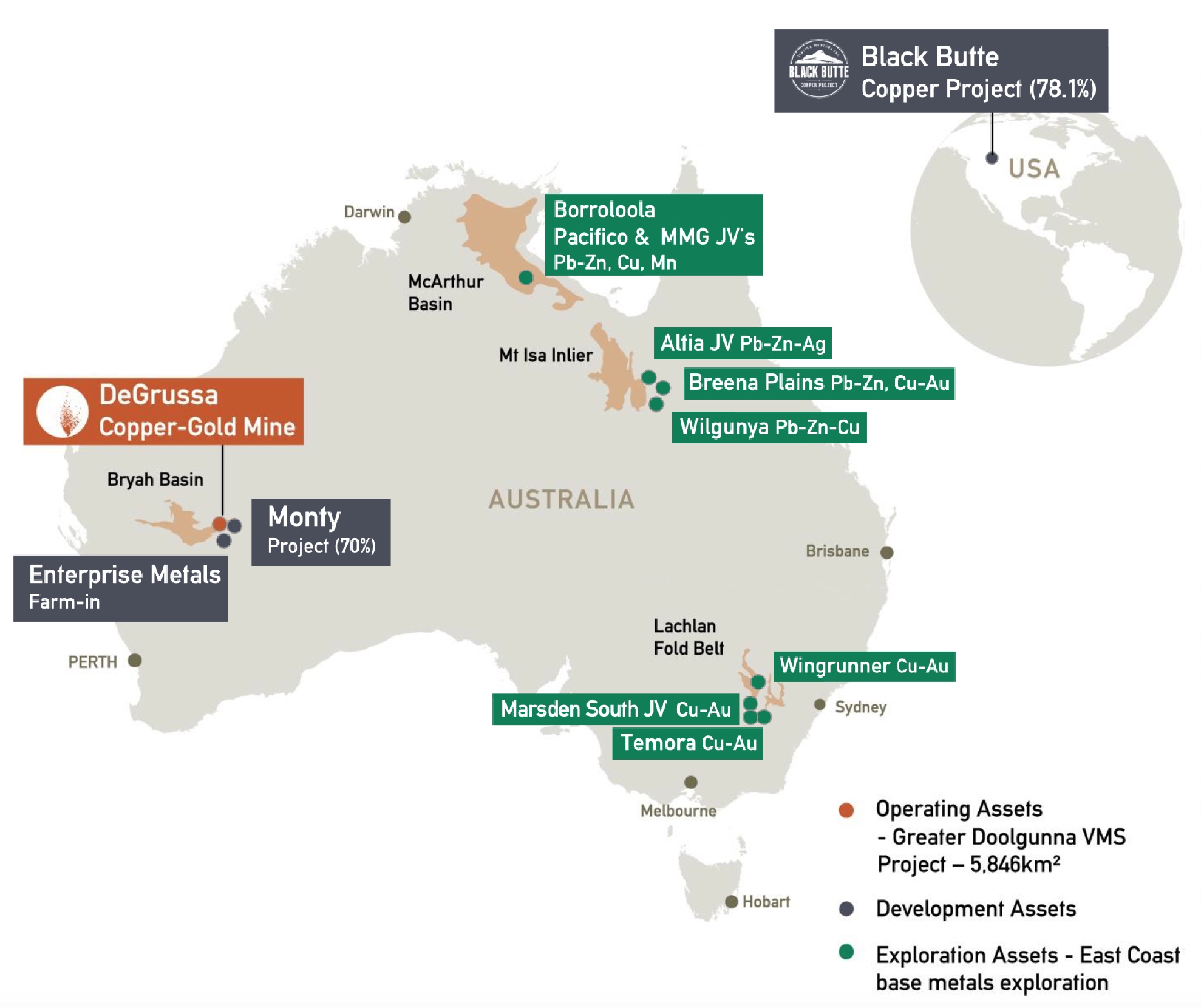

My reasons for selling SFR (yesterday) are: (1) they don't seem to be able to get any love from the market compared to OZL, (2) their one producing mine (De Grussa plus the nearby Monty deposit) has a declining resource with limited life left and they haven't been succesful in finding "another Monty" yet, and (3) there is development risk around their Botswana copper mine development project (the subject of today's announcements as it turns out) as well as the Black Butte Copper Project, located in central Montana in the United States.

None of those risks are new of course, but taken together - well, I thought I could invest the money elsewhere in companies with less downside risks and more upside, so that's what I did. Those companies just happened to all be gold producers as it turns out (NST, SBM & RRL). Sandfire do produce some gold too (as does OZL), but their bread and butter (for both SFR and OZL) is copper production. That's their main game.

For now, SFR remains on my Strawman.com scorecard, but is no longer in any of my real-life portfolios.

03-Nov-2020: SFR: Adriatic Metals Investment Update plus ADT: Sandfire Resources Litigation Upate

SFR: Sandfire Resources Ltd (ASX: SFR) is pleased to advise that it has entered into a Deed of Settlement and Release with Adriatic Metals Plc (ASX: ADT) whereby both parties have agreed to settle the dispute relating to proceeding CIV 1820 of 2020 brought by Sandfire against Adriatic in the Supreme Court of Western Australia. Under the terms for settlement of the Proceedings, Adriatic will issue to Sandfire 4,830,156 Chess Depository Interests (CDIs) in Adriatic for approximately $8.65 million ($1.79 per CDI) to reinstate Sandfire to 16.2% voting power in Adriatic.

Sandfire and Adriatic have also agreed to having the Proceedings dismissed with no order as to costs.

Sandfire [now] intends to vote in favour of all resolutions at Adriatic's upcoming AGM.

--- end of excerpt ---

ADT: Adriatic Metals PLC (ASX: ADT, LON: ADT1) has entered into a Deed of Settlement and Release with Sandfire Resources Limited (ADT: SFR) where both parties have agreed to settle the dispute relating to proceeding CIV 1820 of 2020 brought by Sandfire against Adriatic in the Supreme Court of Western Australia, as announced on 31 July 2020. Sandfire has agreed to pay Adriatic A$8,649,360.35 in cash for the issue of 4,830,156 Chess Depository Interests (“CDIs”) in the Company, pursuant to Sandfire's anti-dilution right under the previously announced Collaboration and Strategic Partnership Deed.

---end of excerpt ---

[I hold SFR shares, but not ADT shares. SFR are a substantial shareholder of ADT shares, and will soon own 16.2% of ADT once again.]

03-Nov-2020: Media Speculation - China Copper Imports

I hold SFR shares. If China does indeed ban copper concentrate imports from Australia, that could have some significant consequences for the copper market dynamics. I believe it would affect all players, but particularly the smaller end of the market, and particularly those who produce lower quality concentrate that would be more difficult to sell to other customers. I'm not too worried about Sandfire however, for the reasons they have given in this announcement.

Here's what they said this morning:

MEDIA SPECULATION – CHINA COPPER IMPORTS

Sandfire Resources Ltd (ASX: SFR) has become aware of reports in the Australian and international media stating that China may be considering a ban on imports of copper ore and concentrate from Australia. Sandfire is not aware of the reasons for the reported potential ban or the reliability of the media reports.

Sandfire maintains regular contact with its key customers and concentrate trading and smelter partners around the world in the sale of copper concentrate from its DeGrussa Operations in Western Australia, including customers within and trading into China. Should it be required, Sandfire is confident in its ability to increase sales contract volumes to existing and also new copper concentrate customers in non-Chinese markets (for example, into existing markets in Japan, Korea, the Philippines and Europe) based on its market soundings and engagement during its regular tender processes. The global copper concentrate markets are mature, robust and highly competitive for clean, high quality concentrate such as that produced fromDeGrussa over the past 8 years.

The DeGrussa Operations in Western Australia have continued to operate at full production rates into the December 2020 Quarter and production guidance for FY2021 is maintained. Four shipments of copper concentrate in the month of October have further built our robust financial position with a cash balance of some $398 million and no debt, outside of lease liabilities, as the Company looks towards progressing its emerging and diversified international project development pipeline.

ENDS.

30-Oct-2020: SFR: Acquisition of Interest in Red Bore Copper Project (adjacent to DeGrussa)

ACQUISITION OF 85% INTEREST IN RED BORE PROJECT

Sandfire Resources Ltd (ASX: SFR) advises that it has entered into agreements that will see it acquire an 85% joint venture interest in the Red Bore Copper Project (Red Bore) (ML52/597), located adjacent to its DeGrussa Copper-Gold Mine in Western Australia.

The Red Bore Project comprises a 2 square km granted Mining Licence, ML52/597, located approximately 1km east of the DeGrussa Copper-Gold Mine. The tenement was previously subject to a joint venture between Ora Gold Ltd (ASX: OAU) (90% interest) and Mr William Richmond (10% interest).

Sandfire will make a cash payment of $1.25 million to Mr Richmond and grant him a 1.25% net smelter royalty over minerals produced from Red Bore.

Upon Sandfire reaching a decision to mine, Ora Gold has a put option to sell its retained 15% interest. If Ora Gold does not exercise its put option, Sandfire must continue to cover Ora Gold’s share of any cash call by way of interest-free loans repayable from 75% of Ora Gold’s free cash-flow from its share of any minerals produced from Red Bore.

Sandfire’s Managing Director, Mr Karl Simich, said the agreements entered into with Ora Gold and Mr Richmond consolidate ownership of this strategically located tenement adjacent to the DeGrussa Copper-Gold Mine.

“The Red Bore Project will be incorporated within our near-mine exploration programs at DeGrussa and explored using our leading geochemical and geophysical exploration methodologies” he said.

ENDS

--- click on the link above for the tenement map on the second page - Figure 1: Location of ML52/597 relative to the DeGrussa Mining Lease. ---

[I hold SFR shares, but not OAU shares.]

28-Oct-2020: Sandfire September 2020 Quarterly Report plus Sandfire September 2020 Quarterly Report Presentation

Also: USA and Botswana Development Projects Update

Plus: 27-Oct-2020: Sandfire enters Endeavor Farm-In, Cobar NSW

And: 26-Oct-2020: AUR: Sams Creek Drilling To Commence

[I hold SFR shares. While they have only one producing asset currently - De Grussa, which is also processing ore from Monty - they are developing two other projects and are very active in regional exploration around De Grussa. I consider them to be a very good copper play, as OZL have already run very hard IMO, and SFR have not.]

14-Oct-2020: Diggers & Dealers Presentation, from the SFR website, or alternatively, here's the ASX Version of the same presentation.

[I hold SFR shares.]

01-Oct-2020: Divestment of Sams Creek Gold Project, NZ

I posted a straw here last night under "AUR" - Auris Minerals - regarding AUR buying the majority share of the Sams Creek Gold Project (SCGP - in NZ) that Sandfire (SFR) own. 20% of one of the two leases is owned by OGC (OceanaGold Corporation), however SFR owned the other 80% plus 100% of the second lease, and will now transfer that ownership to AUR. As I explained last night, the SCGP came with the MOD Resources (MOD) acquisition that SFR made to get hold of their Botswana copper assets, and SFR have always considered the SCGP to be non-core, as they are focussed on copper production and only produce gold as a byproduct of copper production (at De Grussa in WA). SFR aren't interested in developing and/or operating a standalone gold project. AUR own a number of tenements around SFR's De Grussa and Monty copper/gold mines in WA and have been involved in exploration JVs with SFR, as have all of the other surrounding tenement holders, so the management of AUR and SFR know each other reasonably well.

While Sams Creek clearly has a lot of gold under the ground there, it remains to be seen how economic the project will be in terms of development and production costs. I'm not rushing to buy AUR shares on the back of this announcement, but I'll keep them on one of my watchlists. Probably the best outcome for AUR would be to develop the project and then have OGC buy them out, or buy the project off them for a nice profit. OGC already have two gold mines in New Zealand, and they also already own 20% of one of the two tenements that contain the SCGP.

[I hold SFR shares.]

27-Aug-2020: FY2020 Full Year Financial Results Announcement and 2020 Full Year Financial Results Presentation

plus 2020 Annual Financial Report and Appendix 4E

Record copper and gold production drives strong revenue and operational cash-flow, underpinning another solid profit result and full-year dividend

Highlights

- Sales revenue of $656.8M (FY2019: $592.2M): payable metal sales 69,593t Cu (FY2019: 65,074t Cu) and 40,004oz Au (FY2019: 39,265oz Au)

- Strong cash flow from operating activities of $273.6M (FY2019: $210.4M) – $331.0M prior to payments for exploration and evaluation expenses (FY2019: $257.4M)

- DeGrussa Operations EBITDA $414.4M (FY2019: $365.4M)

- Depreciation and amortisation of $201.4M (FY2019: $140.8M)

- Profit before net finance and income tax expense of $113.8M (FY2019: $153.1M), including a previously announced impairment of $23.6M

- Net profit attributable to members of $74.1M (FY2019: $106.5M)

- Group net profit after income tax of $72.3M (FY2019: $104.0M)

- Earnings per share of 42.88cps (FY2019: 65.23cps) (basic and diluted)

- Final dividend of 14cps fully-franked (FY2019: 16cps fully-franked); FY2020 dividends 19cps fully-franked (FY2019: 23cps fully-franked)

- Group cash and deposits of $291.1M (FY2019: $247.4M)

Sandfire Resources Ltd (ASX: SFR) is pleased to report its financial results for the year ended 30 June 2020, with the Company posting a net profit after tax attributable to equity holders of $74.1 million and declaring a final fully-franked dividend of 14cps.

The solid financial performance reflects the Company’s success in mitigating potential business interruptions from the COVID-19 pandemic during the year, while also ensuring the safety of its employees and contractors at all times.

This allowed the Company to achieve a record operational performance at its DeGrussa Operations in Western Australia, with production of 72,238 tonnes of contained copper and 42,263 ounces of contained gold, at a C1 cost of US$0.72/lb (FY2019: 69,394t Cu and 44,455oz Au at a C1 cost of US$0.83/lb).

Total revenue of $656.8 million (FY2019: $592.2 million) was underpinned by payable metal sales totalling 69,593 tonnes of contained copper (FY2019: 65,074t Cu) and 40,004 ounces of contained gold (FY2019: 39,265oz Au).

This strong operational and sales performance resulted in the Company reporting a 13.4% increase in EBITDA from its DeGrussa Operations to a record $414.4 million (FY2019: $365.4 million).

The FY2020 net profit after income tax was $72.3 million (FY2019: $104.0 million). The current year net profit result includes depreciation and amortisation of $201.4 million (FY2019: $140.8 million) and an impairment charge of $23.6 million for oxide copper stockpiles and regional resources (as previously announced in the June 2020 Quarterly Report).

The FY2020 result includes a full year of production from the new satellite Monty Copper-Gold Mine. This has resulted in an increase to depreciation and amortisation expense of $60.6 million during the year, driven by the amortisation of the 30% Monty Mine purchase from Talisman Mining Ltd in 2018, as well as amortisation of the decline and mine development works.

The bottom line result equates to earnings per share of 42.88cps (FY2019: 65.23cps) (basic and diluted) and allowed Sandfire to continue to return funds to shareholders and declare a final fully franked dividend of 14cps (FY2019: 16cps). Combined with the 5cps fully-franked interim dividend, this takes the full-year payout to 19cps fully-franked (FY2019: 23cps fully-franked).

Cash flow from operating activities was $273.6 million (FY2019: $210.4 million), $331.0 million prior to payments for exploration and evaluation expenses (FY2019: $257.4 million).

The Group cash position at 30 June 2020 was $291.1 million after making significant investments in long-term growth and diversification projects during the year. This included $44.6 million for the cash component of the acquisition of MOD Resources Ltd, giving Sandfire 100% ownership of the T3 Copper-Silver Project and expansion area, adding a new growth platform for the Company in the Kalahari Copper Belt.

The Company made $60.7 million in income tax payments and $37.4 million in dividend payments during the year, and remains debt-free (excluding lease liabilities).

This information should be read in conjunction with Sandfire’s audited 2020 Annual Financial Report and accompanying notes.

Management Comment and Outlook

Sandfire’s Managing Director, Mr Karl Simich, said the record production and financial results for the year reflected another consistent and highly professional performance across the business, despite the disruptions and uncertainty caused by the global COVID-19 pandemic.

“The onset of COVID-19 forced a number of changes and adjustments to our operating procedures, and I am proud of the professional and focused response from our people across the organisation in adapting to this new environment and foreseeing and dealing with potential impacts,” he said.

“The exceptional performance of the DeGrussa Operations drove increased revenue and operational cash-flow, resulting in a net profit after tax of $74.1 million – a very solid result.

“We finished the year with an impressive cash balance of almost $300 million and no debt, after making substantial investments in our future growth pipeline.

“This enviable position has allowed us to maintain our track record of returning funds to shareholders by declaring a final fully-franked dividend of 14cps, taking our full year payout to 19cps.

“It has also put us in an excellent position to take full advantage of the recent recovery in the copper price, which is already up around 35 per cent from its COVID-19 lows, and unlock the potential of our building global development pipeline – which has positioned Sandfire for what we believe is a very bright and exciting future.

“The next few months will be a pivotal period for Sandfire as we put some firmer detail and timelines around our key offshore development projects.”

“We expect to complete and announce the results of our Feasibility Studies on the T3 Copper-Silver development project in Botswana and the now fully permitted Black Butte Copper Project in Montana, USA,” Mr Simich said.

“We also expect to post a maiden resource for the exciting A4 Dome discovery in Botswana, located just 8km from our T3 development project, with scoping underway to include it along with T3 in an expanded Motheo production hub.

“Much has changed within the business over the past 18 months, and there is considerable energy and excitement as we embrace the challenges and opportunities involved in building an international growth pipeline and elevate Sandfire as a global mining company.”

ENDS

--- click on links at the top for more ---

[I hold SFR shares. As explained in Karl's comments above, SFR is a growth story now, with multiple overseas new copper mine developments in progress. I am holding for this future growth, as well as their current production. I prefer explorers and developers who are either fully or mostly self-funded from existing production - to those who keep going cap-in-hand to the market for more cash. That's not to say that Sandfire won't have another capital raising. They almost certainly will, at some point, but they need far less cash from existing and new shareholders because they are generating their own cash from profitable production already. That's a better position to be in, in my opinion. And as a copper mine manager, I rate Karl Simich highly. He can be prickly with analysts at times, but he's very good at what he does best.]

30-7-2020: Sandfire June 2020 Quarterly Report

Also: Sandfire June 2020 Quarterly Report Presentation

[I hold SFR shares]

01-July-2020: Strategic Plan, Board Succession and Management Restructure

Key takeaway: "Corporate and organisational changes reflect Sandfire’s transition into an international, multi-asset base and precious metals producer"

Importantly, while they have a new director and a couple of the exisiting non-executive directors are leaving, the key management team are still in place, and Karl is still there at the top. The management structure has just been streamlined.

In their words: "A refined senior executive management structure has been implemented, which has seen the establishment of a streamlined Executive Committee (EXCO) consisting of Karl Simich (Chief Executive Officer and Managing Director), Jason Grace (Chief Operating Officer) and Matthew Fitzgerald (Chief Financial Officer and Company Secretary). All senior managers now report directly to either Mr Grace or Mr Fitzgerald, who have overall oversight of their respective divisions.

Mr Karl Simich, Chief Executive Officer and Managing Director of the Company, was a founding shareholder and director of Sandfire and has led its strategy and execution both in Australia, with DeGrussa, and international project expansion into Botswana and North America. Mr Simich is responsible for strategic execution of the business plan, leadership and engagement with key business stakeholders at a global level.

Mr Grace is an internationally experienced mining engineer and geologist who heads up Sandfire’s mining and exploration operations, both existing and emerging, as well as managing the continued development of the Company’s project pipeline and environmental and social governance areas.

Mr Fitzgerald, an experienced mining executive and accountant, heads up Sandfire’s key corporate business areas and support functions encompassing finance and forecasting, sales and marketing, legal and procurement, technology, human resources, investor relations and corporate governance."

--- continues ---

Plenty of detail in the announcement for those who are interested (just click on the link above). I hold SFR shares.

29-May-2020: https://www.macrotrends.net/charts/commodities

The last chart there shows the live copper price over 24 hours. As of this morning, that is looking very positive. However, one good day does not make a rally.

I have been tipping that I think copper will likely move first, and nickel could follow. I hold SFR for Copper/Gold, and S32 for nickel, alumina/aluminium, silver, lead, zinc, manganese and met coal, plus RVR for zinc - and gold soon as well, plus plenty of pure-gold-plays, but back to base metals. While the near-term outlook is very challenging, the market will start bidding up copper when there's the possibility of a glint or flash of light at the end of the tunnel, i.e. they will look through the current situation once they can see a plausible way through and a believable timeline. When they're not in the grip of panic, the market has the ability to price in future expectations. In other words, I believe copper will turn back up ahead of a decent global economic recovery. Copper could be a leading indicator, as it has been in the past.

So, is today's small positive uptick (i.e. the overnight northern hemisphere price movements) the start of something bigger? Probably not, but I'm keeping an eye on it nonetheless.

Because I reckon copper will move first.

27-May-2020: Sandfire RRS Investor Forum Presentation

Mon 25-May-2020: Operations Update and Tshukudu Exploration Update

Disclosure: I hold SFR. Things are humming at DeGrussa (copper & gold). It looks like they are going to beat their own guidance once again - particularly in terms of coming in with lower costs than previous guidance had suggested. Also, their Tshukudu Project (Botswana) drilling results continue to be very positive for both copper and silver.

01-May-2020: KMT: Sale of Namibian assets to Sandfire Resources

Sandfire continues to pick up assets at bargain prices during this period of lower base metal prices.

[Disclosure: I hold SFR shares, their SP rose +36.7% in April, one of my best performers for the month!]

17-Apr-2020: Sandfire March 2020 Quarterly Report

Sandfire March 2020 Quarterly Report Presentation

DeGrussa Ore Reserve and Mineral Resource Update

Tshukudu Exploration Update (Botswana)

Disclosure: I hold SFR shares. They are my preferred copper exposure. When the outlook for global growth improves, copper will lead the way. They don't call it Doctor Copper for nothing. Copper prices are very often a good proxy for the health of the global economy, or the market's view of the near-to-mid-term health of the global economy. In other words, the copper price is often a leading indicator. When sentiment turns positive, copper prices will improve, probably before other base metals like nickel, zinc, tin, alumina/aluminium, lead, etc. The rest will follow. For that reason, I prefer to lock in my copper exposure early, and feel that I can increase my exposure to producers of those other base metals once copper starts to rebound.

16th Sep 2018: I've posted a few straws here about Sandfire (SFR). I sold them when they did their 4th quarter production report and conference call, which I listened in on live. I thought there was a good chance of analysts downgrading them based on the tone of the questions and responses that Karl gave. That did occur, and the price subsequently dropped a couple of dollars over the next couple of weeks. I've since bought back into Sandfire.

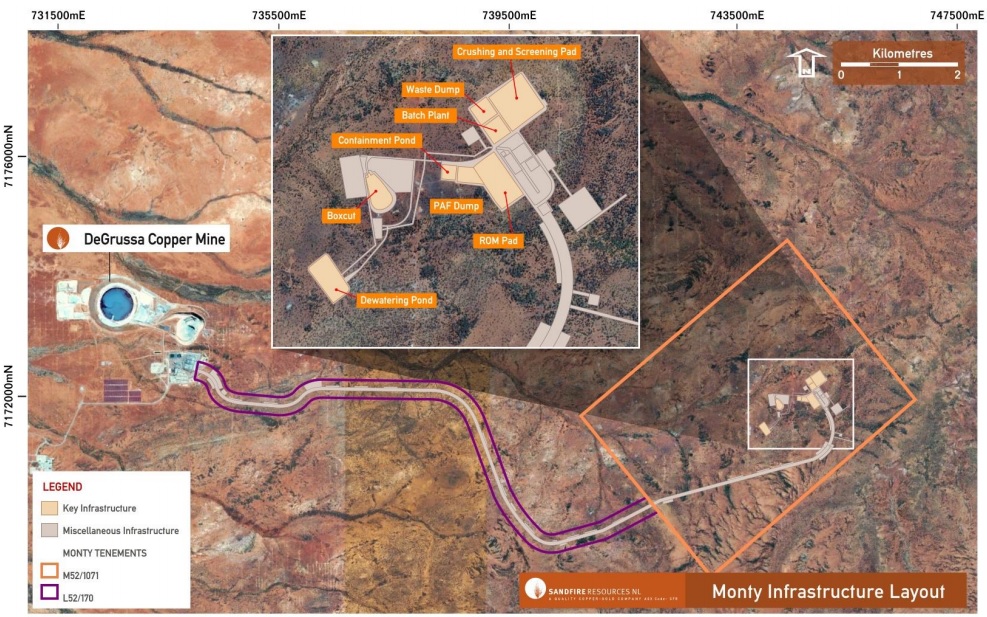

There are concerns about their mine life at DeGrussa. They need to find more commercial deposits close to DeGrussa to keep the processing plant operating. They have already achieved this with the Monty deposit, which sits 10 kilometres east of DeGrussa. They are in the process of buying TLM's 30% share of that deposit, which will leave SFR with 100% of that area in addition to their other extensive landholdings. Sandfire are also currently exploring areas to the south of DeGrussa and Monty via JVs with AUR, FEL, ENT & GTE.

They have a high grade deposit in Montana (Black Butte) ready to go, and are progressing the permitting and expect to break ground over there early in calendar 2019.

They also have further exploration assets within Australia:

Karl Simich has also flagged that they are evaluating various other overseas opportunities. He views DeGrussa as the launch pad for Sandfire and expects they will be bigger and better long after DeGrussa has been mined out. Pleasingly, the company has a big pile of cash and no debt and, as Pmonkey has mentioned, Karl is a high quality manager. He can seem a little aggressive at times - and can get annoyed with analysts on conference calls, but he knows his stuff when it comes to managing a copper producer!

The recent copper price falls & the associated negative sentiment towards copper miners generally - & Sandfire more specifically - seems more like a good opportunity to pick SFR shares up at much cheaper levels, or to top up, than to bail out of the stock.

Trump is playing a dangerous game with China, but he is getting pushback from within his own administration now, and it would not be in China's best interests to escalate this either seeing as they export much more to the US than they import from them. A trade war does hurt China more than the US, but it could also stall global growth and will hurt stock markets, and Trump has publically linked his own success as POTUS with the success of the US market, so he doesn't want to crash it.

I hold SFR.

Tuesday 31st July 2018:

"Dr. Copper" is generally regarded as a historically reliable leading indicator of global growth - which means copper companies like Sandfire might be a good way to go if you're bullish on global growth continuing, and probably best to avoid if you're expecting an imminent global recession.

Here's the most recent view from S&P:

http://www.miningnews.net/research/news/1342130/s-p-boosts-outlook-for-nickel-copper

Remember that S&P don't always get things right (such as their AAA ratings on dodgy CDOs prior to the GFC)...

Listening to the SFR 4th Qtr results conference call, I can see why the market may have got a little jittery about SFR. On top of trade war fears, the copper price in US$ have been falling recently, SFR is guiding for around the same level of copper production in FY19 as what they achieved in FY18 - but at ~10% higher costs due to having to transport the Monty ore 10km to the DeGrussa plant as well as the lower grades from Monty that will have to be processed before they get to the higher grade ore. While copper production in FY20 is expected to be around 20% higher, with lower costs (as they process a lot more of the higher grade ore from Monty), we have to get through FY19 first. SFR's 78% owned Black Butte (pronouced "Beaut") project in the USA could take longer than expected to get permitted - they don't expect to be breaking ground there until January at the earliest. And SFR's CEO/MD Karl Simich has a little bit of empire-building about him. While SFR do need to grow to remain relevant, and achieve economies of scale, it could be worrying some analysts that he sees a lot of that future growth being in various other countries - rather than here in Australia, and he was clearly prepared to invest in deposits (such as Black Butte) that are clearly inferior to DeGrussa.

http://webcasting.boardroom.media/broadcast/5b2aeea449e38c1023dbd10f

Finally, Karl was keen to squash the false rumour that SFR had a capital raising brewing. He stressed 3 times that while Sandfire America (which our SFR own 78% of) would continue to raise capital, mostly via rights issues to fund development, which SFR would participate in, there were NO plans for our ASX-listed SFR to raise capital. They have plenty of cash - and no net debt.

Disclosure: I often hold SFR, but I'm currently not holding. I'll likely buy back in when the copper price starts rising again.

DeGrussa open pit and processing plant.

20-Feb-2020: I've posted links and a results summary (for SFR's FY2020 H1 Results) in a separate straw. The following is their outlook statement (that accompanied their report):

Management Comment and Outlook

Sandfire’s Managing Director, Mr Karl Simich, said the first-half of the 2020 financial year marked the beginning of an exciting new growth chapter as the Company began its transformation from a single-mine company into a diversified and sustainable global metals company operating across multiple jurisdictions.

“Underpinned by another solid operational and financial performance at DeGrussa, we took some important long-term growth steps during this period with the completion of the MOD acquisition, continued progress with the permitting and Feasibility Study for the Black Butte Copper Project in Montana, USA and the commencement of a major new exploration campaign in Botswana.

“At the operational level, the DeGrussa Operation posted another strong set of numbers despite what continues to be a relatively muted global environment for base metals. Another impressive production performance once again drove strong sales revenue, low unit operating costs, robust operating cash flows and strong bottom line earnings – helping us to maintain a period-end cash position of $201.7 million.

“It is important to note that this was after making significant investments in our long-term growth pipeline, including $44.6 million on the cash component of the MOD acquisition and $23.1 million on further investments in high-quality base metal opportunities, while also paying out $28.5 million in dividends and $40.0 million in income tax.

“With a debt-free balance sheet we remain in an excellent position to fund the next stage of our growth and diversification. The key focus in the short term is completing the optimisation of the Feasibility Study and permitting for the T3 development project in Botswana, which we expect to be our first new base metal operation outside of DeGrussa. Project funding discussions are underway and we remain on track to make a decision to mine by mid calendar year 2020.

“Meanwhile, our expanded exploration campaign in Botswana has also paid early dividends, with an exciting new copper discovery at the A4 Dome, located just 8km from T3, rapidly taking shape and five diamond rigs currently focused on delineating this zone.

“The delineation of additional resources within close proximity of our proposed first production hub in Botswana would stand us in excellent stead as we begin to unlock the potential of this belt-scale exploration opportunity. I am optimistic about the outlook for this project given that we effectively control the 200km long centre of an emerging sediment-hosted copper province.

“Turning to the macro picture, there is no doubt that 2020 has seen a number of new challenges emerge in commodity markets due to the impact of the coronavirus and potential impact on metals demand and global logistics and trade. Notwithstanding the short-term impacts, which will continue to play out over the next few weeks and months, we remain positive about the medium-term outlook for copper, which remains fundamental as an essential ingredient for a sustainable, low-carbon future.

“Sandfire is getting on with the job of advancing our new mid-tier projects in Botswana and the USA towards development, exploring vigorously for new deposits in Botswana and Australia, and increasing our exposure to high-quality assets around the world.

“I am pleased to say that the second half of the financial year is off to a strong start and we are on track to achieve FY2020 guidance of 70-72kt of contained copper and 38-40koz of contained gold with C1 costs of ~US$0.90/lb.”

ENDS

-------------------------

Disclosure: I hold SFR shares.

20-Feb-2020: December 2019 Half Year Financial Results Announcement

December 2019 Half Year Financial Report and Appendix 4D

December 2019 Half Year Financial Results Presentation

DECEMBER 2019 HALF YEAR FINANCIAL RESULTS

Increasing copper-gold production drives solid interim profit, enabling further investment in long-term growth projects

Highlights

- Sales revenue of $313.1M (1HFY18: $272.3M): payable metal sales 33,616t Cu (1HFY18: 32,715t) and 18,252oz Au (1HFY18: 20,721oz)

- Cash flow from operating activities of $109.1M (1HFY18: $97.5M) – $140.3M prior to payments for exploration and evaluation expenses (1HFY18: $121.9M)

- DeGrussa Operations segment earnings before net finance and income tax expense of $91.4M (1HFY18: $101.7M)

- Profit before net finance and income tax expense of $50.0M (1HFY18: $70.1M)

- Net profit attributable to members of $34.2M (1HFY18: $49.6M)

- Earnings per share of 20.6cps (basic and diluted) (1HFY18: 31.1cps)

- Interim dividend of 5.0cps fully-franked (1HFY18: 7.0cps fully-franked)

- Group cash of $201.7M at 31 December 2019

Sandfire Resources Ltd (ASX: SFR; “Sandfire” or “the Company”) is pleased to report its financial results for the six month period ended 31 December 2019. The Company delivered another strong operational and financial performance underpinned by robust production and cost management at its DeGrussa Operations in Western Australia.

This allowed the Company to maintain strong revenues and operating cash flows, to post a net profit after income tax of $33.3 million (1HFY18: $48.3 million). The interim profit translates to earnings per share of 20.6 cents (basic and diluted).

Total revenue of $313.1 million (1HFY18: $272.3 million) was underpinned by payable metal sales totalling 33,616 tonnes of contained copper (1HFY18: 32,715t) and 18,252 ounces of contained gold (1HFY18: 20,721oz).

The half-year results included production from the new satellite Monty Copper-Gold Mine, resulting in an additional amortisation expense of $34.2 million driven by the amortisation of the Monty CopperGold Mine purchase price, following the acquisition of Talisman Mining’s 30% interest in the project in 2018, as well as amortisation of the decline and mine development. There was also increased investment in exploration and evaluation expenditure of $6.2 million during the period, including exploration at the newly acquired Tshukudu Project in Botswana following its acquisition from MOD Resources Ltd (MOD) in October 2019.

The strong financial performance was achieved despite weakness in the US Dollar copper price during the reporting period, offset by a fall in the USD: AUD exchange rate and a stronger gold price.

The DeGrussa Operations delivered another strong operational performance for the period, with production of 34,988 tonnes of contained copper (1HFY18: 34,813t) and 19,370 ounces of contained gold (1HFY18: 21,567oz), towards FY2020 guidance of 70-72kt of contained copper and 38-40koz of contained gold.

As a result, the DeGrussa Operations segment generated earnings before net finance and income tax expense of $91.4 million (1HFY18: $101.7 million), which included depreciation and amortisation charges of $90.1 million (1HFY18: $61.6 million).

Cash flow from operating activities was $109.1 million (1HFY18: $97.5 million) and $140.3 million prior to payments for exploration and evaluation expenses (1HFY18: $121.9 million).

The Company maintained its strong commitment to shareholder returns during the half-year, declaring an interim fully-franked dividend of 5 cents per share.

The Group cash position at 31 December 2019 was $201.7 million after making significant investments in long-term growth and diversification projects. This included $44.6 million for the cash component of the acquisition of MOD (giving Sandfire 100% ownership of the T3 Copper-Silver Project and adding a new growth platform for the Company in Botswana, southern Africa) and $23.1 million on further investments in early stage, high-quality base metals exploration and development assets through the Company’s Sandfire Ventures program. The Company also paid $40.0 million in income tax payments and $28.5 million in dividend payments during the reporting period.

This information should be read in conjunction with Sandfire’s December 2019 Half-Year Financial Report and accompanying notes.

[See separate straw for outlook statement.]

July 2018: Sandfire are growing via exploration in surrounding tenements (to DeGrussa) via farm-in agreements where SFR do the drilling (spend the money) in exchange for earning a share of the tenement if something is found. This worked well with TLM (Talisman Mining) when they found the Monty deposit. It worked out really well for TLM who have now agreed to sell their minority 30% stake in Springfield (the tenements that host Monty) to SFR for $72m plus a 1% NSR royalty on any future discoveries at Springfield. Sandfire are currently exploration drilling through tenements belonging to Auris Minerals (AUR), FE Ltd (FEL), Enterprise Metals (ENT), and have plans to also drill out areas of the Great Western Exploration (WTE) tenements to the east of the ENT tenements. Any of these tenements could host another commercial deposit such as DeGrussa or Monty. Sandfire are also developing the high-grade Black Butte Copper Project, located in central Montana in the United States.

January 2019: The SFR/TLM transaction completed in October 2018, TLM declared and paid a special dividend in December, and are expected to also pay a capital return to their shareholders early this year (2019).

Since the Monty discovery - which was on TLM (Talisman Mining) land, now bought and owned by SFR, the various JVs that SFR are involved in have not yielded any further commercial metal/mineral discoveries to date, but they're still drilling.

Disclosure: I hold SFR and TLM shares.

08-Jul-19: Update. I no longer hold TLM shares. Still hold SFR. Still think SFR is a decent copper play, if you're bullish on copper.

Post a valuation or endorse another member's valuation.