Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

This has been (another) disappointing investment for me. So far at least.

I have taken a few days, digesting the FY25 result and reviewing the investment thesis. Putting it in writing is useful, basically because it forces me to do it properly.

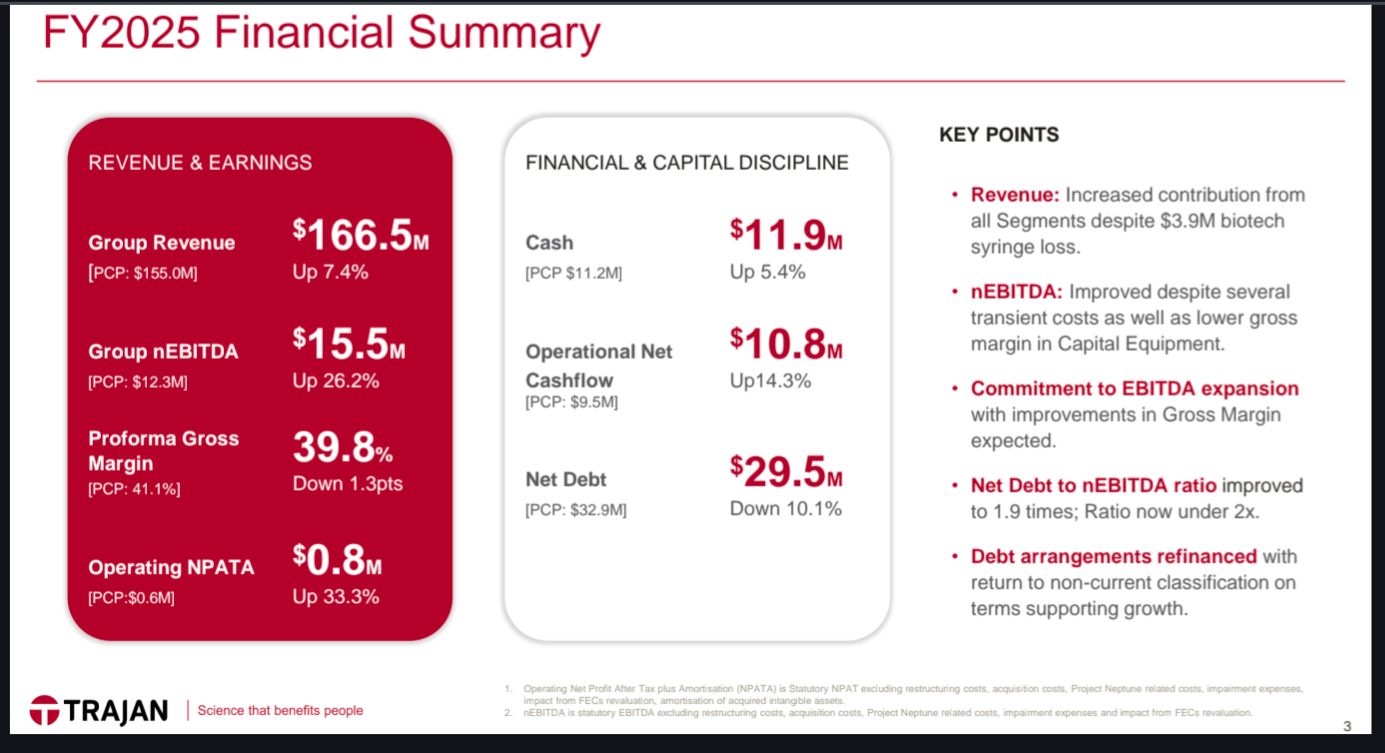

On the surface, the result looks pretty good. Decent increases in revenue and EBITDA. However, they were cycling the FY24 year, which was a terrible result, hit by destocking behaviour. For those who follow Audinate, TRJ experienced a very similar phenomenon, where customers stocked up on consumables following pandemic-related supply issues. This then unwound in FY24. Basically customers ran down their stockpiles back to normal levels and didn't buy anything. Revenue actually dropped from FY23 to FY24.

TRJ Revenue

FY23 $162.2M

FY24 $155.0M

FY25 $166.5M

Viewed across the 3 years, revenue growth is obviously nothing special. Prior years are not comparable due to acquisitions, unfortunately, so we can't get a more long-term picture. Presumably FY23 was slightly inflated by "stocking up", whereas FY24 was artificially low due to destocking. So the 7.4% revenue growth this FY almost certainly overstates the real underlying growth. And is therefore a bit disappointing.

Now on to profitability. Again the published numbers look superficially good. nEBITDA up 26% to $15.5 million. But again, they are cycling a poor result from last year. They missed their initial guidance ($17-19M), as guided in the market update a few weeks ago. The given reasons were: FX revaluation, delays, and tariff announcements requiring "repositioning" of supply chains. As I understand it, manufacturing at the US facility was increased, to avoid tariffs. It is reasonable that doing this would come at a cost, and that it is outside the company's control. However the overall lack of profitability is still a concern.

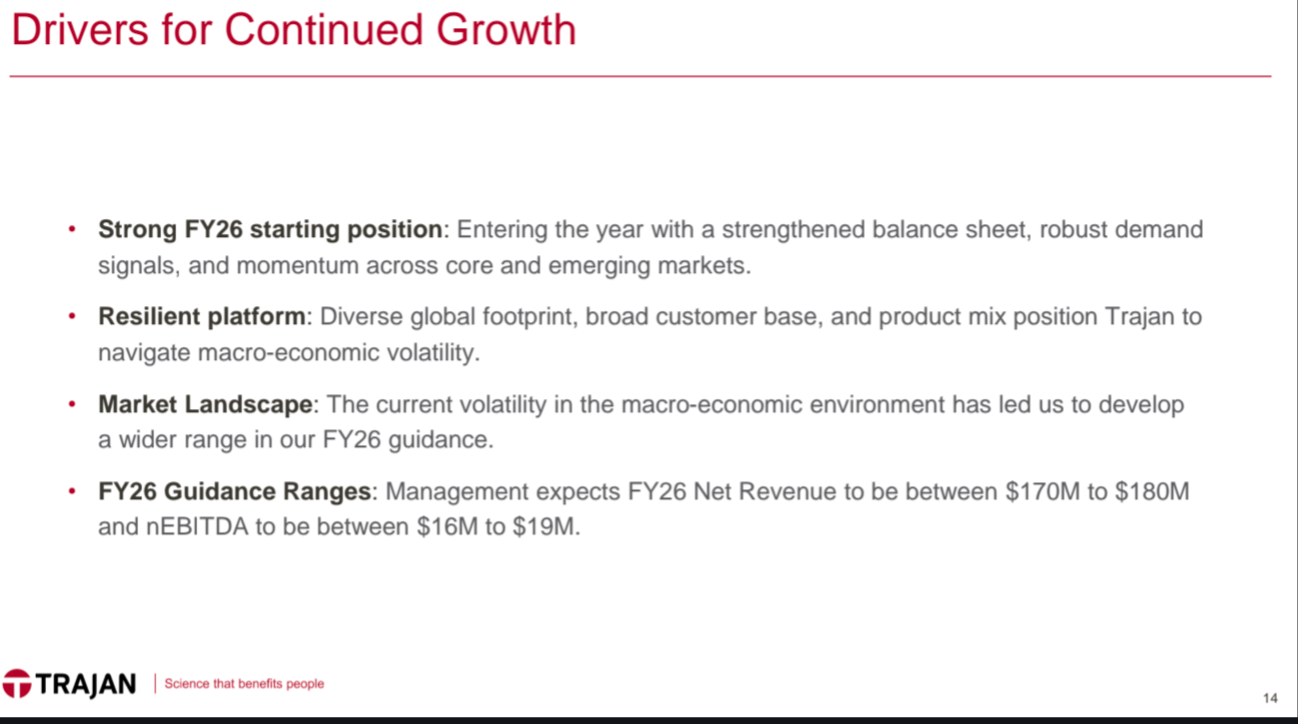

Guidance is interesting:

The overall tone is quite positive. But the guidance for nEBITDA in particular is not inspiring. Perhaps they are being conservative, due the the "macroeconomic environment". But if they are to start advancing towards their stated target of gross margins of 50%, EBITDA would have to improve much more. For comparison, Thermo Fisher Scientific (a much larger international company in the same industry) has EBITDA margins of 20-25%.

Investment Case

I invested in this company because I believed that it was undervalued, mainly due to a spate of acquisitions. It seemed to have been hyped on IPO and made a lot of acquisitions in a very short space of time. Profitability had suffered, the share price had tanked (from an IPO price of $1.70 in 2021, and an all-time high of over $4 in early 2022). The price was cheap relative to revenue. Any kind of improvement in profitability, coupled with long-term revenue growth of 5-7%, would increase the share price. Initiatives to boost profitability, including shifting some manufacturing to Malaysia, were underway and seemed likely to produce benefits.

So is that investment case still intact? Sort of. As is often the case, it hasn't happened as quickly as I would have liked. Profitability needs to improve. Some positive signs are there. But management need to "walk the walk".

The share price is still cheap on a revenue multiple basis (price/sales 0.84, EV/revenue 1.1). By comparison, Thermo Fisher trades on an EV/revenue or 4.8. Although statutory profits don't show it, TRJ is genuinely profitable, with free cash flow $9.3 million (and a market cap of only $138M)

I am prepared to hold for another 6-12 months. Still believe that the upside is greater than the downside. If they can grow revenue at 5% per year, and get their gross margin even halfway from the current 40% to the target of 50%, the share price will be much higher. The downside, given how cheap the price is, seems limited. TRJ makes essential products and has sticky customers. Debt is manageable, cap raises are very unlikely to be necessary.

It's not going to shoot the lights out. But it is pretty low risk, with some significant upside IMO. Some parallels with AHL, for those following that one.

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02975097-3A672900&v=4a466cc3f899e00730cfbfcd5ab8940c41f474b6

A mixed and interesting update.

Revenue beat the top end of guidance and is up 7.4% for the year.

Unfortunately profitability (nEBITDA) was worse than guidance. This was already flagged in a previous update and was due to a combination of factors including FX revaluation, delays, and tariff announcements requiring "repositioning" of supply chains.

Notably, nEBITDA was still substantially better than the previous year (when it was hit be destocking). Net cash is up, net debt is down, as is leverage.

Overall, a moderately positive update. Nice to see revenue growth exceeding expectations. And while I hate to see excuses for poor profitability, the disruption due to tariffs is obviously outside the company's control and FX losses are not likely to be ongoing.

Having digested the H1 results, I thought I would do a valuation.

Methodology is very simple. I tried to think what the company would be worth if it continues to turn around (ie revenue and profitability to both grow modestly)

EV/revenue seems the best way to come up with a reasonable valuation. It reflects the potential of the company, as well as it's value in a breakup or takeover scenario.

I have gone with an EV/revenue of 2. This would still be cheap compared to the multiples that larger competitors trade on.

Quite arbitrary, and really just a starting point to demonstrate how cheap the stock is

H1 results just released:

Financial Summary – H1 FY25

• Group Net Revenue $81.0M, up 6.0% on previous corresponding period (PCP:

$76.4M)

o Components & Consumables segment $48.9M, up 4.9% (PCP: $46.6M)

o Capital Equipment segment $29.9M, up 8.1% (PCP: $27.6M)

o Disruptive Technologies segment stable at $2.2M (PCP: $2.2M)

• Group Normalised EBITDA (nEBITDA) $7.9M, up 97.2% (PCP: $4.0M). Operating

segments were:

o Components & Consumables segment $16.3M, up 10.7% (PCP: $14.7M)

o Capital Equipment segment $5.6M, up 10.2% (PCP: $5.1M)

o Disruptive Technologies segment ($1.0M), improved 65.8% (PCP: ($2.9m))

• Operating NPATA of $1.0M (PCP: $1.3M)

• Proforma Gross Margin 39.7% (PCP:39.7%)

o Components & Consumables was 41.2% (PCP: 39.6%)

o Capital Equipment was 36.2% (PCP: 39.8%)

• Net Debt decreased a further $2.3M in H1 to $30.6M, a $6.2M reduction on PCP

(PCP: $36.7M)

• $10.4M Cash at 31 December 2024 (June 2024: $11.2M)

Outlook

• Guidance maintained:

o FY25 Net Revenue Guidance of $160.0M to $165.0M (FY24: $155.0M).

o Group nEBITDA of $17.0M to $19.0M (FY24: $12.3M).

At a glance, this looks quite good. Improvements on all fronts. Still need to improve profitability, but heading in the right direction

I think the market will like this, given the share price

Decided to put some thoughts down before tomorrow's half-year results

This has been a frustrating investment so far for me. Thought it was cheap at $1.30. Thought it was even cheaper at under $1. Still do

This is a small company, making analytical science products (eg chromatography, mass spectrometry). Basically laboratory equipment and consumables. It has an owner founder with a large stake in the business. He started out as the CEO of an analytical science company, bought a company that manufactures microscope slides and then went from there. In short, many acquisitions followed. there was an IPO in 2021 at $1.70, more acquisitions, and a peak share price of over $4 in 2022.

Since then it has been all downhill. Lack of profitability has been a major problem. In hindsight, probably too many acquisitions too quickly, making cost-control difficult. The company has also been hit with a similar problem to Audinate, with over-ordering due to supply chain issues, followed by a period of destocking, which made the numbers for revenue and profitability in 2024 look particularly bad.

The bull case now hinges on the fact that the problems mentioned above are abating, and the share price is very cheap

TRJ now trades at a price/sales of around 0.8 and an EV/revenue of just over 1. For a quick comparison, Thermo Fisher Scientific (a much larger company selling similar products) is on multiples of around 5 (admittedly with much more scale, profitability etc).

TRJ has made no further acquisitions for around 2 years (it basically can't without raising capital at current depressed prices, which the CEO has said he won't do). There have been signs of cost-cutting, eg reducing headcount and moving some manufacturing to Malaysia. The de-stocking cycle should be coming to an end. Long-term the industry has tailwinds, with expected growth of 5 - 7% per year.

So, I am cautiously optimistic for tomorrows result. Not a lot of success is "baked in" to the current share price

Let's see

Trajan really on the acquisition spree recently. Catch is a placement was done at $2 and Trajan is also doing a SPP at $2 for existing shareholders. This is one I've been following as it is similar to ALS but yet to pull the trigger. Think I will wait on this one as well...

Details below:

Trajan to acquire leading chromatography consumables and tools business building critical mass in the gas chromatography portfolio

Highlights

• Trajan to acquire Chromatography Research Supplies, Inc. (CRS), a leading global manufacturer of high-quality analytical consumables

• Provides Trajan with enhanced and extended production capabilities to service its growing gas chromatography business. Strengthens Trajan’s product portfolio particularly in the critical area of the gas chromatography inlet and sample introduction

• Expands global infrastructure footprint with the acquisition of manufacturing real estate assets in the US

• Follows three successful acquisitions and one strategic investment since listing on the ASX in June 2021

• Acquisition delivers FY22 forecast revenues of US$14.1 million (A$20.1 million1) and EBITDA of US$4.2 million (A$6.0 million1)2, and estimated annual synergies of ~A$1.3 million

• Acquisition price of US$43.3 million (A$61.9 million1) implies ~9.5x FY22F EBITDA (pre synergies)3

• Expected to deliver FY23F earnings per share accretion of >31%1,4,5,6 (excluding the impact of synergies) or >42% (including 100% of the pro forma impact of identified corporate savings and product line synergies7)

• Acquisition to be funded via a fully underwritten A$29.7 million institutional placement (Placement) A$20.0 million in acquisition debt financing through a facility with HSBC and $13.4 million from existing cash

Just stumbled across Trajan this morning catching up on some reading. Not held, now a bit interested. Had a look here to triangulate and only saw Noddy74's great stale straw so thought I would drop in a quick update. February first half results are here --> https://trajan-assets.s3.ap-southeast-2.amazonaws.com/1_H_FY_22_Financial_Results_Investor_Presentation_aeae742717.pdf

Key highlights

- Significant revenue growth (+/- 20% pcp) to $43.7M

- Some cost control to GP Margin of 40%

- Normalised EBITDA $4.8M

- Organic growth low double digits; average revenue growth in top 10 customers 18%

- $33M cash at bank

Full year Forecast

- Revenue of between $104 and $110M

- Normalised EBITDA $12.5 to $13.5M

Very acquisitive at the end of last calendar year buying 4 firms and it looks like that those have been well executed and have strengthened the right capabilities.

About Trajan

We’re an Australian headquartered, global developer and manufacturer of analytical and life sciences products and devices, founded to have a positive impact on human well-being. We do this through consumable products, devices and solutions that are used in the analysis of biological, food, water, and other environmental samples. Through our portfolio and technology pipeline we’re supporting the move towards decentralised, personalised data-based healthcare.

Two Divisions

Analytical Products Trajan’s analytical products and components are sold to a broad range of participants in the analytical science industry, including large OEMs, pharmaceutical, food and CRO laboratories and scientific distribution companies.

Life Sciences Solutions Trajan's life sciences solutions focus on areas directly related to human health. We enhance and optimise workflows with a variety of automated preparative or sample collection systems ready to integrate into laboratories, or generate custom solutions for life science research and development.

SP has been bullish the last couple of months, up 22% since early March. I wish I had been catching up on my reading back then! Small numbers of buyers/sellers. High ownership from founder.

I'll be doing a bit more digging, possible that there's something here but is trading on a high multiple of earnings as @Noddy74 pointed out.