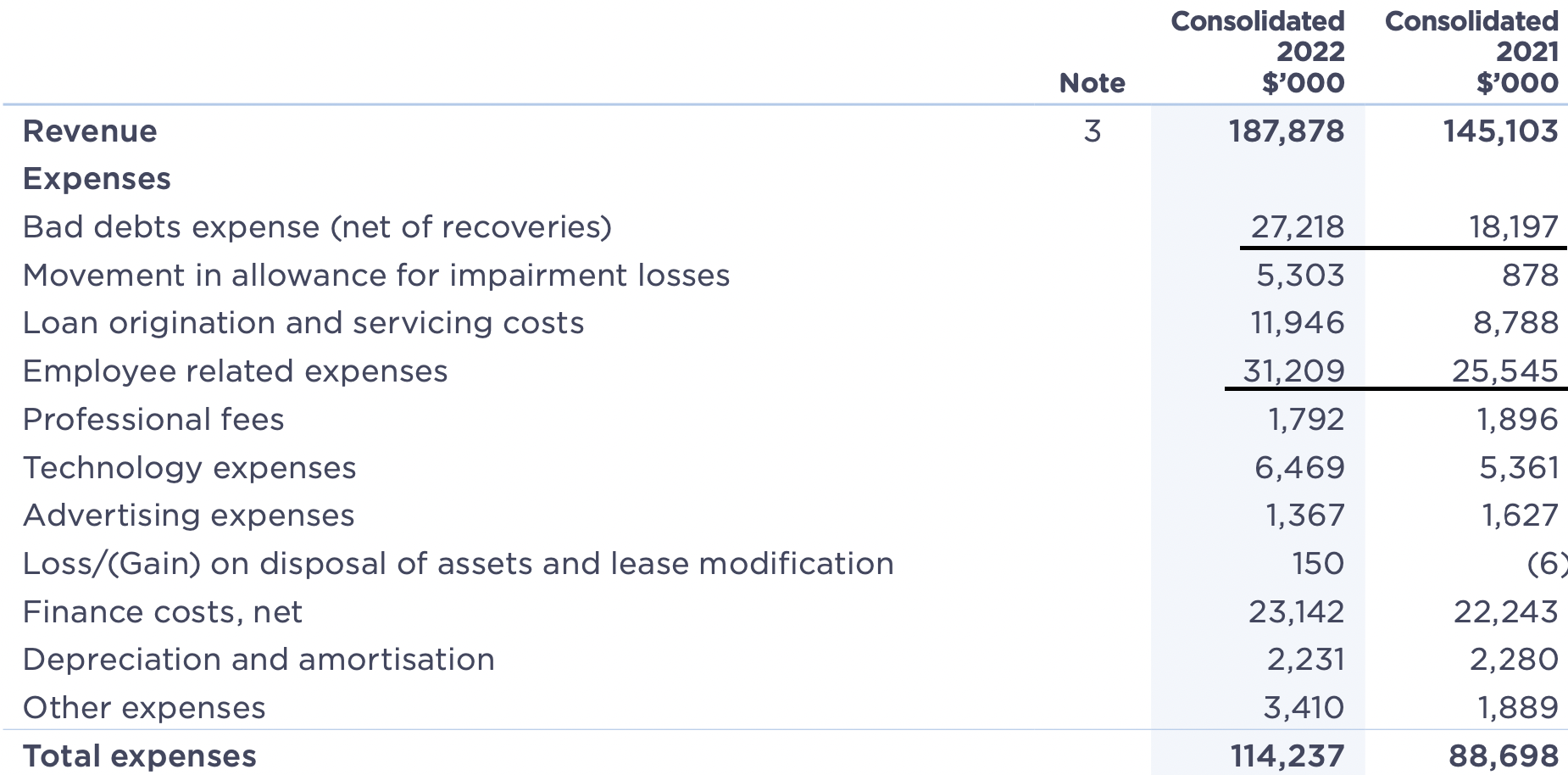

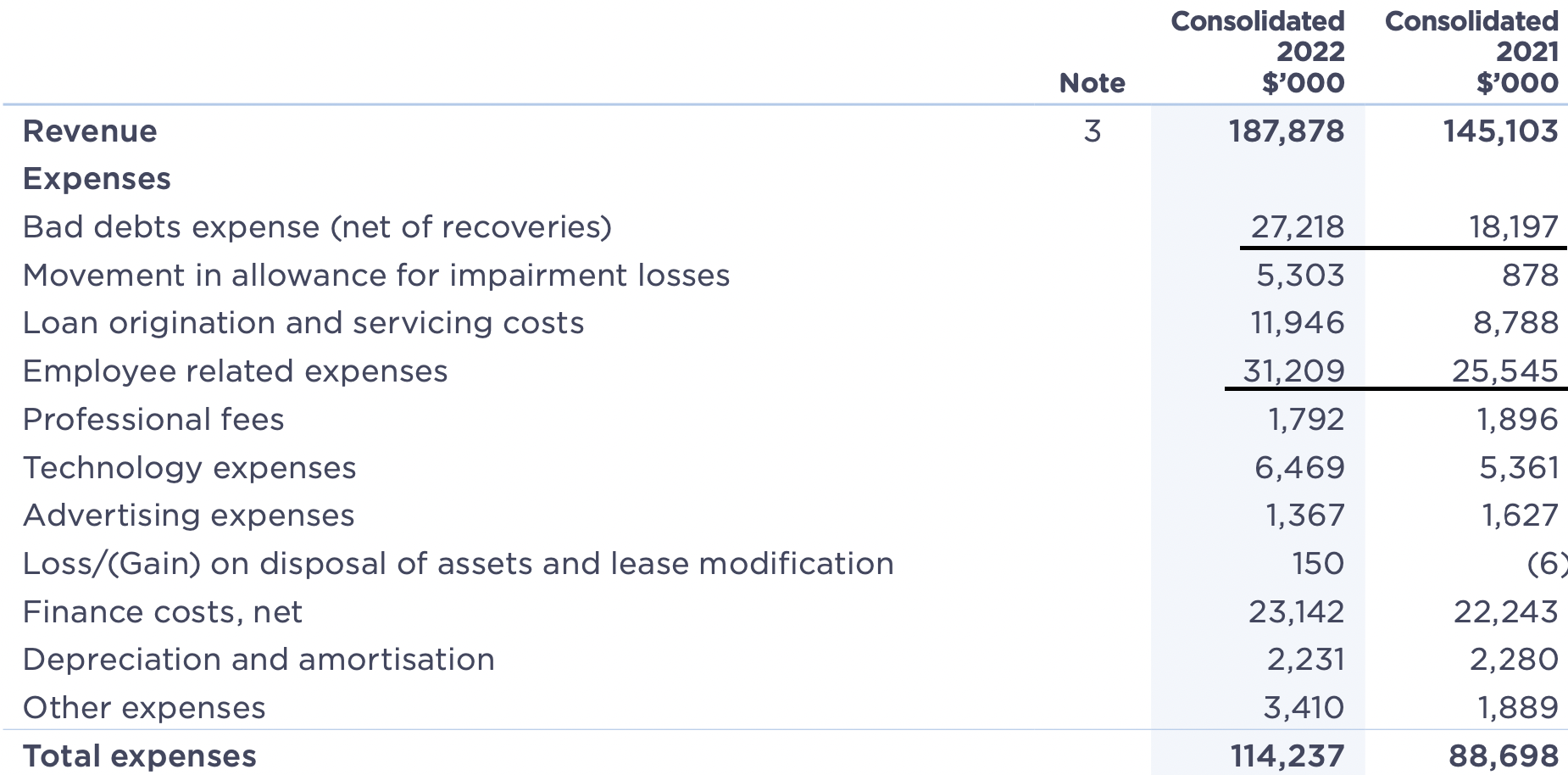

As per @jayjayjayjay 's post, this year's result was another cracker.

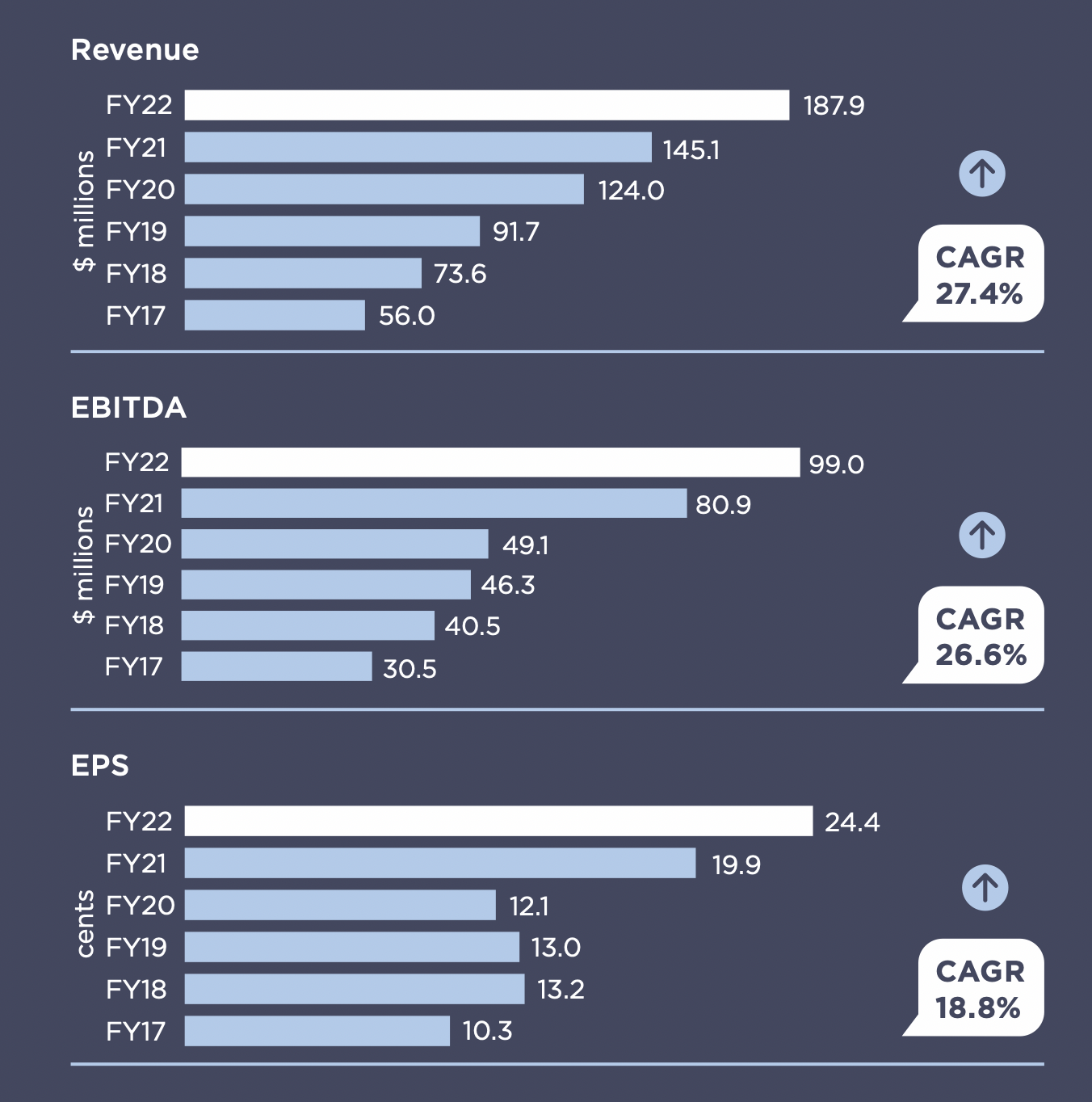

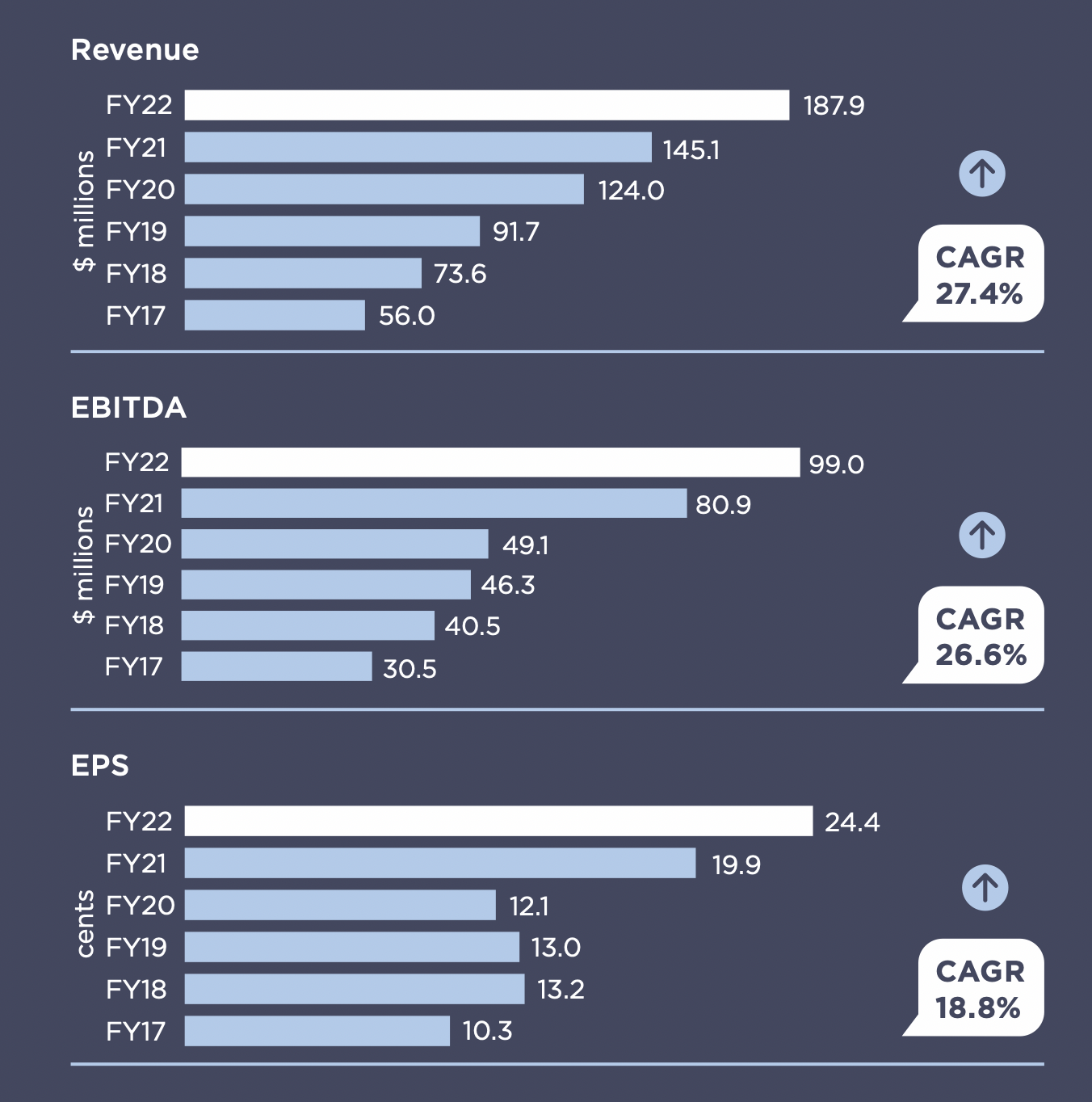

The following bar charts show the performance over the last 5 years. This is not all organic, there have been acquisitions, but it is important note that EPS have steadily increased over this time. There was a hiccup in most metrics because of the pandemic. This had a couple fp important impacts - it caused a reduction in the steady increase in usual business but markedly reduced delinquencies/non-performing loans due to the Ozzy version of the stimmy.

There has also been a steady improvement on ROE over the last few years, now tracking at 14.6%

As they have grown, they have been albeit access borrowing at lower and lower rates so the margin on each loan increases, this trend should continue over time

Delinquencies will pick up and have provisions for a 5.6% rate have been made for the near-term. They report an improvement in credit risk across their customer base which should mitigate this, but it is unclear how this is measured, and what impact rising rates will have on these metrics (it certainly won't improve them, that's for sure)

The near term goal is for 1billion in loans for 2023 increasing to 3 billion for the "mid-term".

The risks are likely two-fold:

constraining staff related costs required to implement this growth (see below)

risk mitigation of non-performing loans.

I am reasonably confident, given their long track record that they should be able to accomplish this, but they have been sold off in anticipation of deteriorating credit environment. If this turns out to be not as bad as feared then today's valuation will prove to be an excellent buying opportunity