I had this on my watchlist for a long time since this was around $2 before the share price crashed back to current levels.

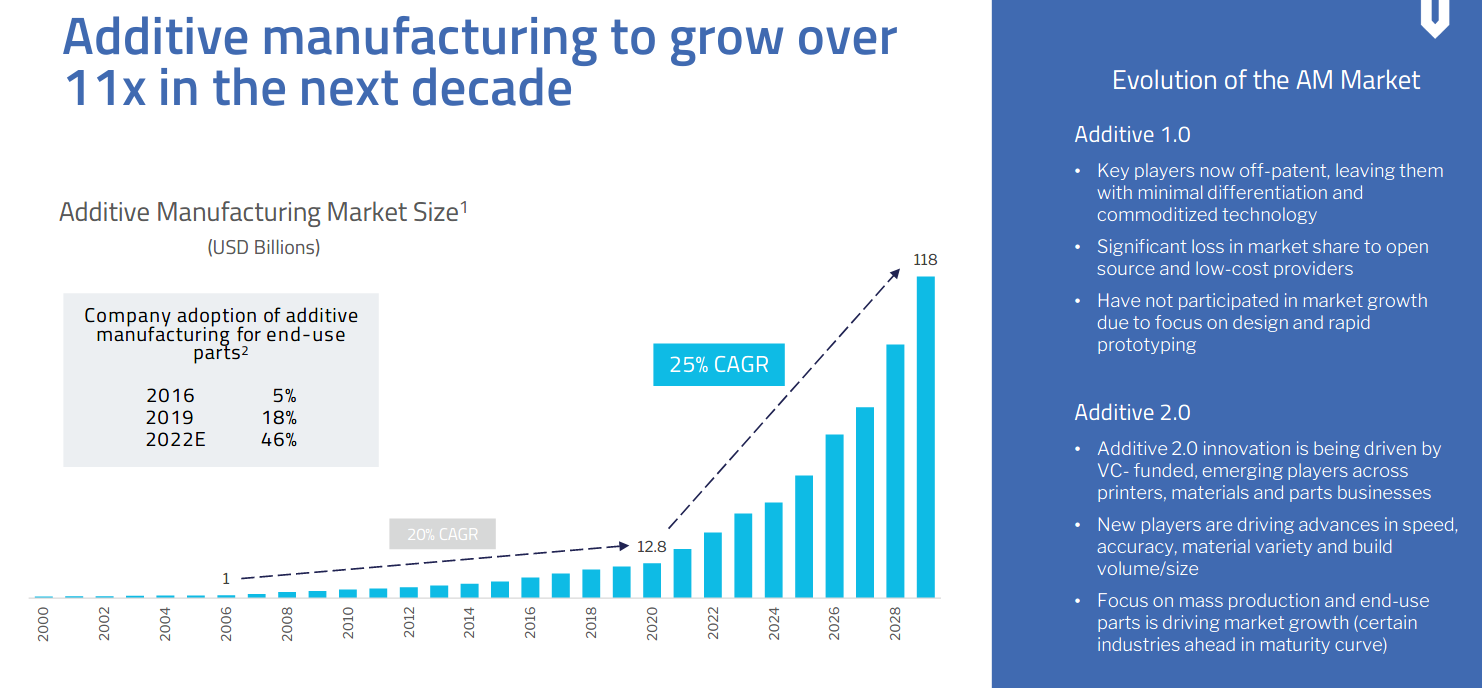

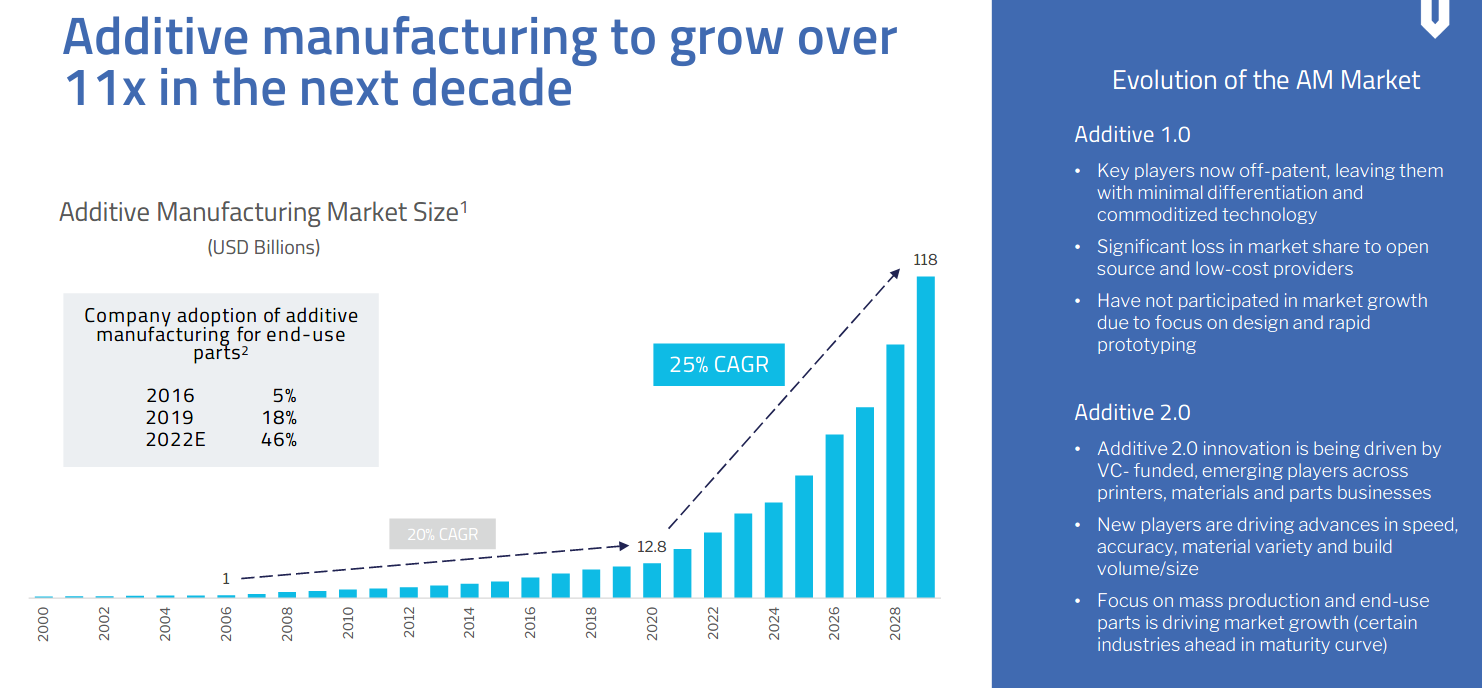

Most of the price was really driven on the hype on numerous applications of Titomic's technology with Titanium and other metallic powders in regards to advanced tooling and manufacturing (especially 3D printing) for a large number of industries. Titomic has been working on machines using cold-spray technology as an alternative path for doing metal fabrication and advanced coatings by sending metal powders at supersonic speeds which then bond together forming a strong smooth finish (from my understanding - correct me if I'm wrong).

However with no revenue or deals, the share price quickly caught up with reality as various commercialisation milestones got pushed out. Then, in 2021, there were changes in management which included Herbert Koeck appointed as CEO and then eventually MD in 2022. During his time, he contributed to the commercialisation of the metal technology.

Over the last month, Titomic have made a few commercial announcements that are presented in the last quarterly and caught my attention.

- Sale of first D523 System into Asia Pacific In May, Titomic Australia sold its first D523 System into Asia Pacific to Singapore-based D&C Coating for AUD44,758. Titomic believes that it will be able to sell 20 more D523 Systems into the region in the financial year ending 30th June 2023.

- Sale of first four D523 systems into the Australian transport industry Titomic has received purchase orders from Australian-based companies for four separate D523 low-pressure cold spray systems, totalling $314,900 in sales.

- Completed Site Acceptance and installation of Titomic TKF 1000 at TWI UK at end of June 22. This alone is worth $2.2m and revenue will be recognised this FY22.

Other positives

- Inside ownership. CEO/MD has a holding in the company which is reassuring as compared to some other companies I've seen.

- Lots of commercial partnerships across a wide range of industries

With all that out of the way now some of the concerns:

- Lumpy cashflow. Despite the last quarter announcing all those deals, the last quarterly cashflow report did not quite match up. The TWI UK deal is one example. I contacted the company regarding how the cash gets realised from that deal, and they replied back stating it will take over a month before the revenue gets converted to cash. The revenue also includes a deposit that was paid when the work was first announced in Aug 2021. Fair enough, but does highlight some challenges regarding cashflow.

- Recent selldown as a result of issued shares from the Tri D Dynamics acquisition

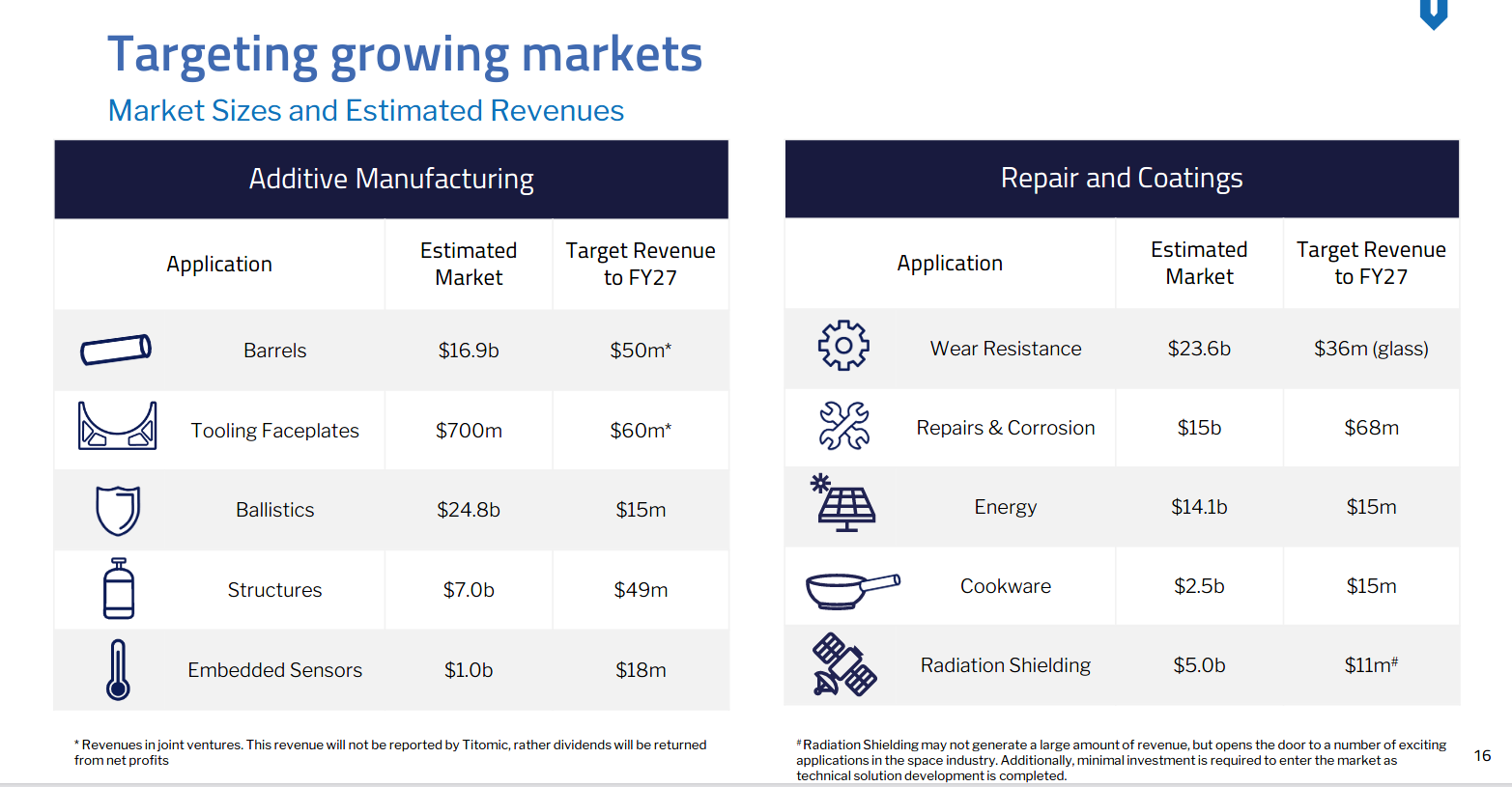

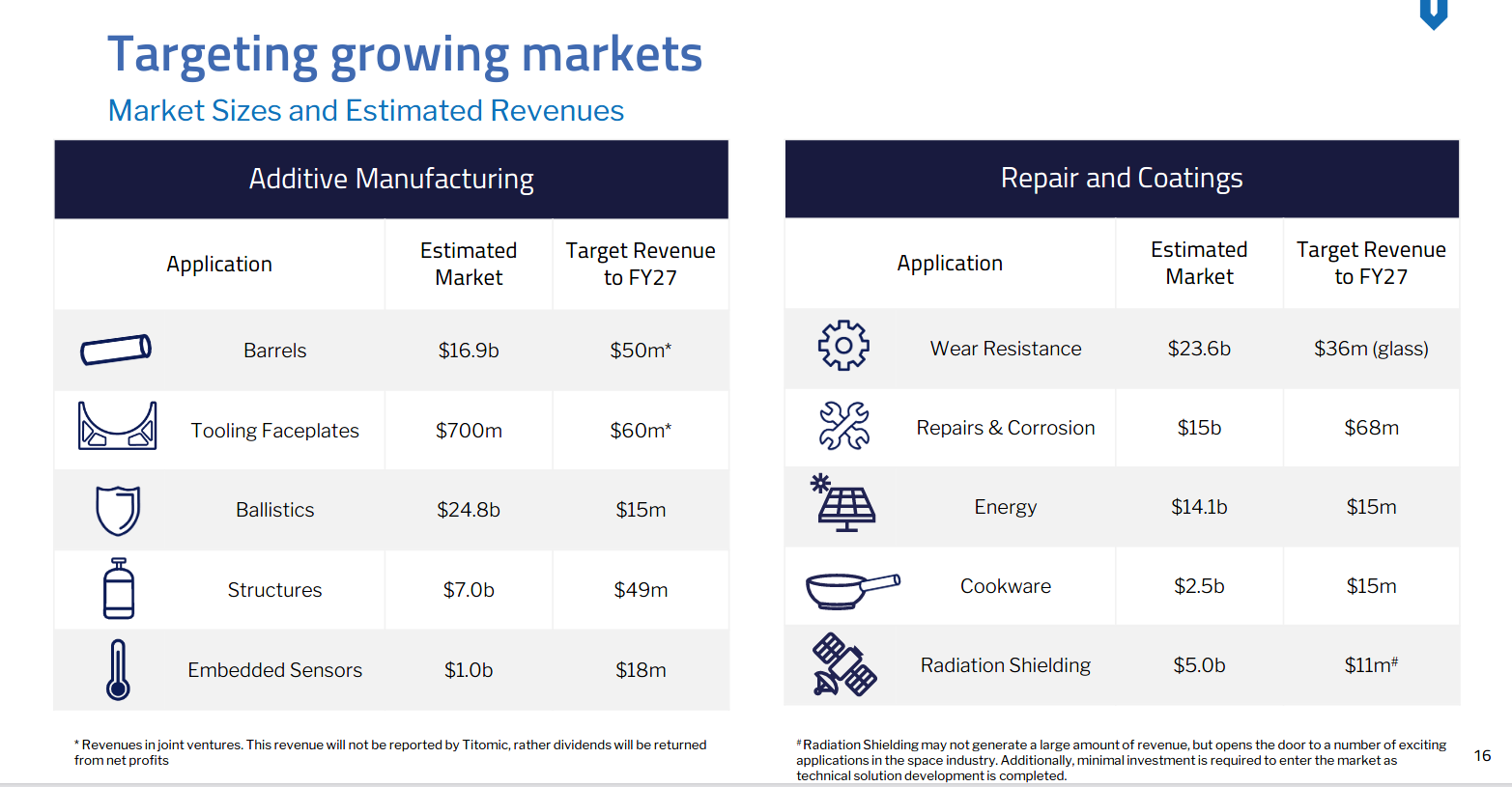

- And lastly, serial criminal of TAM (Total addressable market). Their last presso still uses TAM to hype up the company. And they have been doing this for a while.

Hopefully I've provided a sufficient summary on what Titomic is about and where they are heading. Only have a small holding as I'm still not that convinced yet but there seems to be some potential here.

[Held]