Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

So I'm sure a lot of you here listen to The Motley Fool Podcast, and there was a section recently on 'crimes in charting' and the benefit of companies that report clearly.

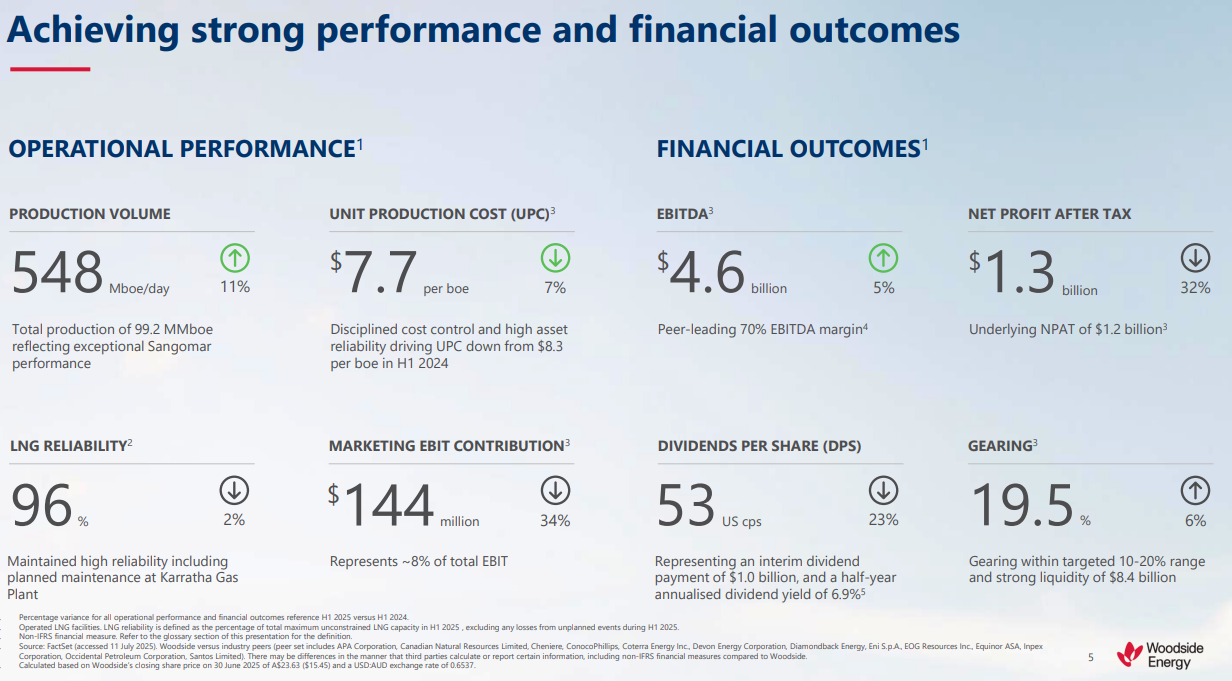

Below is a snip from the investor presentation from WDS today:

Nice and clear. Production volume up - good, Unit Production Cost down - good, EBITDA up - good, NPAT down - bad, LNG reliability down - bad, Marketing EBIT contribution down - bad, Dividends down - bad (fiscally responsible?), Gearing up - high end of targeted range ok.

So here's my dilemma. My macro investing strategy, when I am deploying capital, has always been very simple:

Big liquid companies, P/E of as close to 10 as possible (below is amazing), Dividend before franking credits of greater than 6% and share price below 52 week highs.

There's a few other things that I look at but this is my starting point.

Now WDS, with its share price dropping as I type this is still comfortably within these metrics. I accumulated when it got sub $20.

Here's the rub though, WDS is my biggest holding already and I am wary of the old 'too many eggs in one basket'. I am still bullish on WDS as demonstrated by my last valuation, but I'm wondering if anyone here would like to put a case for why I shouldn't buy more WDS (other than the obvious, got too much already).

Talking about dodgy charting, back when I was doing M&E I provided a chart to the bosses with the improvement that had been achieved by a project. It accurately represented what had been achieved. The boss was very unhappy with the graph, saying it 'didn't show enough improvement'. I obviously wasn't going to fudge any figures, so I simply changed the scale of the graph. Visually much better, cue happy boss, but data was the same. Misleading optically, sure, but if you read the data, factually correct.

Looks like the approval for the Northwest extension has just landed ( 5 year process was it )? Funny how I saw the Woodside share price rise 3% this morning and first thought was there must be good news pending.

let’s see if it spurs any buying - anything would be good after the run it’s had. Was anyone here buying under $20 recently ? Like others have said - I was already over allocated so couldn’t really justify!

November 2024

Since posting the half-year results, Woodside Energy’s price has fallen another 10% to around $24.50 (as of Friday, November 29). I’ll admit—this hurts. It’s unclear why the price keeps dropping. Am I overestimating my conviction, or is the market overlooking something? The only plausible reason I see is the perception of WDS as a “fossil fuels company” rather than an “energy company.” If anyone has more insight, I’d love to hear it.

The numbers look strong, yet this year has been shocking for the stock. From an oil perspective, I don’t see demand declining quickly. Working in Queensland’s power industry, I see first hand the volume of oil used for maintenance and installations, even in grid power systems. (Just topping up an earthing transformer takes 40 litres.)

Meanwhile, the Lytton Oil Refinery produces 60% of Queensland’s fuel, refining 109,000 barrels of crude oil daily into 18 million litres of fuel. The government has even allocated $300 million toward its Future Fuels Desulfurisation Project to enhance sustainability, signalling ongoing demand.

I believed $27 was a buy, so surely $24 is a bargain. What am I missing?

August 2024

Financial highlights (Taken from todays results announcement)

“• Net profit after tax of $1,937 million.

• Underlying net profit after tax of $1,632 million.

• Operating cash flow of $2,393 million and positive free cash flow of $740 million.

• Australian tax and royalty payments of A$2,682 million.

• Liquidity of $8,479 million.

• Determined a fully franked interim dividend of 69 US cents per share (cps)”

Based off yesterday’s share price of $26.33, this results in roughly a 5.53% half year dividend yield (fully franked inc., with today’s exchange rate equaling $1.02 for 69 US cents). I think this is the main reason the share price jumped 5.26%, currently trading at $27.60, as most investors were worried they may not received a meaty payout due to recent acquisitions.

Very glad to be holding in my SM and IRL portfolios (largest positions). I would have bought more last week if not for the 20% rule ha. I still think this is a strong buy at current levels.

I have been a big fan of WDS since I started investing. Lately the price has been smashed and I thought I’d ask an AI to write me an analysis based on the current company. Below is the Comprehensive Analysis Report, and underneath that is a fair value that it has concluded based on current values as of today, 20th August 2024.

Woodside Energy Group (ASX: WDS) - Comprehensive Analysis as of August 2024

Woodside Energy Group (WDS), one of Australia’s leading energy companies, continues to play a pivotal role in the global energy market, particularly in liquefied natural gas (LNG) and oil production. As of August 2024, the company's stock is trading at approximately AUD 26.08 per share, reflecting a recent decline from its 52-week high of AUD 38.89 [oai_citation:1,UBS Sticks to Their Hold Rating for Woodside Energy Group (WDS) | Markets Insider](https://markets.businessinsider.com/news/stocks/ubs-sticks-to-their-hold-rating-for-woodside-energy-group-wds-1033698751).

Recent Acquisitions and Projects

Woodside has been aggressively expanding its portfolio, particularly in clean energy. Notably, it acquired a clean ammonia project in Texas for USD 2.35 billion in July 2024, marking a significant shift towards low-carbon solutions. This acquisition is part of Woodside's strategy to diversify its operations and secure a foothold in the growing market for clean energy solutions [oai_citation:2,UBS Sticks to Their Hold Rating for Woodside Energy Group (WDS) | Markets Insider](https://markets.businessinsider.com/news/stocks/ubs-sticks-to-their-hold-rating-for-woodside-energy-group-wds-1033698751).

Additionally, Woodside is progressing with its Scarborough gas project off Western Australia, a major LNG project expected to significantly boost production. The project is slated to start production by 2026, reinforcing Woodside's position as a leading LNG producer [oai_citation:3,Woodside Energy Group Ltd (ASX:WDS) Share Price - Market Index](https://www.marketindex.com.au/asx/wds).

Commodity Prices and Outlook

As of August 2024, Brent crude oil is trading around USD 88 per barrel, while natural gas prices are hovering near USD 2.70 per MMBtu. The future outlook for these commodities remains mixed. While oil prices could see upward pressure due to geopolitical tensions and supply cuts from OPEC+, the outlook for natural gas is more subdued due to oversupply and weak demand in key markets like Europe and Asia [oai_citation:4,UBS Sticks to Their Hold Rating for Woodside Energy Group (WDS) | Markets Insider](https://markets.businessinsider.com/news/stocks/ubs-sticks-to-their-hold-rating-for-woodside-energy-group-wds-1033698751) [oai_citation:5,Woodside Energy Group Ltd (ASX:WDS) Share Price - Market Index](https://www.marketindex.com.au/asx/wds).

For Woodside, this scenario implies a challenging environment for its oil-related revenues but a more stable outlook for LNG, especially as demand from Asia is expected to remain robust in the coming years. However, the volatility in commodity prices could impact Woodside’s profitability and cash flows, especially as it embarks on capital-intensive projects.

Fair Value and Analyst Ratings

Analysts currently estimate Woodside’s fair value around AUD 31 per share, implying a potential upside of approximately 19% from current levels. Despite this, the stock has been under pressure, and many analysts maintain a "Hold" rating, citing concerns over the execution risks associated with its major projects and the uncertain commodity price environment [oai_citation:6,UBS Sticks to Their Hold Rating for Woodside Energy Group (WDS) | Markets Insider](https://markets.businessinsider.com/news/stocks/ubs-sticks-to-their-hold-rating-for-woodside-energy-group-wds-1033698751).

Dividend Outlook

Woodside has been a reliable dividend payer, distributing a dividend yield of around 6-7% over the past two years. For the full year of 2024, estimates suggest a dividend payout of approximately AUD 1.80 per share, reflecting a slight increase from the previous year, assuming stable oil and gas prices and no significant disruptions to its operations. The company's current balance sheet shows a healthy cash position, supporting its ability to maintain or even slightly increase its dividend payout, despite heavy capital expenditures on new projects [oai_citation:7,Woodside Energy Group Ltd (ASX:WDS) Share Price - Market Index](https://www.marketindex.com.au/asx/wds).

Conclusion

Woodside Energy remains a solid player in the global energy sector, with strategic expansions into clean energy and a robust LNG portfolio. However, investors should be mindful of the risks associated with volatile commodity prices and the execution of large-scale projects. The stock currently offers a decent dividend yield, making it attractive for income-focused investors, but its near-term capital appreciation potential may be limited.

Fair Calculation

To calculate a fair value for Woodside Energy (WDS), we can use several commonly accepted valuation methods: the Dividend Discount Model (DDM), the Price/Earnings (P/E) ratio analysis, and the Discounted Cash Flow (DCF) model. Below, I'll go through the calculations for each method and then average the results.

1. Dividend Discount Model (DDM)

The DDM estimates the fair value of a stock based on its future dividend payments, which are discounted back to their present value.

Formula:

P0 = D0 x (1 + g)/(r - g)

Where:

- P0 = Fair value of the stock

- D0 = Current dividend per share (AUD 1.80)

- g = Dividend growth rate (let's assume 3%)

- r = Required rate of return (let's assume 8%)

Calculation:

P0 = 1.80 x (1 + 0.03)/ 0.08 - 0.03)

P0 = 1.854/0.05

P0 = AUD 37.08

2. Price/Earnings (P/E) Ratio Analysis

This method involves multiplying the company's earnings per share (EPS) by the average P/E ratio for the industry or company.

Assumptions:

- Current EPS: AUD 2.00

- Industry average P/E: 15

Formula:

P0 = EPS x P/E

Calculation:

P0 = 2.00 x 15 = AUD 30.00

3. Discounted Cash Flow (DCF) Analysis

The DCF model values a company by estimating its future cash flows and discounting them back to their present value.

Assumptions:

- Free Cash Flow (FCF) for the next year: AUD 2.5 billion

- Growth rate of FCF: 2% (conservative estimate)

- Discount rate: 8%

- Number of shares outstanding: 960 million

Formula:

P0 = sum (FCFt)/(1 + r)^t + TV/(1 + r)^n

Where TV is the terminal value:

TV = FCFn+1/(r - g)

Calculation:

Let's simplify by calculating for a 10-year period with a terminal value at the end:

P0 = 2.5/(1.08)^1 + 2.55/(1.08)^2 + … TV/(1.08)^10

Terminal Value (TV):

TV = 2.5 x (1 + 0.02)/(0.08 - 0.02) = AUD 42.50 billion

Present value of TV:

PVTV = 42.50/(1.08)^10 = AUD 19.77 billion

Sum of PV of FCFs (approximately over 10 years) + PV of TV:

P0 = approx AUD 32.08 per share

Average Fair Value Calculation

Now, we take the average of the three methods:

Average Fair Value = {37.08 + 30.00 + 32.08}/3 = AUD 33.72

Based on these calculations, the fair value of Woodside Energy (WDS) is approximately AUD 33.72 per share. This suggests that the stock, trading at AUD 26.08, might be undervalued, providing a potential buying opportunity. However, it's essential to consider market conditions, company-specific risks, and the broader economic environment before making investment decisions.

Do take these words with a grain of salt, I have experienced products generated by AI to be incorrect in the past. In saying that, I believe this stock is quite undervalued and I give it a Strong Buy rating. Not only because of the math, but because of where the world is heading with its ever growing demand for energy.

Disc: Held IRL (largest holding) and SM.

Hi @Remorhaz I watched the ABC report also. I think the so called ‘gas crisis’ is the result of the perfect storm of events that have driven gas demand, and consequently sky high gas prices. Here are some of the contributors to the perfect storm:

- Coal is the dominant source of Australia’s electricity generation, accounting for about two-thirds.

- The role of coal in electricity generation has been falling amid a wave of new zero-emission generation and environmental advocacy.

- Several ageing coal fired power stations have been shut down for maintenance leaving 25% of the country’s capacity offline

- the Victorian state government put a moratorium on gas exploration and production, and now we don’t have enough gas.

- the Australian Energy Market Operator has warned of “potential ongoing implications for reliability” in the National Electricity Market this winter because of the recent “challenges” with the availability of fuel.

- Australian wholesale electricity prices have surged because of the lack of investment in generation.

- the Ukraine war has resulted in oil and gas shortages and price hikes

- A sudden cold snap in eastern Australia spiking the demand for power

- we find out the Snowy 2 hydro battery project is 19 months behind schedule and will not level out renewable energy cycles until 2027.

I think the perfect storm will pass in months, not years. When it passes, I think the long-term low carbon emission theme will return to haunt Woodside and other fossil fuel producers.

While the shortage of fossil fuels has some time to run, I’ve taken this as an opportunity to offload Woodside IRL at 12 month highs. I think back to March 2020…nobody wanted Woodside for just over $15.

Fossil fuels, carbon credits and transitioning to clean energy ABC 7:30 Carbon Dilemma

A recent short (seven and a half minutes long) ABC 7:30 piece on Woodside's Scarborough Gas Project. It questions whether natural gas is truly key in the green transition and whether Woodside's latest proposal will blow past the global carbon budget

https://www.abc.net.au/7.30/scientists-warn-new-natural-gas-projects-will-make/13922854

Disc: Held in RL

FOURTH QUARTER REPORT FOR PERIOD ENDED 31 DECEMBER 2020

Performance highlights

• Delivered production of 24.9 MMboe, down 2% from Q3 2020, contributing to record annual production of 100.3 MMboe.

• Delivered sales revenue of $920 million, up 32% from Q3 2020.

• Delivered sales volume of 29.1 MMboe, up 9% from Q3 2020.

• Installed the Pluto water handling module on the Pluto offshore platform.

WOODSIDE EXPANDS LONG-TERM LNG SUPPLY AGREEMENT

Woodside Energy Trading Singapore Pte Ltd (Woodside) and Uniper Global Commodities SE (Uniper) have agreed to amend the binding long-term sale and purchase agreement (SPA) announced in December 2019 to increase the supply of LNG from Woodside’s global portfolio to Uniper.

The quantity of Woodside LNG to be supplied under the amended SPA has doubled. Initial supply commencing in 2021 is now for a volume of up to 1 million tonnes per annum (Mtpa), increasing to approximately 2 Mtpa from 2026.

The majority of LNG supply from 2025 is conditional upon a final investment decision on the development of the Scarborough gas resource offshore Western Australia. The 13-year term of the SPA is unchanged.

08-Sep-2020: Livewiremarkets.com: With Woodside down 40%, is it time to get greedy?

[I hold WPL shares.]

14-Aug-2020: Half-Year 2020 Results Briefing Teleconference Transcript

That link will take you to a full transcript of the Teleconference that Woodside held yesterday after announcing their half year results. I posted a straw here yesterday with links to their results announcements.

[I hold WPL shares]

13-Aug-2020: Half-Year Report 2020 and Half-Year 2020 Results and Briefing Pack

[I hold WPL shares]

16-7-2020: 4:18pm: Q2 2020 Briefing Transcript and Additional Information

Also: 15-7-2020: 8:30am: Second Quarter 2020 Report

[I hold WPL shares] Gas company, largest market cap Energy play on the ASX, but entirely leveraged to Natural Gas rather than oil. Not ex-growth yet. They can move at glacial pace, but they get things done - in their own time. Very measured. Great management. Good focus on shareholder returns. Gas Production revenue underpinned by multi-year long-term contracts (recurring revenue). Pays reasonable dividends. Not as leveraged as a Santos or an Oilsearch, so less bang-for-your-buck on an oil price recovery (which drags gas producing companies up with it), but less downside risk, and still plenty of upside from here when energy companies are back in vogue once more. Good company to buy when their SP is low, which it still is.