Summary of results:

Revenue from ordinary activities - $3.748b (down 6% PCP)

NPAT - $365 million (down 12% PCP) however up 7% since 2022/23

EPS - .165c per share with dividends issued this FY at 100% payout ratio (equates to 3.27% yield / 4.67% gross)

While the overall results were modest, there was an increase in the share price of approx. 7% today.

Key Highlights

- Retention of customers strong for Saturday Lotto even with recent price increases. Price increase only reflected in 1/12 of the FY 2024-25 results.

- Expecting more revenue to come in later this year once powerball price increases are made

- The annual report gave a high focus on the improvements made to increase user experience

- New Weekly windfall draws increased revenue by $90m this FY

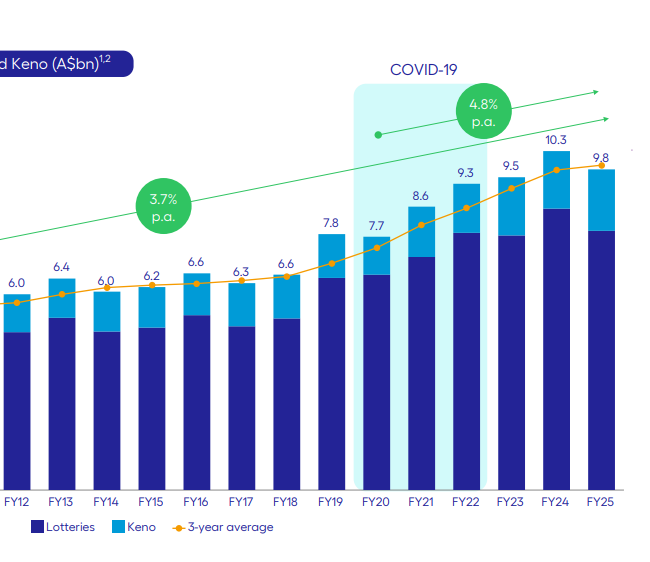

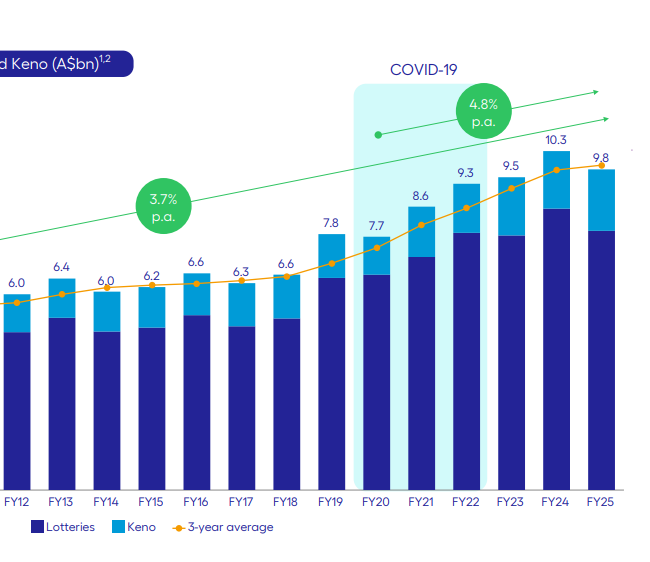

- Significant NPAT drop due to the high jackpots in 2023-24 due to the $200m powerball. Overall, Lottery Industry turnover in Australia is still trending upwards with approx 3.7% growth per annum (see image below).

- NPAT margin below the 10% range for the first time since the demerger.

My opinion:

- TLC is starting to look like its priced for perfection, even with a new CEO coming in shortly.

- The Vic licence expiring in 2028, however I would expect however that they would be hard to displace given the widespread infrastructure in place for the various lottery products.

- 2 x interest rate reductions from the RBA this year will start to impact the interest revenue generated for products like set for life.

- The P/E of 34.51x is starting to get up there, well above the 2023 average of 30.79, and 22-31x range while TLC was part of Tabcorp.

- The Rate of Return under the McNiven formula is sitting around 3.8 based on my calculations.

My valuation for TLC is as follows:

Est Revenue - 4.5% increase to $3.92b (accounting for price increases for Saturday Lotto)

NPAT - $392m (based on historic margin of approx. 10%)

EPS = $.176c

Valuation - $4.8 to $5.6 based on PE 25-32x future earnings. Thinking this sits closer to the $5 mark given the historic P/E range

Held IRL and SM.