Had a quick revisit of this one after the full year FY23 results this morning.

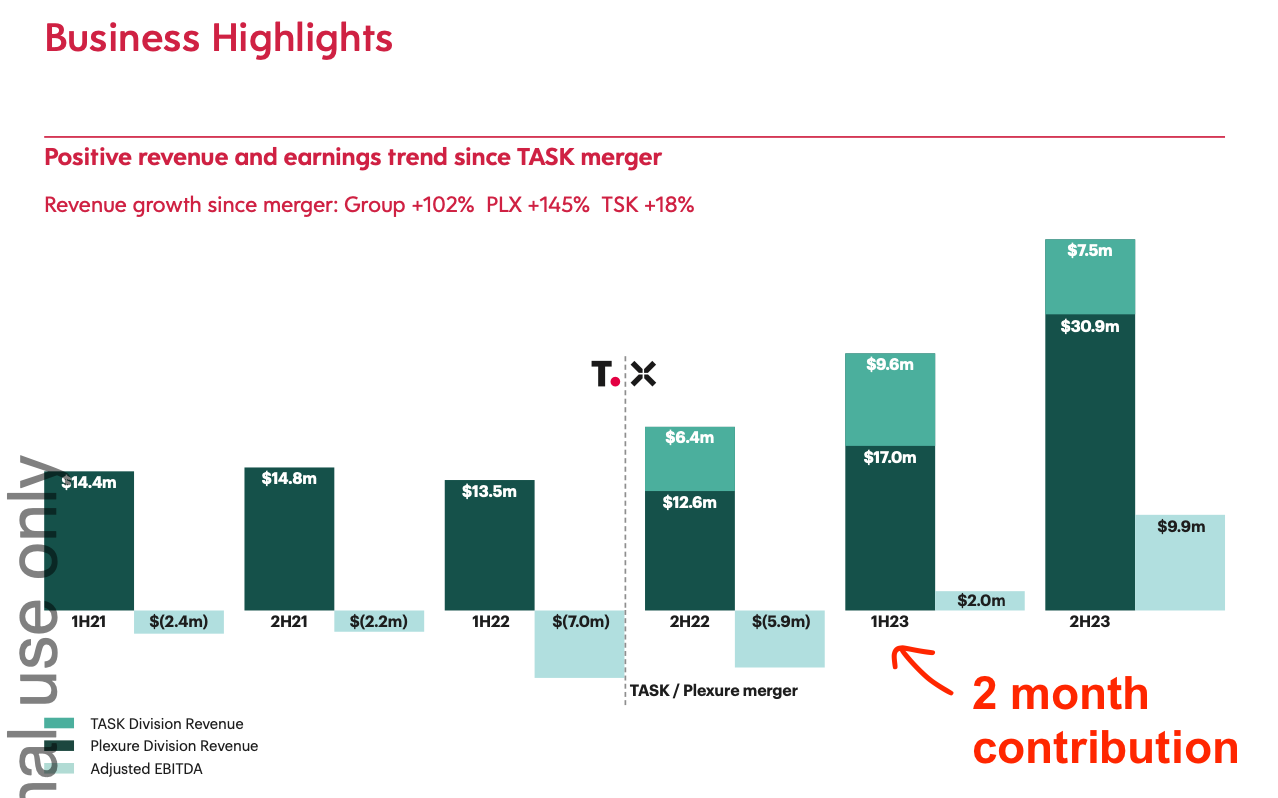

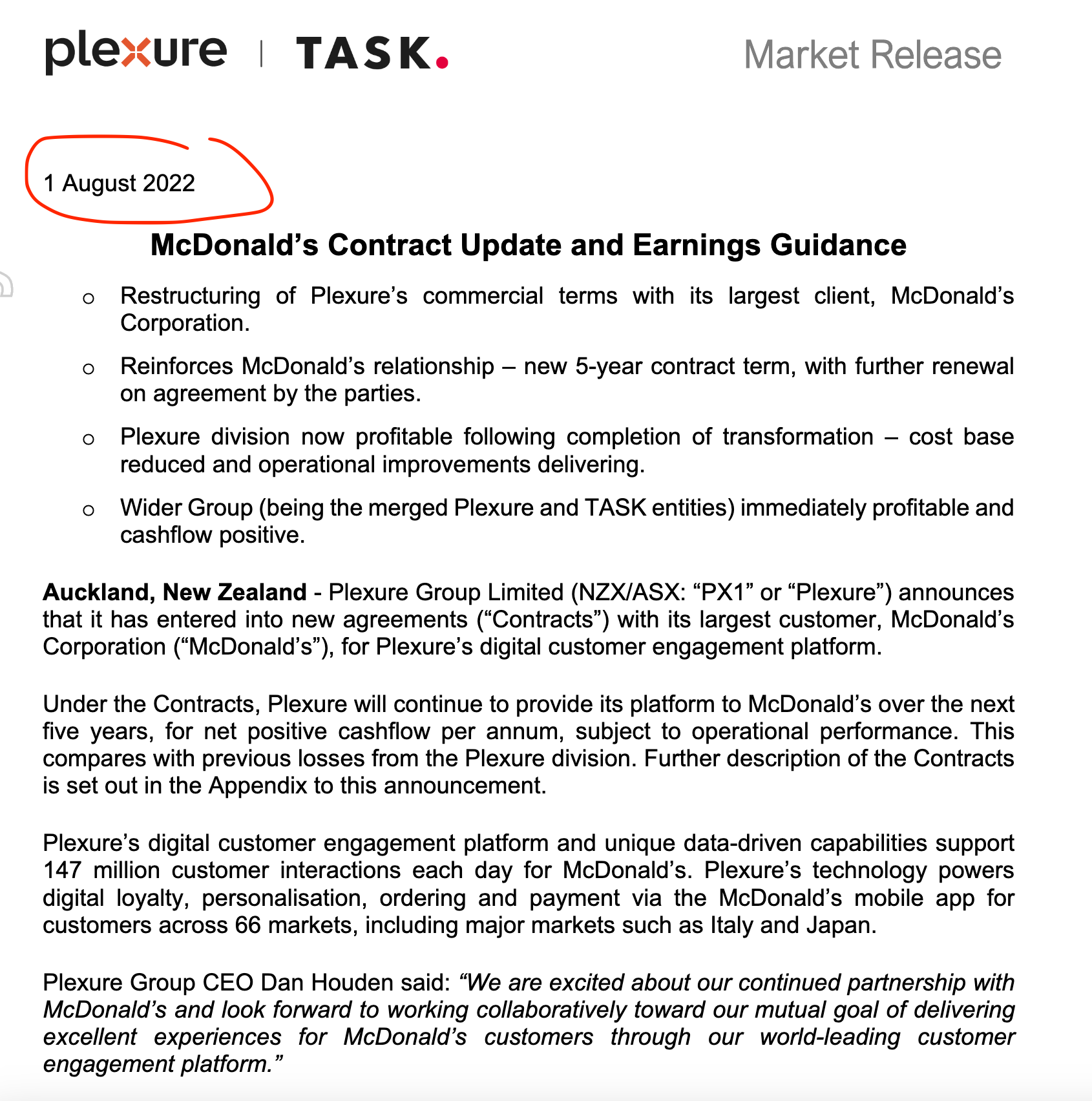

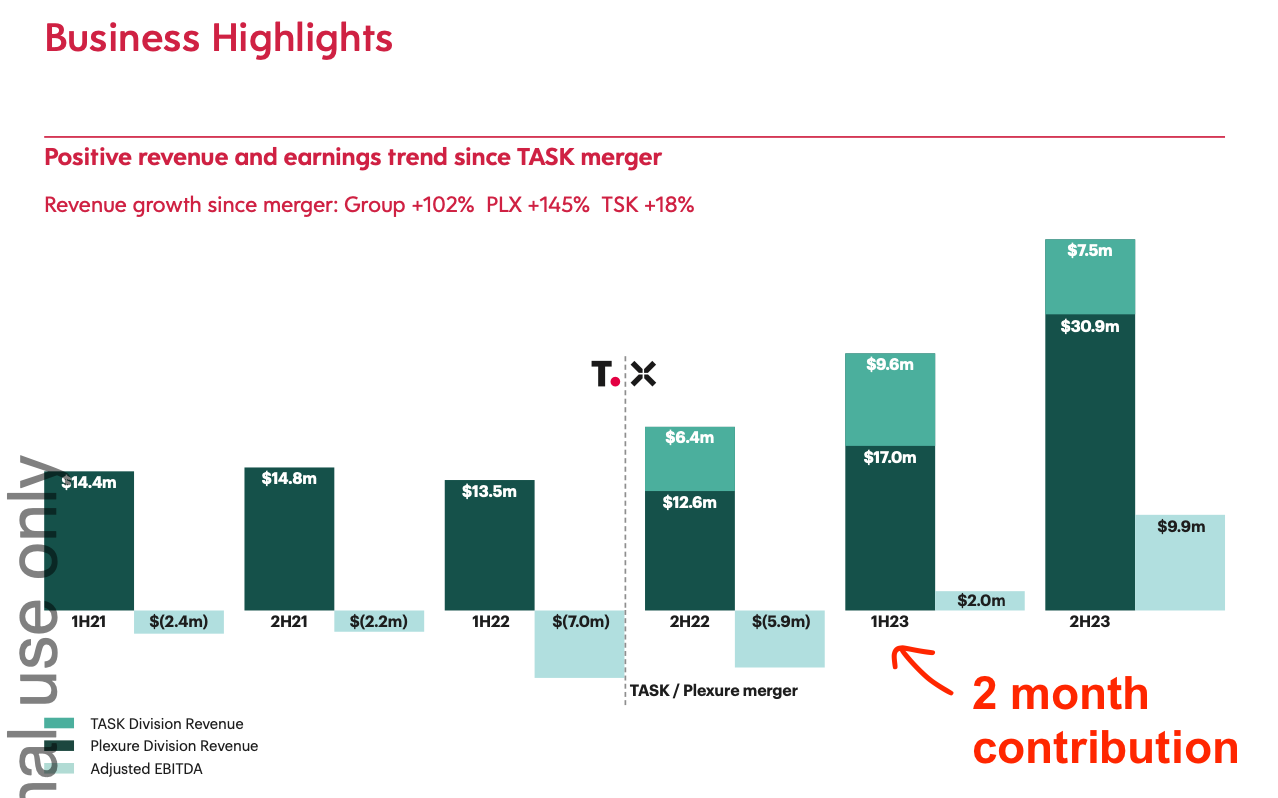

The contract renewal with McDonald's in Aug 2022 was one hell of a renewal. McDonald's is >90% of Plexure's revenue, and it has more than doubled since the renewal. I certainly didn't realise it was that big at the time.

If I normalise all their numbers, they're running at around NZ$10.5m/annum EBIT or around 20x EV/EBIT. Looks interesting - just unsure where the organic growth will be coming from in future years since everything else outside the contract renewal looks pretty flat.

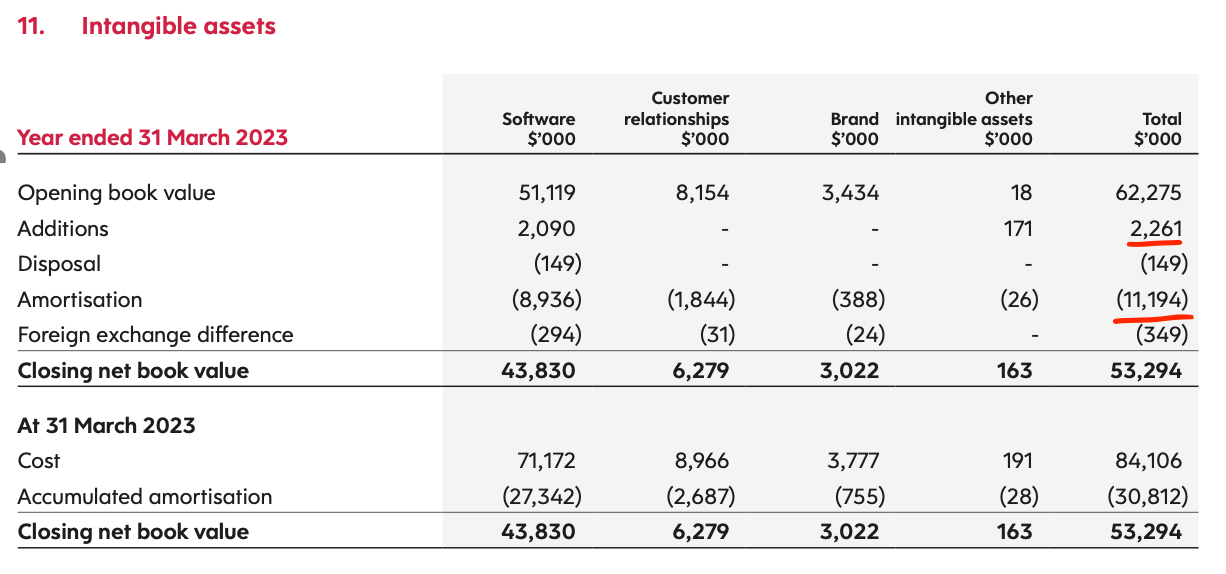

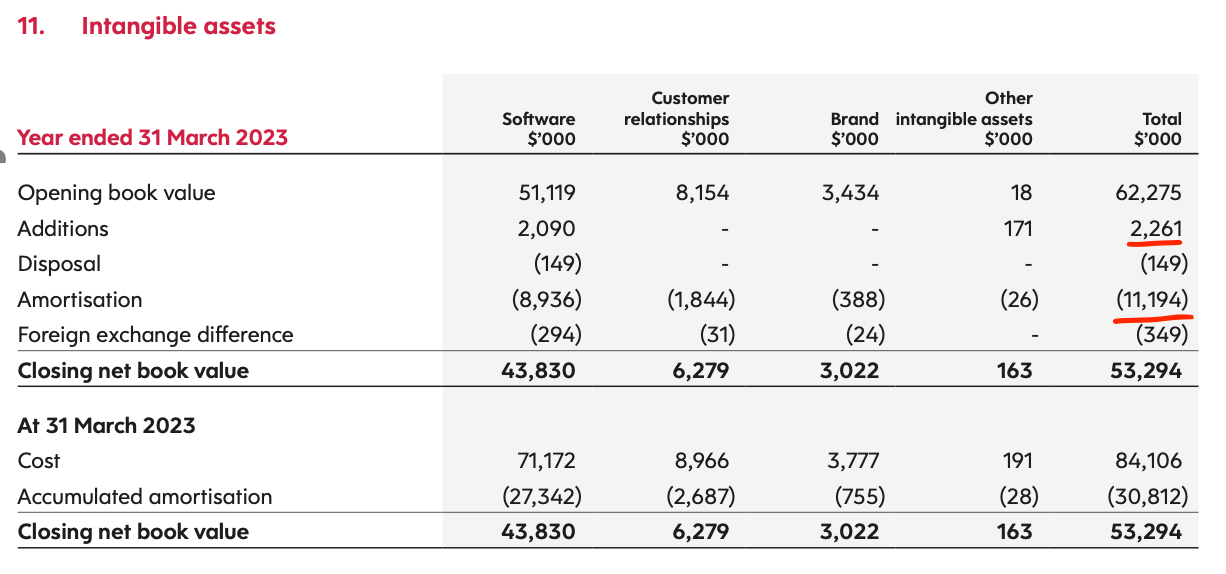

Something you don't see every often - the company has really ramped down the amount of intangibles (mainly software dev) being capitalising. As a result amortisation was $9m higher than what was actually spent on capex, and NPAT is not shown in its most favourable light.

Normally companies like to dress up the bottom line numbers, and this is very much a dressing down. Which is very interesting.