I haven't looked at SenSen for a while, but their quarterly update today caught my eye.

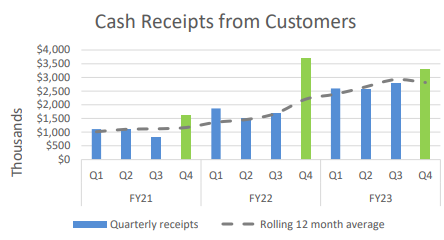

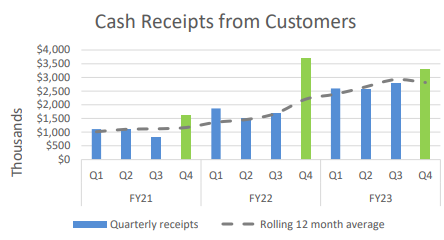

Q4 cash receipts were down a bit on the previous corresponding period, but overall they have managed decent growth over FY23 with 27% growth in customer cash receipts.

The business remains cash flow negative -- missing aspirations to flip into positivity this latest quarter. Apparently several payments slipped into July.

They reckon they'll be cf +'ve in the current year. If sales momentum continues they'll likely avoid a raise, but with only $1.9m in cash and a $2m facility it'll be a close call.

Cost cutting continues, with a further $750k in annual savings achieved in the quarter. They expect more in the current year. Comparing staff and admin costs from the same quarter last year shows a 13% reduction, Manufacturing and operating costs (presumably mostly cloud and IT services) were down 24%.

Looking ahead, they are targeting 100+ enterprise clients in the first half of FY24, up from 85 at present. And there's a raft of new products/features that are now launched.

It's an interesting enough company (we spoke with the CEO in April last year if you want a good overview). Guestimating a P/S of around 3.5x which aint terrible if they can sustain the pace of sales growth and keep costs contained. (yeah, P/S is overly crude, but it'll have to do until we see earnings or even EBIT)

These guys were doing AI before it was cool, so maybe they'll get some hopium from that angle at some stage? But i suspect the market will want to see sustainable positive cash flows first. There's also an ongoing legal dispute with a former distributor that can't be helping sentiment.

I'd be a lot more interested if I could understand the competitive edge they have. My layman's perspective is that there are far bigger AI vision focused companies that could outcompete them, but perhaps they can carve out a profitable niche within areas such as service stations and casinos.