Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

November Update

- Profit Reserve - 55.4c - 5.2yrs of Dividends

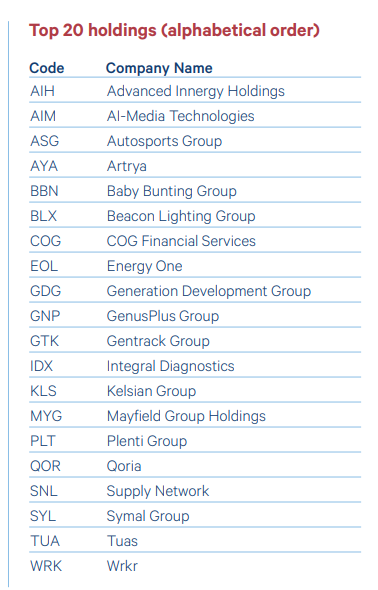

Some familiar names in the top holdings

They say this was recorded on Tuesday July 20th, 2023, however the 20th was a Thursday. It was posted on Livewiremarkets.com on Friday (July 21st): https://www.livewiremarkets.com/wires/oscar-oberg-small-caps-are-primed-to-rally-and-it-doesn-t-happen-without-these-stocks

Oscar Oberg is the Lead Portfolio Manager (PM) of WAM Microcap (WMI), WAM Research (WAX), WAM Active (WAA) and WAM Capital (WAM), however his strength is in WAM Funds' Research-Based investments (WMI, WAX, & half of WAM) rather than the market-based, short-term-arbitrage-based strategy of WAA and the other half of WAM, which is demonstrated by WMI and WAX consistently outperforming WAA and WAM over recent years - since Oscar joined WAM Funds from his previous role at the Hong-Kong-based CLSA (he was at Grant Thornton before that).

In this Livewiremarkets.com "Rules of Investing" podcast episode, titled, "Small caps are primed to rally, and it doesn't happen without these stocks", Oscar covers off the following:

Timestamps:

0:00 - START

1:50 - When will small caps bottom?

4:30 - No small cap rally without consumer discretionary

6:30 - Profit taking

7:30 - Why large cap tech matters to small caps

10:14 - 30-40% rally is not out of the question

14:30 - Harvey Norman's (ASX: HVN) property backstop

16:00 - Wearing the volatility

17:00 - Industrials

20:20 - Going tactical

24:15 - Mermaid Marine

26:30 - Body language matters

27:30 - City Chic (ASX: CCX) was a mistake

29:20 - Managing liquidity in small caps

32:45 - Takeover target

34:50 - Balance sheets look good

36:55 - Going public too early

40:25 - The classifieds company for the bottom drawer

Here's a snapshot of his WAM Microcap LIC (WMI.asx) as at June 30th, 2023:

Their top 20 positions (in alphabetical order, not weighting order) are listed there in the bottom right corner of the slide.

Disclosure: I do not currently hold WMI or any other LIC managed by WAM Funds, nor do I hold any of those 20 companies in their "top 20" list above, however I have time for Oscar Oberg, and when I have spoken to him at WAM Roadshows in previous years, he always came across as knowledgeable and smart, without being cocky, and he often has some good insights into what is going on within various sectors. Many of his good ideas are too big (in terms of their market cap) for WMI (which only holds Microcaps), so may end up in WAX instead - here's how WAX looked at the end of June:

WAX is not constrained by the size of the companies, other than if they are large caps they are more likely to end up in WLE (WAM Leaders), so WAX holds mostly Small and Midcap companies, plus some microcaps. If you see companies in both WAX and WMI - such as CAJ, RIC, TPW and TUA currently - then it's safe to assume that Oscar has some serious conviction about them. Of those 20 in WAX, I hold PME here (but not currently IRL) and I hold TNE both here and IRL.

WAM Capital (WAM), which used to be their flagship fund, the OG if you will, holds all of the companies that the other funds hold, but usually in larger quantities, because it is a much larger fund. The exception is WLE (WAM Leaders) which is even larger at $1.85 billion. WAM is $1.7 billion. WMI = $305 million. WAX = $222 million. WAA is a tiny $52.5 million.

Here is what WAM held (top 20 positions) at the end of June:

You can often work out which companies are the larger positions in WAA, WAX and WMI by whether or not they also make it into WAM's top 20 list for the same month. Remember however that WAM is supposed to be 50/50 Research/Active, meaning that around half of their top 20 positions are market-based or arbitrage opportunities rather than based on fundamental research like the positions in WAX and WMI are. That is backed up if you look at the following slide (below) - of WAA (WAM Active) - and see how many of those positions are also in WAM's top 20 (above).

It's therefore safe to assume that Neuren (NEU), Life 360 (360), Bellevue Gold (BGL), Flight Centre (FLT), Fisher and Paykel (FPH), NextDC (NXT) and Worley (WOR) are all reasonably high conviction positions, and larger positions in WAA, because they are also top 20 positions in WAM (WAM Capital). And that companies like Codan (CDA), Megaport (MP1), Smartpay (SMP) and TPG Telecom (TPG) are smaller positions in WAA, because they do NOT feature in WAM Capital's (WAM's) top 20.

WAM Capital (WAM) also used to occasionally hold some large-cap positions that were also held within WLE (WAM Leaders) - see here:

However, only the highest conviction positions in WLE (which is a bigger fund than WAM) also make it into WAM's top 20, and in this instance there were no companies that were in the top 20 of both WAM and WLE, which may suggest that WAM Capital has gone back to ONLY holding Microcaps through to Mid-cap companies, and no large caps, which would make a lot of sense, because that's where they had all of their success in their early years. WLE is also a well-run fund - Matt Haupt is the lead PM of WLE, so different PM there - however I believe it's a different skill set that is required to be succesful in small and microcap investing compared to large cap investing. For one thing, you need to consider liquidity issues with smaller companies, something that Oscar touches on in this podcast, near the end.

Disclosure: From WLE's top 20, I also hold CSL, FMG and S32. From the top 20 lists of WAA and WAM, I also hold CDA and TNE, and I've been in and out of BGL (currently out). I also have NEU on my watchlist and I'm following them closely thanks to a lot of great content on them here on SM.

It is good to hear Oscar admitting that City Chic (CCX) was a mistake - as it's a company that they were very bullish on for a number of years and they also heavily promoted.

I also found his comments on Harvey Normal (HVN) and their property backing interesting, as well as his assertion that a rally of between 30% and 40% is "not out of the question".

By the way, I'm not suggesting anyone buy any of those LICs based on what they hold, coz there are other considerations. For instance, whether the LIC is trading at a premium or a discount to their NTA (aka NAV). In WMI's case, they ended June at $1.41, being a 8.3% premium to their before tax NTA (which was $1.30), and they've put on another 3.5 cents since then, closing at $1.445 on Friday. I'm not generally keen on buying a portfolio of shares (which is, at its heart, what a LIC is) for more than I could buy the same shares on-market unless there are other positive considerations that make the premium worth considering. I guess it's fair to say that some of the gaps (between share price and NTA) that some of Wilson's LICs have previously enjoyed have narrowed a little of late, but I still regard an 8.3% premium to be too high personally.

Further Details:

Another consideration is the fees they charge and whether they are attractive or excessive. See here: WAR - Risks (strawman.com) [Thank you @ArrowTrades for that gem!]

Any ideas why the WMI price spiked today? Do they have a huge holding in something that did really well today and I missed?

02-Feb-2021: Outperformance drives increased FF interim div and profit

- +155.2% increase in operating profit before tax to $69.6 million

- +36.4% investment portfolio performance in the financial year to date, outperforming the S&P/ASX Small Ordinaries Accumulation Index by +16.1%

- +33.3% increase to FY2021 fully franked interim dividend - to 4.0 cents per share.

Note: The HY2021 figures are unaudited; the audited half year results will be announced later this month (Feb 2021). The investment portfolio performance and index returns are before expenses, fees and taxes.

--- click on the link above for the full announcement ---

I hold WMI shares. I have previously explained why I prefer WMI to WAM Funds' flagship LIC, WAM Capital (ASX: WAM). WMI (WAM Microcap) continues to outperform and keeps building on their healthy profit reserve, allowing them to continue to increase their dividends every single year at a good clip while still having plenty of years worth of dividends left in that profit reserve. This provides a degree of comfort around not just the sustainability of their high fully franked dividend yield, but also that they can continue to increase their dividends - as they have been doing since inception (in July 2017, with first dividend paid in early 2018 and every dividend since being higher than the div for the corresponding prior period).

By contrast, WAM (WAM Capital) have only just managed to maintain their dividend at 7.75cps every 6 months (15.5cps/year) for the last 3 years, so no dividend increases since WAM's April dividend in 2018, due to their very low profit reserve, from which dividends are paid.

On top of that, WAM Capital (WAM) is trading at a larger premium (to NTA) than WMI is. I actually bought WMI when they were trading at a small discount to NTA, and at 31-Dec-2020 they were at $1.89/share, some +18.9% above their $1.59/share NTA, while WAM was trading at a +23.9% premium to their $1.80 NTA.

Yesterday (01-Feb-2021), WMI closed at $1.75, only +10% above their 31-Dec-2020 NTA, but WAM closed at $2.23, still +23.9% above their 31-Dec-2020 NTA (net tangible assets).

WMI is up today, understandably, on the back of this positive results and dividend increase announcement, yet is still trading at a smaller premium than WAM Capital (WAM) is. WAM have already announced their results, on 18-Jan-2021, and, as expected, have maintained their dividend at 7.75cps once again. I know they have a very loyal shareholder base, who are loath to sell. These guys are mostly self-funded retirees who bought WAM shares at much lower levels and are loving the dividends, even if they haven't increased in 3 years. It is this lack of supply that is keeping the share price elevated, in my opinion. WMI is a much younger LIC (listed investment company) and doesn't have the same level of shareholder loyalty, however when you look at them subjectively, WMI looks like a far superior option - to me - at current prices.

That said, I still prefer to buy these LICs when they are trading at around NTA or preferably at an NTA-discount, not when they have a double digit NTA-premium in the share price.

Also, WAM Microcap (WMI), as the name suggests, invest in MICROCAPS, so there is elevated risk there compared to WAM where the average market cap of their portfolio positions is much higher. However, as many of us here at Strawman.com do realise, if you do your DD (due diligence, a.k.a. homework) properly, smaller companies, while presenting elevated risk, often also produce above-average returns as well. That has certainly been the experience with WAM Microcap since inception in mid-2017.

03-Aug-2020: Outperformance, increased FF final and special div, and SPP

[I hold WMI shares] They rose +6.55% today on these results. SPP will be priced at July 31 NTA.

04-Feb-2020: The WAM Microcap (ASX: WMI) Board of Directors announced today a 311.9% increase in operating profit before tax to $27.3 million and a 333.1% increase in operating profit after tax to $19.7 million in its FY2020 half year results*. The Board also announced a fully franked interim dividend of 3.0 cents per share, representing a 33.3% increase on the prior corresponding period and currently representing an annualised fully franked dividend yield of 4.2%**.

The fully franked dividend has been achieved through the strong performance of the investment portfolio since inception and the profits reserve available and is consistent with the Company's investment objective of delivering investors a stream of fully franked dividends. The Company's profits reserve is currently 28.3 cents per share and forms a part of the net tangible assets.

*The HY2020 profit figures are unaudited. Audited half year results will be announced to the market in February 2020.

**Based on the 3 February 2020 share price of $1.435 per share.

[taken from email sent out this morning by Geoff Wilson to WMI shareholders and others on their mailing list]

19-Nov-2019: November 2019 Shareholder Presentation

Note: This Presentation is related to the WAM Group (WAM Funds) + FG (Future Generation) Funds November 2019 Australian Roadshow (which I'll be attending here in Adelaide next Wednesday) and covers all of WAM Group's 6 LICs: WAM Global (WGB), WAM Leaders (WLE), WAM Capital (WAM), WAM Research (WAX), WAM Microcap (WMI) and WAM Active (WAA).

This one is for the Sydney leg of the roadshow, which includes their AGMs, but similar Presentations will be made at all of the venues they attend during the roadshow over the next couple of weeks.

March 2019 Report for all the Wilson LICs - including WMI - see here.

WMI had a pre-tax NTA of $1.27 on March 31st.

September 2019 Report for WMI and the other Wilson LICs - see here.

WMI had a pre-tax NTA of $1.43 on September 30th.

WMI's outperformance against the ASX Small Ordinaries (ASX:XSO) Accumulation index is +3.1% in September, +10.4% over 3 months, +14.8% over 6 months, +10.1% over the year to September 30, and also +10.1% per year since inception (June 2017). All positive ourperformance, hard to achieve for a micro-cap fund, especially since Oscar and Marty went to cash towards the end of calendar 2018 and missed the start of the rally in January 2019, so had substantial underperformance (-3.9%) against their benchmark index (XSO Accumulation index) in January. They've staged a good recovery from there. Marty has followed Chris Stott out the door, and it looks like Oscar Oberg is now the sole PM for WMI (WAM Microcap), WAM (WAM Capital), WAX (WAM Research) & WAA (WAM Active). Matt Haupt and John Ayoub are still running WLE (WAM Leaders fund, the large-cap fund), and Catriona Burns is still in charge of WGB (WAM Global). Geoff watches over them all of course but he has other priorities as well these days (philanthropy, protecting franking credits - and activism mostly it would seem, as well as spending time with family and smelling the odd rose, plus promoting healthy eating and how a healthy gut positively affects mental health). I have shares in WAM, WAX, WLE & WGB, and it looks like this ex-dividend period might be a good time to get back into WMI. The WAM funds often fall by more than the grossed up value of their dividends in the fortnight following their ex-div dates, as some people rotate into something else, and WMI went ex-dividend on October 7th (along with WAX & WAA). WGB & WLE went ex-div on 11th October, and WAM (WAM Capital) went ex yesterday (17th October) so we're in that "ex-div" period now.