... and we're back to where we started... rapid flash up 20% in hours and a slightly slower settling back down 20%. But, in between the actual scoping study for the Kharmagtai Copper-Gold Project was released. The XAM Board has endorsed this Study, and subject to funding, has approved progression to Pre-Feasibility (PFS) Stage. From the announcement...

"This Study confirms the potential of Kharmagtai as a globally significant, long life, low cost, low-risk future copper-gold mine. It is based on conventional, low risk open pit mining and sulphide flotation, with low environmental, social and governance (ESG) risk, and supported by nearby rail, road and power links providing the potential for rapid development. Kharmagtai is well positioned to help fill the looming copper global supply gap driven by growing demand for an increasingly electrified economy.

Highlights

Presented in 100% Terms (Xanadu share 76.5%)

- Confirms Kharmagtai as a potential world class, low cost, long life mine

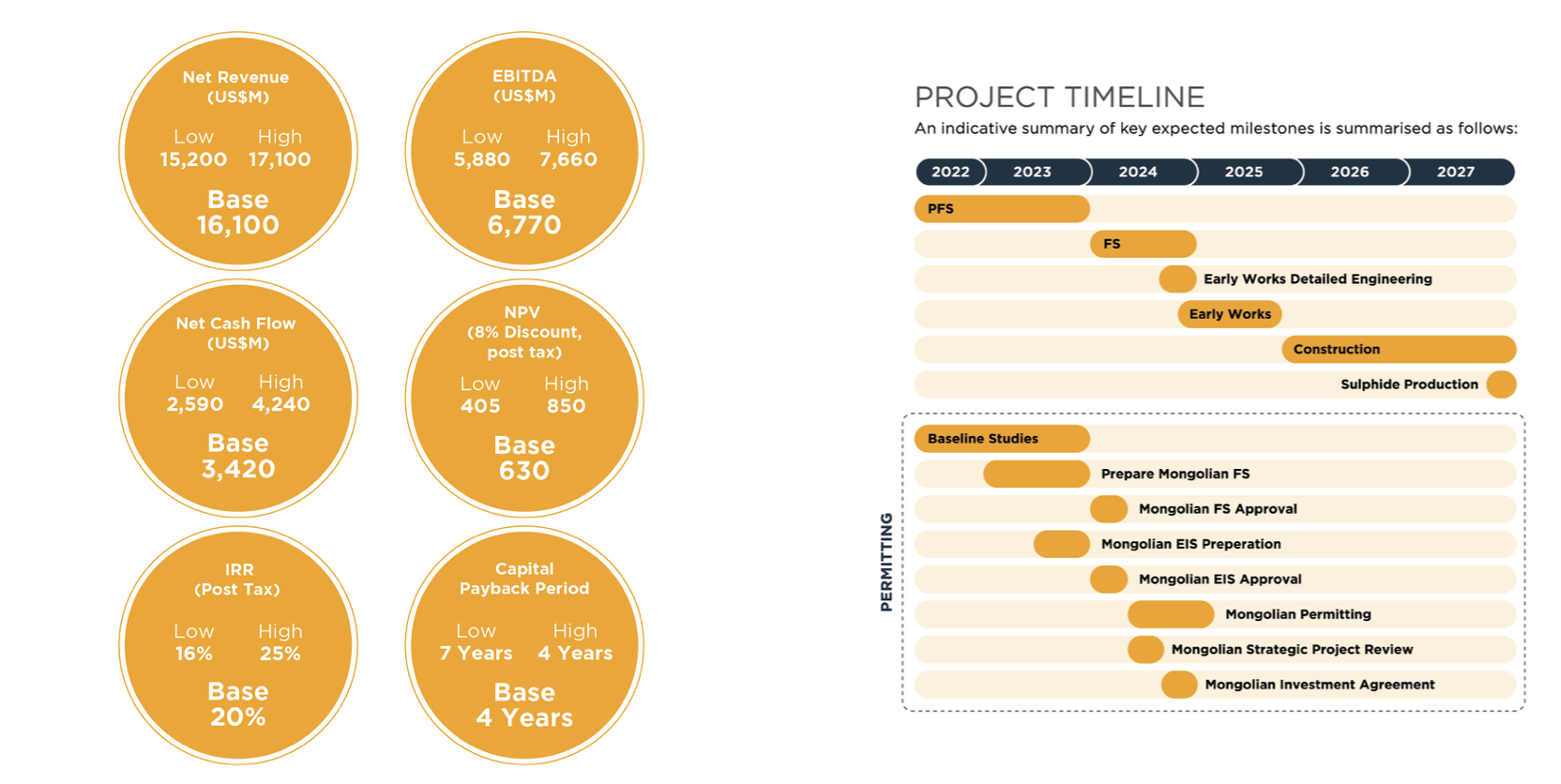

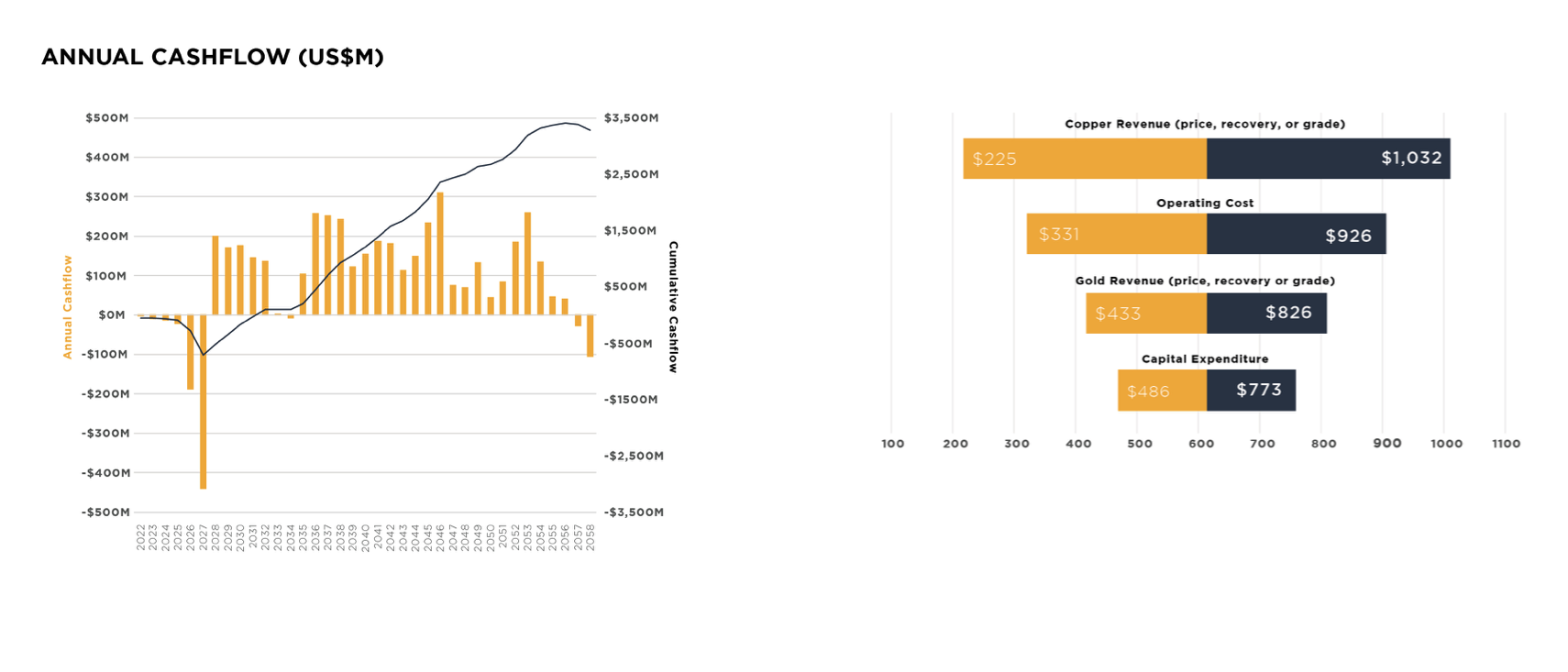

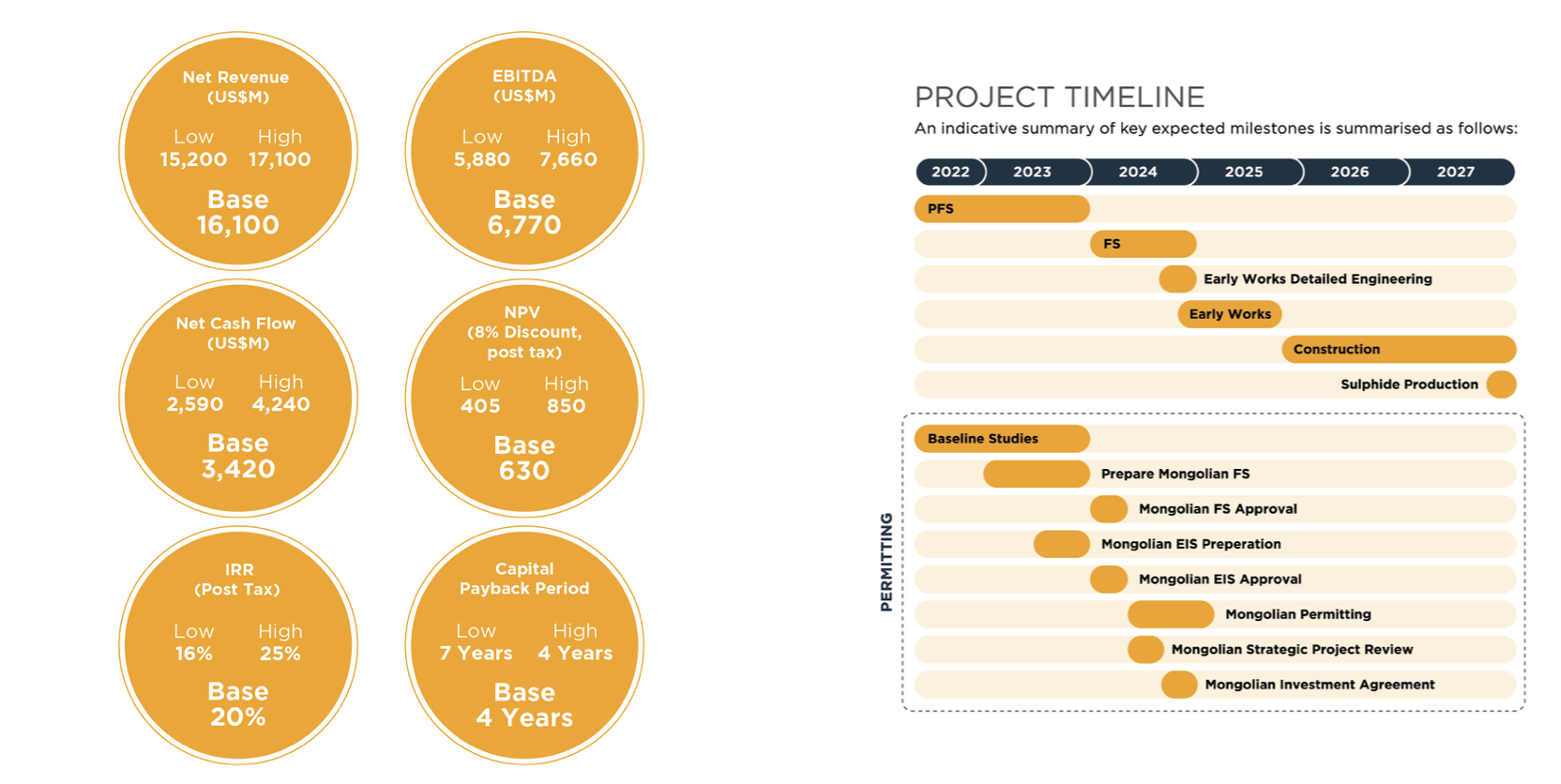

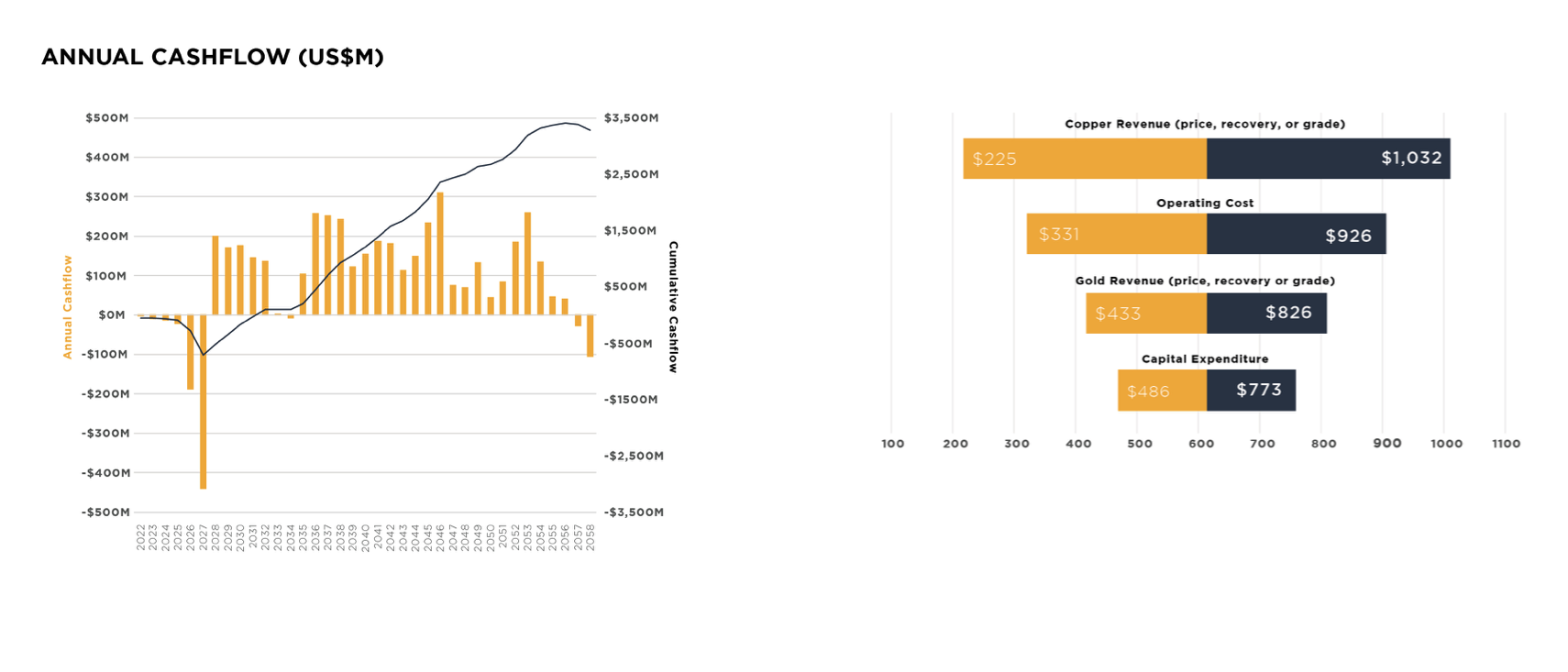

- Estimated 20% IRR (range 16-25%), US$630 million NPV @ 8% (range US$ 405-850 million) and 4 year payback

- (range 4-7 years) over 30 year mine life

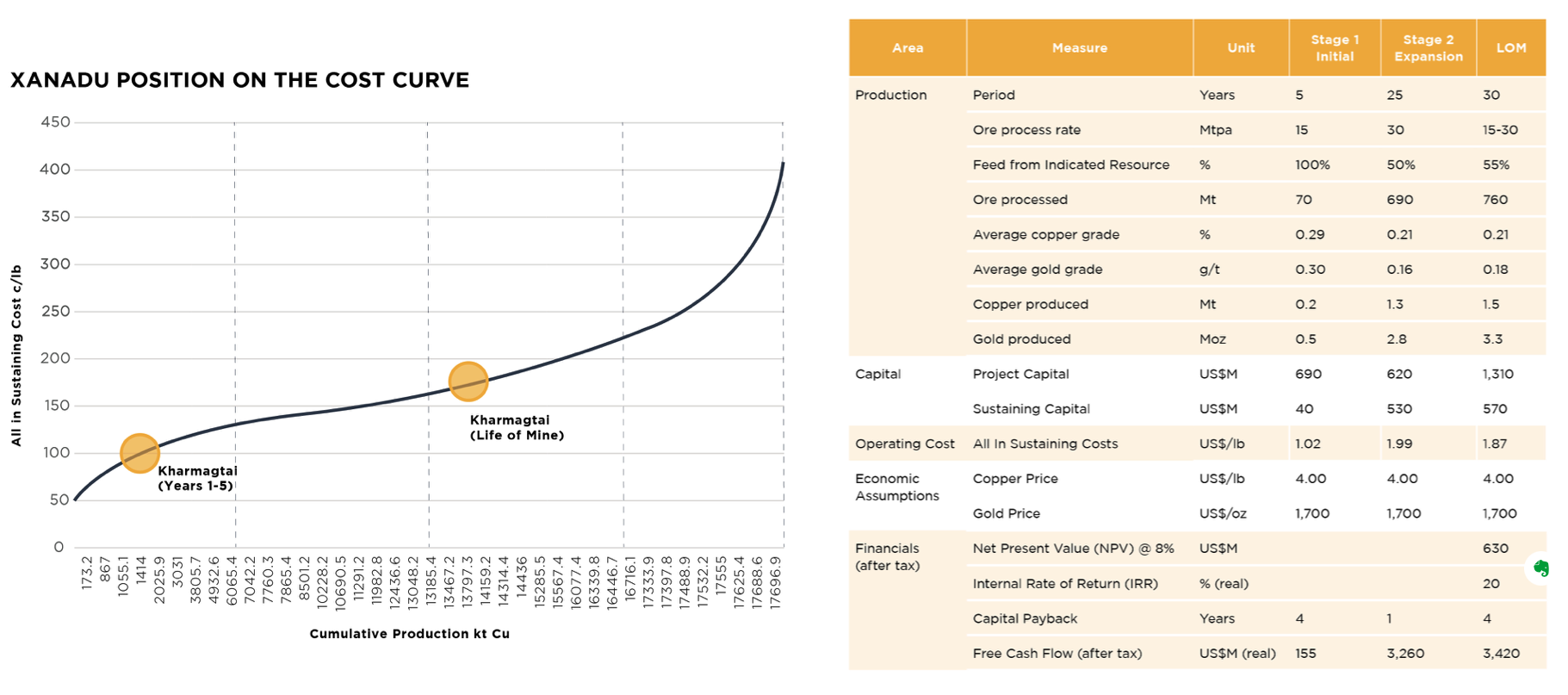

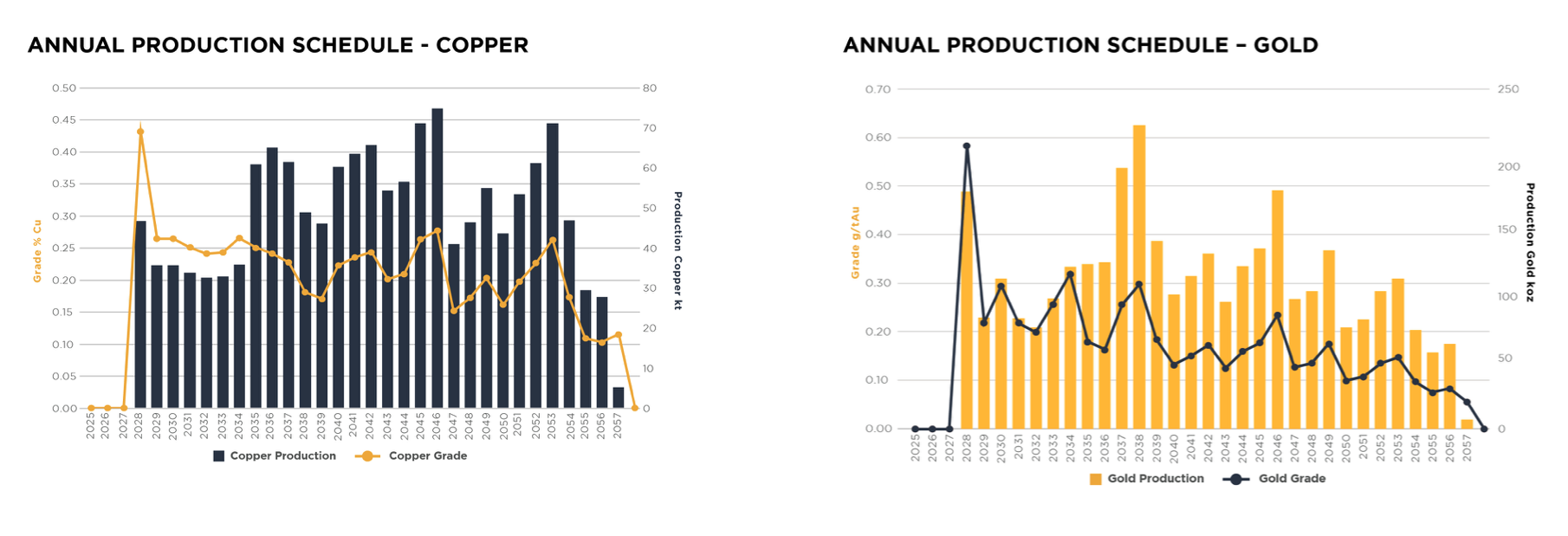

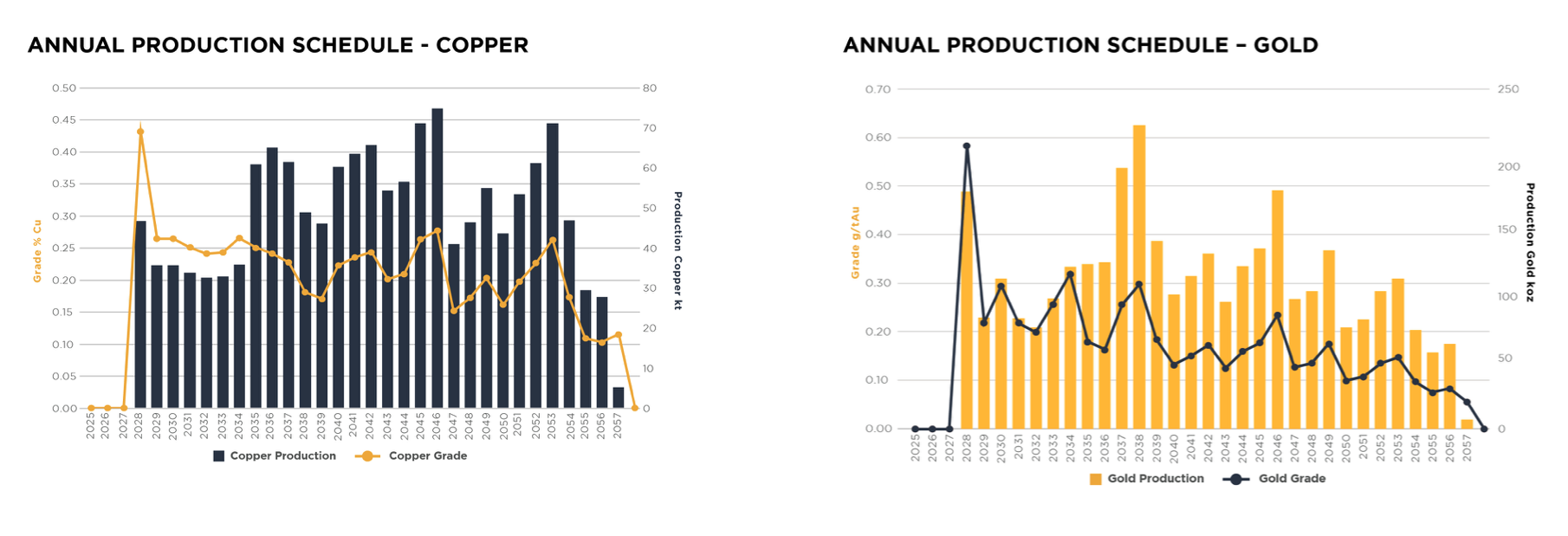

- Projected production ranges from 30-50ktpa copper and 5-110kozpa gold production during the first five years

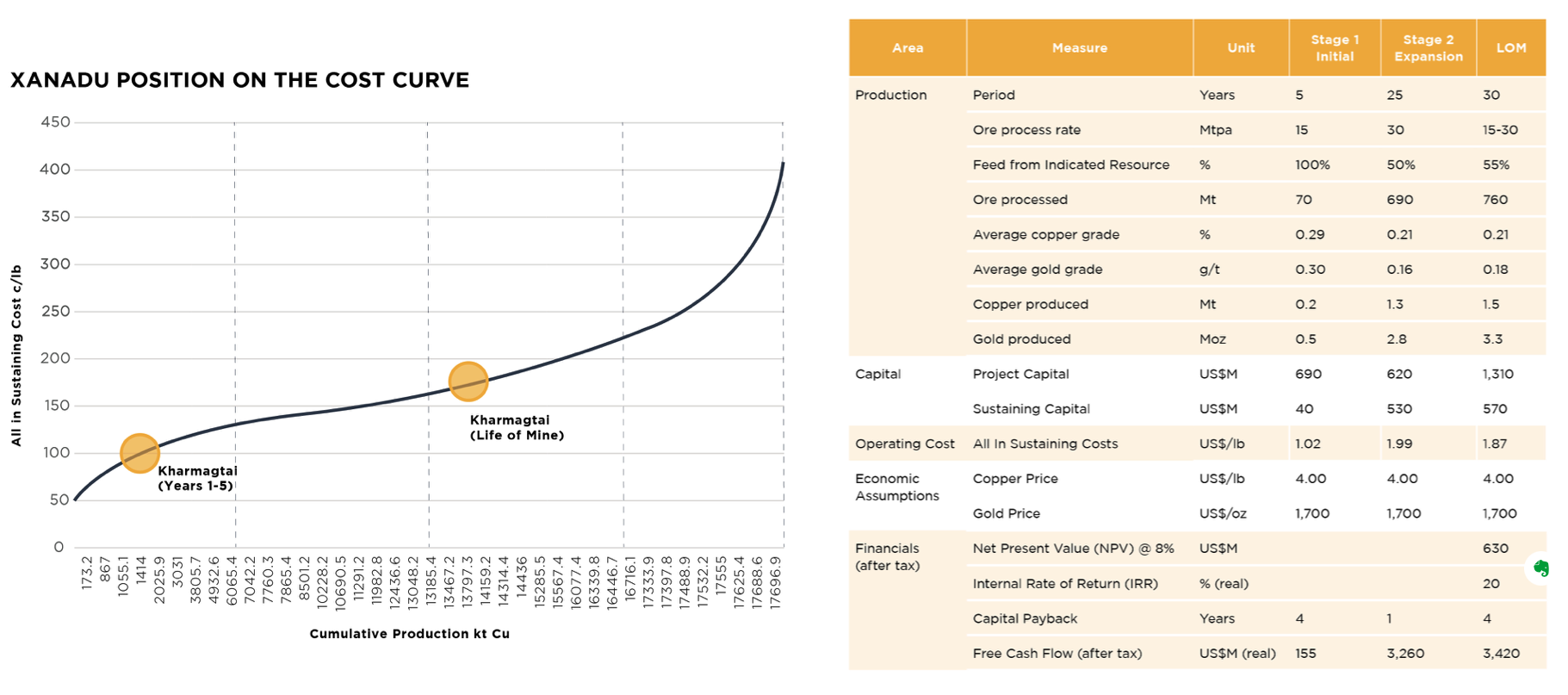

- First quartile all-in sustaining (C1) costs of US$1.02/lb Cu for first five years, net of by-product credits

- Conventional, low technical complexity open pit and process plant with low 0.9:1 strip ratio for first five years

- Located in sparsely populated, flat terrain, with nearby established rail, power and water links

- Pre-Feasibility Study expected to commence in Q3 CY2022 and complete in Q4 of CY2023"

As we know from the experience of RIO, it's probably a bit much to call any massive mining venture in Mongolia "low-risk". Actually XAM is in my portfolio because it is high risk but that I guess is a semantic quibble at this stage. Picking up on those highlights, some pieces I pulled from the investor webinar this morning.

Timeline and Key Financials

All those Mongolian approvals send tremors through my body for some reason but those potential numbers look compelling. And because of the geology involved there is significantly low cost initial production.

Of course it never goes quite like that but the fact that significant quantity of high grade ore is close to the surface is very good news for a mine like this - so what will the price of Cu and Au be in 2027/2028? It might look something like this...

All of that means I will continue to Hold XAM and at under $0.03 am increasing my holding in my SMSF.