I didn't really explain why I think this "thematic ETF" is worthy of consideration. I think that COVID brain-fog thing must be real!

It combines two of Morningstar's strengths: identifying and quantifying companies with "moats", and identifying when companies are trading at a significant discount to Fair Value.

I believe that this combination of criteria is likely to produce out-performance of a simple NASDAQ tracker over the long term.

Here is some more info on their methodology:

Morningstar Developed Markets Technology Moat Focus Index

Sector-focused portfolios allow investors to target economic areas where they see opportunity. Sector investing can

offer a means of expressing a short-term market view, or can serve as a finely-tuned mechanism for building a strategic asset allocation. Some investors use sector investments to augment exposure lacking elsewhere in their portfolio.

The technology sector is home to a wide range of companies, engaged in hardware, software, and IT services. The sector is notoriously fast-changing. Industry stalwarts can

quickly become irrelevant. Start-ups can become leaders

in a few short years.

Most equity sector indexes are market-capitalization weighted. They are designed to reflect the current state of the sector landscape, so they devote significant weight

to current champions.

The Morningstar Developed Markets Technology Moat Focus Index offers exposure to the most competitively advantaged and attractively priced technology companies according to the forward-looking views of Morningstar’s global equity analyst team. The index’s equal-weighting scheme allows all constituents to contribute to returns.

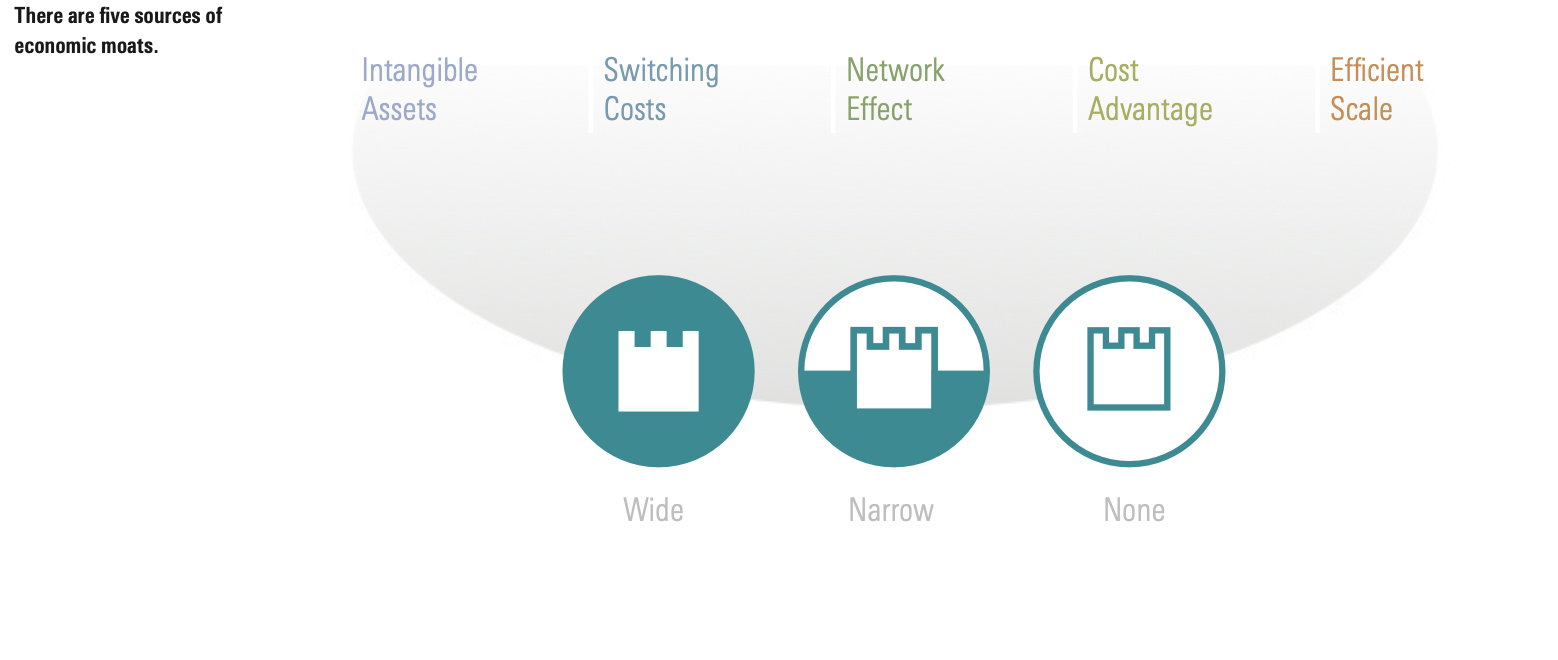

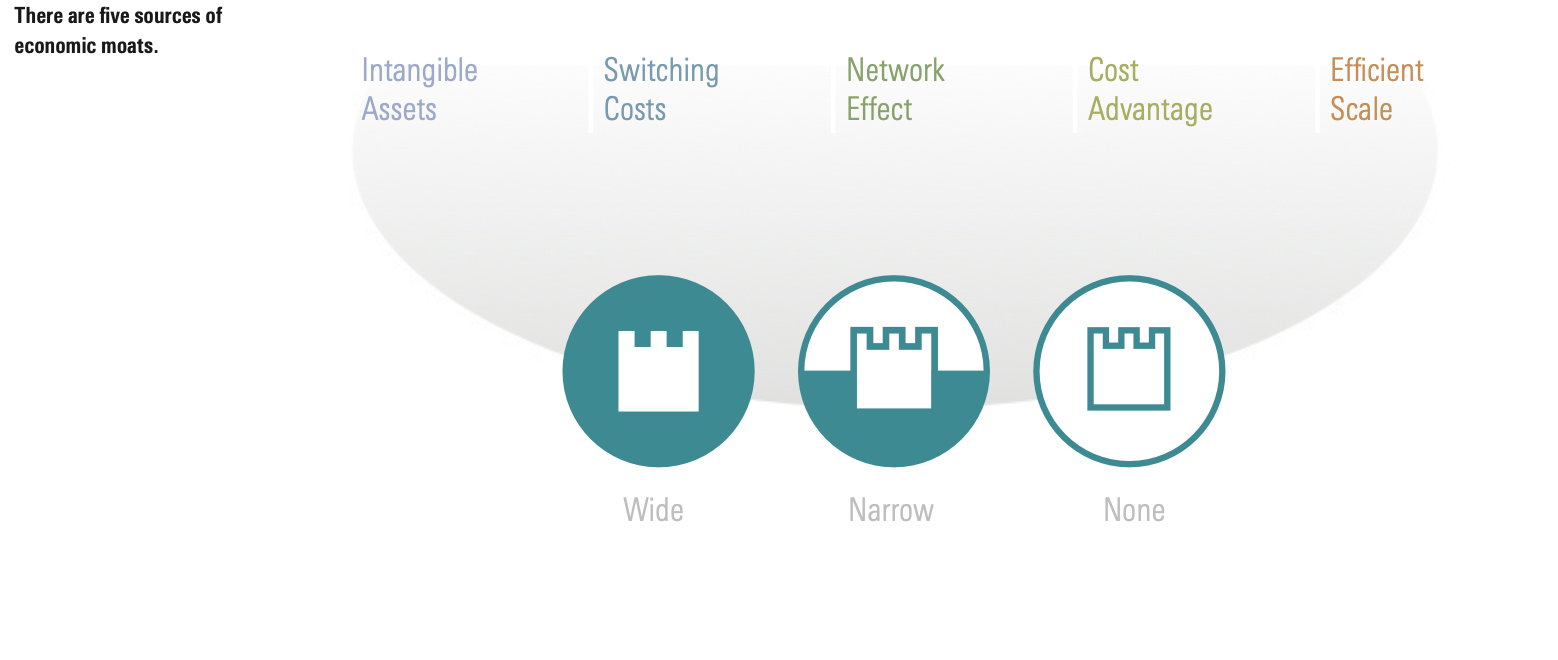

What is an Economic Moat?

Economic moat describes the sustainability of a company’s economic profits. We define economic profits as returns on

invested capital over and above our estimates of a firm’s cost of capital, or the weighted average cost of capital. Only firms with economic moats—something inherent in

their business model that rivals cannot easily replicate— can stave off competitive forces for a prolonged period

of time. There are two major requirements for firms to earn either a narrow or wide economic moat rating. The prospect of earning above average returns on capital, and some competitive edge that prevents these returns from quickly eroding. The vast majority of firms do not possess an economic moat.

Index Methodology

The Morningstar Developed Markets Technology Moat Focus Index selects securities from the Morningstar Developed Markets Technology Index, a market capitalization weighted benchmark comprising technology companies based in developed markets spanning North America, Europe, and the Asia Pacific region. To qualify for the Moat Focus Index, companies must be deemed by Morningstar equity analysts to have a wide or narrow economic moat rating. At reconstitution, the index selects the 25 wide- or narrow-moat rated stocks within the technology sector that are

cheapest as determined by the ratio of market price to Morningstar’s estimate of fair value. Wide- and narrow-moat companies whose share prices have fallen precipitously

are avoided as part of a momentum screen. To mitigate turnover, existing index constituents can remain so long as their share prices trade within a reasonable range of the cheapest 25 wide- or narrow-moat stocks within the technology sector at the time of reconstitution.

Weighting and Constituent Count

Positions are equally weighted within each index’s two subportfolios at reconstitution. This assures that performance is not overwhelmed by a small number of securities

and that all stocks can contribute to returns. Because of the index’s staggered rebalancing methodology, it will typically hold more than 25 constituents of varying weights.

Rebalancing and Reconstitution

The index follows a semiannual reconstitution on a quarterly staggered rebalancing schedule. This means that half the index is reset quarterly. Staggering allows for more frequent hunting for undervalued stocks than does a standard semi-annual frequency, but it reduces trading by roughly half compared with a quarterly schedule. The index is divided into two subportfolios, which each contains 25 stocks. One subportfolio resets in December and June, the other in March and September. The subportfolios are brought back to equal weight in the overall index in December and June.

Country Capping

As a risk control, the maximum weight of an individual country in the index is capped at either 40% or 10 percentage points beyond its corresponding weight in the Morningstar Developed Markets Technology Index.