Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Discl: Held IRL

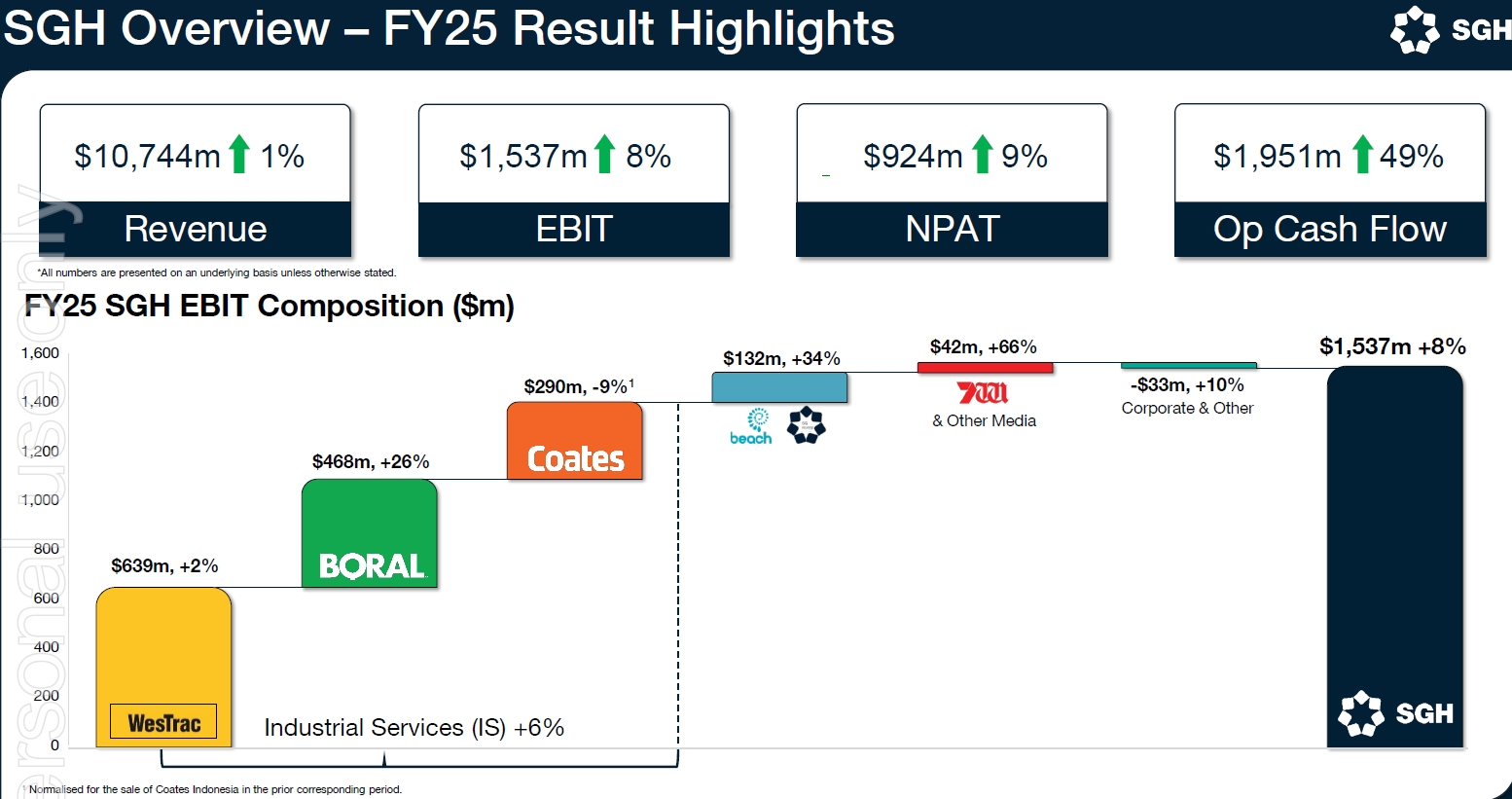

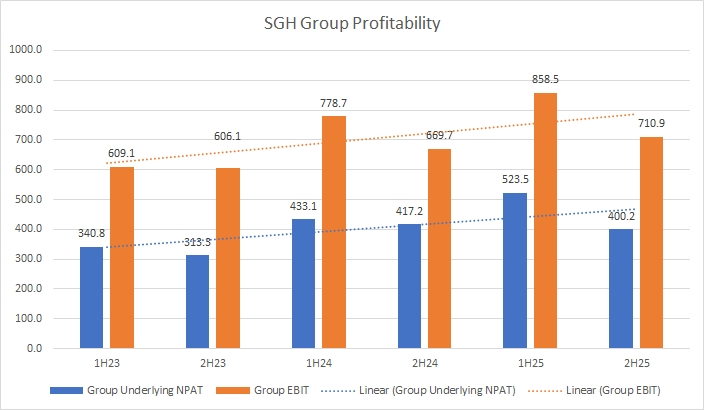

SUMMARY

Flatish 2HFY25 HoH result, in both Revenue and EBIT, which is the normal seasonal trend, but YoY was also flat which the market did not like.

Guidance was FY2026 was also downgraded to “low-mid single-digit EBIT growth” from the usual “high-single digit EBIT growth”, which did not help.

2H25 Dividend was up 2c to 32c - when SGH raises the dividend amidst flattish results, you know, they know, it wasn't great ...

Notwithstanding this, it is never wise to bet against the Stokes family, but FY26 will be interesting amidst the cautious outlook and ongoing uncertainty.

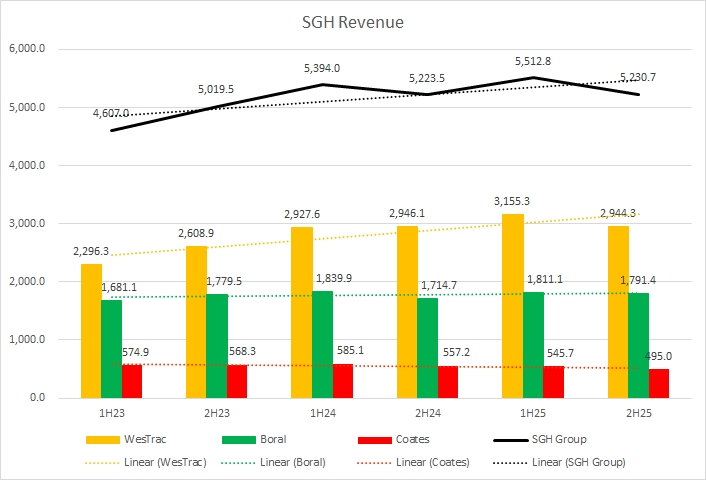

Revenue - WesTrac on trend growth, Boral flat, Coates fell 9%

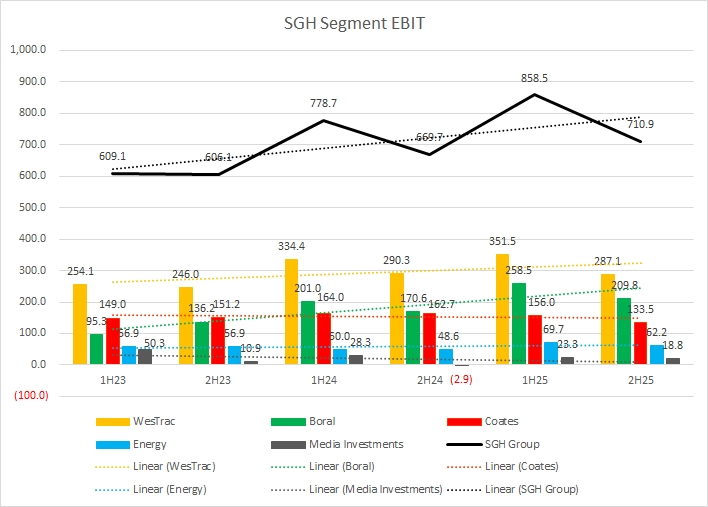

EBIT - overall on trend growth

Segment EBIT - Westrac on trend growth, Boral growth continues to accelerate, Coates and Media trending downwards, Energy is flattish

WESTRAC

- Revenue growth was average, up 4% - strong capital sales offset by lower average parts pricing.

- Capital sales $2.2b, up 12% - flagged to revert to recent averages

- Services $3.9bm flat, but installed fleet continues to age to 12.4 years, up 7% YoY, underpinning ongoing service revenue

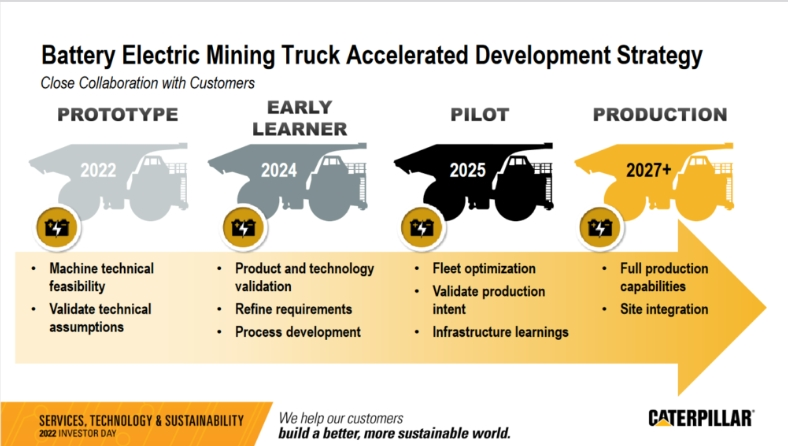

- Battery fleet replacement will drive next wave of capital fleet replacements - earliest will be in 2028, services will continue to buffer revenue and earnings in the meantime

Was a bit surprised by the uptick in capital sales and the flat services, given that the Battery Electric Mining Truck is due in 2028-ish - was expecting the exact opposite, higher services, less capital sales as miners sweat existing assets until the Battery Trucks become available.

BORAL

- Revenue growth flat - resilient demand from engineering and pricing traction offsetting volatility in road and residential activity

- Cost efficiencies have kicked in to drive operating leverage

- Expecting recovery in residential in CY26 underpinned by government housing programs, interest rate moderation - operating leverage will become more evident

- Pricing traction sustained

The challenge for Boral in FY26 and one to watch out for, will be to sustain the gains achieved by Vik Bansal once he exits.

COATES

- Revenue down 9%, EBIT down 9% normalised for the sale of Coates Indonesia in the PCP - mixed market conditions, mostly in VIC and SA

- Cost takeouts occurred in FY25 - workforce, branch footprint, repairs & maintenance

Inevitable and probably imminent when SGH took BLD private, as Vik publicly said he wanted to front a public company, but still sad to see Vik go.

I have a lot of issues with crazy aggro CEO's and given Vik's much highlighted style-related challenges at Cleanaway, I was very weary when SGH announced Vik to run BLD. But gee, he has done a good job turning it around and putting it on the right trajectory. He will be missed. The market made that clear this morning!

SGH has a good track record of getting the right managers in place (bar Seven West Media, but thats another story on its own), so have confidence that they will eventually find the right guy to succeed Vik and see the rest of the transformation through.

Which makes the SM LGI conversation tomorrow that much more interesting as Vik is the Chairman of LGI. He has a track record of making something of things he takes on ...

Discl: Held IRL

16-Jan-2019: Briefly, exposure to oil/gas (including 28.57% of Beach Energy - BPT), exposure to mining and construction via Cat dealerships in WA, NSW & ACT (WA=WesTrac) and Coates Hire, plus exposure to media (40.88% of Seven West Media, SWM, Channel 7 should do well in 2019 vs 9 & 10), plus this is Kerry and Ryan Stokes' main listed company, and you can do worse than follow a self-made billionaire like Kerry Stokes.

Recently traded at over $22 (in October) - and now back to just above $15 - due to shift in sentiment (energy + mining). May well be heading back up if Trump and Jinping do a trade deal.

http://www.westrac.com.au/Industries/Pages/Earthmoving-Equipment.aspx

http://www.sevengroup.com.au/our-investments/sgh-energy