Alrighty, can I pique anyone's interest with a filthy high-volatility Rare Earth's mining explorer?

Allow me to introduce Viridis Mining and Minerals Limited (VMM). They have the rights to the Colossus mine in Brazil which contains the preferred Ionic Absorption Clay (IAC) rare earth's. Please see the below summary from highly conflicted broker Fosters (They ran the last two capital placements).

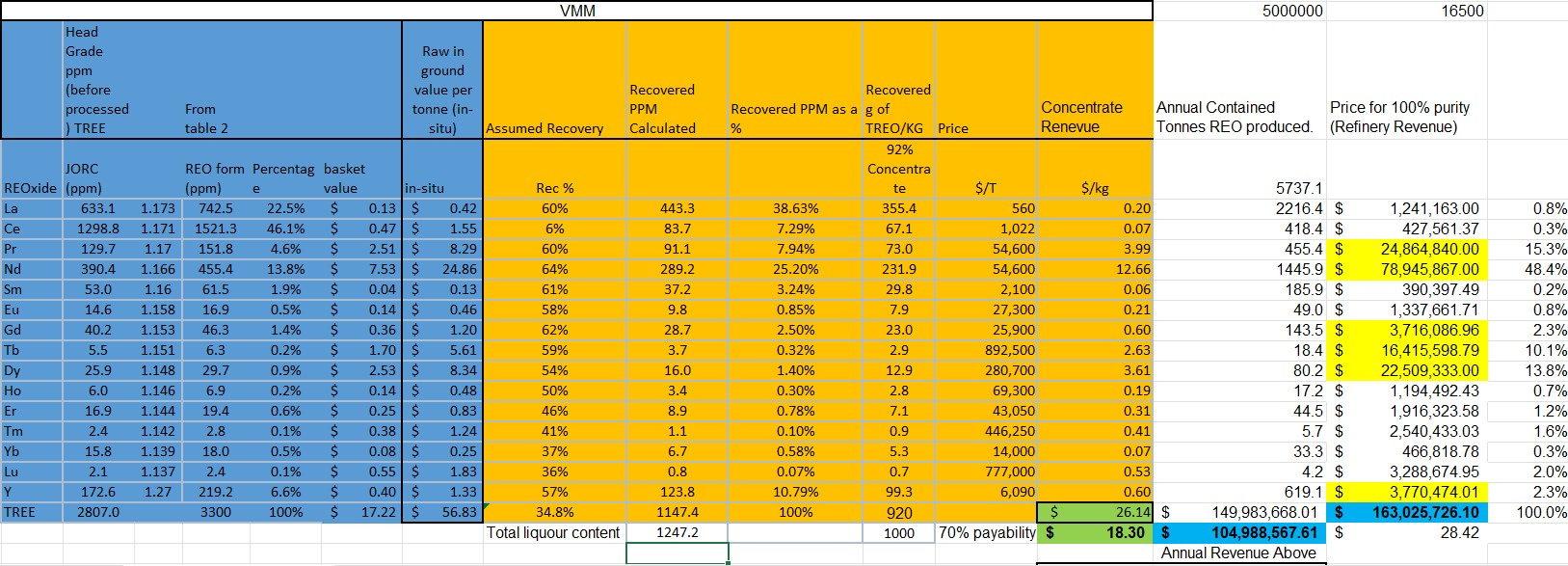

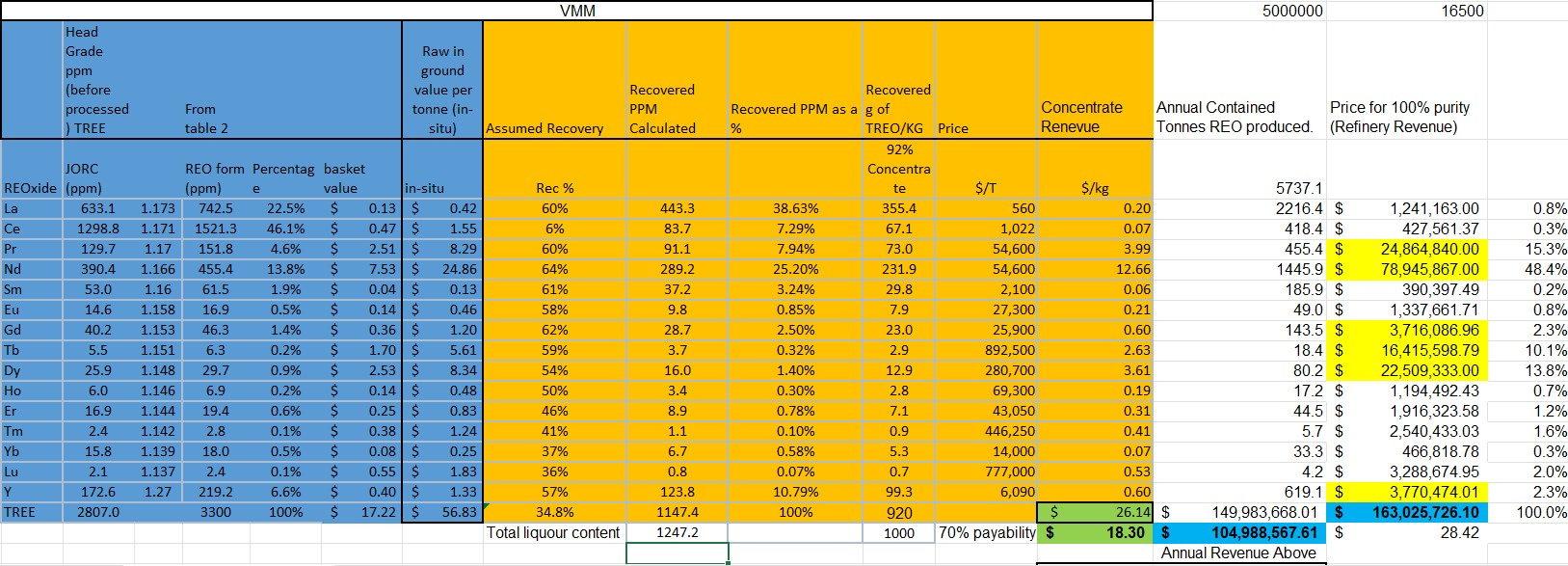

To most of us I imagine, the details on those grades are very difficult to interpret, which is why I have also added some useful valuation information from the Hot Copper god @SetFire2TheHive (Yes, there are still a couple of them left on that hell-site). His below calculation of annual mine revenue is approx USD $105mm at current rare earth prices. He estimates annual profit in the ballpark of USD $40m.

Further to the above, the key appeal for VMM in my view, is that their new rare earth's mine at Colossus abuts the Caldeira mine owned by Meteoric Resources (ASX:MEI). The Caldeira mine has a current resource estimate of 409MT @ 2626 ppm. This is a similar total size and grade to VMM, however MEI is further down the path towards commercialisation and thus has a current market cap of $380m. MEI's key advantage over VMM is that they hold more concessions in the area to further explore, however this is of limited relevance to the current value, when a normal REE mine only produces around 5MT annually, thus giving both mines extensive livelihoods.

With the above in mind, my very simple conservative valuation for VMM is $3.40. Double today's SP would give VMM a market cap of $212m, which is still only 55% of MEI's market cap!