“It’s the mark of a charlatan to try and explain simple things in complex ways, and it’s the mark of a genius to explain complicated things in simple ways.”

— Naval Ravikant

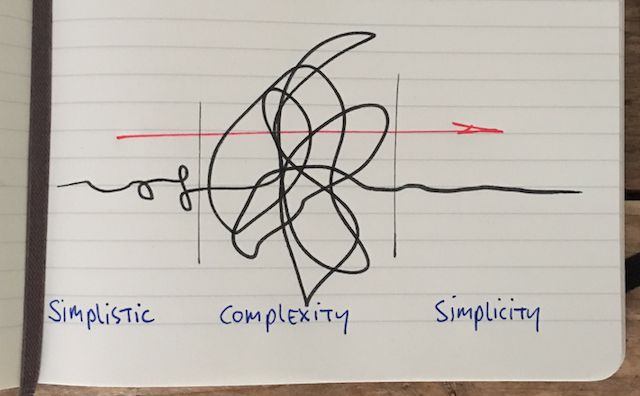

I don’t think many of us would disagree with Naval’s sentiment. But if we’re honest with ourselves, most of us are still drawn to sophisticated-sounding speech. Big words, technical jargon, and polished presentations tend to convey intelligence and expertise, and who doesn’t want to feel like they’re dealing with someone who knows what they’re talking about? Especially when our money is on the line.

It isn’t just about language either. A confident-looking person behind a big oak desk in a glass-walled tower naturally seems more credible than a hoodie-wearing YouTuber streaming from their bedroom. One screams “professional,” the other “amateur.”

We are social creatures, wired to pick up on subtle cues like posture, clothing, vocabulary, and even office décor. These signals often serve us well as quick heuristics for trust and competence. But they are not foolproof. In fact, they can backfire, sometimes spectacularly, especially in investing.

Take broker and analyst reports. They are often filled with precise forecasts, granular industry statistics, and elaborate discounted cash flow models, all wrapped in mathematically intimidating language. On the surface, this level of detail feels reassuring. But it is a false precision that masks just how uncertain the world really is. No matter how many decimal places you add to a projection, no one can predict earnings in 2028 with any real accuracy. They certainly can’t predict the market’s mood. Generally speaking, these complex models exist less to forecast reality and more to signal authority: “Look how deep in the weeds we are, trust us!”

CEO interviews and glossy investor presentations can be just as seductive, especially when a company is working on bleeding-edge technology. Founders and executives can speak passionately and confidently about breakthroughs, and it is easy to get swept up in the excitement. But there is a vast difference between a cool technology fresh out of the lab and a commercially viable business model. History is littered with examples where the former never became the latter.

This is not to say jargon is inherently bad. It exists for a reason. It can condense complex ideas into shorthand and make communication between experts more efficient. But there is a test worth applying: if someone cannot explain their idea in plain, simple language, as if to a 12-year-old, they probably do not understand it well enough themselves. When someone truly grasps the fundamentals, they can strip away the complexity and still make the core insight clear.

Simplicity, when grounded in genuine understanding, is far more powerful than complexity. As people like Carl Sagan, Morgan Housel, and (of course) Uncle Warren have shown, true genius is not about sounding smart, it is about making complex ideas simple enough for anyone to understand. That kind of clarity is rare, and it is worth seeking out.

Complexity often feels safe because it looks rigorous. It can create an illusion of certainty, but certainty in markets is a mirage. The best investors are comfortable admitting what they do not know and focusing instead on what can be known. They strip away noise, reduce things to first principles, and make decisions based on the simplest possible explanations.

When someone can take something complicated and make it clear without dumbing it down, pay attention. That is where the real signal lies.

Strawman is Australia’s premier online investment club.

Members share research & recommendations on ASX-listed stocks by managing Virtual Portfolios and building Company Reports. By ranking content according to performance and community endorsement, Strawman provides accountable and peer-reviewed investment insights.

Disclaimer– Strawman is not a broker and you cannot purchase shares through the platform. All trades on Strawman use play money and are intended only as a tool to gain experience and have fun. No content on Strawman should be considered an inducement to buy or sell real world financial securities, and you should seek professional advice before making any investment decisions.

© 2025 Strawman Pty Ltd. All rights reserved.